Timeline and Action Plan - Cooperative Credit Union Association

advertisement

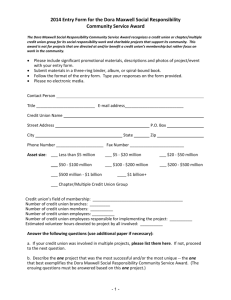

2013 Dora Maxwell Social Responsibility Community Service Award and the Louise Herring Philosophy-in-Action Member Service Award Program Packet Commonly Asked Questions About the National Recognition Awards Q: Who was Dora Maxwell? A: Dora Maxwell was an early credit union pioneer. One of the original signers of CUNA's constitution at Estes Park, Colorado, she worked as an organizer for the movement's trade association (then called the Credit Union National Extension Bureau) and held numerous volunteer positions at the local and national level. In addition to organizing hundreds of credit unions, she developed volunteer organizer clubs and worked with organizations on behalf of the poor. Q: Who was Louise Herring and why is the award named for her? A: Louise Herring was an active supporter, organizer and champion of credit unions. She was the Ohio delegate to the 1934 national credit union conference in Estes Park, Colorado, where she signed the original constitution for a national credit union association. Louise Herring believed that credit unions should work in a practical manner to better people's lives. She saw the credit union as more than just a financial institution. In her own words, "The purpose of the credit union is to reform the financial system, so that everyone can have his place in the sun." Q: What time period do the award entries cover? A: Leagues determine any qualifying time frames. In general, entries should cover the previous year's activities, but there are no exact deadlines prescribed. A good rule of thumb is that entries submitted by the August 2, 2013, deadline should cover activities taking place between May 2012 and May 2013. Q: What's the difference between the Louise Herring Award and the Dora Maxwell Award? A: The Dora Maxwell Social Responsibility Community Service Award is given to a credit union or chapter/multiple credit union group for its social responsibility projects within the community. The award is given for external activities. The Louise Herring Philosophy-in-Action Member Service Award is given to a credit union for its practical application of credit union philosophy within the actual operation of the credit union. It is awarded for internal programs and services that benefit membership. Q: Can a credit union enter both competitions? A: Yes. Just be sure to clearly define which program the credit union is entering and how the activities submitted meet the program guidelines. Q: Can a credit union enter the same entry in both competitions? A: No. Because each program has different objectives and requirements, entries should be tailored to match the defined goals of the particular competition. Q: How do the Dora and Louise programs differ from the Desjardins program? A: Training teachers or lobbying on behalf of state personal finance curriculum requirements are considered community service activities and would be eligible for the Dora Maxwell award. Operating an in-school branch is considered a member service activity and would be eligible for the Louise Herring award. All -2- activities to teach personal finance to people of any age are consider financial education and would be eligible for the Desjardins award. (If you’re confused, call 800-356-9655, ext. 4234, and give Vikki Kinsler a piece of your mind.) Q: Can a credit union submit the same entry to more than one league for state-level judging? A: No. A credit union’s entry may only be submitted to one league, even if the credit union pays dues in more than one state. Q: Can a credit union submit more than one entry in either competition? A. A credit union should submit only one entry per competition. Each entry can list the number of projects conducted in the timeframe established by the league, but the credit union must select one project that best exemplifies the criteria for each award. The questions on the entry form must be completed detailing the one project that was selected. Q: Why must a credit union supply financial information with its entry in the Louise Herring Philosophy-in-Action Member Service Award? A: A credit union must be in solid financial condition in order to provide the highest level of service to its members. Sound financial management ensures a credit union's ability to continue to provide that service, as well. Therefore, the entry must include current and previous year’s (2 years total) balance sheets and income statements and/or NCUA’s Financial Performance Report (FPR). Entries received without the financial information will be disqualified. -3- Secrets of a Winning Dora Maxwell Social Responsibility Community Service Award or Louise Herring Philosophy-in-Action Member Service Award Program Entry And now, a word from the Judges . . . Did you ever wonder what the members of the CUNA’s Awards Committee are looking for when they select the winners in the national recognition programs? Here's the scoop: Review the program entry form carefully and answer all of the questions relative to the one unique project you selected in the original format provided. The scoring is based on these elements, so the more information you provide in direct response to the questions, the higher your score. Please answer all the questions on the form and in order. Read the rules, and make sure you're entering the appropriate competition. Remember: Dora Maxwell entries should focus on community involvement, charity work, or social responsibility programs external to the credit union. Louise Herring entries should be based on your credit union's internal programs that benefit its members, and provide examples of how you put philosophy into action for your members.(Note: Teaching personal finance is the sole focus of the Desjardins adult and youth financial education awards.) Make your entry easy to read and easy to follow. Include the name of your credit union on the front cover of the binder. Use a table of contents. Avoid handwritten entries, and use standard fonts: no italic style or small print. Print items you want read on white paper and refrain from printing on hard-to-read colors, such as magenta, purple, or neon orange. Misspellings leave a bad impression, too. Clearly identify who is involved in your project. Who did the work? Who were the beneficiaries? How many people were reached? While giving donations is admirable, the judges also look for strong volunteer involvement from staff within the credit union at all employment levels. Bigger isn't always better. Keep your entry to a manageable size. Keep it fresh: include current activities only, not programs or events from several years ago. Put all materials in an album, 3-ring binder or spiral-bound book. Include samples or descriptions of the promotional materials related to the entry. Share pictures from the event or the