2009 Firm Element Continuing Education Training Plan Dated

advertisement

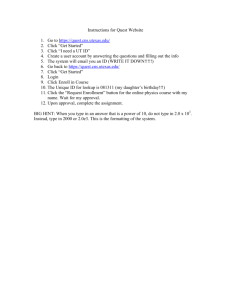

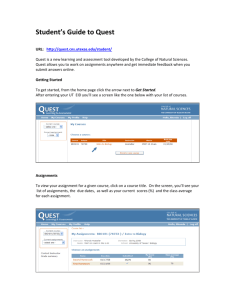

Compliance Department | Chicago, IL | compliance@ziegler.com 2009 Firm Element Continuing Education Training Plan Dated Audience Effective date August, 20 2009 (Updated) The Ziegler Companies, Inc. Immediately PLAN OVERVIEW Pursuant to FINRA regulations requiring broker/dealers to have firm-sponsored continuing education (CE) programs, Ziegler requires all securities-registered personnel to participate in training on an annual basis. The Company’s program is administered by the Compliance Department. Based on an annual needs analysis, various training programs require completion by all registered personnel in a given business unit (see description in Section II below). For training year 2009, we are moving away from the credit hour requirement and moving to an assigned coursework/topic requirement. Individuals’ requirements are based upon what business unit they are a part of and must be completed by all registered personnel by January 31, 2010. In addition to the required coursework, registered personnel also have the option of submitting outside training to satisfy the elective course portion of their requirement. Programs offered through other organizations can qualify for CE credit, provided copies of the materials, certificates, outlines or other requested information have been reviewed and approved by Compliance. A Continuing Education Request Form can be used to request credit for any non-company sponsored programs. Complete the Form and submit it to the Compliance Department with the attached back-up documentation. I. 2009 FIRM ELEMENT TRAINING PLAN Required Coursework for 2009: The following coursework is the required training for each business unit for the 2009 CE cycle. These courses are available through Ziegler’s CE website at www.zieglerce.com. Please access the site to complete this training before January 31, 2010. The Compliance Department will be notified of your completion. Business Unit Administration All Registered Reps Alternative InvestmentsAll Registered Reps Assigned Training Source Completed By Anti-Money Laundering Quest CE/Ziegler Compliance Staff January 31, 2010 Ethics: The Importance of Ethical Behavior FINRA Webcast January 31, 2010 Conflicts of Interest FINRA Webcast January 31, 2010 One Elective Quest CE /Approved Outside Training January 31, 2010 Annual Compliance Meeting Ziegler Compliance Staff December 31, 2009 Anti-Money Laundering Quest CE/Ziegler Compliance Staff January 31, 2010 Ethics: The Importance of Ethical Behavior FINRA Webcast January 31, 2010 Conflicts of Interest FINRA Webcast January 31, 2010 Two Electives Quest CE/Approved Outside Training January 31, 2010 Annual Compliance Meeting Ziegler Compliance Staff December 31, 2009 B.C. Ziegler and Company | Member SIPC & FINRA 1 Business Unit Capital Management All Registered Reps Capital Markets Trading & Sales Capital Markets Investment Banking Capital Markets Consulting Capital Markets Mergers & Acquisitions /Corporate Finance Capital Markets Research Assigned Training Source Completed By Anti-Money Laundering Quest CE/Ziegler Compliance Staff January 31, 2010 Ethics: The Importance of Ethical Behavior FINRA Webcast January 31, 2010 Conflicts of Interest FINRA Webcast January 31, 2010 Spreading of False Rumors and Market Manipulation Quest CE January 31, 2010 Two Electives Quest CE /Approved Outside Training January 31, 2010 Annual Compliance Meeting Ziegler Compliance Staff December 31, 2009 Anti-Money Laundering Quest CE/Ziegler Compliance Staff January 31, 2010 Ethics: The Importance of Ethical Behavior FINRA Webcast January 31, 2010 Conflicts of Interest FINRA Webcast January 31, 2010 Debt Mark-Ups FINRA Webcast January 31, 2010 Spreading of False Rumors and Market Manipulation Quest CE January 31, 2010 Two Electives Quest CE /Approved Outside Training January 31, 2010 Annual Compliance Meeting Ziegler Compliance Staff December 31, 2009 Anti-Money Laundering Quest CE/Ziegler Compliance Staff January 31, 2010 Ethics: The Importance of Ethical Behavior FINRA Webcast January 31, 2010 Conflicts of Interest FINRA Webcast January 31, 2010 Underwriting Disclosure and Due Diligence Quest CE/Ziegler Legal Department January 31, 2010 Suitability Issues: An Institutional Focus FINRA Webcast January 31, 2010 Spreading of False Rumors and Market Manipulation Quest CE January 31, 2010 Two Electives Quest CE/Approved Outside Training January 31, 2010 Annual Compliance Meeting Ziegler Compliance Staff December 31, 2009 Anti-Money Laundering Quest CE/Ziegler Compliance Staff January 31, 2010 Ethics: The Importance of Ethical Behavior FINRA Webcast January 31, 2010 Conflicts of Interest FINRA Webcast January 31, 2010 Spreading of False Rumors and Market Manipulation Quest CE January 31, 2010 Two Electives Quest CE/Approved Outside Training January 31, 2010 Annual Compliance Meeting Ziegler Compliance Staff December 31, 