2000-01 SCI - National Electricity Code Administrator

advertisement

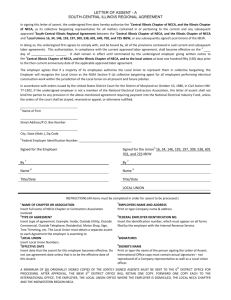

STATEMENT OF CORPORATE INTENT 2000-01 July 2000 National Electricity Code Administrator Limited ACN 073 942 775 Contents Introduction 3 Mission 4 Review programme Vision Review programme in outline Review of the scope for integrating the energy market and Network services Network and distributed resources issues End-user advocacy Review of technical standards Demand-side participation Review of the Code change process Consultation with stakeholders Feedback and post-review evaluations Resources and expertise 5 5 5 6 7 8 8 9 10 11 11 11 Surveillance, monitoring and enforcement Surveillance and monitoring programme Compliance monitoring programme 12 12 13 Other core activities 14 Key challenges 15 Critical success factors and key performance indicators 16 Beyond 2000-01 Assessment of the operation of the Code Code simplification Continuing core functions 21 21 22 22 Budget 23 National Electricity Tribunal Budget Reporting 28 28 28 2 Introduction This Statement of Corporate Intent sets out: our mission, and the commitments and aspirations we embrace in order to deliver that mission; our vision for the future of the market; proposals for delivering a coordinated review programme and our market surveillance, monitoring, enforcement and other core functions; the critical success factors and the specific key performance indicators against which we invite and expect our stakeholders to judge us; our plans beyond 2000-01; and the budget, which represents a reduction of some 10 per cent on 1999-2000, within which we commit to deliver those plans. The separate supporting material sets out more detail about our operating environment and our specific plans. The supporting material also includes a statement of corporate governance, our accounting policies and details of the NECA team. 3 Mission NECA’s mission, as articulated in our 1999-2000 Statement of Corporate Intent, is to: promote the effectiveness, efficiency and equity of the national electricity market; and lead the development of the market towards more competitive, market-oriented outcomes in order to deliver a viable market that benefits end-use customers. We aspire in fulfilling this mission to: act impartially and with integrity in accordance with the highest ethical standards; work in partnership with all our stakeholders, be open and communicate well; take responsibility for our actions and decisions; achieve results of high quality and good value; and innovate and learn. 4 Review programme Within the market and Code objectives and the broader public policy framework which is properly the responsibility of our Member Governments to lay down, NECA is responsible for administering the ongoing development of, and changes to, the Code to achieve the market objectives. Our review programme is designed to enable us to fulfill that function as set out in the Code in ways that are effective, efficient and economical; and that, as a result, command the confidence and support of governments, regulators, market participants and end-users. Vision Our vision for the future of the national electricity market is a genuinely open market that delivers electricity efficiently and at competitive prices, which is safe and reliable and in which there is: an efficient and economically rational framework; and provision of clear and rational signals for location and new investment. Review programme in outline The introduction of full retail competition will represent the single most important and farreaching development since the launch of the market itself. Other significant market developments are also already proposed or in the pipeline, including as a result of our transmission and distribution pricing and VOLL reviews. The expansion of inter-state trade as a result of the commissioning of QNI and the anticipated application by Tasmania to join the national market will also result in important changes. We intend to play our part in facilitating those initiatives. The significance of those developments points to the need for a period of relative consolidation on a broader front. It is also important, however, not to abandon or lose sight of the need for a continuing priority review programme centred around: completion of the review of the scope for integrating the energy market and network services. This review is aimed at improving the efficiency of despatch, and investment and locational signals within the market; 5 pursuit of a broader package of network and distributed resources issues, aimed at streamlining and clarifying the arrangements for the planning and approval of new regulated investments. These initiatives are intended to promote an effective framework for the market and ensure that signals to producers, suppliers and consumers are more appropriate; working with the jurisdictions and the jurisdictional regulators to develop an equivalent package of network issues at the distribution level; completion and implementation of the review of end-user advocacy in the national electricity market. This review is aimed at enhancing the ability of the demand-side of the market to participate in decision making and