preparation. Include flyers or newsletters that show how you communicated or got the word out about your project or initiative. Please avoid electronic media. Of course, only a limited number of entries can win at the state and national levels. By heeding this advice, you can improve your chances of receiving recognition for your good works. -4- CUNA Award Differentiation Chart Dora Maxwell Social Responsibility Community Service Award Louise Herring Philosophy-in-Action Member Service Award Recognizes model credit union efforts to strengthen local institutions and materially improve the lives of nonmembers through community outreach programs (other than personal finance education). Examples: Recognizes model credit union efforts to materially improve members’ lives through programs (other than personal finance education). Examples: Special loan modification program Wealth-building or debt-reduction incentive program Outreach to underserved population Student-run in-school or campus branch Credit union difference campaign Predatory lending alternative Support for member ESL instruction Charity fund raising Support for public events Donation to social service programs VITA or EITC assistance Lobbying or advocacy on behalf of K-12 financial education Support for teacher training -5- Entry Fees The fee for each entry submitted for judging is $50 made payable to CUNA, Inc. and should be included with your entry sent to the New Hampshire Credit Union League by August 2, 2013. The entry fee will be returned to credit unions that do not advance to the national competition. -6- The Dora Maxwell Social Responsibility Community Service Program Purpose To promote social responsibility among credit unions by formally recognizing their community service achievements. Procedure Prior to judging, ensure you verify the credit union’s asset size. Each league will select winners from each of the following categories: Less than $5 million in assets $5 - $20 million in assets $20 - $50 million in assets $50 - $100 million in assets $100 - $200 million in assets $200 - $500 million in assets $500 million - $1 billion $1 billion+ Credit union chapter/multiple credit union group Only the first place winner in each category will advance to the national competition. If more than one has been chosen, please send just one for judging at the national level. If more than one entry per asset size category is submitted for national judging, the entries will be sent back to the league to determine one winner. Plaques for state-level winners are available at cost to leagues. Credit Union National Association (CUNA) will provide the plaques for the national winning award entries. Enclosed is an entry form to reproduce and distribute to credit unions along with information about the program. The program entry form included in the packet must be completed and submitted with the entry. (Entries received at the national level without completed entry form will be returned.) We also strongly recommend that the credit union completes and follows the checklist that is provided. Leagues determine any qualifying time frames. Chapter/multiple credit unions groups’ entries should describe a project or activity that was conducted as a chapter/multiple credit union group, not credit unions' individual contributions or projects. Submit only one entry form, even if there were multiple projects. If a credit union conducted multiple projects, they must pick their most successful and/or unique project and complete the entry form based on that one project. Providing promotional materials for that one project is essential but additional materials for other projects can be included in the entry. Eligible Activities Credit unions could receive an award for involvement in almost any kind of activity that helps other people or strengthens the structure of a community. This might include raising funds for charity, educational activities, or community involvement projects, such as a volunteer fair, building low-income housing, or loaning employees a few hours a week to work in hospitals, -7- retirement homes, schools, etc. In the resource section of this packet, a summary of 2012 national winners, which provides additional ideas, is included. The Selection Process Credit unions will submit their project binder, album or spiral bound book, along with a completed, typed entry form (required). Support materials for the project should be included in the binder, album or book. Please no electronic media. We also strongly recommend that the credit union completes and follows the checklist that is provided. Each league will appoint a selection committee. Some leagues have judged each other's state entries. Leagues should judge the entries using the same guidelines. In addition to using the enclosed standardized score sheet, the judges should also take into consideration the following: 1. 2. 3. 4. 5. 6. 7. 8. What were the goals of the project and how did they show social concern for the community? How did the project help support the needs of the community? Were the project's target audience(s) defined, including who was involved and who benefited? What strategies were used to reach the project's goal? How were the project's promotional materials targeted to the intended audience(s) and how did they communicate the project's goals? How is this project unique? How does it demonstrate extraordinary effort and devotion of time and organization by the credit union? Were the measurable or defined results of the project achieved? Did the project demonstrate credit union values of mutual self-help, cooperation, economic empowerment and volunteerism? Submitting Winning Entries Leagues then select winners in each category and prepare to forward their first-place selections. First, the League Submission Sheet is completed and sent along with the winning entries to CUNA at the address indicated on the sheet. Next an Entry Fee Payment Form is completed and sent along with a share draft to CUNA at the address indicated on the form. (Reminder: Only one first-place winner per asset category can advance to the national competition. If multiple first-place awards are given at the state level, a tiebreaker must be conducted. If more than one entry per asset size category is submitted for national judging, the entries will be sent back to the league to determine one winner.) In the national competition, CUNA’s appointed Awards Committee judges the entries. -8- 2013 Entry Form for the Dora Maxwell Social Responsibility Community Service Award The Dora Maxwell Social Responsibility Community Service Award recognizes a credit union or chapter/multiple credit union group for its social responsibility work and charitable projects that support its community. This award is not for projects that are directed at and/or benefit a credit union’s membership but rather focus on work in the community. Please