14th ed Chapter 4 worksheet

advertisement

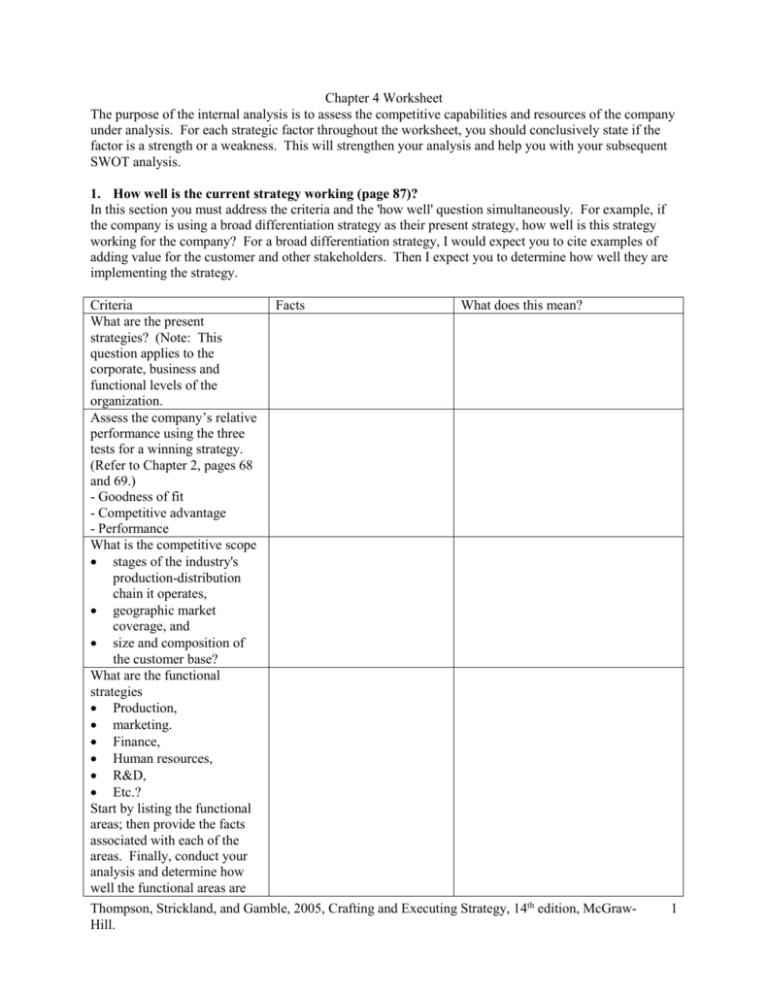

Chapter 4 Worksheet The purpose of the internal analysis is to assess the competitive capabilities and resources of the company under analysis. For each strategic factor throughout the worksheet, you should conclusively state if the factor is a strength or a weakness. This will strengthen your analysis and help you with your subsequent SWOT analysis. 1. How well is the current strategy working (page 87)? In this section you must address the criteria and the 'how well' question simultaneously. For example, if the company is using a broad differentiation strategy as their present strategy, how well is this strategy working for the company? For a broad differentiation strategy, I would expect you to cite examples of adding value for the customer and other stakeholders. Then I expect you to determine how well they are implementing the strategy. Criteria What are the present strategies? (Note: This question applies to the corporate, business and functional levels of the organization. Assess the company’s relative performance using the three tests for a winning strategy. (Refer to Chapter 2, pages 68 and 69.) - Goodness of fit - Competitive advantage - Performance What is the competitive scope stages of the industry's production-distribution chain it operates, geographic market coverage, and size and composition of the customer base? What are the functional strategies Production, marketing. Finance, Human resources, R&D, Etc.? Start by listing the functional areas; then provide the facts associated with each of the areas. Finally, conduct your analysis and determine how well the functional areas are Facts What does this mean? Thompson, Strickland, and Gamble, 2005, Crafting and Executing Strategy, 14th edition, McGrawHill. 1 working and the associated strengths and weaknesses. Has the company achieved its financial objectives? Go back to your chapter 2 worksheets for the financial objectives. Determine if they achieved their short and long-term objectives and provide the supporting analysis why they did or did not achieve the objective. Then you are in a position to determine the associated strengths or weaknesses. Has the company achieved its strategic objectives? Go back to your chapter 2 worksheets for the strategic objectives. Determine if they achieved their short and long-term objectives and provide the supporting analysis why they did or did not achieve the objective. Then you are in a position to determine the associated strengths or weaknesses. What is the company's position relative to EACH of its competitors? Market share Profit margin Net profits ROI EVA (page 9) MVA (page 10) Financial strength Sales growth Image Reputation Industry position Etc. If the strategy is not working, is it due to: Weak strategy and/or Poor implementation Thompson, Strickland, and Gamble, 2005, Crafting and Executing Strategy, 14th edition, McGrawHill. 2 2. What are the company's resource strengths and weaknesses (page 89)? The purpose of this tool is to assess the competitive values of the company's resources. The four tests of competitive value (pages 123-124) are: Is the resource hard to copy? How long does the resource last? Is the resource really competitively superior? Can the resource be trumped by a rival's resources/capabilities? For each of the resource types listed below, assess the competitive value of each resource. Criteria Facts What does this mean? Please note the following criteria are examples to get you started. You should add the applicable resources for each category. Skills and expertise Proprietary technology advertising and promotion product innovation ability to improve production processes technological know-how Physical assets plant capacity plant and equipment age and technological capabilities plant and retail location access to distribution channels wide geographic coverage global distribution capability ownership of valuable natural resource deposits Human assets Superior intellectual capital Collective organizational knowledge Proven managerial capabilities Organizational asset financial position patents better product quality culture product line breadth and depth Thompson, Strickland, and Gamble, 2005, Crafting and Executing Strategy, 14th edition, McGrawHill. 3 product quality proprietary technology mineral rights customer needs data base exceptionally strong financial position Intangible asset image brand name reputation for customer service Competitive capabilities cost advantages sophisticated use of ecommerce logistics strong supplier and dealer networks Market position recognized industry leader attractive customer base Alliances or cooperative ventures Thompson, Strickland, and Gamble, 2005, Crafting and Executing Strategy, 14th edition, McGrawHill. 