influence the development of a more effective and responsive market framework; completion of the review of technical standards in the Code. This will help to ensure that, as far as possible, non-tariff barriers to new entry are eliminated; and the launch of reviews, as required by the Code, of the existing market information provisions and the alternative dispute resolution arrangements. These initiatives are intended to enhance the effectiveness of the market framework while facilitating more competitive and market-oriented outcomes. We shall work with Tasmania, and the other participating jurisdictions, to encourage and facilitate its anticipated application to join the market. We have already put forward Code changes to facilitate the integration of Basslink into the national electricity market and look forward to the Tasmanian Government’s becoming a Member of NECA and nominating a director to serve on our board. We plan to work with the jurisdictions and the ACCC on a review of the Code change process, with the aim of simplifying and streamlining that process. We shall continue to pursue our demand-side participation initiative. We shall also convene a forum to assess the performance of the market, to follow-up the forum we held jointly with NEMMCO in August 1999. Taken together, whilst recognising the need for a period of relative consolidation, this programme represents a formidable agenda for 2000-01 and future years. Review of the scope for integrating the energy market and network services We launched this review, required under clause 3.5.1(e)-(f) of the Code, last October. It is addressing: the most appropriate basis for the division of the market for spot market purposes. NECA is required by the Code to review the adequacy and appropriateness of the existing criteria for the determination of regions. The options for the basis for dividing the market range from minimal changes to the existing criteria through more extensive changes (including to introduce explicit forward looking elements into those criteria) to full nodal pricing; 6 the options for improved risk management mechanisms and techniques, including refinements to the existing residue auction arrangements or the introduction of some form of transmission congestion contracts or other financial instruments; and improved or alternative ways of representing or calculating transmission and distribution loss factors, in accordance with our obligations under clause 3.6.3(h) of the Code. The review will also address implementation and transitional issues. We intend to publish a draft report by September and our final report by November. Network and distributed resources issues We are working on a package of network and distributed resources issues aimed at refining the draft Code changes we put forward to implement the recommendations of our transmission and distribution pricing review in order to provide a clear framework and streamlined process for determining the relative beneficiaries of new regulated network investments. The package is also intended to refine the existing provisions of the Code, for example in relation to consideration of demand-side and distributed generation alternatives to new network investments, in order to give proper effect to those provisions. The main components of that package are: changes to the respective rôles and responsibilities of NSPs, the IRPC, NEMMCO and the ACCC in relation to the planning and approval of new regulated network investment projects; a streamlined process, compared to the one proposed in the final report of our transmission and distribution pricing review, for determining the relative beneficiaries of those projects; and strengthened requirements to ensure proper advance disclosure of information, genuine consideration of demand-side and local generation alternatives, and meaningful consultation with affected customers on proposed network investments. Linked to this package the Reliability Panel is also undertaking a review of the network performance requirements set out in schedule 5.1 to the Code. This review will be completed by November. We intend to bring forward the other components of the wider package alongside the draft report of our review of the scope for integrating the energy market and network services. In the light of the outcomes of this initiative, we will work with the jurisdictions and the jurisdictional regulators to seek endorsement to develop an equivalent package of network refinements at the distribution level. 