2009 Anti-Money Laundering Quest CE/Ziegler Compliance Staff January 31, 2010 Ethics: The Importance of Ethical Behavior FINRA Webcast January 31, 2010 Conflicts of Interest FINRA Webcast January 31, 2010 Spreading of False Rumors and Market Manipulation Quest CE January 31, 2010 Two Electives Quest CE/Approved Outside Training January 31, 2010 Annual Compliance Meeting Ziegler Compliance Staff December 31, 2009 Anti-Money Laundering Quest CE/Ziegler Compliance Staff January 31, 2010 Ethics: The Importance of Ethical Behavior FINRA Webcast January 31, 2010 Conflicts of Interest FINRA Webcast January 31, 2010 Spreading of False Rumors and Market Manipulation Quest CE January 31, 2010 Two Electives Quest CE/Approved Outside Training January 31, 2010 Annual Compliance Meeting Ziegler Compliance Staff December 31, 2009 B.C. Ziegler and Company | Member SIPC & FINRA 2 Business Unit Wealth Management All Registered Reps Assigned Training Source Completed By Anti-Money Laundering Quest CE/Ziegler Compliance Staff January 31, 2010 Ethics: The Importance of Ethical Behavior FINRA Webcast January 31, 2010 Conflicts of Interest FINRA Webcast January 31, 2010 Considerations for Working w/ Seniors FINRA Webcast January 31, 2010 Electronic Communication for Registered Representatives Quest CE January 31, 2010 Spreading of False Rumors and Market Manipulation Quest CE January 31, 2010 A Professional’s Guide to NASD Rules on Variable Annuity and Variable Insurance Prospecting Quest CE January 31, 2010 Fixed and Variable Annuities vs. Mutual Funds Quest CE January 31, 2010 Taxable Fixed Income Investing Quest CE January 31, 2010 Managed Futures Quest CE January 31, 2010 Annual Compliance Meeting Ziegler Compliance Staff December 31, 2009 Variable Annuities: Requirements for Supervisors FINRA Webcast January 31, 2010 Supervisory Considerations for Working with Seniors FINRA Webcast January 31, 2010 A Supervisors Role in Deterring the Spreading of False Rumors and Market Manipulation Quest CE January 31, 2010 Wealth Management Supervisors AVAILABLE ELECTIVE COURSEWORK FOR 2009 In the required training outlined above, each business unit is assigned either one, two or three elective courses. One option for completing electives include self-study courses which are offered through www.zieglerce.com. A complete list of self-study courses is listed herein. Email Ben George with the course name to have it added to your profile. Elective Training Available Through Ziegler’s CE Website 401(k) and Qualified Plans A Professional’s Guide to Ethical Decision Making A Professional’s Guide to NASD Rules on Variable Annuity and Variable Insurance Prospecting A Supervisors Role in Deterring the Spreading of False Rumors and Market Manipulation New - 2009 Advanced Asset Allocation New - 2009 An Introduction to Non-Traded REITs New - 2009 Annuities Essentials Annuities: Owner Driven and Annuitant Driven Contracts Annuity Basics Anti-Fraud Programs Anti-Money Laundering Regulations and New Red Flag Requirements New - 2009 Anti-Money Laundering Regulations and Ramifications Anti-Money Laundering Training for Agents Anti-Money Laundering Training for Broker-Dealers Anti-Money Laundering Training for Home Office Personnel Bank Secrecy Act Basics of 403(b) Plans Basics of Bond Investing Basics of Investing Basics of Stock Investing Business Continuity Planning Class B Mutual Fund Shares Disability Income Insurance Economic Growth and Tax Relief Reconciliation Act of 2001 Economic Indicators B.C. Ziegler and Company | Member SIPC & FINRA 3 Elective Training Available Through Ziegler’s CE Website Effects of Market Uncertainty on Retirement Planning Electronic Communication for Registered Representatives Equity Indexed Annuities Ethics and Professional Conduct Ethics for the Financial Services Professional Ethics and the Securities Futures Professional Executive Bonus Plans Financial Performance Evaluation FINRA Rule 2821 Supervisory Training Fixed and Variable Annuities vs. Mutual Funds Futures Markets Gifts and Gratuities: Guidance on Rule 3060 Gramm-Leach Bliley Act Overview Hedge Fund Investing How to Read a Prospectus Hybrid Securities Identity Theft Prevention and the Financial Services Industry Income Planning for Heirs Income Planning for Retirement Insider Trading Introduction to 529’s Introduction to Blue Sky Laws Introduction to Derivatives Introduction to EIAs Introduction to Estate Planning Introduction to FINRA Rule 2821 for Registered Representatives Introduction to Gift and Estate Taxation Introduction to Mutual Fund Investing Introduction to Suitability and the Senior Protection Model Regulation Investment Advisor Code of Ethics IRA Basics IRA Goldbook Long Term Care Insurance Managed Futures Margin Trading Mergers and Acquisitions Meeting the Federal Trade Commission’s Safeguards Rule Mutual Fund Class Share Online Identity Theft Scams “Phishing” Options Basics Pension Protection Act of 2006 Prevention of Personal Identity Theft Principles of Asset Allocation Professional Sales Presentations