A Business Plan with a Broadly Based Research

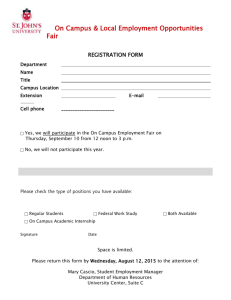

advertisement