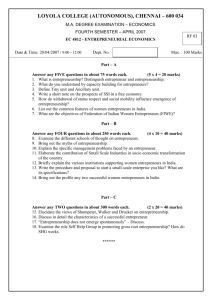

INFORMATION ON POLICIES REGARDING COMPANIES IN POLAND

advertisement