Retirement Planning Rule 144 and 144A Rule 3012 and Rule 3013: Supervisory Controls Rules on Internet Availability of Proxy Materials Sarbanes-Oxley Overview Split Dollar Plans Spreading of False Rumors and Market Manipulation New - 2009 Structured Sale Annuities Suitability Obligation to Institutional Customers B.C. Ziegler and Company | Member SIPC & FINRA 4 Elective Training Available Through Ziegler’s CE Website Section 1035 Exchanges Section 529 Plans Suitability of Variable Annuities Suitability of Variable Life Insurance Suitability of Variable Products Supervision of Electronic Communications Supervision of Life Insurance Professionals Supervision of Registered Representatives Taxable Fixed Income Investing New - 2009 The Truth About Variable Annuities Types of Fixed Annuities Understanding Annuities Understanding ERISA New - 2009 Understanding IRAs Variable Universal Life I Variable Universal Life II Wrap Fee Accounts B.C. Ziegler and Company | Member SIPC & FINRA 5 Employees may also elect to complete training hosted or provided by outside vendors. In these cases, the employee must submit a Continuing Education Request Form to Compliance for approval along with the required backup documentation. Credit granted for this type of training will vary and will depend upon the coursework provided. Elective Training Through Other Vendors Securities-specific training provided or hosted by outside training vendors Must be related to the investment activities the employee is engaged in. Those training sessions which are not specifically related to sales of registered products are not eligible for credit. II. DESCRIPTION OF ANNUAL CONTINUING EDUCATION REQUIRMENTS Training Content Continuing Education programs or topics are chosen based upon a variety of factors which are reviewed by Compliance in the needs analysis process. These topics are relevant to the business units and categories of employees. Training Due Dates The required CE training must be completed prior to February 1, 2010 or the employee needs to submit in writing by January 1, 2010 their intent to attend specific training programs prior to January 31, 2010. Categories of Employees Administrative Employees All registered individuals who are not assigned to one particular business unit, are required to take the following training: Alternative Investments All registered individuals who are part of this business unit, are required to take the following training: - Anti-Money Laundering Ethics: The Importance of Ethical Behavior Conflicts of Interest One Elective Annual Compliance Meeting Anti-Money Laundering Ethics: The Importance of Ethical Behavior Conflicts of Interest Two Electives Annual Compliance Meeting Ziegler Capital Management/Portfolio Managers Those individuals who are registered and work in a sales capacity within the Investment Advisor, including Portfolio Managers, Sales Persons, Internal Wholesalers and External Wholesalers, are required to take the following training: - Anti-Money Laundering Ethics: The Importance of Ethical Behavior Conflicts of Interest Spreading of False Rumors and Market Manipulation Two Electives Annual Compliance Meeting B.C. Ziegler and Company | Member SIPC & FINRA 6 Capital Markets — Trading & Sales Those registered individuals who work in investment banking, trading or serve as registered assistants to one of these functions are required to take the following training: - Capital Markets — Investment Banking Those registered individuals who work in investment banking, trading or serve as registered assistants to one of these functions are required to take the following training: - Anti-Money Laundering Ethics: The Importance of Ethical Behavior Conflicts of Interest Spreading of False Rumors and Market Manipulation Two Electives Annual Compliance Meeting Capital Markets — Mergers & Acquisitions/Corporate Finance Those registered individuals who work in investment banking, trading or serve as registered assistants to one of these functions are required to take the following training: - Anti-Money Laundering Ethics: The Importance of Ethical Behavior Conflicts of Interest Underwriting Disclosure and Due Diligence Suitability Issues: An Institutional Focus Spreading of False Rumors and Market Manipulation Two Electives Annual Compliance Meeting Capital Markets — Consulting Those registered individuals who work in investment banking, trading or serve as registered assistants to one of these functions are required to take the following training: - Anti-Money Laundering Ethics: The Importance of Ethical Behavior Conflicts of Interest Debt Mark-Ups Spreading of False Rumors and Market Manipulation Two Electives Annual Compliance Meeting Anti-Money Laundering Ethics: The Importance of Ethical Behavior Conflicts of Interest Spreading of False Rumors and Market Manipulation Two Electives Annual Compliance Meeting Capital Markets — Research Those registered individuals who work in investment banking, trading or serve as registered assistants to one of these