Proposed Classification Plan and Factors

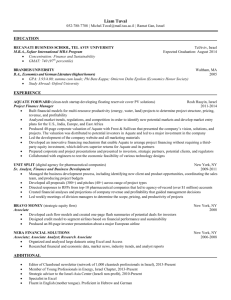

advertisement