LURLEEN B WALLACE COMMUNITY COLLEGE

advertisement

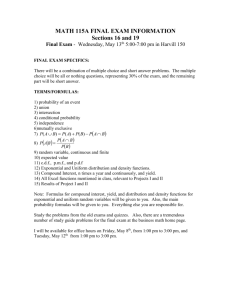

LURLEEN B. WALLACE COMMUNITY COLLEGE ONLINE COURSE SYLLABUS CONTACT INFORMATION Instructor Name: Michelle Goosby Campus Location: Macarthur Campus Office Location: E. Claude Nevin Bldg, Rm K113 Office Phone: 334-493-5339 Office Email: mgoosby@lbwcc.edu Office Hours: 1:00 – 4:00 pm M – TH, 8:00 am – 1:00 pm F Campus Mailing Address: 1708 North Main Street Opp, AL 36467 COURSE NUMBER AND TITLE MTH 246 Mathematics of Finance PREREQUISITES MTH 098 or appropriate math placement score DIVISION AND DEPARTMENT Math/Science Division, Math Department SEMESTER HOURS CREDIT Three hours CATALOG DESCRIPTION This course explores mathematical applications relevant to business practices. Types covered include simple and compound interest, credits, trade and bank discounts, annuities, amortizations, depreciation, stocks and bonds, insurance, capitalization, and perpetuities. TEXTBOOK(S) Business Mathematics, 10th edition by Miller, Salzman and Clendenen. Publisher is Addison Wesley. New text includes access to MyMathLab (additional expense if book is purchased used) TECHNOLOGY REQUIREMENTS A. General requirements A personal computer (not WebTV) with Windows 2000 or Windows XP (computer labs are available on all three campuses) A VGA (or equivalent) or better monitor Reliable Internet access. (If using a dial-up connection, at least 28.8k modem is recommended. Slower dial-up connections will affect course performance. If you are an AOL user: You will need AOL version 7.0 or higher) Netscape Navigator/Communicator 7.1 higher or Internet Explorer 6.0 or higher Sound Card Most recent versions of plug-ins and viewers. These are free additions to browsers that allow students to view special course components such as video, clips, or animations. B. Course specific requirements none SUPPLEMENTARY MATERIAL Paper Scientific calculator COURSE OBJECTIVES CHAPTER 3: PERCENT The student is required to meet the following objectives: define percentages, write decimals and fractions as percents, write percents as decimals and fractions, solve percentage problems through mathematical computations, concepts and applications, in particular, increase and decrease problems; solve word problems using scientific calculator, formula, and algebraic concepts. CHAPTER 6: MATHEMATICS OF BUYING The student is required to meet the following objectives: identify invoice abbreviations, complete invoices, define list price and trade discounts, calculate single discounts, series discounts, net cost, net cost equivalents, single discount equivalents, calculate cash discounts using the ordinary dating method, end-of-month method, receipt of goods method, extra dating method; determine whether cash discounts are earned, determine credit given for partial payment of an invoice; solve word problems using scientific calculator, formula, and algebraic concepts . CHAPTER 8: SIMPLE INTEREST The student is required to meet the following objectives: define and calculate interest, principal, annual rate, maturity value, time in years, and due date of a simple interest note; define and calculate the bank discount, discount rate, effective interest rate, discount period, proceeds, and face value of a simple discount note; calculate interest, discount, and proceeds when discounting simple interest and simple discount notes before maturity, use algebraic concepts, simple interest formulas and scientific calculators to solve word problems involving the aforementioned. CHAPTER 9: COMPOUND INTEREST The student is required to meet the following objectives: define and calculate compound interest, compound amount, present value of an investment, interest rate per compounding period, number of compoundings per year, number of compoundings for the duration of the investment; define compound interest periods such as daily, monthly, annual, semiannual, and quarterly compoundings, solve word problems using compound interest formulas, simple interest formulas, and compound interest tables; solve word problems involving interest bearing accounts such as passbook, savings, and time deposit accounts, solve word problems involving consumer price index and inflation; identify the differences between simple interest and compound interest, use algebraic concepts, compound interest formulas and scientific calculators to solve word problems involving the aforementioned. CHAPTER 10: ANNUITIES AND RETIREMENT ACCOUNTS The student is required to meet the following objectives: define an ordinary annuity, an annuity due, a sinking fund, and the present value of an ordinary annuity; identify the compounding periods of an annuity; calculate the amount, present value, interest earned and equivalent cash price of an ordinary annuity, calculate the amount of an annuity due; calculate the amount of each periodic payment of a sinking fund; define various types of annuities such as IRA’s, company-sponsored retirement plans and social security; define types of stock, mutual funds, Dow Jones Industrial Average and Nasdaq Composite Index; read stock tables; find current yield on a stock and stock’s current ratio; define bonds; read bond tables; find commission charge on bonds and cost of purchasing bonds; find the effective yield of a bond; solve word problems using algebraic concepts, sinking fund table, compound interest