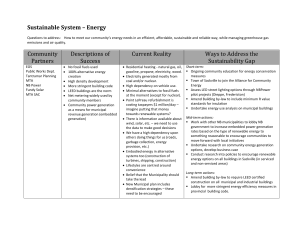

2-1226.35. Green building standards.

advertisement