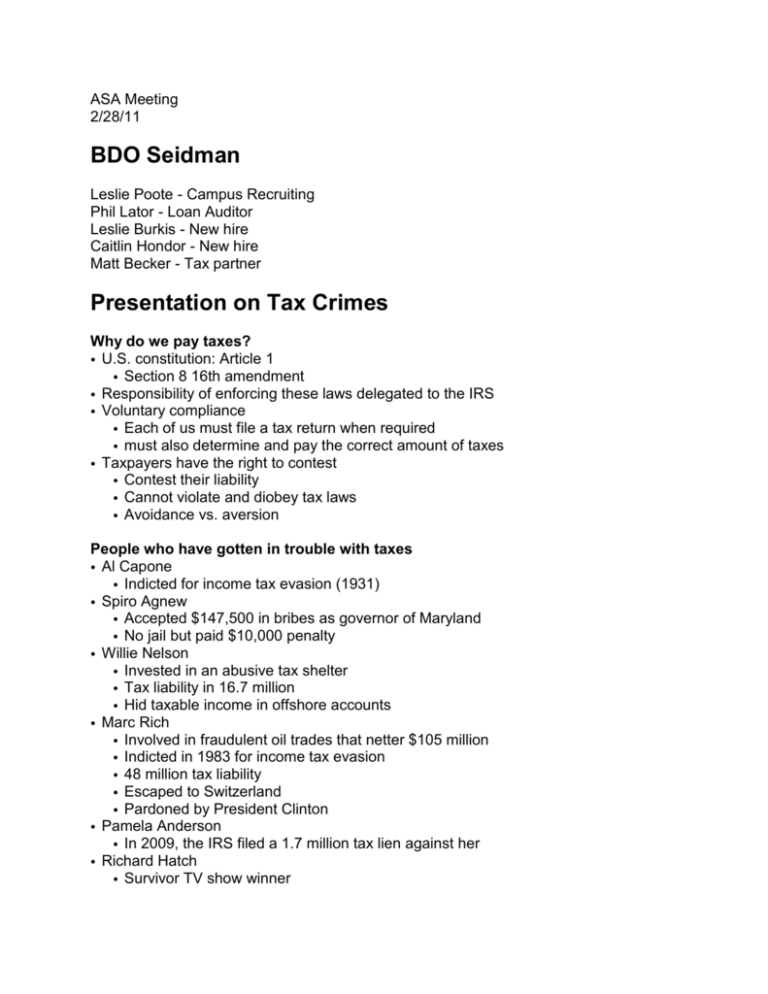

ASA Meeting 2/28/11 BDO Seidman Leslie Poote

advertisement

ASA Meeting 2/28/11 BDO Seidman Leslie Poote - Campus Recruiting Phil Lator - Loan Auditor Leslie Burkis - New hire Caitlin Hondor - New hire Matt Becker - Tax partner Presentation on Tax Crimes Why do we pay taxes? • U.S. constitution: Article 1 • Section 8 16th amendment • Responsibility of enforcing these laws delegated to the IRS • Voluntary compliance • Each of us must file a tax return when required • must also determine and pay the correct amount of taxes • Taxpayers have the right to contest • Contest their liability • Cannot violate and diobey tax laws • Avoidance vs. aversion People who have gotten in trouble with taxes • Al Capone • Indicted for income tax evasion (1931) Spiro Agnew • • Accepted $147,500 in bribes as governor of Maryland • No jail but paid $10,000 penalty • Willie Nelson • Invested in an abusive tax shelter • Tax liability in 16.7 million • Hid taxable income in offshore accounts • Marc Rich • Involved in fraudulent oil trades that netter $105 million • Indicted in 1983 for income tax evasion • 48 million tax liability • Escaped to Switzerland • Pardoned by President Clinton • Pamela Anderson • In 2009, the IRS filed a 1.7 million tax lien against her • Richard Hatch • Survivor TV show winner • Failed to show 1 million dollar winnings on tax return • Served 51 months in prison Simple Tax Crimes • Tax avoidance activities • Frivolous filters/ non filers • Fraudulent return preparers deliberately under-reporting or omitting income • Overstating deductions • Keeping two sets of books (“cooking”) • Claiming personal expenses as business expenses • False deductions • Hiding assets or income • Ponzi Schemes, kitting & Lapping Avoiding Simple Tax Crimes • W-2s that are substantially different from previous years • W-2s that are handwritten, typed or have noticeable corrections • Multiple refunds going to the same address • Multiple direct deposits to the same bank account • Proper documentation for all deductions • Dependent information Complex Tax Crimes • Illegal source tax crimes • Untaxed underground economy • Money laundering • Narcotics Money Laundering • Usually involves some sort of tax evasion • Easier to prove than many other crimes • Bank Secrecy Act • Basis of money laundering regulation • Ways to launder illegal proceeds • Move money out of the U.S. and bring it back in a clean form • Commingle the money through various business activities Abusive Tax Schemes • Foreign Trust • Structure business into two trusts • Business trust (BT) • Equipment trust (ET) • BT pays ET inflated lease costs to nullify lease income • International Business Corporation (IBC) • Same name as U.S. business • Send checks from customers to IBC offshore • Neil R Brown Tax Scheme • Client establish foreign corporations/trusts in Bahamas • Client transfer cash and income to foreign entities as “consulting fees” • $$$ repatriation back to clients through fictitious loans IRS Answer to Crimes • Internal Revenue Service Criminal Investigation (CI) • Created in 1919 to deal with widespread tax fraud allegations Accounting Protection • Forensic accounting • Sarbanes-Oxley procedures • Auditing procedures for kiting and lapping Foreign Bank Account Report (FBAR) • General purpose is for each U.S. person to disclose a financial interest or signature authority in financial account • Must report any foreign account you have • Most common tax crime reported in problems with FBARs • On March 23, 2009 IRS stated they would allow any person who haven’t paid taxes in FBARs in a Voluntary Disclosure BDO Seidman Summer Leadership Conference • • • • 5 days in Chicago 80 Students from across the nation Applications accepted until April 15th Visit bdo.com for more details