Adam Lewis:

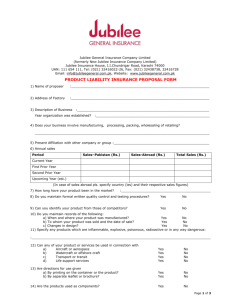

advertisement