CEIBS-Syllabus

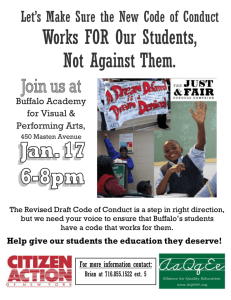

advertisement

INVESTMENT MANAGEMENT & STRATEGY An electronic version of this syllabus is available from http://www.acsu.buffalo.edu/~keechung/courses.htm Kee H. Chung M&T Professor and Chairman Department of Finance and Managerial Economics State University of New York at Buffalo (phone) 716-645-3262 (e-mail) keechung@buffalo.edu http://www.mgt.buffalo.edu/faculty/keechung.shtm OBJECTIVES The primary purpose of this course is to provide you with a general understanding of the operation of capital markets and basic analytical tools of investment management. Specifically, we will examine such topics as Portfolio Theory, Capital Asset Pricing Model (CAPM), Arbitrage Pricing Theory (APT), Bonds and Common Stocks Valuation, Efficient Market Hypothesis, Investment Management, and Option Pricing Model (OPM). In addition, you will be (1) exposed to real-world investment environments through Investment Project, (2) required to make investment decisions in real time, and (3) evaluated based on both the rationale of your investment decisions and the performance of your investment portfolio. PREREQUISITES: Introductory finance, microeconomics, and statistics course. Finance is mathematical and you will need to utilize material developed in the prerequisite courses. If you have not taken these courses, it is a virtual certainty that you will have great difficulty in this one. TEXT: Investments, by Zvi Bodies, Alex Kane, and Alan Marcus, Richard D. Irwin, Inc., 2002 (5th edition). Student resources are available from: http://highered.mcgraw-hill.com/sites/0072339160/ Class handouts, including PowerPoint slides of each chapter will be posted to my webpage. Most materials are in Adobe Acrobat (PDF) or MS Word files. PDF files require the Adobe Acrobat viewer, which is freely available for download at http://www.adobe.com. I will go over assigned homework problems in class. GRADING POLICY Two Mid-term Exams (20% each), Comprehensive Final Exam (30%), Investment Project (20%), Class Participation and Attendance (10%). There will be no make-up examination. For those who miss mid-term exam due to objectively verifiable unavoidable situation, comprehensive final exam will be weighted heavily in the determination of final grade. ATTENDANCE on every class meeting is strictly required. If you miss more than five class meetings, you will automatically receive “F” for the course. EXPECTATIONS FOR STUDENTS 1. Preparing thoroughly for each session in accordance with the instructor's requests; 2. Arriving promptly and remaining until the end of each class meeting, except in unusual circumstances; 3. Participating fully and constructively in all classroom activities and discussions; 4. Adhering to deadlines and timetables established by the instructor; 5. Displaying appropriate courtesy to all involved in the class sessions. CHEATING In my teaching career, I have encountered few incidents involving students sharing information during inclass exams or changing answers on exam papers that have already been graded. With respect to cheating, the standards of the faculty and your fellow students are very clear. If evidence of cheating comes to my attention by any means, I will prosecute to the extent permitted under faculty guidelines. ASSIGMNMENTS I'll be assigning homework problems from the book. I choose problems that I think are "useful", in the sense of helping you understand the material and prepare for exams. You should feel free to work on them in groups. Most of these problems will be reviewed in class. ANNOUNCEMENTS You are responsible for knowing