Chapter F3

advertisement

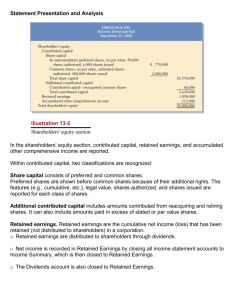

Chapter F3: Tools of the Trade, Part I...The Balance Sheet: Initial Financing-Investments by Owners Multiple Choice 1. The following statement is true regarding assets: An example of an asset is the common stock issued by the corporation. Assets are the difference between liabilities and equity. An example of an asset is the amount owed to employees for wages earned. Assets are items a company owns such as a building that provide future economic benefits. * Hint for question 1 Assets are items a company owns or controls such as cash, equipment, and land. Liabilities are debts a company owes such as amounts owed to employees (wages payable) or to suppliers (accounts payable). Close window 2. Equity -- is debt resulting from past transactions that must be paid some time in the future. * is the portion of assets the owner(s) own free and clear. is referred to as owners' equity in a corporation but as stockholders' equity in a partnership. comes from two sources--amounts borrowed and amounts invested by owners. Hint for question 2 Assets minus liabilities is equity, the residual ownership interest in a company. Equity comes from two sources--amounts invested by owners and amounts earned (profits) by the company. Close window 3. * A company buys a building by paying $100,000 in cash and borrowing $400,000 from a bank. All of the following statements are true regarding the purchase of the building except -- the building is reported as a $100,000 asset on the balance sheet. the $400,000 borrowed is reported as a liability on the balance sheet. the company has $100,000 of equity in the building. the total cost of the building is $500,000--the $100,000 paid in cash plus the $400,000 borrowed. Hint for question 3 Assets = liabilities + owners' equity. Close window 4. The following statement is true regarding the balance sheet: The balance sheet reports a financial picture of the company for the entire year. The owners' equity portion of the balance sheet is reported the same for partnerships and corporations. * The title of "balance sheet" comes from the accounting equation which is assets = liabilities + equity. The balance sheet reports revenues earned, expenses incurred, and profits of the company. Hint for question 4 The balance sheet reports the assets of the company and who has claim to those assets. It reports the financial condition as of a moment in time. Close window 5. The following statement is true regarding partnerships: The only difference between proprietorships and partnerships is that in partnerships each partner's claim to assets must be kept in a separate account. * Partners must split profits equally. When Bob and Carol each contribute $5,000 to a partnership, total equity will increase by $10,000, but assets and liabilities will remain the same. A partnership is a separate legal entity. Hint for question 5 Partnership agreements can contain any method of computing the capital balance or method of splitting profits, just so these items are agreed on by all of the partners. Close window 6. The following statement is true regarding corporations: The federal government approves and issues a corporate charter. * The Board of Directors declares dividends. The CEO (chief executive officer) has the authority to remove a person from the Board of Directors if that person is not fulfilling the duties of that position. The controller manages the company cash. Hint for question 6 Each share of stock owned is worth one vote at shareholder meetings. Shareholders elect the Board of Directors (BOD). The BOD declares dividends and has the authority to appoint a president and other officers to manage the company. Close window 7. Shareholders paid in $500,000 in exchange for shares of stock. The first year of business the company reported $100,000 of net income (profits), and paid out $20,000 in dividends. All of the following statements are true regarding the balance sheet at the end of the first year of business except -- contributed capital will total $500,000. paid-in capital will total $500,000. total stockholders' equity will total $580,000. * retained earnings will total $100,000. Hint for question 7 Contributed capital is amounts paid in by shareholders. Retained earnings is the net income retained in the company and not distributed to shareholders in the form of a dividend. Total SE = contributed capital + retained earnings - treasury stock. Close window 8. Max Corporation began operations by selling 1,000 shares of its $3 par common stock for $8 a share. As a result of this stock issuance -- the market value has increased by $5 per share over the year. the Contributed Capital account would increase by $3,000. * the Additional Paid-in Capital account would increase by $5,000. the common stock account would increase by $8,000. Hint for question 8 Contributed Capital = common stock account + APIC. Amounts paid in towards par value are reported in the common stock account. Amounts paid in addition to the par value are reported in the APIC (Additional Paid-in Capital) account. Close window 9. The following statements apply to common and preferred types of stock. Select the statement that only applies to preferred stock. Shareholders risk the loss of investment. Shareholders bear the risk of no dividend. Shareholders usually have the right to vote. * Dividends are usually based on a percentage of the par value. Hint for question 9 Common shareholders are referred to as residual owners since they get the residual--what is left after creditors and preferred shareholders get their allotments. Therefore, common shareholders bear the greatest risk of loss. Close window 10. Using the following information, calculate total stockholders equity: cash $14,000, common stock $22,000, APIC (additional paid-in capital) $18,000, preferred stock $50,000, retained earnings $60,000, and treasury stock $10,000. Total stockholders' equity equals $100,000. * Total stockholders' equity equals $140,000. Total stockholders' equity equals $154,000. None of the above. Hint for question 10 