7 End-user advocacy This review, required under the terms of the ACCC’s determination on the third tranche Code amendments, was launched in March and is looking in particular at: the need for amendments to the Code to ensure an effective opportunity for end-user involvement by enhanced representation within the national market, eg by amending the Code consultation procedures in chapter 8 of the Code; appropriate provision of information, and practices and procedures, by NECA and NEMMCO reasonably to facilitate end-user advocacy; the scope for improved organisational and representational arrangements on the part of end-users themselves, possibly but not necessarily exclusively through the establishment of a recognised end-user advocacy group; and the arguments for and against funding of end-user advocacy through a levy on participant fees and appropriate arrangements for determining the amount and allocation of such a levy. Review of technical standards The review of technical standards, as required under clause 5.2.6 of the Code, is aimed at ensuring a reasonable balance between the interests of incumbents and new entrants, and remote and embedded generation, and will examine in particular: whether the existing standards in the Code are too stringent and especially therefore whether they represent a barrier to entry to the market in particular for cogeneration and emerging technologies; the relationship between the standards and the provision of ancillary services; the need for consistency in the application of, and adherence to, the standards across the entire national market; and the use of Australian and international standards rather than Code specific standards. The review is being conducted in close cooperation with Standards Australia and is addressing all the technical standards set out in the Code, except those that relate to network performance requirements that will be the subject of a separate Reliability Panel review. The review will be conducted in two stages. Stage one will establish the principles for the standards and identify the appropriate linkage to Australian and international standards. Stage two will develop the detailed standards and Code changes necessary to implement those principles. The aim is to complete stage one of the review by September and stage two by the end of the year. 8 Demand-side participation This initiative is aimed at identifying the existing impediments to, and facilitate and encourage more proactive, demand-side participation in the national electricity market. It was initially included in, and endorsed by Members as part of, our 1999-2000 Statement of Corporate Intent. Proactive demand-side participation can add value to the broader market through: direct participation in the energy market as a demand-side bid, independent customer price responsiveness as a wholesale market participant or under a retail tariff arrangement; provision of ancillary services, for example, for frequency or voltage control, under contract to NEMMCO or through competitive bidding under the likely revised ancillary service arrangements; and network services, for example, for localised voltage contract and peak or contingency load management. Our initiative is examining, amongst other things, the impediments in current market arrangements to the development of a vigorous and competitive demand-side response, and ways in which the market framework could facilitate customers gaining the full value of their demand-side response. This will include: the regulatory framework; commercial incentives; technical coordination; market information and communication; and transaction costs. As a crucial first step, we conducted a questionnaire survey of retailers and end-use customers to assess the existing extent of, and attitudes towards, demand-side participation. Our objectives for the survey were to: establish a database recording the status and scale of retail demand-side programmes and initiatives, and customer involvement in the national market; determine the likely trends for future involvement of the demand-side in the national market; develop, monitor and report on appropriate indicators of demand-side participation; and 9 discover customer attitudes to the market, particularly their understanding of the market design, level of interest in proactive demand-side participation, threshold issues and appropriate incentives for more pro-active participation, expectations of the market and market intermediaries, and their support for existing and appetite for new or additional retail demand-side products. The results of the survey will assist NECA to meet its obligation to report on the extent and effectiveness of demand-side participation in the market and measures that could be taken to enhance demand-side partcipation, as required under clause 8.7.4 of the Code. The survey findings will also provide a basis for shaping further initiatives to overcome any structural or Code-based barriers to greater participation by the demand-side. Review of the Code change process We shall work with our Member governments and the ACCC on the rôles and procedures involved in the Code change process, with the aim of simplifying and streamlining that process. The existing arrangements are too cumbersome. Even relatively straightforward and noncontroversial changes absorb too much time and resources, not least because they involve duplicated procedures. There needs to be a better balance between ensuring essential and appropriate involvement and consultation in developing proposed changes to the Code, on the one hand and the need to streamline the arrangements on the other. One approach which might strike a more appropriate balance, and which we shall wish to explore, is to restructure the Code into three categories of provisions: issues of principle which go to the core of the overall net public benefit of the entire national electricity market arrangements, or affect the access regime, and which will properly continue to require the authorisation or approval of the ACCC following a full and open public consultation process; provisions which are designed to support or give effect to those principles, but which do not themselves affect the public benefit of the market arrangements, and which provided they are consistent with those principles might be dealt with solely by NECA and the Code Change Panel; and technical and operational issues which could be dealt with in schedules to, or be removed entirely from, the Code. In the light of this review, we shall seek opportunities to work with the jurisdictions, jurisdictional regulators, Code participants and other stakeholders to identify opportunities to simplify the Code itself. 