what goes on in class, which may include material not covered in the book, modifications to the syllabus, and announcements concerning exams. CALCULATOR You will live or die in this course by your financial calculator. In addition to the usual arithmetic operations, a financial calculator can compute means, standard deviations, exponentials, log functions, and present and future values of simple sums and annuities. An ability to compute yield to maturity (YTM) and internal rates of return (IRR) is useful. Useful Websites Links to various finance Websites: http://highered.mcgraw-hill.com/sites/0072339160/student_view0/link_to_professional_resources.html See also inside book covers. Yahoo Finance: http://finance.yahoo.com Finance Site List at OSU: http://www.cob.ohio-state.edu/dept/fin/journal/jofsites.htm Social Science Research Network: http://www.ssrn.com/ NYSE website: http://www.nyse.com Nasdaq website: http://www.nasdaq.com/ Head Trader: Head Trader simulates the experience of a Nasdaq Market Maker buying and selling stocks in a screen-based market environment. It puts you in the shoes of a professional trader. http://www.academic.nasdaq.com/headtrader/ To learn more about Nasdaq, read: Smith, J., Selway, J., McCormick, T., The Nasdaq stock market: historical background and current operation. Working paper 98-01, NASD. http://www.academic.nasdaq.com/docs/wp98_01.pdf Electronic journals Financial Analysts Journal: http://www.aimrpubs.org/faj/home.html Review of Financial Studies: http://rfs.oupjournals.org/ (all published and forthcoming papers) Journal of Financial Economics: http://www.elsevier.com/homepage/sae/econworld/econbase/finec/frame.htm AFA & Journal of Finance: http://www.afajof.org/ (all published and forthcoming papers) Journal of Financial and Quantitative Analysis: http://depts.washington.edu/jfqa/ (See below) Journal of Financial Markets: http://www.elsevier.com/homepage/sae/econworld/econbase/finmar/frame.htm CLASS SCHEDULE (Notes) LN denotes “lecture note” RQ denotes “required readings” and RC denotes “recommended readings” FAJ denotes Financial Analysts Journal JPM denotes Journal of Portfolio Management Topic 1 Introduction & History of Returns (Chapter 5) Homework problems: 5:2,3(a)(b)(c),4,7,9 Topic 2 Risk Analysis (Chapter 6) & Capital Allocation (Chapter 7) Homework problems: 6:1,3-12; 7:1,3-10,18-23 (LN) Risk and Return http://www.acsu.buffalo.edu/%7Ekeechung/CU%20Lecture%20Notes/Chapter%206%20%20Risk%20and%20Return.doc (LN) Three Steps in Investment Decisions http://www.acsu.buffalo.edu/%7Ekeechung/CU%20Lecture%20Notes/Chapter%207%20%20Three%20Steps%20in%20Investment%20Decisions.doc Topic 3 Optimal Portfolios (Chapter 8) & CAPM (Chapter 9) Homework problems: 8:1-5,7,9,15-17; 9:1,3,4-14 (LN) Minimum Variance Portfolio and Optimal Risky Portfolio http://www.acsu.buffalo.edu/%7Ekeechung/CU%20Lecture%20Notes/Chapter%208%20%20MVP%20and%20P%20Numerical%20Examples.doc (LN) Economic Intuition of CAPM http://www.acsu.buffalo.edu/%7Ekeechung/CU%20Lecture%20Notes/Chapter%209%20%20Economic%20Intuition%20Behind%20the%20CAPM%20(SML).doc Excel Application http://highered.mcgraw-hill.com/sites/0072339160/student_view0/excel_applications.html Topic 4 Index Models (Chapter 10) & APT (Chapter 11) Homework problems: 11:2,3,4(a), 5-8,11-19 (LN) Single Factor Model http://www.acsu.buffalo.edu/%7Ekeechung/CU%20Lecture%20Notes/Chapter%2010%20%20Factor%20Model.doc (LN) Economic Intuition http://www.acsu.buffalo.edu/%7Ekeechung/CU%20Lecture%20Notes/Chapter%2011%20%20Economic%20Intuition%20Behind%20the%20APT.doc (LN) Multi-Factor Model http://www.acsu.buffalo.edu/%7Ekeechung/CU%20Lecture%20Notes/Factor%20Model.doc