include significant promotional materials, descriptions and photos of project/event with your entry form. Submit materials in a three-ring binder, album, or spiral-bound book. Follow the format of the entry form. Type your responses on the form provided. Please no electronic media. Contact Person Title __________________________ E-mail address__________________________ Credit Union Name Street Address P.O. Box City State Zip Phone Number _____________________ Fax Number ________________________ Asset size: ___ Less than $5 million ___ $50 - $100 million ___ $5 - $20 million ___ $20 - $50 million ___ $100 - $200 million ___ $200 - $500 million ___ $500 million - $1 billion ____ $1 billion+ ___ Chapter/Multiple Credit Union Group Credit union’s field of membership: ________________________________________ Number of credit union branches: _________ Number of credit union members: __________ Number of credit union employees: __________ Number of credit union employees responsible for implementing the project: __________ Answer the following questions (use additional paper if necessary): a. If your credit union was involved in multiple projects, please list them here. If not, proceed to the next question. b. Describe the one project that was the most successful and/or the most unique -- the one that best exemplifies the Dora Maxwell Social Responsibility Community Service Award. (The ensuing questions must be answered based on this one project.) -9- 1. What were the goals of your project and how did they show social concern for the community? (Include measurable goals such as dollars budgeted, number of people impacted, etc.) 2. How did the project support the needs of the community? 3. Define the project's target audience(s), including who got involved and who benefited from the project. 4. What strategies were used to reach the project's goal? 5. How were the project's promotional materials targeted to the intended audience(s) and how did they communicate the project's goals? 6. How is this project unique? How does it demonstrate extraordinary effort and devotion of time and organization by the credit union? 7. Please describe the measurable or defined results the project achieved. 8. How does the project demonstrate credit union values of mutual self-help, cooperation, economic empowerment and volunteerism? Include this form with your entry and return to the New Hampshire Credit Union League by August 2, 2013. - 10 - Checklist for Dora Maxwell Social Responsibility Community Service Award Entries The following checklist will ensure that Dora Maxwell Social Responsibility Community Service Award entries are complete. Please include the completed checklist with your entry form. Does the entry include one completed, typed entry form listing the credit union's name, address, FOM, number of members, number of employees, number of employees responsible for implementing the project, a contact person, and a description of one project (Question b)? Does the entry form state that it is intended for the Dora Maxwell Award program? Does the project fit within the description listed on the top of the entry form? Does the entry form reflect your credit union’s current asset size? Are all materials either in a three-ring binder, album or a spiral-bound book? Does the entry describe the measurable goals of the program, including budgets, numbers of people involved, etc.? Does the entry list the groups the program tried to reach and describe outreach strategies? Does the entry show how activities were promoted and include sample articles, ads, flyers, brochures, descriptions and photos? Does the entry include a timetable, budget, and results in the project description? (Be sure and include dollars and numbers.) Is the typed entry form concise and readable? (Remember, more isn't always better!) Include this form with your entry and return to the New Hampshire Credit Union League by August 2, 2013. - 11 - The Louise Herring Philosophy-in-Action Member Service Award Purpose To promote credit union philosophy by formally recognizing credit unions that demonstrate in an extraordinary way the practical application of that philosophy for their members. Procedure Prior to judging, ensure you verify the credit union’s asset size. Each league will select winners from each of the following categories: Less than $50 million $50 - $250 million $250 million - $1 billion $1 billion+ Credit union chapter/multiple credit union group Only the first place winner in each category will advance to the national competition. If more than one has been chosen, please send just one in each category for judging at the national level. If more than one entry per asset size category is submitted for national judging, the entries will be sent back to the league to determine one winner. Plaques for the state-level winners are available at cost to leagues. Credit Union National Association (CUNA) will provide the plaques for the national winning award entries. Enclosed is an entry form to reproduce and distribute to credit unions along with information about the program. The program entry form included in the packet must be completed and submitted with the entry. (Entries received at the national level without completed entry form will be returned.) Leagues determine any qualifying time frames. Eligible Activities Credit unions could receive an award for programs or policies that demonstrate their commitment to the practical application of the "People-Helping-People" philosophy. Some examples of eligible activities are: Provisions for the small saver or borrower. Member programs for groups that are often economically challenged. Internal programs or services that help to differentiate the credit union from other financial services' providers. Programs that do an extraordinary job of encouraging thrift and provide a source of unbiased money management and consumer information, which would be difficult or impossible to obtain elsewhere. Evidence of an exceptional degree of service to members. In the resource section of this packet, a summary of 2012 national winners is included which provides additional ideas. - 12 - The Selection Process Credit unions will submit to their league a project binder, album, or spiral bound book, along with a completed, typed entry form (required), and 2 years’(current and previous year- required) balance sheets and income statements and/or NCUA’s Financial Performance Report (FPR). Support materials for the project should be included in the binder, album, or book. Please no electronic media. We also strongly recommend that the credit union completes and follows the checklist that is provided. Before entries are judged, analyze the financial statements to determine whether the credit union is operating in a safe and sound manner. This criterion must be met in order for a credit union's entry to be considered for the award. In addition to using the standardized scoring sheet, the following should be taken into consideration: 1. 