Kashi Kings - WordPress.com

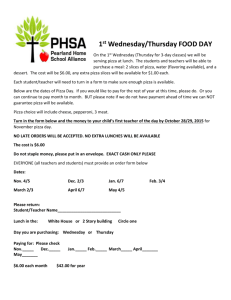

advertisement

Kashi Kings: Frozen Pizza Media Plan Seashols Barnes, Madison Baxter, Kenna Foltz, Viktoria Leks, Andie Moreno Background/ Category Overview: The Kashi company is one of the many successful branches of the Kellogg’s corporation, whose estimated worth is $10.9 billion (annualized national sales for Kashi Pizza brand last year are estimated at $36 million). Founded in 1984, Kashi makes natural and organic food products that are made with their signature whole grain and sesame. Kashi gives emphasis to healthy and active living for all their employees and consumers through advertising, website, packaging, etc. Kashi Fresh Pizza is a new product, made to compete with other frozen pizza companies and give consumers an opportunity to purchase a healthier choice of pizza. There is no advertising for the Kashi Fresh Pizza as of now. Kashi’s main focus is advertising their brand name in general. This media plan is focuses and accentuates the Kashi Fresh Pizza as its own product and will help raise sales and awareness of the Fresh Pizza product. Kashi Pizza belongs to the natural, organic, healthy foods segment, an industry whose sales grew from $12 billion in the year 2000 to over $55 billion today. In addition, total category sales are estimated to increase at least 10% for the current year. Common places to buy natural/organic foods and beverages are natural food chains, such as Whole Foods and Trader Joe’s, which is where our brand is found too. Frozen pizza category sales are projected at $2.7 billion annually, and category ad spending is approaching $110 million annually. Since Kashi is branching out into the frozen foods section, particularly frozen pizza, this means the brand Kashi can now fall into the frozen food category. This also means that Kashi faces big name competitions in the category like Digiorno and Tombstone. It will be imperative for Kashi to identify itself from other frozen pizza brands by standing out. The Problem: Kashi Frozen Pizza has a relatively lower advertising budget than its competitors resulting in lower brand recognition, especially within the category. Although the Kashi brand is well known in other categories such as breakfast foods, its frozen pizza products are generally not well known by consumers and are being out-sold by larger companies whose central or sole focus are their frozen pizza products. The healthy stereotype that follows the Kashi brand may not serve well in the frozen pizza category since most consumers in this category are not typically highly health-conscious. Our goal in this media plan is to increase Kashi frozen pizza sales by 11% to reach $40 million by the end of this year, and we believe we can do it. Target Information: Based on research and data, we have chosen to target women ages 25 to 44 who are living healthy and active lifestyles. These women are educated and career driven with possible jobs in the physical and social science professions as well as in other areas. They have a household income of $40,000+. From a psychographic standpoint, these women are very health conscious. They live an “on the go” lifestyle and want a meal that is not only tasty and quick, but one that also contains natural and healthy ingredients. When it comes to food these women are willing to pay the premium for good quality and natural ingredients. They favor brands that are both socially responsible and environmentally friendly and can be found shopping in Whole Foods or stores similar to it. The health conscious attitude these women have carries over into other lifestyle choices aside from food. These women are either starting a healthy lifestyle of already have one in place and are continuing to live by it. They participate and promote an active lifestyle by incorporating fitness into their busy every day routines. (Figure 1) Meet Sarah… Sarah is a 30-year old physical therapist who lives in an up and coming area of town with her husband Christopher. She earned her graduates degree in physical therapy from the University of Washington and her education. Her career driven attitude has served her well and she recently received a pay raise and now has an annual income of $65, 000. Based on her health related profession, Sarah, along with her husband, lives an active and healthy lifestyle. She is mindful of what she eats and chooses foods with fresh and natural ingredients. She is a frequent shopper at the local Whole Foods. Her health conscious attitude is also reflected in her daily fitness routine. Every morning she runs at least two miles around a track near her house before heading to work. And recently she and her husband have begun training for a triathlon that will take place in