10 Consultation with stakeholders We shall continue to consult the Government Liaison Panel and Market Liaison Panel on the conduct and coordination of the review programme. We shall continue to pursue opportunities for greater involvement in consultation processes by a range of end-use customers, including by representation on liaison panels and working groups. The review of the feasibility and resourcing of end-user advocacy will also help inform our consultation procedures. We are committed to direct consultation with all our stakeholders. We shall continue to hold ad hoc and one-on-one meetings with stakeholders and interested parties, including workshops and fora with each group of stakeholders and in all regions of the market in relation to reviews and major initiatives. Feedback and post-review evaluations We will provide feedback on formal comments made in the course of reviews. Draft and final reports will include comments on specific issues raised. We will also continue our programme of post-review evaluations to collect information about stakeholder perceptions of the conduct, efficiency and effectiveness of review processes and outcomes. We shall publish the results of these evaluations on our website. They will help inform the conduct of future reviews and influence NECA’s consultation and stakeholder liaison processes more generally. Resources and expertise We shall continue to draw on a small, core in-house team but also to make appropriate use of consultants in order to ensure the effective achievement of this programme. 11 Surveillance, monitoring and enforcement We are committed to undertaking appropriate and effective surveillance and monitoring of the market in order to: determine whether Code participants are complying with the Code; assess whether the dispute resolution, Code enforcement, Code change and other mechanisms are working effectively in the manner intended; determine whether, in its operation, the Code is adequately giving effect to the Code objectives; and collect, analyse and disseminate information relevant and sufficient to enable us to comply with our reporting and other obligations and powers under the Code. Our authority to undertake surveillance and monitoring is derived from clause 8.7 of the Code. We also have significant enforcement powers under clause 8.5. We shall approach our Member governments, including to seek additional powers if necessary, if issues arise about our ability to enforce the Code. Our objective is to operate a light-handed but effective regulatory regime that emphasises voluntary Code compliance. Achieving this objective depends crucially on participants acting in good faith to comply with the requirements of the Code. We are confident that we can continue to expect and rely on that good faith. Wewill not hesitate, however, to move swiftly and appropriately in circumstances where we judge it appropriate to take action. Surveillance and monitoring programme We will vigorously pursue our published strategy for surveillance and monitoring. Our objective for this programme is to support and foster the effective and efficient operation of the market. We will continue to undertake: market surveillance, including analysing variations between forecast and actual spot prices as required under clause 3.13.7 of the Code; monitoring of market participants’ compliance with the Code; random targeting of specific aspects of market operation and Code requirements, to detect instances of potential Code breaches; and 12 monitoring and assessment of New South Wales power traders, Queensland exempted generators and Victorian smelter traders. We will also: expand the information published for stakeholders to improve transparency and facilitate greater understanding of the dynamics of the market, eg analysis of rebidding trends and reasons, and the quality of market forecasts; examine the level of competition in energy, ancillary services and inter-regional trading arrangements; and expand our compliance monitoring programme. We will ensure that its monitoring and surveillance methodologies continue to keep pace with the increasing maturity and sophistication of the market, and exploit developments in technology. Compliance monitoring programme We recently initiated a rolling programme to review the Code compliance strategies of market participants. These reviews are conducted cooperatively and involve one-on-one interviews with participants to discuss their compliance strategies, critical challenges they face in discharging their Code obligations and their management of the obligations to them of other participants. The programme is intended to cover all market participants over two years and has so far encompassed two Victorian generators and one retailer in each of Queensland and South Australia. 