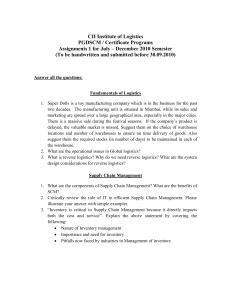

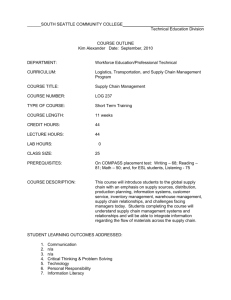

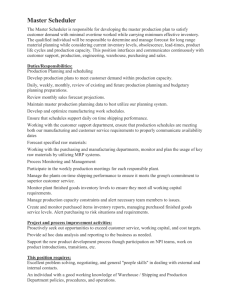

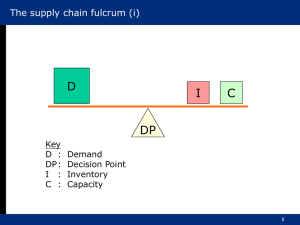

Logistics & Supply Chain Management

advertisement