General Facility Letter

advertisement

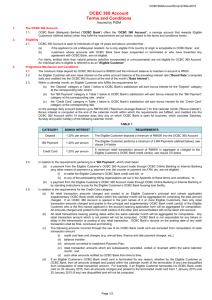

FACILITY LETTER PAWNSHOP FINANCING PRIVATE AND CONFIDENTIAL Our Ref: [ ] Date: [ ] To: [ Name of Borrower ] [ Address ] Dear Sirs CREDIT FACILITIES We are pleased to extend to you (the "Borrower") the following credit facilities (collectively "the Facilities" and each a "Facility") totalling S$[] subject to the following terms and conditions and the Standard Terms and Conditions Governing Banking Facilities:1. LIMITS/QUANTUM [New] Limit ( ) Overdraft S$ [ ] ( ) Specific Advance Facility (Tenor: up to [v] years) S$ [ ] S$ [ ] Total: *[Combined outstanding under ( sublimit] at any one time.] ) to ( ) shall not exceed S$[] [and/or individual *[The Facilities shall not exceed [v]% of the value of [state security], as determined by the Bank, at any time.] 2. PURPOSE ( ) Overdraft : For working capital requirements ( ) Specific Advance Facility : [state purpose for which the SAF is granted ] 3. PRICING ( ) Overdraft : []% p.a. over the Bank's prevailing prime lending rate calculated on daily balance with monthly rests. ( ) Specific Advance Facility : FOR SINGAPORE DOLLARS [cost of funds] OCBC Legal / Sep 09 Our Ref: <Company Name> <Page no.> PRIVATE & CONFIDENTIAL []% p.a. over the Bank's prevailing Cost of Funds for interest periods of *[1, 2, 3, 6, 9 & 12 months] at the Borrower’s option. [or] [swap offer rate] []% p.a. over the Bank's prevailing Swap Offer Rate as determined by the Bank for interest periods of *[1, 2, 3, 6, 9 & 12 months] or such other interest periods at may be agreed by the Bank. [or] At the prevailing market rate as determined by the Bank The Bank’s current prime lending rate is []% p.a. The rate(s) applicable to the relevant Facility shall hereinafter be referred to as the "Prescribed Rate". The Bank shall, at its absolute discretion at any time upon notification (but without your consent), be entitled to revise the Prescribed Rate, the periodic rests applicable to the relevant Facility, and the commission, fee or bank charges in respect of any of the Facilities granted to you. Such notification shall be conclusive and binding on you. [For SAF] If, in relation to the SAF advance, the Bank is unable to determine the *[Swap Offer Rate]/ [SIBOR] by 11.00 a.m. then the rate of interest applicable to that advance for that interest period shall be determined by the Bank in consultation with the Borrower. ( ) SECURITY/SUPPORT The Facilities will be secured by the following in form and substance satisfactory to the Bank:[List security(ies) applicable to Facilities granted. Examples are set out below.] ( ) Debenture over Assets *[Existing] Debenture incorporating a *[Fixed]/[Floating]/[Fixed and Floating] charge over *[all assets] [state specific assets]. Guarantee ( ) *[Existing] Deed of Guarantee and Indemnity for *S$[] / [all monies] from [insert name of guarantor]. OCBC Legal / Sep 09 Our Ref: <Company Name> <Page no.> PRIVATE & CONFIDENTIAL ( ) OVERDRAFT ( ) The Overdraft is subject to monthly or such other periodic interest servicing as the Bank may specify and is repayable on demand. ( ) The Overdraft limit is to be reduced by [] *[monthly/quarterly/semi-annual] instalments of S$[] each starting from [state date], until the *[Overdraft limit is at S$[]]/ [Overdraft is fully repaid]. Notwithstanding the above, the above reduction schedule shall always be subject to review at the Bank’s absolute discretion. The Bank shall have the right and shall be entitled to cancel and demand repayment of the outstanding Overdraft Facility at any time by notice to you in writing. ( ) The Overdraft is subject to monthly or such other periodic interest servicing as the Bank may specify and is repayable on demand. The Overdraft limit is to be reduced as follows: Date Amount of Reduction xxx yyy Notwithstanding the above, the above reduction schedule shall always be subject to review at the Bank’s absolute discretion. The Bank shall have the right and shall be entitled to cancel and demand repayment of the outstanding Overdraft Facility at any time by notice to you in writing. ( ) SPECIFIC ADVANCE FACILITY Availability/drawdown: ( ) Subject to the availability of funds to the Bank the Specific Advance Facility (“SAF”) will be available for drawdown by you from time to time on a revolving basis provided always that at any