13 Other core activities During 2000-01 we shall continue to discharge our other core activities effectively and efficiently. NECA will continue to promote system reliability and security, in particular through the work of the Reliability Panel. The Panel will continue to fulfil its commitments under clause 8.8.1 of the Code to: determine and maintain the power system security and reliability standards; determine and maintain guidelines governing the exercise of NEMMCO’s power to issue power system security directions; determine and maintain guidelines and policies governing the exercise of NEMMCO’s power to contract for the provision of reserves; and review the performance of the market in terms of power system security and reliability. The Panel will take account, in fulfilling these functions, of the lessons arising from investigations into extreme events and NECA’s monitoring and surveillance activity. The Reliability Panel will undertake a review of network performance standards in accordance with schedule 5.1 of the Code. The review will be completed by November. To support the work of the Panel, and to obtain expert advice on system operation, NECA seeks the advice of key personnel within the industry who have expertise in this area. NECA will continue to consult this expert group before taking matters to the Panel and provide the group’s advice to the Panel. NECA will continue to meet its obligations across the full range of its other core activities: alternative dispute resolution procedures; Code updating and publication, including the maintenance of eCode; maintaining the guidelines for exempting network service providers; monitoring and approving changes to NEMMCO’s market management software; processing appeals from decisions involving metering data agents; and ensuring continued end-user representation on the settlement residue auctions steering committee. 14 Key challenges Challenge Response efficient implementation of reform initiatives manage the reform process in a way that will maximise the prospects of smooth and rapid implementation of outcomes cost-effective delivery of high quality outputs plan and manage staff, consultants and other resources to achieve objectives enhancement of stakeholder relationships implement the outcomes of the review of the feasibility and resourcing of an end-user advocacy group, anticipate and address likely objections and concerns and demonstrate a genuine commitment to listening and dialogue ensuring compliance with the market deliver surveillance, monitoring and rules enforcement that is light-handed but effective; identify areas where Code breach is most likely and implement strategies to target those areas facilitating prompt and cost-effective dispute resolution maintain a dispute resolution system that is timely and effective. 15 Critical success factors and key performance indicators Drawing on our aims, objectives, strategic imperatives and key challenges, NECA has established three critical success factors against which to measure its performance during 2000-01, to: administer a targeted programme of practicable and cost-effective reviews to ensure the ongoing development of, and changes to, the Code to achieve the market objectives; ensure effective performance of our Code change, surveillance and monitoring and alternative dispute resolution functions; and continue to build strong, trusting and productive relationships with all our stakeholders by consulting and communicating proactively and responsibly. This section sets out specific key performance indicators linked to each of these success factors. We will formally assess our performance against these key performance indicators in each quarterly report to Members. We will also evaluate our performance through: an independent stakeholder perceptions survey; formal evaluations conducted after each review. The results of these evaluations will be published on our website; and regular feedback received through our liaison panels, and focus and working groups. 16 Critical success factor 1: to administer a targeted programme of practicable and costeffective reviews to ensure the ongoing development of, and changes to, the Code to achieve the market objectives. NECA will complete its: review of the scope for integrating the energy market and network services, with a draft report to be released by September and a final report by November; network and distributed resources initiative, with a package of proposed reforms to be released in September; implement the conclusions of the end-user advocacy review in accordance with the published timetable as soon as practicable after the release of the final report; and review of technical standards in the Code in two stages: stage one to establish principles and standards by September; and stage two to develop the detailed standards and Code changes necessary by December. NECA