Costs & Break Even handout notes

advertisement

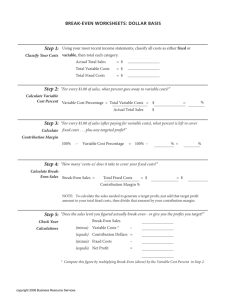

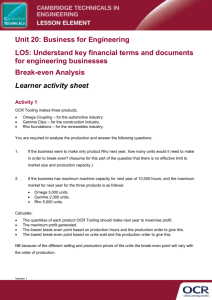

Types of costs Costs are usually classified according to the cost and its relationship with the level of output of the business. The following costs are therefore defined in relation to how they change in value, as the level of output changes. Fixed costs These costs are those that remain unchanged as the output level of firm changes. It does not matter what level of output the firm produces (even zero output makes no difference), any costs, which is a fixed costs will remain the same. Common examples of fixed costs are as follows: Examples of fixed costs Rent Office salaries Advertising Insurance Depreciation Fixed costs can be represented on a graph and this would appear as follows: A common mistake that is made is to state that fixed costs will always remain constant. This is not the case, all we are saying is that these cost are fixed with respect to short-term changes in the level of output only. In the long-term, a firm may rent a second factory or take out more insurance cover. Variable costs Any cost, which varies directly with the level of output, would be classified as a variable cost. Varying directly means that the total variable cost will be totally dependent on the level of output. If output doubles, then the variable cost would double. If halved, the variable costs would halve. If output were zero, then no variable costs would be incurred. Common examples of variable costs are as follows: Example of variable costs Direct labour Raw materials and components Packaging costs Royalties Variable costs can be represented on a graph and this would appear as follows: Semi-variable costs In reality, nearly all costs would not easily be classified into either fixed or variable. Most costs will fall somewhere between the two classifications. In this case, we can classify these costs as semi-variable costs. For example, although the wages of the production staff may appear to be variable costs, in reality, they will vary with the level of output, but not in a direct manner. The direct relationship is unlikely to hold over a long period of time. Similarly, many costs will have a fixed element, but also a variable element (for example, most bills for gas and electricity will consist of a standing charge, which is fixed and a variable element, which will depend on the usage). What would the graph of a semi-variable cost curve appear like? Because there is a link between the cost and the level of output, we would expect the semi-variable; cost curve to be upward sloping. However, there is no real 'textbook' appearance for this curve. It will normally slope upwards in a non-linear (i.e. curved) manner. Total costs Total cost would be calculated as all the costs totalled together for any particular level of output. If the output level were zero, then total costs would just consist of fixed costs. In nearly cases, total costs will be the addition of fixed costs and total variable costs (where total variable cost is the variable cost per unit multiplied by the level of output). Total variable costs = variable cost per unit x output level Total costs = fixed costs + variable costs Total costs can be represented on a graph and this would appear as follows: Direct costs A direct cost is similar to a variable cost in that it compares the cost with the level of output. However, a direct cost is any cost, which is directly related to the output level of a particular product. Direct cost is more appropriate for a firm that makes more than one type of product. For example, assume a firm is producing both chairs and tables. The chairs produced use a certain type of wood, but the tables use another type of wood. Then both types of wood would be direct costs, because they are directly related to the level of output of a particular product, not to the level of output in general Indirect costs An indirect cost is any cost, which cannot be linked with the output of any particular product. These costs are sometimes known as overheads. They are related to the level of output of the firm, but not in a direct manner and not for any one product. For example, the cost of powering machinery will be related to the level of output, but not to a particular product. Generally, the terms indirect and direct are more likely to be used when the firm produces a range of products. In break-even analysis, the firm will only be producing a certain product type. This means that the terms fixed and variable are more likely to be used Costs - task Now, a task for you that will see if you understand the new terms you have just met. Imagine that you have decided to start a business, Student Enterprises Ltd, offering a home delivery service for CD's and DVD's. You are next door to a large rental firm who are prepared to supply you, so you will not have to buy stock yet. What would you have to spend money on to set the business up and then operate it? Make a list of all the costs that you can identify. Examine the list you have made, and then classify the costs between fixed and variable costs? A final question; what type of cost is labour? You will often be asked to give examples of fixed and variable costs. When answering this type of question, it may be best NOT to use labour as an example. Break-even analysis Firms are concerned with the difference between costs and revenue. They will obviously want revenue to be greater than costs so that they make a profit, but they need to know the level of output at which they will start making a profit. This is where break-even analysis comes in. When costs are greater than revenue the firm makes a loss. When costs are less than revenue the firm will make a profit What happens when costs = revenue? The firm will just break even. If your firm is making a loss it will be losing money. It will be 'bleeding' and unless it is stopped it will die. If it is profitable it should be all right, providing it is watching its credit policy (and therefore the cash flow). New firms and new products are unlikely to be profitable at once. It is important to know when they will break even. The bleeding will have been stopped and they will be in a safe position for a time. This leads us into break-even analysis and break-even charts. Break-even analysis is a method for finding out the minimum level of sales necessary for a firm to just start to make a profit. At the