the fall. Sarah is always looking for new ways to improve and maintain her healthy lifestyle. She keeps herself up to date on health related issues as well as current events through her subscriptions to magazines such as SELF, Fitness, New York Times and People. Competition and Environment: By assessing the given information in MFP about the frozen pizza market, as well as conducting online research to determine who are the most represented and well-known frozen pizza brands, we have drawn some conclusions about market share. Although we consider all brands other than Kashi to be competition, those with the highest representation across various media (SOV) are Digiorno Frozen Pizza (23.08%), Stouffer’s Corner Bistro (22.32%), Lean Cuisine (14.74%), and Hot Pockets Frozen Entrees (8.48%). For the top two brands- Digiorno Frozen Pizza holds the largest share of voice within the internet medium, and Stouffer’s Corner Bistro constitutes that largest share of voice within consumer magazines. Although only one of these leading brands is within the health food category, it is important to take into special consideration the brands that market their products as healthy options (Healthy Choice, Lean Cuisine, South Beach Diet). This is because the health factor is one thing that sets the Kashi brand apart from the larger, more heavily represented brands (Digiorno and Hot Pockets). The share of voice for The Kashi line of frozen pizzas would be competing head on with competitors in the mainstream, heavily used mediums, yet also utilizing alterative media which will be discussed later. The media mix for our health conscious competitors is as follows: Healthy Choice Frozen Panini= NET TV: 58.24%, SPOT TV: 7.95%, SLN TV: 0.00%, CABLE: 29.75%, SYND: 4.07%, CON MAG: 0.00%, SUN MAG: 0.00%, LCL MAG: 0.00%, HSP MAG: 0.00%, B-TO-B: 0.00%, NEWSP: 0.00%, HSP NWSP: 0.00%, NET RAD: 0.00%, INTERNET: 0.00%, OUTDOOR: 0.00% Lean Cuisine Frozen Panini= NET TV: 42.06%, SPOT TV: 1.06%, SLN TV: 0.00%, CABLE: 16.59%, SYND: 10.70%, CON MAG: 27.51%, SUN MAG: 0.00%, LCL MAG: 0.00%, HSP MAG: 0.00%, B-TO-B: 0.00%, NEWSP: 0.00%, HSP NWSP: 0.00%, NET RAD: 0.00%, INTERNET: 2.08%, OUTDOOR: 0.00% South Beach Diet Microwave Pizza= NET TV: 22.93%, SPOT TV: 10.64%, SLN TV: 0.00%, CABLE: 0.18%, SYND: 7.28%, CON MAG: 54.50%, SUN MAG: 4.46%, LCL MAG: 0.00%, HSP MAG: 0.00%, B-TO-B: 0.00%, NEWSP: 0.00%, HSP NWSP: 0.00%, NET RAD: 0.00%, INTERNET: 0.00%, OUTDOOR: 0.00% Kashi will also be meeting its competition head-on in terms of scheduling, as we have decided to advertise in the same months as our competitors, yet starting one month earlier to gain an advantage in brand-recognition (more scheduling information is to follow). These are the months the other health-conscious brands are most heavily using: Healthy Choice allocated all of their advertising dollars in the months of SeptemberDecember, spending nearly half of all of their budget in the month of November (45.5%). Lean Cuisine shows a similar pattern, with all their money going towards the months of JuneDecember, most heavily concentrated in September (22.1%) and October (25.66%). South Beach Diet shows a very different pattern, spreading their budget very evenly throughout every month, with their highest months being January at only 18.6%. Based on this data, I would think about why these companies (which are very similar to Kashi) are spending effort on such months. If research indicates a valid reason for why the fall and winter months are more affective times to advertise, I would absolutely urge the same months as the listed competitors. However, it is also important to keep consumer retention, meaning it is important to keep brand awareness all year round so the product is not forgotten. This means that I would keep advertising all year round, but look into which months are more affective and why, and possibly put more emphasis on certain times of year than others. Market Selection: After assessing the information for all the potential markets, the cities in which we would like to advertise Kashi’s frozen pizzas are Philadelphia, PA, New York, NY, Chicago, IL, Los Angeles and San Francisco, CA, Tampa and Orlando, FL, and Detroit, MI. We decided on these cities by looking at a both CDI and BDI as well as Estimated Values. From Assignment #3, we made a list of all the cities with both a CDI and BDI that were above average and from that list we chose Tampa (CDI 104 BDI 108), Orlando (CDI 100 BDI 106), and Detroit (CDI 105 BDI 105). We chose these cities because they are the largest and most recognizable, therefore providing more opportunity for exposures. The smaller towns that were represented by good statistics did not appeal to us because the small populations would not be as worth our time