PROVIDENCE CHRISTIAN ACADEMY 48 Woodland Hills Road

advertisement

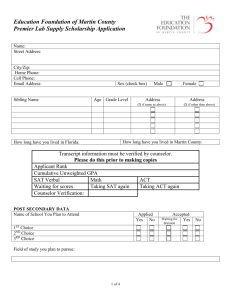

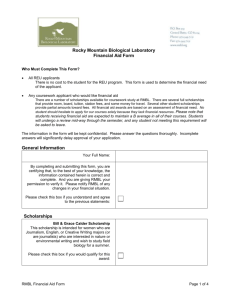

PROVIDENCE CHRISTIAN ACADEMY 48 Woodland Hills Road, Asheville NC 28804 828-658-8964 PHONE – 828-658-8965 FAX 2014-2015 Tuition Assistance Student Aid Application Thank you for your interest in Providence Christian Academy. It is an honor for us to consider your application for Tuition Assistance. We covenant with you in prayer as together we seek Gods provision for your need. Please answer all questions completely and honestly. Our tuition assistance is given on a needs-based priority. Tuition assistance will be given as businesses, churches and individuals partner with specific families to cover the cost of your child(ren)s education. Families applying for tuition assistance should be prepared to assume part of the responsibility of obtaining needed funds. Families who receive tuition assistance will also be expected to actively participate in the volunteer programs of PCA. Application for tuition assistance does not guarantee that assistance will be awarded. We will pray with you that God will abundantly provide for your financial, spiritual, and physical needs as we partner together to provide a Christian education for your child(ren). Please return this completed form, along with a complete copy of your most recent tax return, to the school. Application deadline is April 1 and early submission is encouraged. Applications received after April 1 will be considered if funds become available. Students must be accepted for enrollment before consideration will be given for tuition assistance. You will be contacted if more information is needed, or when a decision has been made on your application. Section A B PARENT OR GUARDIAN INFORMATION Include all parents or guardians who reside in the family home. PLEASE PRINT CLEARLY. Mother Stepmother Guardian Please check one: Father Stepfather Guardian ___________________________________________________ Last Name First Name M.I. ____________________________________________ Last Name __________________ ____ Social Security Number Age ______________________ Social Security Number ______________________ Work Telephone ___________________________________________________ Occupation ___________________________________________________ Occupation ___________________________________________________ Employer # Years ___________________________________________________ Employer Marital Status (check one): Single Married Separated Divorced Widowed Marital Status (check one): Single Married Separated Divorced Widowed Please check one: If any student’s parents are divorced or separated, is there an agreement which requires the non-custodial parent (not listed here) to make contributions specifically earmarked for education? YES ____ NO ____ If so, what is the annual contribution? ______ Section B - HOUSEHOLD INFORMATION PLEASE PRINT CLEARLY. Street Address ________________________________________________________________ _________________________________________________________________ State ____________________________ Zip Code ______________________ Home Phone_____________________________________________________ Work Phone _____________________________________________________ Cell Phone _______________________________________________________ How many people will reside at this address during the coming school year? Number of children______________________________ Number of Parents _____ Section C - INFORMATION ABOUT DEPENDENTS Include all dependents that reside in the family home and rely on the adults in Section A for their primary support. If students attend college, daycare, or private school other than PCA, please indicate. Please print the full name and age of each child below. In the last column, please consider your own budget, and give your best, reasonable estimate, based on the tuition amount you believe you can contribute. Last Name First Name Age Grade Will Child Attend PCA ? If child will not Family attend, where will child attend school? Daycare ? Contribution (Amount you will pay per child) If Section D - INCOME AND EXPENSES Please provide the following information for this past January – December. Enter zero if applicable. Omit cents. Enter totals for all parents/guardians listed in Section A. Wages, Salaries, and Tips $ Taxable Interest Income $ Form 1040 or 1040 A line 8A, or Form 1040 EZ line 2 $ Form 1040 or 1040 A line 9A Tax Exempt Interest Income $ Fo Form 1040 or 1040A line 8B Alimony Received $ Form 1040 line 11. Business Income or (Loss) $ Form 1040 line 12. Capital Gains or (Losses) $ Fo Form 1040 line 13A, or Form 1040A line 10A. Taxable Retirement Annuity $ Fo Form 1040 lines 15b & 16b or Form 1040A lines 