File

advertisement

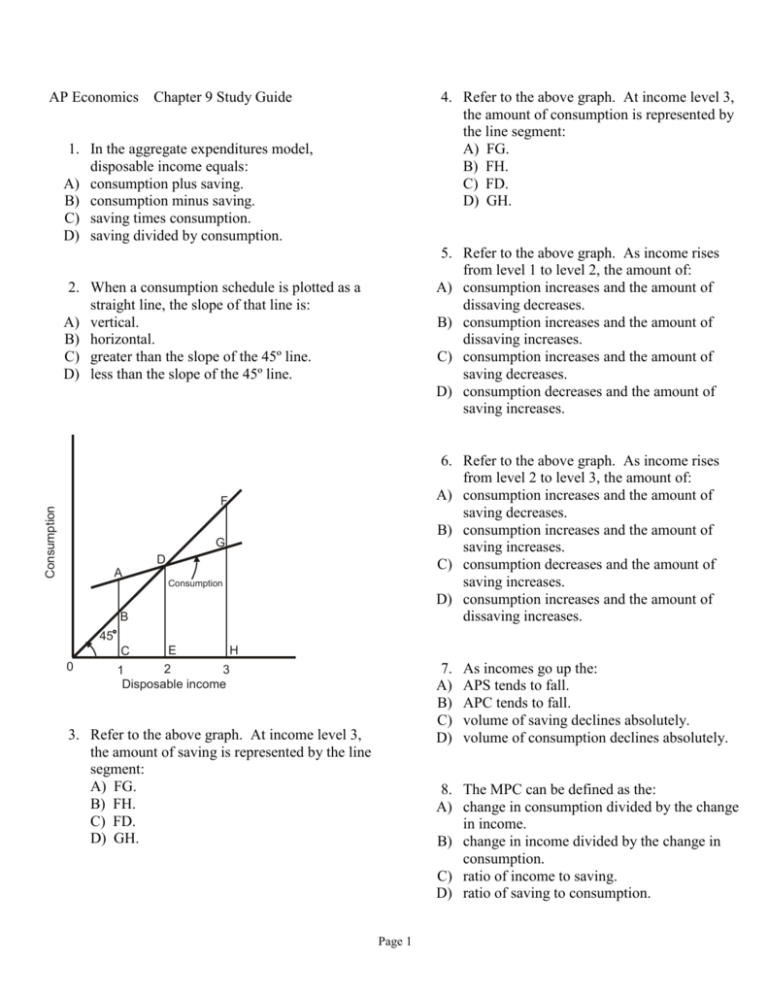

AP Economics Chapter 9 Study Guide 4. Refer to the above graph. At income level 3, the amount of consumption is represented by the line segment: A) FG. B) FH. C) FD. D) GH. 1. In the aggregate expenditures model, disposable income equals: A) consumption plus saving. B) consumption minus saving. C) saving times consumption. D) saving divided by consumption. 5. Refer to the above graph. As income rises from level 1 to level 2, the amount of: A) consumption increases and the amount of dissaving decreases. B) consumption increases and the amount of dissaving increases. C) consumption increases and the amount of saving decreases. D) consumption decreases and the amount of saving increases. 2. When a consumption schedule is plotted as a straight line, the slope of that line is: A) vertical. B) horizontal. C) greater than the slope of the 45º line. D) less than the slope of the 45º line. 6. Refer to the above graph. As income rises from level 2 to level 3, the amount of: A) consumption increases and the amount of saving decreases. B) consumption increases and the amount of saving increases. C) consumption decreases and the amount of saving increases. D) consumption increases and the amount of dissaving increases. Consumption F G D A Consumption B 45 C 0 E H 7. A) B) C) D) 2 3 1 Disposable income 3. Refer to the above graph. At income level 3, the amount of saving is represented by the line segment: A) FG. B) FH. C) FD. D) GH. As incomes go up the: APS tends to fall. APC tends to fall. volume of saving declines absolutely. volume of consumption declines absolutely. 8. The MPC can be defined as the: A) change in consumption divided by the change in income. B) change in income divided by the change in consumption. C) ratio of income to saving. D) ratio of saving to consumption. Page 1 9. If you know that an increase in a household's disposable income from $35,000 to $45,000 leads to an increase in consumption from $30,000 to $38,000, then you can conclude that the: A) slope of the consumption schedule is .75. B) average propensity to consume is .8. C) marginal propensity to save is .25. D) marginal propensity to consume is .8. 13. In a consumption schedule, the change in consumption is a constant $12 billion and the change in income is a constant $16 billion across each consumption and income level. It can be concluded that the: A) slope of the saving schedule is .33. B) slope of the consumption schedule is .67. C) marginal propensity to consume is 1.33. D) marginal propensity to save is .25. 10. The relationship between the MPS and the MPC is such that: A) MPC - MPS = 1. B) MPS/MPC = 1. C) 1 - MPC = MPS. D) MPS x MPC = 1. 14. Which will shift the consumption schedule upward? A) a current high level of consumer indebtedness B) a current low level of wealth or assets held by consumers C) expectations of future declines in the consumer price index D) expectations of future shortages of essential consumer goods Saving Saving 0 A D 15. Which would shift the consumption schedule downward? A) an increase in real and financial assets B) a falling level of consumer debt C) expectations of rising prices D) an increase in taxes C E B 1 2 Disposable Income 3 11. Refer to the above graph. As income rises from level 1 to level 2, the amount of: A) dissaving decreases. B) dissaving increases. C) saving decreases. D) saving