Total stockholders' equity equals contributed capital + retained earnings treasury stock. Close window 11. The balance sheet of Grant, Inc., reported the following on the year-end balance sheet: Common stock (600,000 shares authorized, 200,000 shares issued) $200,000. Additional paid-in capital $300,000. Retained earnings $400,000. Treasury stock (15,000 shares) $ 90,000. All of the following statements are true regarding Grant, Inc., except -- the balance sheet indicates there are 185,000 shares of common stock currently outstanding. the balance sheet indicates there is $400,000 of earned profits that have not yet been distributed to shareholders in the form of a dividend. the balance sheet indicates shareholders have contributed $200,000 for issued shares of stock. * the balance sheet indicates the average selling price of the originally issued shares of stock is $2.50 per share. Hint for question 11 Contributed capital is amounts paid in by shareholders. Retained earnings is the net income retained in the company and not distributed to shareholders in the form of a dividend. Total SE = contributed capital + retained earnings - treasury stock. Close window 12. * In 1990, 10,000 shares were issued for $10 per share. In 1995, an additional 20,000 shares were issued for $20 per share. In the year 2007, the market value of the stock was $50 per share. The following statement is true regarding this corporate stock: 30,000 shares were issued in the primary market. 20,000 shares were issued in the secondary market. Since this company started business, shareholders have paid in a total of $300,000. In the year 2006, contributed capital reported on the balance sheet will total $1,500,000. Hint for question 12 The primary stock market refers to the initial issuance of stock by the corporation to investors, while the secondary stock market refers to shareholders trading stock with other investors. Close window Submit for Grade Chapter F3: Tools of the Trade, Part I...The Balance Sheet: Initial Financing-Investments by Owners True or False 1. * Assets will always equal liabilities plus owners' equity. TRUE FALSE Hint for question 1 The assets must be owned by someone. The ownership is equal to the claims on those assets--creditors' claims (liabilities) or owners' claims (equity). Close window 2. Creditors have a right to a share of corporate profits in the form of a dividend. TRUE * FALSE Hint for question 2 Investors who lend money (creditors) to a corporation have no ownership rights. Investors who purchase shares of stock have ownership rights that include the right to a share of the profits and a right to vote at shareholder meetings. Close window 3. The corporate officers have the ultimate responsibility for managing the corporation. TRUE * FALSE Hint for question 3 The board of directors serves as a link between the shareholders and the officers of the company. The board of directors can replace the officers if the officers are not managing the company in the best interests of the shareholders. Close window 4. A shareholder may serve as chief executive officer (CEO) of the corporation and also as chairman of the board of directors. * TRUE FALSE Hint for question 4 In 1991, nearly 80 percent of the CEOs of U.S. companies also served as chairman of the board of directors. Close window 5. Par value must be separately reported on the balance sheet because it represents the market value of the stock when it was first issued. TRUE * FALSE Hint for question 5 Amounts paid in toward the par value of stock must be separately reported on the balance sheet, however, par value has nothing to do with the market value of the stock. Close window Submit for Grade Chapter F3: Tools of the Trade, Part I...The Balance Sheet: Initial Financing-Investments by Owners Fill In The Blanks 1. On the balance sheet, __________ are the accounting element that provides future benefits--the items a company owns or controls. equity stock * assets liability Hint for question 1 Which accounting element does a company own or control? Close window 2. The _________ form of ownership is a separate legal entity that distributes profits to the owners in the form of a dividend. proprietorship * corporate common partnership Hint for question 2 Proprietorships, partnerships, and corporations are the three forms of ownership. Close window 3. __________ stock is no longer in the hands of shareholders. Preferred Common * Treasury No-par Hint for question 3 What type of stock has been repurchased from shareholders? Close window 4. Net income (profits) increases retained earnings, and __________ decrease(s) retained earnings. par APIC stock * dividends Hint for question 4 What event results in decreasing the retained earnings account? Close window 5. The __________ market is where investors trade shares of stock with each other. common primary preferred * secondary Hint for question 5 First, stock is issued by a corporation to shareholders. Next, shareholders can trade with each other. Close window Submit for Grade Chapter F3: Tools of the Trade, Part I...The Balance Sheet: Initial Financing-Investments by Owners Essay Questions 1. List the three accounting elements reported on the balance sheet. Describe each in your own words. List three examples of account titles for each. Explain the primary purpose of the balance sheet. 2. Explain the similarities and differences between common stock and preferred stock. In your explanation comment on ownership rights, return on investment, and risk. 3. Stockholders’ Equity of Casey Corporation December 31, 2006 Common stock, 10,000 shares issued and outstanding Additional paid-in capital Retained earnings Treasury stock Total SE $100,000 $200,000 $500,000 -0$800,000 Stockholders’ Equity of Casey Corporation December 31, 2007 Common stock $300,000 Additional paid-in capital $800,000 Retained earnings $600,000 Treasury stock $(75,000) Total SE $1,625,000 Comment on the amount of change and the transactions that may have caused the change in each of the stockholders’ equity accounts between December 31, 2006, and December 31, 2007. Submit for Grade