one time the aggregate principal sum of all advances made under the SAF and remaining unpaid shall not exceed the SAF limit applicable at that time. ( ) Subject to the Bank's absolute discretion to permit otherwise:(a) Each advance from the SAF shall be of an amount of not less than S$[] and of integral multiples of S$[]. (b) The duration of each interest period shall be *[1], *[2], *[3], *[6], *[9] or *[12] months as notified to the Bank in your Notice of Drawing relating thereto. You shall select such interest periods as which shall enable you to comply with your obligations under this Facility Letter. (c) Each interest period shall start on the last day of the preceding such period and the first interest period shall begin on the date of the first advance. (d) The Notice of Drawing under the SAF:- OCBC Legal / Sep 09 Our Ref: <Company Name> <Page no.> PRIVATE & CONFIDENTIAL (i) subject to the Bank's absolute discretion to permit otherwise, shall be given by you to the Bank not later than 11.00 a.m. on the third Business Day prior to the intended date of advance; (ii) must specify a proposed date of the advance which is a Business Day; and (iii) must be in writing in the form attached to this Facility Letter and shall be irrevocable and binding on you. (e) If you fail to give the Notice of Drawing in accordance with paragraphs (b) and (d) above, the interest period shall, subject to the other provisions of this Clause, be 1 month. (f) Any interest period which would otherwise end on a non-Business Day shall end on the next Business Day in that calendar month if there is one, or if there is not, on the immediately preceding Business Day. (g) You shall not be entitled to prepay (whether in whole or part) any advance before the last day of the interest period. Repayment: ( ) The SAF is repayable on demand. Without prejudice to the aforesaid, each advance with interest thereon shall be repaid on its due date or rolled over at the Bank’s absolute discretion *[save for interest periods of [e.g. 6, 9 & 12] months wherein interest shall be paid on a [ ] basis. ( ) Amounts drawn under the SAF can only be repaid and/or redrawn on its due date. ( ) The SAF is subject to the following reduction schedule: Date Reduction Amount xx yy Notwithstanding the above, the above reduction schedule shall always be subject to review at the Bank’s absolute discretion. The Bank shall have the right and shall be entitled to cancel and demand repayment of the outstanding SAF at any time by notice to you in writing. ( ) AVAILABILITY PERIOD [Others] ( ) The [state type of facility] shall cease to be available after [state date], unless extended by the Bank in its absolute discretion. ( ) The [state type of facility] shall be available for drawdown subject to fulfilment of all conditions precedent until [state event] or [state date], whichever is the earlier, unless extended by the Bank in its absolute discretion. OCBC Legal / Sep 09 Our Ref: <Company Name> ( ) <Page no.> PRIVATE & CONFIDENTIAL FEES [State fee(s) if applicable. Examples are set out below]] Front-end / Facility Fees ( ) A non-refundable front-end fee of S$[] shall be payable to the Bank upon acceptance of this Facility Letter. ( ) A non-refundable facility fee of S$[] shall be payable to the Bank upon drawdown of the Specific Advance Facility. Cancellation Fees ( ) A cancellation fee of []% flat will be charged if any of the Facilities are not disbursed by the end of the availability period and shall be payable on [state date/period] . ( ) Other Fees All out-of-pocket expenses (including legal fees and goods and services tax) incurred in connection with the preparation, execution and delivery of the Facility Agreement or Term Loan Agreement (where applicable) and related documentation shall be for your account. Further, if upon acceptance of the Facility Letter, the Facilities are aborted for any reason whatsoever or if you subsequently decide not to proceed with the Facilities, you shall in addition pay an abortive fee of []% flat of the limit of the Facilities to the Bank. ( ) FINANCIAL COVENANTS [List applicable financial covenants. Examples set out below.] ( ) You shall increase your paid up capital to at least S$[] prior to disbursement of the Facilities. ( ) You shall maintain your networth at not less than S$[] *[at all times]/[upon completion of the