Homework Assignment 1 - Beedie School of Business

advertisement

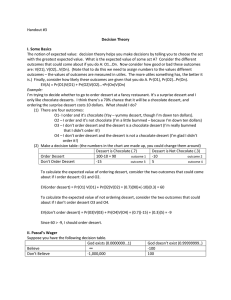

BUEC 232-08-1 Homework Assignment 4. DUE DATE: March 7 (Friday) 5:00 pm Please submit your assignment to the Drop-box. (Using Excel is optional) 1. The owner of a restaurant serving Continental-style entrées was interested in studying ordering patterns of patrons for the weekend period. Records were maintained that indicated the demand for dessert during the same period. The owner decided to study two other variables, along with whether a dessert was ordered: the gender of the individual and whether a beef entrée was ordered. The results for 600 customers are as follows: Gender Dessert Ordered Male Female YES 96 40 NO 224 240 Beef Entrée Dessert Ordered YES NO YES 71 65 NO 116 348 (Note: these two tables are for the same 600 customers). (i) For a randomly select customer, what is the probability that this customer (a) Orders a dessert? (b) Orders a dessert or a beef entrée? (c) Is a female and does not order a dessert? (d) Does not order dessert given that this person is a lady? (ii) (a) Are gender and ordering dessert independent? Why or Why not? (b) Is ordering a beef entrée independent of whether the person orders dessert? Why or Why not? 2. The editor of a publishing company is trying to decide whether to publish a proposed business statistics textbook. Information on previous textbooks published indicates that 10% are huge successes, 20% are modest successes, 40% break-even, and 30% are losers. However, before publishing decision is made, the book will be reviewed. In the past, 99% of huge successes, 70% of moderate successes, 40% of the break-even, and 20% of losers received favorable reviews. Note that the information implies that a published book may have received either the favorable review or unfavorable review. Based on these data, graph a probability tree and compute the following probabilities: (a) What is the probability that a randomly selected published textbook receive favorable review? (b) Given that the book is a modest success, what is the probability that this book received unfavorable review? 3. You are trying to develop a strategy for investing in two different stocks. The anticipated annual return for $1000 investment in each stock under four different economic conditions has the following probability distribution: Returns Probability Economic Condition Stock X (in $’s) Stock Y (in $’s) 0.1 Recession - 50 - 100 0.3 Slow growth 20 50 0.4 Moderate growth 100 130 0.2 Fast growth 150 200 Note: Return means the net change in your initial investment ($1000) after a year, for example, Return=-100 (negative return), it means that after one year, your wealth become $900. (a) Compute the expected return for stock X and for stock Y. (b) Compute the standard deviation for stock X and for stock Y. (c) If the correlation between X and Y is 0.98, compute the mean and the standard deviation of a simple portfolio with 50% of the initial investment in Stock X and 50% of the initial investment in Stock Y.