tables, stock tables, bond tables, and formulas to calculate the aforementioned. CHAPTER 11: BUSINESS AND CONSUMER LOANS The student is required to meet the following objectives: define open-end credit, revolving charge accounts, loan consolidation, installment loans, personal property and real estate, escrow accounts, and fixed and variable rate loans; calculate payment amounts, finance charges, annual percentage rates, and unpaid balance of credit card accounts using the unpaid balance and the average daily balance methods; calculate total installment cost, finance charges and annual percentage rate of installment loans; calculate balance owed, amount due at the maturity and unearned interest of a loan when making early payments by using the United States Rule and the Rule of 78; calculate payments, finance charges, and total cost of personal property loans using formulas and amortization tables; use algebraic concepts, formulas, tables and scientific calculators to solve word problems involving the aforementioned. CHAPTER 12: TAXES AND INSURANCE The student is required to meet the following objectives: define and calculate fair market value, assessed valuation and tax rate for property tax; use formula to calculate property tax; determine tax liability, calculate adjusted gross income, standard deduction amounts, taxable income and federal income tax; determine balance due or a refund from the Internal Revenue Service; prepare a 1040A and a Schedule 1 federal tax form; define the terms policy, coverage, face value, and premium for fire insurance; calculate annual premium for fire insurance; define coinsurance and use coinsurance formula to calculate the amount of loss that the insurance company will pay; define multiple carrier insurance; define liability, property damage, comprehensive and collision, no-fault, and uninsured motorist insurances; find annual premiums of motor-vehicle insurance; define term and whole life insurance, universal life, variable life, limited-payment life, and endowments; determine annual premium of life insurance; identify different types of insurance coverage such as worker’s compensation, liability, homeowner and medical; use algebraic concepts, formulas, tables, and scientific calculators to solve word problems involving the aforementioned. CHAPTER 13: DEPRECIATION The student shall define depreciation and its terms; calculate the amount of depreciation each year, the annual rate of depreciation, the book value of an asset; prepare a depreciation schedule; use the straight-line method, declining-balance method, sum-ofthe-years’ – digits method to determine the aforementioned. ONLINE TEACHING METHODS A variety of teaching methods and student involvement exercises will be utilized to address different learning styles. ATTENDANCE POLICY Completion of homework assignments in a timely manner, completion of tests, and weekly email contacts with the instructor are vehicles used to track student attendance in an online environment. It is the student’s responsibility to allot sufficient time to complete the objectives of the course within the parameters set by the instructor. Class attendance is regarded as an obligation as well as a privilege. Absences seriously disrupt a student’s orderly progress in a course. There is also a high correlation between the number of absences and the final grade. In order to reap the numerous benefits provided by the online environment, topics should be studied sequentially, instructions should be followed explicitly, assignments should be completed in a timely manner and good study skills should be maintained throughout the course. WITHDRAWAL College catalog page 30 EVALUATION PROCEDURES FOR ONLINE STUDENTS The final average for MTH 246 Online will be calculated as follows: 50% Online Chapter Tests 25% Online Homework Assignments 25% Final Comprehensive Exam (proctored) The College grading scale will be used: 90 – 100 A 80 – 89 B 70 – 79 C 60 – 69 0 – 59 D F MAKE-UPS and RE-TAKES: Make-ups and re-takes are only allowed when the instructor deems it appropriate and necessary. In doing so, the student must initiate arrangements with the instructor. ACADEMIC HONESTY Students are expected to follow the Student Code of Conduct as described in the current college catalog (pages 157-159). Cheating and plagiarism violate these standards and may result in disciplinary action, including expulsion. POLICY ON REASONABLE ACCOMODATIONS FOR PEOPLE WITH DISABILITIES Lurleen B. Wallace Community College complies with Section 504 of the Rehabilitation Act of 1973 and the Americans with Disabilities Act of 1990. If you have a disability that might require special materials, services, or assistance, or if you have any questions relating to accessibility, please contact the ADA Coordinator on the respective campuses. For TDD users in Alabama, the Alabama Relay Center is available by calling 1-800-5482546. All materials related to compliance with the Americans with Disabilities Act are maintained by the college coordinators. Andalusia Campus Bridges Anderson 334-881-2247 Greenville Campus Dr. Jean Thompson 334-382-2133 ext. 3102 MacArthur Campus Jason Cain 334-493-3573 ext. 5363 SAFETY Safety procedures will be addressed during the first on campus meeting. OTHER Additional course information may be announced by the instructor, and the instructor may make changes to this syllabus.