development]. Networth is defined as the sum of your paid-up capital and retained earnings. ( ) You shall maintain your gearing at below []% at all times. Gearing is defined as the ratio of debt to debt plus equity. ( ) You shall maintain your total liabilities to tangible networth *[on a consolidated basis] at less than []% at all times. ( ) No dividends are to be paid to shareholders without the Bank's prior written consent. ( ) *[Directors', shareholders' and related corporations’ loans of at least S$[]]/[All directors’, shareholders’ and related corporations’ loans] shall be subordinated to the Facilities from the Bank and any repayment thereof would require the Bank's consent. OCBC Legal / Sep 09 Our Ref: <Company Name> <Page no.> PRIVATE & CONFIDENTIAL ( ) OTHER COVENANTS ( ) OTHER TERMS AND CONDITIONS (a) You shall submit to the Bank a copy of your Monthly Return to the Registrar of Pawnbrokers on Pawnbroking Business within 14 days of your submission to the Registrar of Pawnbrokers of the same. (b) You shall permit a regular inspection to be undertaken at your pawnshop and your pawn articles, which shall be conducted by an inspector appointed by the Bank. (c) The total credit limit of the Facilities shall not exceed [v]% of the value of [pledged stocks][state security], as determined by the Bank based on your Monthly Return to the Registrar of Pawnbrokers on Pawnbroking Business, at any time. ( ) CONDITIONS PRECEDENT TO AVAILABILITY OF FACILITIES The Facilities will be available for your use upon completion of all matters and documentation to the satisfaction of the Bank, and upon: ( ) receipt of the following (where applicable) in form and substance acceptable to the Bank, including but not limited to:[General provisions] (a) Copy of your Certificate of Incorporation and Memorandum and Articles of Association and that of the guarantors, mortgagors, third party depositors and any persons (other than you) providing security for the Facilities (collectively “the Surety”), certified as a true copy by a Director or the Company Secretary. (b) Copy of your Board Resolutions and Shareholders' Resolutions (if required by the Bank) and that of the Surety, if a corporation, in the Bank’s prescribed format and duly certified as a true copy by two Directors or a Director and the Company Secretary. (c) All security and support documents containing such terms and conditions as the Bank may in its absolute discretion require duly executed and duly stamped (where applicable). (d) A copy of your Pawn Broking Licence. ( ) Form for appointment of process agent duly executed (where applicable). ( ) Spousal Consent duly executed (where applicable). ( ) Statement Containing Particulars of Charge in respect of the relevant security documents for filing with the Accounting and Corporate Regulatory Authority. ( ) All insurance policies and assignments required by the Bank. OCBC Legal / Sep 09 Our Ref: <Company Name> <Page no.> PRIVATE & CONFIDENTIAL ( ) Without prejudice to the generality of the foregoing, adequate insurance for such purposes and for such amounts as the Bank shall deem fit from time to time taken out with OVERSEAS ASSURANCE CORPORATION LIMITED or such other insurance company acceptable to the Bank on terms and conditions acceptable to the Bank and assigned/endorsed in favour of the Bank as mortgagee and loss payee. All premium charges are to be borne by you and must be promptly paid. The policy(ies) and receipts for every premium paid in respect thereof shall be delivered and/or produced to the Bank without demand. ( ) Legal opinion by a legal counsel in the country of domicile/incorporation of the foreign *[Guarantor]/[Surety] [state name] [and your country of domicile/incorporation]. ( ) Form of Confirmation and Consent duly executed by the existing third party mortgagor/chargor (where applicable). [Provisions relating to properties/assets] ( ) All title deeds and documents relating to the Property. ( ) Evidence satisfactory to the Bank that the title to the Property is in order and that there are no defects, legal, structural or otherwise, in or affecting the Property and that the Property is acceptable to the Bank, in its absolute discretion, in all respects as security for the Facilities granted to you. ( ) Satisfactory replies to all title/legal requisitions relating to the Property and all