4 3A. Are the company's prices and costs competitive (page 98)? This question applies to all companies independent of the strategy (cost or differentiation) they use to compete in their industry. Using the following criteria, assess each step in the value chain (inbound logistics and supplies, operations, outbound logistics, sales and marketing, service, R&D, human resources, general and administrative) and compare each step with the competitor's prices and costs. After completing this analysis, examine the value chain as a whole. How does the integration of each successive step in the value chain lower costs? Finally, assess the value chain of the company in the context of the industry (page 132). Inbound Logistics Operations Outbound Logistics Sales and Marketing Service Profit Margin R&D HRM A&G Structural cost drivers Scale economies Learning curve Technology requirements Capital intensity Product line complexity Etc. Executional cost drivers Commitment to continuous improvement Product quality Process quality Capacity utilization Internal business processes Working with buyers and suppliers on costs Etc. Thompson, Strickland, and Gamble, 2005, Crafting and Executing Strategy, 14th edition, McGraw-Hill. 5 3B. If the company uses either a differentiation or best-value strategy, also assess how each step in the value chain creates or adds value (e.g. incorporates product attributes and user features, raises performance, increases buyer satisfaction) and how the integration of each successive step in the value chain increases value. Criteria Also refer to pages 164167 for additional differentiation criteria. Incorporate product attributes and user features that lower the buyer's overall costs of using the company's product Incorporate features that raise the performance a buyer gets out of the product, Increase features that enhance buyer satisfaction in noneconomic or intangible ways Deliver value to customers via competitive capabilities that rivals do not have or cannot afford to match Inbound Logistics Operations Outbound Logistics Sales and Marketing Service Profit Margin Thompson, Strickland, and Gamble, 2005, Crafting and Executing Strategy, 14th edition, McGraw-Hill. R&D HRM A&G 6 4. Is the company competitively stronger or weaker than key rivals (page 108)? Although I provide only one column for competitors, you should add the number of columns necessary to assess each of the competitors. Key success weight Company Competitors factors (Refer rating Weighted rating Weighted to Q 6 in the score score external analysis for a list of factors to assess.) 5. What strategic issues and problems merit front-burner managerial attention (page 111)? The following are typical issue areas. This is not an exclusive list of areas. You should provide additional strategic issues based on your analysis of the environment and the company's competitive capabilities and resources. Is the present strategy adequate in light of driving forces present in the industry? Is the present strategy geared to the industry's future key success factors? How good a defense does the present strategy offer to the 5 forces? Does the present strategy protect the company against external threats and internal weaknesses? Is the company vulnerable to competitive attack by one or more rivals? Does the company have competitive advantages or must it offset the competition's competitive advantages? What are the strong and weak parts of the current strategy? facts What does this mean? Thompson, Strickland, and Gamble, 2005, Crafting and Executing Strategy, 14th edition, McGrawHill. 7 What additional moves are necessary to: Improve costs Capitalize on emerging opportunities Boost the company's competitive position 6. Financial ratio analysis for the company and industry (Refer to the web page sample spread sheet. In addition, you are responsible for obtaining the industry's financial ratios from various sources on the Internet or the library to use in your analysis. I encourage you to share this information with other teams.) 7. Top Management’s values and perspectives How are the personal ambitions, business philosophies, and ethical beliefs of managers stamped on the company's strategy and competitive capabilities? 8. Organization’s culture How are the company's values, policies and culture impacting the strategy, strategy implementation and company's competitive capabilities? Thompson, Strickland, and Gamble, 2005, Crafting and Executing Strategy, 14th edition, McGrawHill. 8 9. SWOT Matrix (Refer to page 95) The external and internal analyses provide you with information you need to tailor the strategy for a particular company. The external analysis provided you with the opportunities and threats for the industry and the company. The internal analysis revealed the company's competitive capabilities (strengths and weaknesses). To tailor the strategy, you want a fit between the company's capabilities and the environment's constraints and opportunities. To conduct the SWOT, look for the points of intersection between opportunities and strengths and weaknesses. S-O intersections enable a company to exploit the opportunity. W-O intersections require the company to address the weakness in order that they may fully exploit the opportunity. S-T intersections allow the company to defend against the threat. Strengths spent on defending against threats detract from the company's ability to use that particular resource for exploiting opportunities. W-T intersections jeopardize the company. These intersections require the company to bolster the weakness in order to provide defensive capabilities. Depending on the immediacy of the threat, these intersections may require the company's immediate attention. Threat # 5 Threat # 4 Threat # 3 Threat # 2 Threat # 1 Opportunity #5 Threats Opportunity #4 Opportunity #3 Opportunity #3 Opportunity #1 Opportunities Strength # 1 Strengths Strength # 2 Strength # 3 Strength # 4 Weakness es Strength # 5 Weaknesses # 1 Weaknesses # 2 Thompson, Strickland, and Gamble, 2005, Crafting and Executing Strategy, 14th edition, McGraw-Hill. 9 Weaknesses # 3 Weaknesses # 4 Weaknesses # 5 Thompson, Strickland, and Gamble, 2005, Crafting and Executing Strategy, 14th edition, McGraw-Hill. 10