and money as the larger cities. They all have many visitors as well, so people visiting the city for business or pleasure will be exposed to ads as well, and remember Kashi frozen pizza when they go back to their hometowns. In addition to these markets, the top five cities in estimated value were also chosen, since this information was provided with our target demographics in mind (females 25-44 were weighted by 2). These markets have a healthy representation of our target consumers and would be beneficial in gaining both high reach and frequency due to their large size. Media Selection: When deciding which media to utilize in our plan, we employed a few different strategies in selecting media and specific vehicles. First, we thought about which media we interact with most on a daily basis because although we are younger than our desired demographics, we all consider ourselves to have active lifestyles similar to those in our target market. Internet, television, and radio were in our minds the media most likely to generate a high reach. Assignment two proved or theories right, since most of us gave medium or high weight to Radio and Internet. The media that we ultimately chose to use in our media plan are: internet, network television, consumer magazines, radio, and alternative media including outdoor promotional events, internet coupons and elevator advertising. Our decisions were made based on the data provided in MFP Assignment #2, where quintile index numbers were provided for all total frozen pizza users, those with a fitness lifestyle, and those who purchase Kashi’s cereals. Internet was given high emphasis in our plan because the index numbers in quintiles I, II, and III reflect the high usage in the medium within our target market. Index numbers include 105, 107, and 104 for frozen pizza total, 159, 132, and 112 for fitness lifestyle, and 121, 139, and 99 for Kashi cereal primary. Kashi has used various media to advertise their other products but so far have only used internet ads to advertise for frozen pizza products, so we also decided to use this medium so that if consumers want to go to and find an ad know where to find them. Specific vehicles we felt important were foodnetwork.com, womenshealthmag.com, webmd.com, gourmet.com, and self.com because of the typical types of people that visit these sites tend to be health-conscious and care about what they eat. Although network television received high index numbers in the lower quintiles (IV and V), signifying that a high number of people have low usage of the medium, we wanted to include it because of our competition. Other companies spend large amounts of money on this medium, so we wanted to at least buy some TV ad space to be able to be seen in the same arena as them and thus possibly gain the same recognition. Index numbers in the fourth and fifth quintiles for all of television are 101 and 102 in total frozen pizza, 128 and 146 in fitness lifestyle, and 104 and 120 in Kashi cereal primary. These numbers show that many of those in our target market do not watch television very often, the higher quintile do not show terrible numbers either. Some specific channels on which we decided to advertise include Bravo, Lifetime, TLC, E!, Style, Foodnetwork, and Fit TV, because they reflect the ideals and interests of our target consumers. Consumer magazines were an obvious choice for us to include in our media plan because of their high usage within our target market as well as the opportunities they offer for specialization, meaning the niche markets they can deliver. For example, we decided to include advertisements for Kashi frozen pizza within these specific vehicles for their readership within our desired demographics: Women’s Health, Self, Shape, Bon Appetite, and People. Consumer magazines show high usage in the top three quintiles with index numbers of 107, 105 and 105 within the frozen pizza total, 119, 121 and 98 in fitness lifestyle, and 115, 121 and 109 in Kashi cereal primary. Because radio’s low advertising cost allows for high frequency, we decided to include radio in the media mix for our chosen months. Another benefit of radio is the specific targeting and segmentation that can be done thorough channel selection. The specific types of stations we chose include all Hit Music Stations, News channels, Adult Contemporary, and Easy Listening, because we feel these types of stations deliver to our age and gender demographics. Radio proved to be a heavily used medium within the frozen pizza total, fitness lifestyle, and Kashi cereal primary segments, and will be given a high emphasis in our plan. The index numbers within the top three quintiles were 106, 103 and 104 for frozen pizza total, 103, 104, 120 for those with a fitness lifestyle, and 