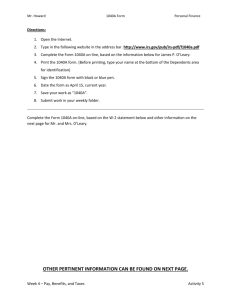

Practice Exercise, Form 1040A

advertisement

Practice Exercise, Form 1040A Included in this practice exercise are: The family information to complete the 1040A The tax table page to look up the 2014 tax A completed 1040A form, to serve as answer key Blank tax forms may be downloaded from the Internal Revenue Service website: www.IRS.gov Practice Exercise, Form 1040A Joyce Johnson is a part-time waitress. Her husband, Anthony, is a medical technician. Their daughter, Sally, is seven years old, and their son, Richard, is four. Anthony earned $24,800, and Joyce earned $7,600, including tips. They have no savings. Anthony had $2,080 withheld from his pay, and Joyce had $208 withheld from her pay. They are not eligible to receive the earned income credit. They have full health care coverage. The Social Security numbers for the family are: Joyce: 987-65-4321 Anthony: 001-34-3445 Sally: 002-22-9998 Richard: 002-45-9834 They live at 4300 Lakeview Avenue, Midville, Georgia 30441. Using this information, complete a 1040A form for Joyce and Anthony. 2014 Tax Table for Practice Exercise, Form 1040A Completed 1040A, Answer Key Page 1 Page 2