will continue its demand-side participation initiative. As a first stage it will complete the survey of retailers and end-use customers and develop initiatives focused on opportunities in the energy market, ancillary services and network services by September. NECA will also: review the Code change arrangements in consultation with jurisdictions and the ACCC to improve effectiveness and to streamline the process; review dispute resolution arrangements in the light of experience to date by March 2001; and review market information provisions by December. NECA will consult using processes at least as thorough as the Code consultation procedures. NECA will provide feedback on its response to issues raised in formal comments made to us in the conduct of reviews. NECA will conduct formal post review evaluations of the conduct of all major reviews within three months of the conclusion of the review 17 Critical success factor 2: to ensure the effective performance of our Code change, surveillance and monitoring and alternative dispute resolution functions. NECA will: continue to make the most up to date version of the Code available in paper and electronic (eCode) form and on our website; administer effective and consultative Code change arrangements within Code timeframes; promote strategies wherever possible to streamline Code change arrangements, including through consultation and liaison with the ACCC; in conjunction with the South Australian Government conduct the next annual review of the National Electricity Regulations by March 2001; ensure Code compliance by: maintaining a proactive and effective surveillance and monitoring programme; ensuring that the provision of information under the NEMMCO information protocol continues to provide NECA with sufficient data to discharge its duties, and reviewing the protocol six-monthly; maintaining a compliance audit programme targeting six specific Code provisions each quarter; initiating a rolling programme of four Code compliance strategy reviews a quarter with individual Code participants; meeting quarterly with the ACCC to discuss and progress compliance issues; publishing and disseminating within one month of the end of each quarter a detailed report on the performance of the market during the preceding quarter; publishing special reports on specific market performance issues as appropriate; and in the case of Code breaches, taking appropriate action either through initiating action before the National Electricity Tribunal, or entering into voluntary agreements with market participants to implement compliance programmes; 18 Critical success factor 2 continued ensure the implementation and effective administration of dispute resolution arrangements by: maintaining the appointment of a dispute resolution advisor; keeping the dispute resolution panels staffed and up to date; completing the review of alternative dispute resolution arrangements by March 2001; and reporting six-monthly on the resolution of matters through the alternative dispute resolution arrangements, by 31 January and 31 July; maintain the Reliability Panel and work with the Panel to: determine and maintain the power system security and reliability standards; determine and maintain guidelines governing the exercise of NEMMCO’s power to issue power system security directions; determine and maintain guidelines and policies governing the exercise of NEMMCO’s power to contract for the provision of reserves; review the performance of the market in terms of power system security and reliability; complete its review of network performance requirements in accordance with schedule 5.1 of the Code by November; and review by April the value of lost load (VOLL), and in particular the cumulative price threshold. 19 Critical success factor 3: to continue to build strong, trusting and productive relationships with all our stakeholders by consulting and communicating proactively and responsibly. NECA will: maintain formal and informal links with stakeholders, including through the Government Liaison Panel, Market Liaison Panel, the national electricity market forum, and other fora; liaise effectively with the ACCC, State and Territory regulators and other market regulators. In particular, we shall hold quarterly formal liaison meetings with the ACCC; maintain close and regular liaison, at all levels, with NEMMCO; maintain and develop an interactive internet homepage; collect information and statistics, publish reports and disseminate information relating to the performance of the national electricity market. In particular, we will provide: quarterly reports to Members within a month of the end of each quarter; half-yearly reports on referrals to the Tribunal, the findings of the Tribunal and any relevant demands for payment, by 31 January and 31 July; a 1999-2000 annual report by 1 November; a report on the operation of the Code during 1999-2000 (under clause 8.7.4) by 1 November; and a draft 2001-2002 Statement of Corporate Intent and budget to Members by 1 June or any new deadline established in our Members’ Agreement. conduct a stakeholder perceptions audit by September; conduct a seminar for members of the National Electricity Tribunal to update them on recent developments in relation to the Code by December; convene a public forum to assess the performance of the market by August; and publish agenda for, and minutes of, all meetings of liaison groups that we convene. 