87, 111, and 106 for Kashi cereal primary. The high usage for our target and the high frequency delivered by radio made this medium an easy choice. Alternative Media: In addition to our more traditional media, we have decided to allocate part of our budget to alternative media as well, including event sponsorships, internet coupons, and elevator advertising. Many of our potential customers maintain a fit and healthy lifestyle, so sponsoring and having a presence at various sporting events felt like a natural choice. Marathons/ half marathons, triathlons, bike racing, and beach volleyball tournaments are all examples of events where Kashi could advertise. Those who attend these public events are all health conscious and put high standards on what they eat, therefore would deliver many people who would potentially be interested in learning about Kashi frozen pizza. We think Kashi would benefit from partially funding these events (or donating money if it is a charity event) because then we could set up large tents, have banners, even have our name printed on cups, water bottles, etc. By being associated with these types of athletic events, Kashi would be correlated with healthy lifestyles and would seem interested in the wellbeing of the community. Our name and logo would be prevalent at these events as well, and sometimes the sponsors are all placed on free t-shirts that would become advertising with a long shelf life afterwards wherever someone wears the t-shirt. Printable, online coupons correlate with the previously mentioned medium of the internet, but would be a way to entice the customer to purchase at least one pizza because we believe many people are more willing to buy something of they are getting it at a discount. Various different sales techniques could be used (50% off, buy one get one free, etc.) and making them printable straight from their own printer would allow an easy way to bring people into the store. Elevator advertising was also selected because of the chosen markets and demographics being targeted. Larger cities have many office buildings and shopping centers that all have many elevators. Our demographics are females (very possibly mothers) with a high education and income, so they will likely be working white- collar jobs in office buildings, and when they get into the elevator to go home, they may be thinking of what they are going to make/ order for dinner. It would be beneficial to place image-based advertisements in these elevators so when they are thinking about dinner, they will be exposed to the images. Shopping malls are often frequented by females ages 25-44, so elevators in those locations would gain high exposure as well. Past Creatives: Qui ckTime™ and a TIFF (U ncompr essed) decompressor are needed to see thi s pi cture. QuickTime™ and a TIF F (Uncompressed) decompressor are needed to see this picture. Kashi currently does not broadcast any television commercials for their frozen pizza products, however they have TV commercials for their Go Lean Crunch cereal which also follows the brand's healthy promise. All ads focus on the healthy aspect of Kashi and the slogan of "7 whole grains on a mission" which can also be seen on Kashi's Brand logo. All Kashi television ads feature an active spokesperson and a light tone. The message is centered around their wholesome ingredients, and is largely image-based (as are their print ads). Their print advertisements have heavy use of images, bright colors, and minimal copy. (This is speaking on Kashi brand advertising as a whole, since they have not yet released any print ads for their frozen pizzas). Kashi encourages people to live their best lives through its interactive online community at Kashi.com and Day of Change cross-country tour supporting natural living. It also educates people through Wellness Hub, educational events that inspire the local Kashi community to embrace natural healthy lifestyle. Kashi.com includes information about their products including all of the frozen pizzas, and all their frozen pizza advertising is currently spent on internet advertising. People can actually rate each flavor and leave a comment. Also the home page provides with the opportunity to find the nearest store that sells a specific pizza. Entering my post index I found that the closest store that sells all flavors of Kashi frozen pizza is Kroger on Mockingbird st. Other stores selling Kashi frozen pizzas are Tom Thumb, SuperTarget and Albertsons. However Kashi hasn't done much to advertise their frozen pizzas. Due to this, Kashi has lacked the recognition needed for its recent all natural pizzas Media Mix/ SOV: From the media mix analysis of the current year for Kashi total we can see that the biggest emphasis is on the cable TV 42.5% and