2. 3. 4. 5. 6. 7. 8. Is the credit union operating in a safe and sound manner? Did the credit union’s project help their members and demonstrate the credit union philosophy? How did the implementation steps allow the credit union to achieve its results in putting its philosophy in action? Did the credit union’s contribution go beyond what is normally expected of a credit union? Was project different from day-to-day operations? How well did the credit union educate its members about the program/project and demonstrate that it showed true credit union philosophy? Is it a program/project that will serve members on an ongoing, consistent basis? Did the credit union show its commitment to credit union principles of democratic structure, service to members, ongoing financial education, and social goals? Did the credit union list the measurable and defined results achieved? Submitting Winning Entries Leagues then select winners in each category and prepare to forward their first-place selections. First, a League Submission Sheet is completed and sent along with the winning entries to CUNA at the address indicated on the sheet. Next an Entry Fee Payment Form is completed and sent along with a share draft to CUNA at the address indicated on the form. (Reminder: Only one first-place winner per asset category can advance to the national competition. If multiple first-place awards are given at the state level, a tiebreaker must be conducted. If more than one entry per asset size category is submitted for national judging, the entries will be sent back to the league to determine one winner.) In the national competition, CUNA’s Awards Committee judges the entries. - 13 - 2013 Entry Form for the Louise Herring Philosophy-in-Action Member Service Award The Louise Herring Philosophy-in-Action Member Service Award is given to a credit union for its practical application of credit union philosophy within the credit union. It is awarded for extraordinary, internal programs that are focused on its membership and create services that benefit its members. This award is not for charitable work that is directed outside or extended beyond a credit union’s membership. Please include promotional materials, descriptions and photos of project/event with your entry form. Please no electronic media. Current and previous years’ income statements and balance sheets and/or NCUA Financial Performance Report must be included with the entry materials. Submit materials in a three-ring binder, album, or spiral-bound book Follow the format of the entry form. Type your responses on the form provided. Contact Person Title__________________________E-mail address __________________________ Credit Union Name Street Address P.O. Box City State Zip Phone Number ______________________ Fax Number _______________________ Asset size: ____ Less than $50 million ____ $50 - $250 million ____$250 million - $1 billion ____ $1 billion+ ____ Credit union chapter/multiple credit union group Credit union’s field of membership: _______________________________________ Number of credit union branches: __________ Number of credit union members: __________ Number of credit union employees: __________ Number of credit union employees responsible for implementing the project: __________ Answer the following questions (use additional paper if necessary): a. If your credit union was involved in multiple projects, please list them here. If not, proceed to the next question. b. Select and describe the one project that was the most successful and/or the most unique -- the one that best exemplifies the Louise Herring Philosophy-in-Action Member Service Award. (The ensuing questions must be answered based on this one project.) - 14 - 1. How did your project help your members? 2. Describe how your credit union implemented the project (i.e., explain the process). 3. How does the project differ from day-to-day operations? How could it be used throughout the credit union system? 4. Explain how members were educated about the project/process and how it showed true credit union philosophy. 5. How is this project going to be used to serve the credit union’s members on a consistent basis? 6. How does the project show your credit union's commitment to the credit union principles of democratic structure, service to members, on-going financial education, and social goals? 7. Please describe the measurable or defined results the project achieved. Include this form with your entry and return to the New Hampshire Credit Union League by August 2, 2013. - 15 - Checklist for Louise Herring Philosophy-in-Action Member Service Award Entries The following checklist will ensure that Louise Herring Philosophy-in-Action Member Service Award entries are complete. Please include the completed checklist with your entry form. Does the entry include one completed entry form listing the credit union's name, address, FOM, number of members, number of employees, number of employees responsible for implementing the project, a contact person, and a description of one project? Does the entry form state that it is intended for the Louise Herring Philosophyin-Action Member Service Award program? Does the project fit within the description listed on the top of the entry form? Does the entry include current and previous years' (2 years total) balance sheets and income statements and/or NCUA’s Financial Performance Report (FPR)? Does the entry form reflect your credit union’s current asset size? Does the entry include promotional materials, descriptions and photos of the project and/or event? Are all materials either in a three-ring binder, album, or a spiral-bound book? Does the entry describe the program's goals and the actual results, including budgets, numbers of people involved, etc.? Is the entry form concise and readable? (Remember, more isn't always better!) Does the entry explain how the program demonstrates credit union philosophy in actual operations? Does the entry show how the program went beyond what is normally expected of a credit union? Does the entry demonstrate how members were educated about credit union philosophy? Include this form with your entry and return to the New Hampshire Credit Union League by August 2, 2013. - 16 - Sample Award Program Activities The award programs differ in the following way: The Dora Maxwell Social Responsibility Community Service Award recognizes credit unions for external activities within the community; the Louise Herring Philosophy-in-Action Member Service Award honors credit unions for exemplary internal programs and services. The following examples help clarify activities appropriate to each award category. Sample Dora Maxwell Award activities include, but are not limited to: Helping solve core community problems, such as housing, transportation, hunger, or