20 Beyond 2000-01 We recognise the need to plan for the medium and long-term whilst at the same time not preempting: developments in broader public policy that are legitimately the domain of the jurisdictions; technological developments; and the natural evolution of the market as a result of the increasing maturity and sophistication of market structures and participants. Our two key priorities beyond 2000-01 will be a comprehensive review of the performance and operation of the Code since market launch and, in the light of that review and of our review of the Code change arrangements, a review of the detailed provisions of the Code aimed at simplifying, and removing the ambiguities in, its provisions. We shall, however, continue to review and refine those priorities and our detailed plans in consultation with the jurisdictions, Code participants, end-use customers and other stakeholders in order to retain flexibility to respond to emerging issues in the market. Assessment of the operation of the Code During 2001-02 we will undertake a comprehensive review of the performance and operation of the Code since the market commenced, as required under clause 8.7.5 of the Code. That assessment will include, amongst other things: the extent to which the operation of the Code during the period covered by the report has met the Code objectives; the extent to which Code participants have complied with the provisions of the Code during the period covered by the report; and the impact of any conditions of any ACCC authorisations or approvals relating to the Code on the operation of the Code. In 2001-02 we will use the annual forum on the performance of the market to initiate this project. We propose to conduct discrete in-depth appraisals of each aspect of the market in consultation with all interested parties, with the outcomes feeding into the holistic report on the overall market. 21 Code simplification As part of our review of the Code change arrangements, and more generally in forwarding Code changes to the ACCC, we shall seek opportunities for simplifying and streamlining the Code with a view to making it less complex and more accessible. In the light of our assessment of the operation of the Code and of the review of the Code change arrangements, we shall also launch a comprehensive review of the Code aimed at simplifying, and removing the existing ambiguities in, its provisions. Continuing core functions In addition to these key priorities, we shall continue to refine and improve our performance of our core functions of market surveillance, monitoring and enforcement, assessing network service provider exemptions and market software approvals. We shall also continue to undertake a relevant and appropriate review programme. We shall seek endorsement of individual elements of that programme as we identify specific needs. 22 Budget The following tables set out NECA’s 2000-01 budget of $5.5 million, together with a breakdown of budgeted administration costs, and forward estimates for 2001-2002 and 20022003. The tables also set out a breakdown of the 2000-01 budget by key activity. The budgeted income will enable NECA to continue its five year repayment programme for its establishment borrowings of $3.5 million. $1.7 million of those borrowings remain. Allowance has been made for sufficient staff and professional advice to fulfill NECA’s obligations. Allowance has also been made in the forward estimates for the entry of Tasmania into the national electricity market. The budget includes provision for the recruitment of suitably qualified staff to complement the in-house team. The 2000-01 budget is 11 per cent below the 1999-2000 budget, and 8 per cent below our projected outturn for 1999-2000. The forward estimates for 2001-2002 and 2002-2003 represent reduction in real dollar terms of the 2000-01 level. The budget does not incorporate the budget of the National Electricity Tribunal, which has been approved separately by the Tribunal’s chairman, the Hon Jerrold Cripps QC, and which is set out elsewhere in this document. With the exception of income raised from sales of the Code and subscriptions to eCode, and other minor sources, NECA’s budgeted costs will be met through participant fees. NECA’s fees for 2000-01 will reduce from approximately 0.5 to 0.3 cents per MWh. This will represent a reduction in the proportion NECA’s fees represent of the cost of delivered energy from 0.004 per cent to 0.003 per cent. NEMMCO will collect fees and the applicable GST from market participants on NECA’s behalf, and pay them to NECA weekly. The outcomes of the national electricity market liability and governance review may require some adjustment to the budget. 