Excel Application http://highered.mcgraw-hill.com/sites/0072339160/student_view0/excel_applications.html (RQ) R. Roll and S. Ross. "The Arbitrage Pricing Theory Approach to Strategic Portfolio Planning." FAJ (May-June 1984), pp. 14-26. http://www.acsu.buffalo.edu/~keechung/Collection%20of%20Papers%20for%20courses/ARBI TRAGE%20PRICING%20THEORY%20APPROACH%20TO%20STRATEGIC%20PORTF OLIO%20PLA.pdf Midterm Exam I Topic 5 Behavioral Finance (RQ) R. Fuller. “Behavioral Finance and the Sources of Alpha.” http://www.acsu.buffalo.edu/~keechung/Collection%20of%20Papers%20for%20courses/Beha vioral%20Finance%20and%20Sources%20of%20Alpha.pdf (RQ) M. Statman. “Lottery Players/Stock Traders.” FAJ (January/February 2002), pp. 14-21. http://www.acsu.buffalo.edu/~keechung/Collection%20of%20Papers%20for%20courses/lotter y%20players%20and%20stock%20traders.pdf (RQ) K. Fisher and M. Statman. “A Behavioral Framework for Time Diversification.” FAJ (May-June 1999), pp. 88-97. http://www.acsu.buffalo.edu/~keechung/Collection%20of%20Papers%20for%20courses/A%2 0Behavioral%20Framework%20for%20Time%20Diversification.pdf Topic 6 How Securities Are Traded (Chapter 3) (LN) Topics Covered http://www.acsu.buffalo.edu/%7Ekeechung/CU%20Lecture%20Notes/Chapter%203%20%20Topics%20Covered.doc (LN) Market Structure http://www.acsu.buffalo.edu/%7Ekeechung/CU%20Lecture%20Notes/Chapter%203%20%20Market%20Structure.xls (LN) Trading of Securities http://www.acsu.buffalo.edu/%7Ekeechung/CU%20Lecture%20Notes/Chapter%203%20%20Trading%20of%20Securities.doc (LN) Margin Trading http://www.acsu.buffalo.edu/%7Ekeechung/CU%20Lecture%20Notes/Chapter%203%20%20Why%20do%20investors%20buy%20securities%20on%20margin.doc Going Public and Listing on the U.S. Securities Markets (RC) http://www.nasdaq.com/about/going_public.stm The NASDAQ/NYSE/Amex Listing Requirements (RC) http://www.nasdaq.com/about/appa.pdf Trading Costs: NYSE vs Nasdaq (RC) http://papers.ssrn.com/sol3/papers.cfm?abstract_id=277817 (RQ) Nasdaq Controversy W. Christie and P Schultz. “Why DO NASDAQ Market Makers Avoid Odd-Eighth Quotes?” Journal of Finance (December 1994), pp. 1813-1840. http://www.acsu.buffalo.edu/~keechung/Collection%20of%20Papers%20for%20courses/Col lusion%20paper%20JF%201994.pdf (LN) Collusion Hypothesis http://www.acsu.buffalo.edu/~keechung/Lecture%20Notes%20(MGF633)/COLLUSION%2 0HYPOTHESIS-Lecture%20note.doc Topic 7 Efficient Market (Chapter 12) Homework problems: 12:1-18 (RQ) R. Haugen. "The Seven Mysteries of the Stock Market." Beast on Wall Street (Prentice Hall,1999). http://www.acsu.buffalo.edu/~keechung/Collection%20of%20Papers%20for%20courses/SEVE N%20MYSTERIES%20OF%20THE%20STOCK%20MARKET.pdf (RQ) C. Beard and R. Sias. “Is There a Neglected-Firm Effect? FAJ (Septermber/October 1997), pp. 19-23. http://www.acsu.buffalo.edu/~keechung/Collection%20of%20Papers%20for%20courses/IS%2 0THERE%20A%20NEGLECTED-FIRM%20EFFECT.pdf (RC) P. Dennis, S. Perfect, K. Snow, and K. Wiles. "The Effects of Rebalancingon Size and Book to Market Ratio Portfolio Returns." FAJ (May-June 1995), pp. 47-57. http://www.acsu.buffalo.edu/~keechung/Collection%20of%20Papers%20for%20courses/EFFE CTS%20OF%20REBALANCING%20ON%20SIZE%20AND%20BOOK%20TO%20MARK ET%20RATIO.pdf Topic 8 Empirical Evidence (Chapter13) (RQ) R. Ibbotson and A. Patel. “Do Winners Repeat with Style? SSRN (February 2002) http://papers.ssrn.com/sol3/delivery.cfm/SSRN_ID292866_code020109590.pdf?abstractid=292 866 (RQ) K. Grundy and B. Malkiel. "Reports of Beta's Death Have Been Greatly Exaggerated." JPM (Spring 1996), pp. 36-44. http://www.acsu.buffalo.edu/~keechung/Collection%20of%20Papers%20for%20courses/REP