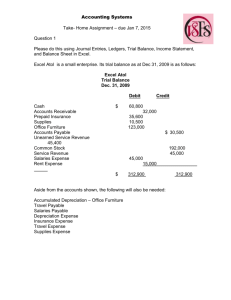

Financial Accounting Adjustments & Statements Solutions

advertisement