literacy. Food, clothing, or school supply drives for the needy. Raising money on behalf of charitable organizations, such as the United Way or Credit Unions for Kids®. Helping an organization or agency with events or projects, such as coaching a Special Olympics team. Tutoring or reading to students at a local school. Sponsoring a community volunteer of the year award. Sample Louise Herring Award activities include, but are not limited to: Services for members with unique financial needs, such as savings clubs for children or discounts for senior citizens, or other extraordinary efforts to serve the membership. Counseling for members facing financial difficulties. Student-run, in-school or campus branch. Efforts to educate members on the credit union difference. Wealth-building or debt reduction incentive programs. - 17 - 2012 Dora Maxwell/Louise Herring Award Winner Summaries DORA MAXWELL SOCIAL RESPONSIBILITY COMMUNITY SERVICE AWARD Dora Maxwell (Less than $5 Million in Assets) First Place Renaissance Community Development Credit Union – Somerset, NJ Renaissance Community Development Credit Union hosted a Bike-A-Thon to raise awareness of prostate cancer. Cyclists and volunteers, some who had never volunteered before, came out to support the ride, which consisted of 10, 30 and 45 mile options. As a result, 700 men, including 400 who had not previously been tested, received free prostate cancer screenings, and the credit union donated $1,000 to the Robert Wood Johnson Hospital Foundation, Dora Maxwell ($5-$20 Million in Assets) First Place United Labor Credit Union – Kansas City, MO In response to a call for help from the president of another credit union for one of its members in dire need, United Labor Credit Union launched Operation: Maximum Impact, its version of the television series Extreme Makeover: Home Edition. The home of a widowed mother of six, who also is the caretaker of elderly parents suffering from Alzheimer's disease, had dangerous structural problems and was in desperate need of major repairs. The credit union tapped its membership of highly skilled labor for assistance and over a period of 18 months, garnered more than $100,000 in labor, equipment, supplies, appliances and materials to address the home's deficiencies. Dora Maxwell ($20 to $50 Million in Assets) First Place Health Center Credit Union – Evans, GA Health Center Credit Union leveraged the location of one of its branches to raise funds for the Georgia Health Sciences Children's Medical Center. Its parking lot is convenient to the Evans Towne Center Park, a concert venue. The credit union charges concertgoers $5 for parking and donates the money to the Medical Center. Its employees volunteer to serve as parking attendants. The credit union also participates in a number of other events and sponsorships in support of children and families. - 18 - Second Place American Partners Federal Credit Union – Reidsville, NC American Partners Federal Credit Union's “Love My Credit Union” campaign to recognize one World War II veteran by fundraising $500 for his Triad Flight of Honor got off to such a great start the goal was bumped up to $2,500, enough to sponsor five veterans. During the month of February, the credit union sold hearts on which donors could write the name of someone special. Sales of hearts were so brisk that as February came to a close, American Partners was only $86 short of the $2,500 goal. One member stepped in to cover the shortfall and the credit union was able to honor five veterans by paying their expenses for their Triad Flight of Honor to Washington, DC, where they toured the World War II and other memorials. Honorable Mention CrossRoads Financial Federal Credit Union – Portland, IN A football theme resonated with the community enabling CrossRoads Financial Federal Credit Union to exceed its original goal of raising $1,000 and collecting 10 boxes of non-perishable items to stock the shelves at local food banks. Its “Tackling Hunger” campaign raised a total of $2,576 and collected 15 boxes of food, enough to provide nutrition for 452 families. During October, the credit union used a number of fundraisers, including collecting donations from members, allowing employees to wear jeans for a $5 contribution, and stationing volunteers at the town's main intersection for a “CrossRoads at the CrossRoads” collection from passing motorists. Dora Maxwell ($50 to $100 Million in Assets) First Place Rock Valley Federal Credit Union – Loves Park, IL A credit union employee's attendance at a Rotary Club presentation sparked Rock Valley Federal Credit Union's “Adopt a Camper” fundraising campaign, enabling 35 individuals with special needs to attend summer camp. Initially, Rock Valley sought to raise $1,500 in order to support the camp experience of 15 residents of MILESTONE, an organization providing group homes and other services to people with developmental disabilities. Through blue jeans day, water park ticket sales, a silent auction, a “Bears vs. Packers” coin jar collection and other donations, the credit union raised $2,947. Rock Valley made an additional $553 donation to bring the total to $3,500, enough to send 35 residents to camp, or more than double the original goal. Second Place Michigan One Community Credit Union – Ionia, MI Michigan One Community Credit Union sought to provide a boost to downtown Ionia local businesses and area non-profits with its “Mingle & Jingle: Cool Communities Give” holiday shopping event. Area non-profits were paired with the businesses, where they were able to set up displays explaining their missions and services. Participating businesses donated 10 percent of each purchase to the non-profit designated by the shopper. After visiting each business and display, shoppers were invited to enjoy refreshments and enter for a chance to win a credit union-sponsored $300 drawing as well as vote for their favorite non-profit. The non-profit with - 19 - the most votes received $300 from the credit union. Honorable Mention Carolina Postal Credit Union – Charlotte, NC Carolina Postal Credit Union assisted the National Letter Carriers Annual Food Drive by spreading the word about the need for food donations through billboards, social media, and postcards. In contrast to results nationwide, where donations from the food drive dipped 8 percent, donations stayed the course in North Carolina, showing a slight increase over the previous year. More than 700,000 pounds were collected in the credit union's target areas. Carolina Postal also collected $16,000 in donations for a teen-age member injured in a rodeo accident. Dora Maxwell ($100 to $200 Million in Assets) First Place Mid Missouri Credit Union – Ft. Leonard Wood, MO Mid Missouri Credit Union showed its support and gratitude for those who serve our country by hosting its 6th Annual Military Appreciation Day at the Springfield Cardinals baseball game. Its “Put a Soldier in a Seat” campaign raised more than $15,000, surpassing its goal of $14,000. The funds, raised through jeans days, member donations, car washes and sponsorships, covered the cost of 1,800 game day tickets for active duty military, reservists and retired military and their immediate families, as well as a tee-shirt and vouchers for popcorn and a hot dog. By exceeding its goal, Mid Missouri was able to purchase 100 VIP tickets that were distributed at random to soldiers. Second Place Streator Onized Credit Union – Streator, IL Streator Onized Credit Union lit up its community, both literally and figuratively, with its holiday Animated Light Show and 31 Days of Giving initiative. Each day in December was matched with a charity or social service organizations. The credit union far exceeded its initial goal of raising $6,200 – roughly $200 for each of the designated charities – through fundraisers, such as casual days, raffles, bake sales and bus trips as well as the donations from display visitors. The credit union ultimately raised more than $14,000 allowing it to contribute to each of the 60 organizations that had applied to be part of the 31 Days of Giving. Honorable Mention SPC Credit Union – Hartsville, SC SPC Credit Union raised funds for the March of Dimes as well as raised the esprit de corps of the community by organizing and staffing A Taste of Marlboro County. The event brought 250 residents together to sample offerings from local restaurants and businesses and raised $4,321.83 for the March of Dimes. SPC helped satisfy the residents' appetite for camaraderie as well, as the dissolution of the local Chamber of Commerce had left it bereft of opportunities for community-building events. The credit union also was active in other charitable activities throughout the year, and introduced Cares2Share, a branded employee-giving campaign. - 20 - Dora Maxwell ($200 to $500 Million in Assets) First Place Alabama Credit Union – Tuscaloosa, AL Free and reduced school breakfast and lunch programs help feed kids during the school week, but many spend the weekend hungry, returning to school on Monday morning with growling stomachs. Alabama Credit Union's Secret Meals for Hungry Children helps to fill that gap. Childfriendly, non-perishable, easily consumed and vitamin-fortified snacks and meals are slipped into the backpacks of at-risk children. The secrecy is key to ensuring kids are not subjected to ridicule or singled out by other students. Demand for the program is on the rise, with 1,100 children receiving Secret Meals last year, a 22 percent increase from the previous year. Fundraisers, both large and small, at the credit union and in the community, help pay the $132,000 grocery bill. Last year, the program surpassed that goal, raising $170,000. Second Place CASE Credit Union – Lansing MI Through a team effort, CASE Credit Union is giving every child a chance to play ball. In partnership with Dewitt Charter Township, the credit union's charitable affiliate, CASE Cares, raised $669,000 in donations and grants to construct its Miracle Baseball Field designed for use by those with cognitive and physical disabilities. The Miracle Field features a rubberized surface with painted bases, allowing players with special needs to play ball in a barrier-free, safe, inclusive and fun environment. Future fundraising is planned to add an announcer's booth, lighting and an electronic scoreboard, bringing the total support to $1.1 million. Honorable Mention Merck Sharp & Dohme Federal Credit Union – Chalfont, PA Merck Sharp & Dohme Federal Credit Union held an “udderly” successful fundraiser for two local charities with its 12th annual Cow Plop. Teams of credit union employees sold three-foot square property “deeds” for a $10 donation. On Cow Plop Day, the “owner” of the property where the cow was “moo-ved” to heed the call of nature won a cash prize of 10 percent of the funds raised, while owners of the two adjacent deeds shared another 10 percent. Eighty percent – $24,000 – was divided equally between Manna on Main Street, an interfaith outreach organization and The Shepherd's Shelf, an emergency food pantry. The event has raised more than $200,000 since its inception in 2000 and enables the credit union to involve its staff in helping others as well as have fun for a worthy cause. Dora Maxwell ($500 Million to $1 Billion in Assets) First Place Credit Union ONE – Ferndale, MI Credit Union ONE re-purposed a former office into a facility for FernCare, a local non-profit organization that provides health care services to the uninsured or underinsured. In addition to the space, the credit union donated staff time to coordinate the renovation process with architects, engineers and contractors, as well as to secure the appropriate government permits and provided much of the office furniture being used at the clinic. The lack of a permanent home from which to provide care to its patients had constrained FernCare's effectiveness. With Credit - 21 - Union ONE's help, FernCare has been able to make a significant shift in operating expenses from facilities to patient care. Second Place Kitsap Credit Union – Bremerton, WA Kitsap Credit Union helped alter perceptions of what “poor” looks and feels like by co-hosting “Life on the Edge in Kitsap County,” a day-long workshop, poverty-simulation, resource fair and celebration of successes. The sold-out event was the first of its kind in the area – combining education with an emotional, experiential learning opportunity in which participants spend time in the shoes of those who live in poverty. During the simulation, the participants – elected officials, local community leaders, educators, employers, social service providers, members of the law enforcement and the faith communities – role played anyone from a single parent to senior citizens to a store clerk to a pawn broker. Following the simulation, participants debriefed and identified action steps that could be taken both as individuals and as a community to help eradicate poverty. Honorable Mention Credit Union 1 – Anchorage, AK Credit Union 1 created the One for All Alaska Fund as a way to help alleviate a statewide hunger problem. Each branch office solicited donations from members, who were advised that the funds collected there would be used within the local community. In addition, $5 of the $25 fee charged for the credit union's Skip-A-Pay service was contributed to the fund. At year-end, a total of $14,152.72 was distributed to seven organizations located throughout Alaska that provide food for the hungry. Dora Maxwell (More than $1 Billion in Assets) First Place American Heritage Federal Credit Union – Philadelphia, PA American Heritage Federal Credit Union's support of the Kids-N-Hope Foundation allows hospitalized children to benefit from a Music Therapy Program at the Children's Hospital of Philadelphia Children's