other searches as may be applicable and required by the Bank in connection with the Facilities. ( ) A valuation report from a valuer approved by the Bank stating that the market value of the [state asset] is not less than S$[]. ( ) Evidence satisfactory to the Bank that all stamp fees, goods and services tax, value added or other similar taxes or fees payable in respect of the purchase and/or mortgage of the Property have been fully paid or have been earmarked/set-aside in such manner as the Bank may, in its absolute discretion, deem fit. ( ) (where the Property is leased from the JTC, HDB, URA or other authority) Approval(s) from the relevant authority(ies) to the mortgage of the Property to the Bank. ( ) Duly signed consent from prior mortgagee or chargee, where required. ( ) Evidence satisfactory to the Bank that the [state asset] are in good working order. ( ) (where the asset are located in premises not owned by you) Letter(s) of consent(s) from landlords/owners of the premises in which the [state asset] or any part thereof are placed, located or installed. OCBC Legal / Sep 09 Our Ref: <Company Name> ( ) <Page no.> PRIVATE & CONFIDENTIAL (where the asset are located in premises which are charged/mortgaged to another bank/others) Letter(s) of consent(s) from the existing chargees/mortgagees of the premises to exclude the [state asset] from the existing [state existing security(ies) e.g. mortgage, debenture, charge etc]. [Provisions relating to guarantees] ( ) ( ) Form of Confirmation and Consent duly executed by the existing Guarantors (where applicable). The following conditions being satisfied:[General provisions] (a) There is no material adverse change in your financial condition, operating environment, management or any other conditions which in the opinion of the Bank will materially affect your ability to perform your obligations under this Facility Letter. (b) There exists no event of default as set out in the Bank's Standard Terms and Conditions Governing Banking Facilities or any other event which would, with the giving of notice or passing or lapse of time and/or a relevant determination, constitute an event of default. (c) All representations and warranties contained in this Facility Letter and in the Bank's Standard Terms and Conditions Governing Banking Facilities have been complied with and would be correct in all respects if repeated on the date of advance, drawdown or availment of each of the Facilities by reference to the circumstances then existing. (d) You shall provide any other document(s) as may be required by the Bank from time to time and adhere to and abide by all other conditions precedent as the Bank may in its absolute discretion impose. ( ) BREAKFUNDING COSTS ( ) If you fail to effect drawdown in respect of the [state type of facility], or satisfy the conditions for advance after the Notice of Drawing has been given by you, in addition to the other remedies of the Bank hereunder, you shall on demand, pay to the Bank such amount as the Bank may certify as necessary to compensate it for any costs incurred by the Bank resulting from your failure to effect the drawdown or a failure to satisfy the conditions for the advance, including but not limited to losses from re-employment of funds borrowed or contracted for to fund the advance at rates lower than the cost of such funds. ( ) In addition to the prepayment fee and/or cancellation fee in respect of the [state type of facility], any break funding costs incurred by the Bank, to be determined by the Bank in its sole discretion, in respect of any amount prepaid before its original due date or in unwinding its funding prematurely shall be borne by you notwithstanding that the prepayment or full settlement before the maturity of the loan(s) is requested by the Bank. OCBC Legal / Sep 09 Our Ref: <Company Name> ( ) <Page no.