consumer magazines 36.3%. The least was spent on newspapers 0.1% and network TV 0.3%. In general compared to previous years Kashi decreased spending on network TV, syndication, consumer magazines, and spent more on spot TV, cable TV, business-to-business, newspapers and internet. However, the media mix only for Kashi pizza shows that internet was the only medium they spent on. Kashi total share of voice is 0.21%. Since internet was the only medium they used share of voice of that is 8.81%. SWOT Analysis Strengths: -Recognizable brand -Sold in a variety of stores -Healthy choice for Frozen Pizza -newer brand that offers natural ingredients -One of the few healthy/natural pizza brands -reasonable price for quality of products -appeals to consumers leading healthy lifestyles By using the brands strengths in other Kashi products, we will be able to push the frozen pizza by popularity of their other products. Weaknesses: -Consumers have bias opinion on healthy food products -Facing a lot of strong competitors -Won’t have as large of a budget as competitors -Don’t have current advertisement for frozen pizza -Lack of recognition among frozen pizza market The price and lack of familiarity of the brand hurts the prospective market of Kashi frozen pizza. Opportunities: -Opportunity to grow sales as healthy choice pizza brand -Natural food category is growing much faster than regular foods categories -Chance to use other media that competitors are not using in order to gain brand recognition in the frozen pizza category Organic and natural ingredients will have the greatest impact on our target audience. Threats: -Long-standing brands that hold large SOV within certain medias -Large competitors with a lot of ad spending power -Having smaller budget than competitors -Other healthy choice brands like: South Beach and Lean Cuisine Other larger companies push less natural and unhealthy products that will drown out Kashi’s organic frozen pizzas. Creative Goal: Our creative goal is to continue the current Kashi advertising trends of simple yet effective ads by using image-based print ads and commercials with a light, casual tone. The central message will still be the natural, healthy ingredients and all ads will be aimed at creating Kashi to be a feel-good brand. We feel that ads with little copy will deliver the message in a clear way and stand out of the advertising clutter. Qui ckTime™ and a TIFF (U ncompr essed) decompressor are needed to see thi s pi cture. Target Audience Objectives: According to our Media plan on Media Flight Plan Launch we will be reaching 23.91% of the US. And women ages 24-35 in Nationally and in our spot markets. We chose people 25-34 to be our target market and to mainly focus on women. We made this choice based off of assignment number one. Also, most Kashi users are moderately to highly educated and most likely have a job (MFP assignment 1). During Kashi’s national campaign we have a frequency of 70% and during the spot months the frequency raises to 75%. We also have chosen a reach of 2.9 due to the Ostrow Frequency Model during all months of advertising. And the spot markets are raised to 3.5 reach during the spot advertising months. When we implanted our media plan we got our goals for reach and frequency or exceeded our goals, as shown in the figure below. (Figure 2) Gross Rating Point Objectives: According to Media Flight Plan less than 1,000 gross rating points and there will be no impression made on our target market. As long as we had more than 1,000 we would make impressions. But we want to do more than just make the cut off so we had an objective of 1,915. We came up with this number when we set our objectives and goals for reach and frequency on Media Flight plan. It was our goal to exceed this. We did this by buying specific medias in certain months and balancing our budget. We ended up with an estimated 2,068 gross rating points! Ostrow Model: (Figure 3) Marketing Factors That Affect Frequency Established brand? Yes, Kashi is well known national brand -1 High market share? No, low market share compared to competitors +1 Dominant brand? Not among the frozen pizzas +1 High brand loyalty? Yes, among health conscious people -2 Long purchase cycle? +2 No, short purchase cycle, people buy food frequently Product used occasionally? Yes, product used ~1x/week -1 Need to beat competition? Yes, threat from competitors +1 +.1 Copy Factors That Affect Frequency Simple copy? Yes, message will be very simple Copy more unique than competition? Yes relatively, concentrating on the healthy lifestyle -2 -1 Continuing campaign? Yes, relatively continuing campaign -1 Product sell copy? Yes, combination of image and product sell +2 Single kind of message? Yes, focusing on healthy lifestyle, ''7 