Seashore House. The Music Therapy Program promotes healing and rehabilitation through group and individual sessions. Music therapy helps children work through their trauma and encourages the development of strategies for coping with hospitalization. Exceeding its $75,000 goal, American Heritage raised $80,000 through fundraisers that included a golf outing, gelatin olympics, antique and classic car show and through employee and member donations, bringing its total donations in 15 years to $760,000. Second Place Desert Schools Federal Credit Union – Phoenix, AZ Premium silent auction items including autographed sports memorabilia, a trip to Disneyland, golf packages plus tickets to popular concerts and sporting events and more highlighted the Desert Schools Federal Credit Union 14th Annual CMN Golf Tournament. The event attracted 45 foursomes and raised more than $290,000. The money was earmarked for the Phoenix Children's Hospital's “1 Darn Cool School.” The school serves grades K-12 and allows young - 22 - patients to continue learning, which helps to lower their anxiety. The program provides individualized instruction, homebound coordination, a liaison between hospital and school, school re-entry program, inpatient/outpatient literacy programs and summer theme-based enrichment programs. Honorable Mention Indiana Members Credit Union – Indianapolis, IN Indiana Members Credit Union raised more than $75,000 for backpacks filled with school supplies for 3,500 children in need. In its fourth year, The Backpack Attack ensures children have the tools they need for succeeding in the classroom. Special events, such as a Bowl-AThon and a golf outing and numerous candy, yard and other sales helped raise the needed funds and a coordinated volunteer effort assembled the backpacks and handed them out. The Backpack Attack attracted local media attention as well as mentions in the credit union trade press. Television coverage alone is estimated to have reached 468,029 people, with a total publicity value of $21,187. Dora Maxwell (Credit Union Chapters or Multiple Credit Union Group) First Place Pittsburgh Chapter of Credit Unions – Pittsburgh, PA Kids visiting Children's Hospital of Pittsburgh for treatment now have less of a frightening experience and more of an adventure, thanks to the Pittsburgh Chapter of Credit Unions. A twoyear fundraising effort culminated in the sponsorship of a pirate-themed Distraction Therapy room, designed to divert young patients' attention and allay their fears and anxiety about their treatments. The Chapter raised $30,000, exceeding its original goal by $5,000. It also was awarded a Miracle Match grant of $10,000. Twenty-one credit unions took part in the campaign, raising funds through a Miracle Jeans Day (which allowed employees to wear jeans in exchange for a minimum $5 donation) as well as a number of other events culminating in an auction at its holiday meeting. Second Place Indiana Credit Union League – Indianapolis, IN The goal of the Indiana Credit Unions: Commitment to Change program is to track, promote and communicate the difference credit unions are making in their communities. Developed over a two-year period by working group from the League's “Ignite” initiative, the program features a Web site that allows credit unions to share their community involvement stories and best practices as well as collaborate on projects. The Web site also highlights the amount of money and number of volunteer hours that credit unions in the Hoosier State have contributed to their communities. This tally and the accounts of community involvement are important tools in the league's lobbying efforts. - 23 - LOUISE HERRING PHILOSOPHY-IN-ACTION MEMBER SERVICE AWARD Louise Herring (Less than $50 Million in Assets) First Place Syracuse Cooperative Federal Credit Union – Syracuse, NY Syracuse Cooperative Federal Credit Union offers a Matched Savings Program, which provides Individual Development Accounts (IDAs) for first-time homeownership, microbusinesses, higher education and vehicle purchase. Members with low and moderate incomes are eligible to participate in the IDA program, enabling them to accumulate savings for goals that previously may have seemed unattainable. The Matched Savings Program combines education and counseling with a structured savings plan. Once members reach their savings goals and complete the educational requirements, all or part of their savings is matched, depending on their goals. The credit union raised grant funds to use for the match, which serve to motivate and leverage personal savings. Second Place Communicating Arts Credit Union – Detroit, MI Communicating Arts Credit Union's “Auto Loan Bailout” program leveraged a grant from the Community Development Financial Institutions Fund, allowing 123 members to save $520,000 in interest. The loan modification program offered members the chance to cut in half whatever rate they were paying on their vehicle loans – some as much as 25 percent APR – and attracted favorable publicity in local, state and national press. The program not only slashed loan payments, but also served as an educational opportunity to help members understand the importance of good credit and that the credit union offers an alternative to predatory lenders. Honorable Mention United Labor Credit Union – Kansas City, MO United Labor Credit Union hosts an annual Union Retiree Financial Forum to educate union members who are retired or about to retire on topics such as Social Security, estate planning, consumer protection and earning income in retirement. The Forum, which is free-of-charge, also features health and wellness screenings. As a trusted source of financial information for its members, the credit union carefully selects speakers who are experts in their fields and are not selling a specific product or service. The Forum is well-received by the participants who appreciate the opportunity to get honest and straight-forward answers to the difficult financial decisions faced in retirement. Louise Herring ($50 to $250 Million in Assets) First Place St. Louis Community Credit Union – St. Louis, MO St. Louis Community Credit Union partnered with Grace Hill Settlement House and the Better Family Life’s MET Center, two social service agencies that provide resources to underserved populations to open micro-branches within their facilities. The community organizations are located within economically distressed areas where check cashers and payday lenders dominate the financial services marketplace. By opening the micro-branches, the credit union - 24 - not only has a cost-effective way to provide a full array of financial services, but also secured a platform from which it could gain the trust of those who may be wary of mainstream financial institutions. Second Place GEMC Federal Credit Union – Tucker, GA GEMC Federal Credit Union's HomePlus Energy Loan program