AUTOMATIC ACCOUNTING INSTRUCTIONS (AAI's)

advertisement

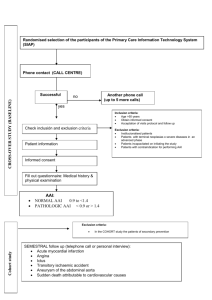

AUTOMATIC ACCOUNTING INSTRUCTIONS (AAI’s) for Purchasing, Inventory, AP voucher match T:\PO\AAI We only need a few of the AAI’s, and we only need a few of the doc types that can be set up. These AAI’s are accessed by program P40950 in the inventory setup menu. AAI 4122 and 4124 AAI 4122 is called by issues (doc types II and IC), transfers (doc type IT), and adjustments (doc type IA). It specifies the inventory account 154100. Issues (doc types II and IC) credit account 154100 (reduce inventory) if the sign of the transaction is positive. Adjustments (doc type IA) debit 154100 (increase inventory) if the sign of the transaction is positive. For issues, the account for other half of the transaction is keyed in the grid of the transaction screen. For adjustments (IA), AAI 4124 is called and specifies expense account 435100 to debit for the lost stock or credit for the found stock, for the other half of the transaction. For transfers (IT), AAI 4124 is called and specifies the inventory account 154100 again, with TOE 3200, as the other half of the transaction, since the stock goes from inventory to inventory. AAI 4126 and 4128 Called when an inventory transaction is made which leaves zero units on hand for an item, but more than or less than zero $$ on hand. AAI 4126 calls account 154100 and makes a debit or credit to bring the $$ on-hand balance to zero. AAI 4128 calls account 780060 and credits or debits the same $$ to balance the transaction and debits or credits the $$ to expense. AAI 4134 and 4136 Called when a unit cost in inventory is manually changed. AAI 4134 debits or credit inventory account 154100 for the increase or decrease in extended cost resulting from the change in unit cost. AAI 4136 makes a corresponding opposite entry to account 780060 to debit or credit the expense account. AAI 4152 and 4154 Called when a cycle count or tag count inventory adjustment changes $$ on hand for an item. AAI 4152 debits or credits inventory account 154100 for an increase or decrease in units on hand. AAI 4154 makes a corresponding opposite entry to inventory adjustment account 435100, as an expense or negative expense. AAI 4162 and 4164 Called by program “average cost update” R41811. Use this program only if have “on-line unit cost update” turned off in System Constants for Inventory, which we have turned on, so do not use it. For stock only. AAI 4162 changes inventory account 154100 for $$ of variance. AAI 4164 charges same $$ with opposite sign to inventory adjustment account 435100. Use only if auto update got turned off somehow. AAI 4310 and 4320 Called by Receiving screen P4312, for stock items. AAI 4310 creates a debit (increase) entry to inventory account 154100 to record inventory received, when unit quantity is positive. (For non-stock items, there is no AAI because the transaction is charged to the expense account number on the PO). The setup of the line-type (inventory interface field, Y for stock and call an AAI, A for non-stock and require an account number on PO) determines whether an AAI will be called. AAI 4320 creates a credit entry to the received-not-vouchered account 232150, for the other half of the transaction, to record inventory received as a liability due the vendor, for any receipt, stock or non-stock. Dollar amount equals PO price times received quantity. AAI 4330 and AAI 4332 Called by voucher screen P4314 used by AP, which is called by P0411, when using line type S (stock) and have a price variance (PO price not same as invoice price). Situation 1: If quantity of units on hand in inventory is equal to or greater than quantity of units to vouch on this transaction, and there is a price variance, all of variance is applied to inventory account 154100 by AAI 4330. Situation 2: If quantity of units on hand in inventory is less than quantity of units to vouch on this transaction, AAI 4332 gets called along with AAI4330. This would happen if we receive and issue units before we vouch the invoice. If vouching , for example, 10 units, and have only 8 units in inventory, we do not want to apply the price variance for the 10 units purchased to only the 8 units on hand. This would distort the unit cost of the units on hand. So program looks at units on hand, applies the proper portion of the price variance to inventory (the variance amount which applies to the 8 units) via AAI 4330, and applies the rest of the price variance to expense account 780060 via AAI 4332. Situation 3: If have no units on hand and vouch some units, and have a price variance, AAI 4332 applies all of variance to expense account 780060. AAI I 4405 and 4400 Called by receiving program P4312, for a stock item (line type S), when doing a negative receipt or a receipt reversal, and average price of units of inventory on hand is different from PO price we are reversing, and we are reversing a quantity of units equal to the quantity of units on hand, thus end up with zero units on hand. Thus, example, have 5 units on hand at $20 average price, and reverse a PO for 5 units at any price different from $20. With zero units on hand we need to expense the $$ left on hand. AAI 4400 calls the inventory account 154100 and reduces the $$ on hand for this item to zero. AAI 4405 calls account 780060 to charge the $$ to expense.