functions are required to take the following training: - Anti-Money Laundering Ethics: The Importance of Ethical Behavior Conflicts of Interest Spreading of False Rumors and Market Manipulation Two Electives Annual Compliance Meeting B.C. Ziegler and Company | Member SIPC & FINRA 7 Wealth Management Employees Those registered individuals who are employed by, or associated with Ziegler as a Branch Manager, Financial Advisor or Registered Sales Assistant within a retail sales office. On an annual basis, these individuals are required to complete the following training: – All Registered Representatives - Anti-Money Laundering - Ethics: The Importance of Ethical Behavior - Conflicts of Interest - Considerations for Working w/ Seniors - Electronic Communication for Registered Representatives - Spreading of False Rumors and Market Manipulation - Fixed and Variable Annuities vs. Mutual Funds - Taxable Fixed Income Investing - Managed Futures - A Professional’s Guide to NASD Rules on Variable Annuity and Variable Insurance Prospecting - Annual Compliance Meeting - Registered Supervisors - Variable Annuities: Requirements for Supervisors - Supervisory Considerations for Working with Seniors - A Supervisors Role in Deterring the Spreading of False Rumors and Market Manipulation Exceptions Certain individuals are also subject to extensive educational training, which would meet or exceed the firm’s annual requirements. Those individuals listed below are exempt from the firm's annual CE requirement for the calendar year they are hired or licensed. - New Employees of the firm, who complete or participate in firm element CE at their previous firm, may be awarded credit at Ziegler if they provide documentation showing the CE was completed. - Employees who complete the Series 6 or 7 examinations as the recommended number of self study hours for these examinations is 90—120 hours. - Participants of the ZONE training conducted onsite at the Ziegler offices. ALL employees must complete Anti-Money Laundering (AML) training each year. There will not be any exceptions granted from this training requirement. III. ADMINISTRATION OF THE TRAINING PLAN Delivery Training may be delivered by a variety of methods. They may include, but are not limited to the following: - Direct participation sessions with instructors or discussion leaders - Supervised independent study, assigned reading or internally generated material - Meeting, conferences - Computer-based training - Training by approved vendors Ziegler’s Continuing Education Vendor Ziegler has chosen Quest as its CE supplier for online, self-study training materials. All covered persons will be given access to www.zieglerce.com on which the above-listed training requirements will be available for completion. Required coursework will be available through this site as will elective training which is available for use to fill-in credit requirements as needed. B.C. Ziegler and Company | Member SIPC & FINRA 8 Documentation and Record Keeping Participation in an educational program designed to meet initial and/or ongoing requirements of a professional designation program in a field related to the securities industry (i.e. CFA, CFP, etc.) may qualify for credit toward the firm’s annual training requirements. The employee participating in such training must document and provide an agenda of the training to Compliance. The employee should be prepared to demonstrate that the content is consistent with the requirements of the Firm Element training plan. Any program attended for CE credit that is not sponsored by Ziegler requires the employee to maintain copies of any books, handouts, agendas or outlines provided during the training session. These items must be retained for three full years. These materials will need to be submitted to Compliance for review in determining the amount of Firm Element credit which is awarded for such training. Tracking of all employees’ progress toward completion of the annual training requirements will be maintained by the Compliance Department in Chicago. Feedback All training programs sponsored by Ziegler will provide for appropriate feedback or evaluation to contribute to modifications of the program or the planning of future programs. Enforcement Securities regulations and company policy require individuals to participate in the company-sponsored CE program each year. Individuals who fail to satisfy the required CE training for their particular employee category will be subject to suspension of their registration. Such a suspension will result in restrictions on their activities as it relates to their activities in the securities industry (i.e., no securities transactions, no offering positions to other dealers, no payment of commissions, trail commissions, sales credits, fees (of any sort) or any compensation requiring specific securities industry registration), until the CE requirements are appropriately met. The Compliance Department will strictly enforce this policy. B.C. Ziegler and Company | Member SIPC & FINRA 9