> PRIVATE & CONFIDENTIAL DEFAULT INTEREST [State applicable default interest. Example set out below.] Default interest shall be payable at the rate of []% p.a. over the Bank’s *[prime lending rate]/[Cost of Funds]/[Swap Offer Rate] prevailing from time to time for financing in Singapore Dollars or such other rates as may be determined by the Bank in its absolute discretion on the following:- (a) any part of the Facilities that is not paid on due date or upon demand, as the case may be; and (b) any utilisation in excess of the approved limit of the Facilities. You shall, unless otherwise agreed to by the Bank, maintain at least one operating account with the Bank for the day-to-day operation of your business for so long as any sum remains owing under the Facilities. You agree that the volume of your transactions including FX spot, forward and derivative transactions and Interest Rate swap and derivative transactions with the Bank would reasonably correspond with the utilization of the Facilities as well as the level and nature of your business activities. To the extent that the same are not inconsistent with the express terms herein, the Bank's Standard Terms and Conditions Governing Banking Facilities and any amendments, supplements or replacements thereto from time to time shall form part of and be deemed to be incorporated in this offer. This Facility Letter when accepted will supersede the Bank’s previous letter(s) of offer to you. The Bank reserves the right to request you, from time to time, to furnish it with documentary evidence (in form and substance acceptable to the Bank) showing your compliance with all the terms and conditions required by the Bank and to execute any further document(s) deemed necessary by the Bank. We trust that the above terms and conditions are acceptable to you. This offer will lapse after [] days from the date of this Facility Letter, unless otherwise arranged. Please signify your acceptance by signing and returning to us the duplicate copy of this Facility Letter *[together with a certified copy of your Board *[and Shareholders'] Resolution(s) in the form attached]. We are pleased to be of service to you and look forward to hearing from you in due course. Yours faithfully for OVERSEA-CHINESE BANKING CORPORATION LIMITED ...................................................................... We hereby accept the Facilities on the terms and conditions contained in this Facility Letter and in the Standard Terms and Conditions Governing Banking Facilities. OCBC Legal / Sep 09 Our Ref: <Company Name> ...................................................................... For and on behalf of [Name of Borrower] Name of Authorised Signatory(ies): Date: OCBC Legal / Sep 09 <Page no.> PRIVATE & CONFIDENTIAL Our Ref: <Company Name> <Page no.> PRIVATE & CONFIDENTIAL [On Borrower’s Corporation Letterhead] FORM OF NOTICE OF DRAWING OVERSEA-CHINESE BANKING CORPORATION LIMITED 65 Chulia Street OCBC Centre Singapore 049513 Date: Dear Sirs NOTICE OF DRAWING SPECIFIC ADVANCE FACILITY OF S$[] Pursuant to Clause [] of the Facility Letter dated _____________________________ (“Facility Letter”) in respect of the above Specific Advance Facility, we hereby give you notice that we request a drawing under the said facility to be made to us under the Facility Letter on the following terms:(a) (b) (c) Amount Proposed Drawing Date Interest/Loan Period : : : *(1), (2), (3), (6), (9), (12) months The proceeds of this drawing are to be made available to us by [specify mode of disbursements]. We confirm:(i) that the conditions precedent under the Facility Letter and the Bank's Standard Terms and Conditions Governing Banking Facilities have been complied with in every respect; (ii) that each of the representations and warranties contained in the Facility Letter and the Bank's Standard Terms and Conditions Governing Banking Facilities are true and accurate in all respects as though made on the date of this request; (iii) that all the covenants on our part contained in the Facility Letter and the Bank's Standard Terms and Conditions Governing Banking Facilities have been fully performed and observed by us; and (iv) that as at the date hereof no event of default as set out in the Facility Letter and the Bank's Standard Terms and Conditions Governing Banking Facilities (“Event of Default”) has occurred and no event has occurred which, with the giving of notice and/or the lapse of time and/or upon your making any necessary certification and/or determination under the Facility Letter and the Bank's Standard Terms and Conditions Governing Banking Facilities, might constitute an Event of Default. We further represent warrant and undertake that no Event of Default and none of the events aforesaid will exist at the date of the intended drawdown. By: ______________________ Authorised Signatory OCBC Legal / Sep 09