Activity 5 - 1040A Form

advertisement

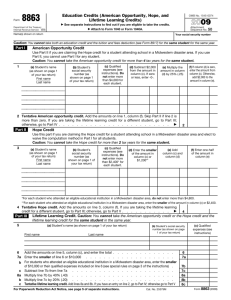

Mr. Howard 1040A Form Personal Finance Directions: 1. Open the Internet. 2. Type in the following website in the address bar. http://www.irs.gov/pub/irs-pdf/f1040a.pdf 3. Complete the Form 1040A on-line, based on the information below for James P. O’Leary: 4. Print the 1040A form. (Before printing, type your name at the bottom of the Dependents area for identification) 5. Sign the 1040A form with black or blue pen. 6. Date the form as April 15, current year. 7. Save your work as “1040A”. 8. Submit work in your weekly folder. Complete the Form 1040A on-line, based on the W-2 statement below and other information on the next page for Mr. and Mrs. O’Leary. OTHER PERTINENT INFORMATION CAN BE FOUND ON NEXT PAGE. Week 4 – Pay, Benefits, and Taxes Activity 5 Mr. Howard 1040A Form Personal Finance Other pertinent information: INCOME Annette earned $4,000 for babysitting. They had interest income of $800. They had tax-exempt interest income of $482. Annette also received $2000 in unemployment compensation benefits. ADJUSTED GROSS INCOME James had IRA deductions totaling $2000 for the year. TAX, CREDITS, & PAYMENTS Line 24 You need to calculate the standard deduction Line 25 Perform calculation Line 26 Calculate Exemptions. Line 27 Perform calculation Line 28 Go to www.irs.gov and use Federal Tax Tables to find tax Line 35 Perform calculation Line 37 Perform calculation Line 38 Find number from the W-2 form Line 44 Perform calculation REFUND or AMOUNT YOU OWE Compare lines 37 the Total Tax and Line 44 the Total Payments to analyze if James owes more money or is due money back. Subtract and write in the correct line. Week 4 – Pay, Benefits, and Taxes Activity 5