ORTS%20OF%20BETA'S%20DEATH%20HAVE%20BEEN%20GREATLY%20EXAGGE RATED.pdf (RC) W. Bauman and R. Miller. "Can Managed Portfolio Performance Be Predicted?" JPM (Summer 1994), pp. 31-40. http://www.acsu.buffalo.edu/~keechung/Collection%20of%20Papers%20for%20courses/CAN %20MANAGED%20PORTFOLIO%20PERFORMANCES%20BE%20PREDICTED.pdf Midterm Exam II Topic 9 Equity Valuation (Chapter 18) Homework problems: 18:1,2,3,5-8,10,11,12,17,19,20 (RQ) R. Shiller. "Theories of Aggregate Stock Price Movement." JPM (Winter 1984), pp. 2837. http://www.acsu.buffalo.edu/~keechung/Collection%20of%20Papers%20for%20courses/THE ORIES%20OF%20AGGREGATE%20STOCK%20PRICE%20MOVEMENT.pdf Topic 10 Analysts’ Earnings Forecasts and Stock Recommendations (RQ) S. Stickel. "The Anatomy of the Performance of Buy and Sell Recommendations.” FAJ (September-October 1995), pp. 25-39. http://www.acsu.buffalo.edu/~keechung/Collection%20of%20Papers%20for%20courses/ANA TOMY%20OF%20THE%20PERFORMANCE%20OF%20BUY%20AND%20SELL%20REC OMMENDATIONS.pdf (LN) Recommendation of Security Analysts http://www.acsu.buffalo.edu/%7Ekeechung/CU%20Lecture%20Notes/Special%20Topic%20%20Analyst%20Recommendation.doc (RQ) K. Chung. Marketing of Stocks by Brokerage Firms: The Role of Financial Analysts. Financial Management (Summer 2000), pp. 35-54. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=248008 Topic 11 Options Market (Chapter 20) Topic 12 Option Pricing (Chapter 21) Excel Application http://highered.mcgraw-hill.com/sites/0072339160/student_view0/excel_applications.html Topic 13 Bond Analysis I (Chapter 14) (LN) Bond Pricing Illustration http://www.acsu.buffalo.edu/~keechung/Lecture%20Notes%20(MGF633)/bond%20pricing.xls Homework problems: 14:1,2,3,5,6,7,14-18 Topic 14 Bond Analysis II (Chapters 15,16) Homework problems: 15:1-8,11,12,17; 16:1,2,3 Topic 15 Process of Portfolio Management (Chapter 26) Homework problems: 26: 7, 8. Final Exam *This is a tentative schedule and thus subject to modification if any such need emerges during the course. All changes will be announced in class. Students not attending class are responsible for obtaining this information. Investment Project with STOCK-TRAK STOCK-TRAK is a Website that can help you to learn about the workings of the stock exchange and investment in general. Learning about the stock exchange from a book can be difficult, because it lacks the aspect of timing that is so important in exchanges. STOCK-TRAK provides the solution to this problem. It is software that uses real, time-delayed market information to simulate real-world stock portfolio performance. It allows you to learn in a time-dependent educational environment, without the high cost of mistakes in the real environment. 1. Group formation: Each group consists of X students and one of them serves as the group representative. You can form your own group and let me know who are your group members and group representative. For those who do not belong to any group will be assigned to a group by me. 2. Sign up for STOCK-TRAK at http://www.stocktrak.com/ Each group representative signs up for STOCK-TRAK and group members share the cost equally. You will need a credit card number to sign up. 3. Each group shall make collective investment/trading decisions. 4. Each group submits and presents the investment performance report during the last week of class. The report will be evaluated and graded based on the following four criteria: a. b. c. d. Investment performance = Trading profits – Number of trades x $10 Rationale for investment (trading) decisions Quality of in-class presentation Quality and thoroughness of the report