increases. The table shows a consumption schedule. Disposable income $300 350 400 450 500 12. Refer to the above graph. As income rises from level 2 to level 3, the amount of: A) dissaving decreases. B) dissaving increases. C) saving decreases. D) saving increases. Consumption $310 340 370 400 430 16. Refer to the above data. The marginal propensity to consume is: A) .80. B) .75. C) .60. D) .40. Page 2 17. Refer to the above data. If disposable income is $550, we would expect consumption to be: A) $430. B) $450. C) $460. D) $470. 20. A firm invests in a new machine that costs $2,000 a year but which is expected to produce an increase in total revenue of $2,200 a year. The current real rate of interest is 8 percent. The firm should: A) undertake the investment because the expected rate of return of 12 percent is greater than the real rate of interest. B) undertake the investment because the expected rate of return of 10 percent is greater than the real rate of interest. C) undertake the investment because the expected rate of return of 9 percent is greater than the real rate of interest. D) not undertake the investment because the expected rate of return of 7 percent is less than the real rate of interest. 18. The graph above shows the relationship between consumption and income. Which statement is correct? A) There is saving at lower income levels. B) The marginal propensity to consume varies across income levels. C) The average propensity to consume at income level K is given by KM divided by MN. D) The marginal propensity to consume can be calculated by dividing LM by PL. 21. A) B) C) D) 19. An inverse relationship between the rate of interest and the level of: A) income is suggested by the consumption function. B) prices is suggested by the aggregate supply curve. C) employment is suggested by the aggregate demand curve. D) investment spending is suggested by the investment-demand curve. Page 3 Which would increase investment demand? an increase in production costs a decline in business optimism a decrease in business taxes a decrease in the interest rate 26. Refer to the above graph. When C + Ig is $350 billion there will be: A) equilibrium GDP. B) saving exceeding planned investment. C) unplanned increases in inventories. D) unplanned decreases in inventories. 27. When saving exceeds planned investment in a private, closed economy: A) aggregate expenditures will equal GDP. B) aggregate expenditures will exceed GDP. C) aggregate expenditures will be less than GDP. D) consumption plus investment will equal GDP. 22. Refer to the above graph. In this economy, investment is: A) $50 billion. B) $100 billion. C) $150 billion. D) $200 billion. 28. (Last Word) The aggregate expenditure model emerged: A) in the 1960s. B) in the 1980s. C) as a reinforcement of Say's Law. D) as a critique of classical economics. 23. Refer to the above graph. The equilibrium level of GDP in this economy is: A) $150 billion. B) $250 billion. C) $350 billion. D) $450 billion. 24. Refer to the above graph. At the equilibrium level of GDP, saving will be: A) $50 billion. B) $100 billion. C) $150 billion. D) Cannot be determined from the information given. 25. Refer to the above graph. When C is equal to $150 billion, aggregate: A) saving will be equal to zero. B) saving will be equal to $50 billion. C) investment will be equal to $50 billion. D) investment will be equal to $250 billion. Page 4