23 Budget for 2000–2001 and indicative budgets for 2000–2002 and 2002–2003 Income 1998-1999 (outturn) 1999-2000 (budget) 1999-2000 (forecast) 3,340,892 6,201,100 6,823,000 Surplus carried forward Participant Fees Code Sales Bank Interest 2000-01 (budget) 2001-2002 (budget) 2002-2003 (budget) 5,500,000 5,500,000 5,500,000 330,000 385,000 400,000 2,150,000 2,250,000 2,300,000 147,600 5,300,600 50,000 2,400 Expenditure Board Expenses 377,337 455,500 331,800 Board Fees Board Travel & Expenses Personnel Expenses Salaries Personnel Expenses Consultants & Legal Fees Running Costs Depreciation Debt Financing Total Expenditure 260,000 70,000 1,543,223 2,255,000 1,870,000 1,900,000 250,000 1,461,321 1,350,000 1,364,591 1,500,000 1,300,000 1,200,000 1,162,278 1,156,600 723,000 930,000 975,000 1,000,000 39,257 54,000 40,000 36,000 30,000 25,000 214,254 930,000 1,594,743 554,000 560,000 575,000 4,797,670 6,201,100 5,924,134 $5,500,000 $5,500,000 $5,500,000 24 Projected statement of cash flows 2000-01 year CASH FLOWS FROM OPERATING ACTIVITIES Receipts from market participants Receipts from customers Interest received Payments to suppliers and employees Interest and other finance costs 5,300,000 50,000 2,400 (4,910,000) (100,000) Net cash outflow from operating activities 342,400 CASH FLOWS FROM INVESTING ACTIVITIES Payment for property, plant & equipment Net cash outflow from investing activities - CASH FLOWS FROM FINANCING ACTIVITIES Repayment of borrowings (2,059,000) Net cash inflow from financing activities (2,059,000) NET INCREASE (DECREASE) IN CASH HELD (1,716,600) Cash at beginning of financial year (estimated) CASH AT END OF FINANCIAL YEAR 25 1,175,000 541,600 PROJECTED BALANCE SHEET EQUITY Estimated surplus 30 June 2000 Less recovery of establishment cost borrowings Estimated surplus 1 July 2000 - 30 June 2001 30 June 2000 (draft) 30 June 2001 (projected) 2,342,350 1,398,724 507,200 152,400 1,043,924 2,342,350 Represented by: CURRENT ASSETS GST asset Petty cash imprest Trade debtors BankSA Accounts receivable 110 160 279,000 1,147,567 512,236 1,939,073 500,000 1,007,200 19,820 6,416 13,404 19,820 9,820 10,000 203,427 80,761 122,666 202,000 122,000 80,000 NON CURRENT ASSETS Term debtors 2,585,804 1,521,624 TOTAL ASSETS 4,660,947 2,618,824 68,000 705 51,533 209,643 329,881 541,600 150,000 30,300 133,205 85,000 125,000 1,065,105 1,288,793 1,288,793 643,000 643,000 TOTAL LIABILITIES 1,618,674 1,708,105 NET ASSETS 3,042,273 910,719 FIXED ASSETS Leasehold improvements Less: Accumulated depreciation Office furniture and equipment Less: Accumulated depreciation CURRENT LIABILITIES Bank SA Accrual consultants Sundry creditors GST liability Provision for holiday pay Accrued charges NON CURRENT LIABILITIES Bank SA (fully drawn advance) 26 507,200 2000-2001 expenditure by cost centre Tax payments 2% Repayment of establishment costs 10%Code The Board 6% 18% General liaison and programme Review consultation 5% 19% programme Review Surveillance, 19% monitoring and enforcement 13% Reliability Panel 6% of Repayment Administration 18% establishment costs Alternative dispute 10% Reliability Panel resolution 3% Tax payments 2% Business cost centres Corporate cost centres Board 6% 6% General liaison and consultation 5% Alternative dispute resolution Surveillance, monitoring 3% and enforcement Administration 13% 18% Cost centre Review programme The Code Surveillance, monitoring and enforcement Reliability Panel Alternative dispute resolution Administration General liaison and consultation Board Tax payments Repayment of establishment costs Total 27 The Code 18% Budget 1,065,100 999,500 720,420 322,500 140,000 981,480 282,000 330,000 105,000 554,000 $5,500,000 National Electricity Tribunal The National Electricity Tribunal was formally established at the same time as market launch on 13 December 1998. NECA has appointed a Tribunal registrar, and deputy registrars in each jurisdiction, and together with the registrar will provide appropriate administrative support for the Tribunal. In 2000-01 NECA has agreed to arrange a seminar for members of the Tribunal to update them on developments in relation to the Code and the market since market start. An agenda for the seminar will be developed in consultation with the chairman of the Tribunal. Budget The Tribunal’s 2000-01 budget is attached. The Tribunal’s chairman, the Hon Jerrold Cripps QC, has determined its budget, in consultation with NECA. The budget allows for known and estimated fixed and variable costs. The jurisdictions have decided that the remuneration of members will be reviewed annually, taking into account Tribunal activity levels. The Tribunal’s budgeted costs are met through participant fees, collected on the Tribunal’s behalf by NEMMCO under the arrangements set out in clause 2.11 of the Code. During 2000-01, however, funds already held on deposit by the Tribunal are expected to meet the costs of the Tribunal’s operations. Reporting The Tribunal prepares an annual report on its activities. NECA is required to report half-yearly on issues referred to the Tribunal, Tribunal findings and fines that may result from Tribunal decisions. 28 National Electricity Tribunal Budget 2000-01 Tribunal Retainers Sitting fees Travel and accommodation Accommodation – Chairman Support costs $39,000 $100,000 $40,000 $12,000 $29,000 Assessors Fees Travel and accommodation $48,000 $19,000 Registrars Registrar and deputy registrar fees Secretarial and administration support Travel and accommodation Office expenses Total $24,000 $11,000 $22,000 $6,000 $350,000 29