whole grain on a mission'' -2 To avoid wear out: new messages? No, no new copy strategy +2 Larger ad units? No, small ad units +2 0 Media Factors That Affect Frequency Lowed ad clutter? No, media selected have high clutter +2 Compatible editorial? Yes, accurate positioning, consumer aperture -2 Attentiveness high? No, relatively low involvement product -1 Continuous advertising? No, limited budget requires pulsing +1 Few media used? Yes, limited media mix -1 Opportunities for media repetition? Yes, relatively good, ads running several times on TV and radio -1 -.2 +.1-.2= -.1+3=benchmark +2.9 Geographic objectives: Our spot markets should get more reach and frequency than our national plan. This is why we chose to raise the reach from 2.9 to 3.5 for spot markets. The frequency from 70% to 75% for all spot markets. We went above our set goals in all of our spot markets in both reach and frequency. (Spot spending below) February: (Figure 4) May: (Figure 5) August: (Figure 6) September: (Figure 7) We chose to advertise in our spot markets during key times that frozen pizza spending goes up and also February. We chose to start advertising in February in order to start advertising before Kashis competitors. According to assignment 5, frozen pizza spending goes up in: September: 16.9% May: 13.1% August: 10.2% March: 9.5% April: 8.9% July: 8.7% October: 8.3% June: 7.4% November: 5.7% February: 4.1% December: 3.9% January: 3.3% Another reason we advertised in these months is because we wanted to advertise during the times that moms, and young women, that make health conscious decisions would be buying frozen pizza for home. Right when summer starts and when school starts up again in September and August. Media Strategies: (Budget and Costs) We have chosen to do a flighting media plan during the most important months for of frozen pizza sales. We will start advertising heavily in February before our competitors start advertising so when people begin to shop for frozen pizza in higher numbers hopefully Kashi will be a viable option to a greater number of people. Also in February we have chosen to do spot marketing so our eight spot markets will be receiving extra attention on Primetime TV and the radio. The media budget assigned to Kashi is 12 million dollars. We chose to allocate $1,150,000 to alternative media. Also after our media plan was decided and implemented according to media flight plan we have an extra $24,000 to save for any possible new alternative media in the future. So we spent a total of $10,826,000 (plus alternative media) = $11,976,000 (total cost). All Media Break down (Figure 8) National Radio 4,357,000 Womens Magazines 1,669,200 Internet: Key word search 1,892,000 Internet: Targeted Sites 1,892,000 Spot TV Prime 633,900 Spot Radio 381,300 Radio Break down: (Figure 9) Net Radio Morning Drive 1,099,900 Net Radio Day Time 1,023,800 Net Radio Evening Drive 1,042,800 Net Radio Night 1,190,500 (Figure 10) Kashi Media Breakdown National Radio 10% 3% Womens Magazines 5% 36% 16% Internet: Key word search Internet: Targeted Sites Spot TV Prime Spot Radio 16% 14% Alternative Media We chose to use this group of media because they are high weight mediums of Kashi users. Magazines have high index numbers (all above 100) in quintiles 1 and 2 ( Assignment 2) and therefore they are above averagely used by not only frozen pizza eaters, but fitness and lifestyle, and Kashi cereal primary too. So magazines are a good option for Kashi to use as a medium. And since Kashi is targeting women from 24-35 we chose to use magazines for women not general interest. (Magazines targeted at women were also less expensive and therefore an easy way to balance the budget). We chose radio to use in our media plan because we can buy a large number of gross rating points for not too much money. Radio is a medium weight alternative according to assignment 2. There are many options in radio and we chose to balance and advertise at all times of the day (morning, daytime, and night). Internet is a high usage ( high index numbers in quintiles 1 and 2 ( above 100)) category for Kashi cereal users, fitness and life style, and frozen pizza eaters. Therefore we chose to advertise in internet. Sadly internet is very expensive so even though it is such a great way to reach our target market we weren’t able to buy as much as we wanted to. We also chose to do some spot Prime TV. Although spot Prime TV is low to medium weight according to assignment 2, it is a way to advertise in our spot markets and make an impact. Its high usage in a lower weight medium. Which means the people who do watch it are the people we want to reach. We didn’t buy a lot of TV. (Figure11) QuickTime™ and a TIFF (Uncompressed) decompressor are needed to see this picture.