attracted more than 2,500 new members who took advantage of the program's zero percent financing to make energy efficient improvements to their homes. The zero percent financing was made possible by a $3 million grant from an Energy Efficiency and Conservation Block Grant, secured through a partnership with a power supply cooperative, one of GEMC's Select Employee Groups. GEMC approved, processed and funded the loans to members of Georgia's electric co-ops, who joined the credit union when they applied for the loans and make loan payments as part of their utility bills. The HomePlus Energy Loan program has funded nearly $13.5 million of home improvement projects. Honorable Mention Public Service Credit Union – Romulus, MI With the opening of its Focus: HOPE branch, Public Service Credit Union seeks to help one of the lowest-wealth communities in Detroit, a city hard hit by the Great Recession. The credit union is using word-of-mouth advertising to gain the trust of community members, many of whom distrust mainstream financial institutions and pay to cash their checks at the party (liquor) store on the corner and use predatory lenders for credit. Through classes, seminars and oneon-one counseling, the credit union is helping many residents understand the importance and power of money. Louise Herring ($250 Million to $1 Billion in Assets) First Place Commonwealth Credit Union – Frankfort, KY Commonwealth Credit Union invited members and potential members to “Stop. $ave.” And, indeed they did, reaping nearly $1.3 million in interest savings. The program provided a free review of current bills and credit reports, including checking for fraudulent activity and for interest rates the credit union could lower on loans financed elsewhere. If the credit union could not offer a better rate, the member would be paid $25. Only 11 members collected the $25. In its first-stage, 52 loans were identified saving members almost $129,000 in interest, including slashing $15,695 in interest for one member. In its second stage, the project saved 85 members some $252,000 in interest on loans and 38 members more than $900,000 in mortgage interest. Second Place DuPont Community Credit Union – Waynesboro, VA DuPont Community Credit Union renovated a bank building for its newest branch, the Reservoir Member Center. The branch features a barrier-free environment (no teller line, formal desks or closed-in offices) conducive to engaging members in conversation about their financial needs - 25 - and goals and ways the credit union can meet them. A Member Advisor greets members at the door and is empowered to provide immediate assistance, rather than handing them off to someone else – be it taking a deposit or discussing home loan options. Members can try out the latest in mobile devices at an “@ Your Service Bar,” where credit union staff demonstrate how to conduct financial transactions online and on-the-go. Honorable Mention Michigan First Credit Union – Lathrup Village, MI Michigan First Credit Union's Turning Point Home Loan allows members who need an alternative to a traditional mortgage to achieve their dreams of homeownership. Michigan First holds the mortgages so that members who may have a tarnished credit record or a previous foreclosure can take advantage of low interest rates and home prices in the Detroit Metro area, which has been hard hit by the economic downturn. The program also has served as a stepping stone to the credit union's traditional mortgage offerings. The credit union offers seminars on home buying throughout the year to help members better understand the process. Louise Herring (More than $1 Billion in Assets) First Place State Employees' Credit Union – Raleigh, NC Through its Estate Planning Essentials Program (EPE), State Employees' Credit Union seeks to provide members with the tools needed to build a sound financial plan for the future and the opportunity to gain peace-of-mind, knowing that their wishes will be carried out. The credit union identified experienced estate planning attorneys who agree to prepare basic documents for the fixed price of $250 for individuals and $350 for couples with substantially similar estate plans prepared at the same time. Recognizing that even these prices might make an estate plan out of reach for some of its members, the credit union offers a low-cost loan to cover the fees. In the two years since EPE was launched, the credit union has helped more than 7,000 members achieve their estate planning goals. Second Place Wright-Patt Credit Union – Fairborn, OH A “You Save or We Pay” program saved members of Wright-Patt Credit Union more than $20 million in interest, or double the credit union’s original goal of trimming $10 million from members' payments. The credit union invited its members to: “Give us 20 minutes. If we can't find a way to save you money on your loans....we'll pay you $50.” Only 124 of the 1,683 members who took the credit union up on its offer and had their credit reports reviewed had low enough loan rates somewhere else – they walked away with $50 for their time. The remaining 93 percent refinanced nearly $65 million in loans with the credit union. Honorable Mention TruMark Financial Credit Union – Trevose, PA With the opening of its Eastern North Philadelphia branch, TruMark Financial Credit Union brought affordable financial services to an impoverished community that has been devoid of a financial institution for more than 60 years. The full-service branch offers bilingual brochures and is staffed by bilingual, multi-cultural employees. The credit union conducted extensive research - 26 - and preparation, including partnering with APM, a Hispanic-based community and economic development organization, to ensure it would gain the support of community members, who previously relied on check-cashers and predatory lenders for their financial services. The credit union actively promotes financial literacy in a variety of ways including one-on-one counseling, seminars and raising money for the purchase of materials for schools with a “Kiss-A-Pig” fundraiser. Louise Herring (Credit Union Chapters or Multiple Credit Union Group) First Place Erie Chapter of Credit Unions – Erie, PA In honor of its long-standing president, James J. DeDad, the Erie, PA Chapter of Credit Union annually presents $8,000 in scholarships. Nearly 200 students entered the scholarship competition, funded by donations from 11 credit unions in the chapter. Applicants were asked to write a 500-word essay in response to the question: “Young people often find themselves carrying large amounts of student loan and/or credit card debt upon graduation from college. What can you do to prevent yourself from overspending in college?” The six winners received scholarship awards ranging from $500 to $3,000. The scholarship program has awarded a total of $123,000 since its inception in 1995. ### - 27 -