break-even point the revenue obtained from the sale of a number of items, equals all the costs paid out in making and selling them. This is a very popular examination topic so must be fully understood. You must be able to draw or modify a break-even chart and then to analyse its consequences for a firm. To be able to do this you must understand in detail costs and revenues. Earlier we developed some cost curves and if we add a revenue curve to these we get the basis for break-even analysis and a break-even chart. In figure 1 below we have drawn all these together on a single graph: Figure 1 Break-even level of output Where the TR line crosses the TC line is the break-even point. However, let's break this down and look at how to build the graph. Building a break-even chart Break-even analysis is based on costs, prices and production/sales levels. First, some definitions: Break-even quantity (BEQ) The level of sales or output, where costs equal revenue and the firm is therefore making neither a loss nor a profit. Break-even revenue (BER) The level of sales revenue being earned by the firm at the break-even level of output. (In other words where the sales revenue is the same as the costs of production). Break-even point (BEP) The position where TC and TR lines cross. Let's confirm where these points are on a break-even chart. Look at the illustration below. Figure 1 Break-even point, break-even quantity and break-even revenue Break-even chart A diagram showing how total costs and revenue change with increasing production / sales. Margin of safety The difference between the planned or actual level of production/sales and the break-even quantity. To be able to handle break-even questions, you have to be able to identify and draw the total cost and the total revenue lines. Let's do some quick revision of these, and then a little very useful mathematics: Total revenue(TR) = Number of items sold x their price = P(x) (Where P = price (of items sold) and x = number sold) Total costs (TC) = FC + VC(x) Remember ;costs are either fixed (FC) or variable (VC). Total costs (TC) are the sum of fixed and variable costs. Remember, also that fixed costs are those costs which do not vary with the number made or sold and that variable costs are those that change in proportion to production and sales. At break-even TR = TC or P(x) = FC - VC(x) So BEQ = FC/(P - VC) Drafting a break-even diagram You must be able to draw the following diagram - figure 2 - from given information. Figure 2 Break-even diagram You may be asked either to draw a break-even chart from scratch, to complete one on a given piece of graph paper, or to modify a given chart to reflect changes given in the case. Any of these versions tests your knowledge and understanding of break-even analysis. As with any question, the first stage is to read it carefully before you rush in and put pen to paper. Make sure that you know exactly what is expected of you. In the next two sections, we look at these two possibilities - drawing from scratch and modifying a given chart Drawing a break-even diagram from scratch Do not rush into drawing. Think first, and you will see it is wise to work out the BEQ before putting pencil to paper. Having read the question you may now start to follow a procedure. Remember, you will be expecting to see fixed costs, price and variable costs for a product and a period of time. Remember the alternative words for fixed and variable costs. Step 1 Extract the data Extract the data required from the question or text. (The use of case study questions and the provision of written stimulus material, gives scope for the 'hiding' of data.) You should now have identified: FC per period of time, price per unit and VC per unit. Assume you have extracted the following information from your case study: FC $480,000 per month. VC: $60 per unit Price: $120 per unit The decision whether a cost is fixed and variable sometimes causes problems. Do not be confused by the title, or name, but look at the units given. If the units are 'per unit', 'per number made or sold' then the cost concerned is variable. If the costs are 'per unit time' then the costs are fixed costs. Step 2 Calculate the BEQ Yes, even though you are going to draw the break-even chart to find the break-even point, calculate the answer first. This will make the rest of the work much simpler, and the drawing easy and exact. Insert the numbers in the formula you now already know. (BEQ = FC/(P - VC)) The equation - BEQ = FC / (P - VC) Insert the correct numbers (watch the zero's) $480,000 per month / ($120 - $60 per unit) = $480,000/$60 = 8,000 units per month. So we now know that the BEQ is 8,000 units per month. We know where the TC line will cross the TR line. Useful? Now we can start drawing, step by step. Step 3 Fix the X axis (capacity) You will be able to start drawing very soon! If you are given a maximum capacity, use that figure. If not, double the break-even quantity is a good guide figure, or 16,000 units in this case. Now sketch that information. Figure 4 Building a break-even diagram from scratch (1) Step 4 Fix the Y axis (revenue and costs) Revenue is usually the greatest figure. In this case the maximum revenue is 16,000 x $120 = $1.92 million (price per unit x maximum possible sales). Figure 5 Building a break-even diagram from scratch (2) Step 5 Plot the TR axis This passes through the origin, since there is no revenue if there are sales. You also know that TR = $1.92 million when sales = 16,000 Figure 6 Building a break-even diagram from scratch (3) Step 6 Add the FC point Fixed costs are the same, irrespective of output. So mark on the Y axis the value of the FC. In this case it is $480,000. Remember, fixed costs are the costs of producing at 'output zero'. Figure 7 Building a break-even diagram from scratch (4) Step 7 Add the TC Line You know that this crosses the TR line at the BEQ, and that it starts at the FC at output zero, so draw it. Figure 8 Building a break-even diagram from scratch (5) You also know that the TC at maximum output of16,000 units is: $480,000 + 16,000 ($60) = $1.44 million. Remember to add labels to the two axes and to give the chart a title! It is no exaggeration; there may be a mark or two available for this. Always take the 'gift marks'. You now have an exact break-even diagram. Break-even route map Note and remember the 'Route Map' for drawing a break-even chart. The other tasks you may be given are based on this basic technique