11b & 12b Ta Dividend Income F Form 1040 or 1040A line 7, or Form 1040EZ line 1 Re Rental Properties, Royalties, Partnerships, S. $ Corporations, Trusts, Etc. Form 1040 line 17. Far Farm Income or (Loss) $ Form 1040 line 18. Un Unemployment Compensation $ Fo Form 1040 line 19, Form 1040A line 13, or Form 1040EZ line 3 Ta $ Fo Form 1040 line 20b or Form 1040A line 14A less 14B Taxable Social Security Benefits Non-taxable Social Security Benefits . $ Form 1040 line 20A less 20B or Form 1040A line 14A less 14 B $ Form 1040 line 21. Welfare Received $ Include AFDC, ADC received during 2011 Food Stamps Received $ Include the total received during 2011 Child Support Received $ Do not include amounts reported in Section A specifically earmarked for educational purposes. Other Non-Taxable Income $ Include any income not listed above, i.e. Veteran’s Benefits, housing, insurance, etc. Federal Income Taxes Withheld $ Form 1040 line 61, Form 1040A line 39, or Form 1040EZ line 7. Child Support Paid $ Include the total paid during 2011 Alimony Paid $ Include the total paid during 2011 Medical & Dental Expenses not paid by insurance or otherwise reimbursed $ Include amounts paid for medical or dental insurance, or for treatment, and not reimbursed by others. Do not include insurance premiums paid by an employer. Monthly Rent or Mortgage Payment $ Comments: Monthly Car Payment (s) $ __ Total Credit Card Debt Average Monthly Payment $ $ Other Taxable Income e Monthly Expenses: Section E- ASSETS AND LIABILITIES Please enter current values for all information requested. Enter zero if applicable. Omit cents. Current amount of money in cash, savings, checking, NOW accounts and Certificates of Deposit. Current market value of stocks, bonds, mutual funds, money market accounts, And other liquid investments. If you own your own home: How much did it cost? What year was it purchased? What is it’s fair market value today? How Much do you owe on it? If you own other real estate: What is it’s fair Market value: How much do you still owe on it? Student Savings Do not include any amounts in tax-deferred retirement accounts such as an I IRA. Do not include tax-deferred retirement accounts such as an IRA, 401(k), 403 (b), etc. Include the capital purchase price and the cost of any capital improvements. Provide your best estimate of today’s fair market value. Include mortgages and outstanding home equity loans. Include second homes, land, and other real estate. Do not include rental properties and property used in your business. Include savings for all students applying for aid. Section F - SPECIAL CIRCUMSTANCES PLEASE PRINT CLEARLY. Please provide a brief description of any significant changes in income, expenses, or financial conditions expected during the current year or any other information that you would like the committee to consider when determining aid eligibility. Attach additional sheets if necessary. Section G - PARENT PARTICIPATION COMMITMENT As indicated, Providence Christian Academy does not have a scholarship fund which provides for the loss of income resulting from tuition assistance awarded. We believe that every Christian family should have the opportunity to provide a Christ-centered education, grounded in the Gospel of Jesus Christ and taught from a Biblical worldview, regardless of financial status or background. For this reason, we are committed to trusting God in seeking resources to help families in need. Individuals, businesses and churches are encouraged to partner with families to provide a Christian education for families who would not otherwise be able to attend. We are partners in this venture with you. For this reason, we expect a high level of participation, interest, commitment, accountability, and willingness to sacrifice on your part to keep your child(ren) here. All PCA families receiving tuition assistance, are required to volunteer at least 75 hours throughout the school year. There are also many other areas where your time and talent can make a difference in the school financially. Please indicate below the amount of time (per month) you expect to give in service to the school, and the area(s) of school life in which you can invest. Number of hours you can commit (monthly) _______________________________________________________ Areas of work _________________________________________________________________________________________________________ _____ __________________________________________________________________________________________________________________ Section H - CERTIFICATION AND SIGNATURE This form must be signed by ALL parents in Section A. Incomplete or unsigned applications will not be processed. I (we) hereby certify that the information on this form and all attachments is complete and accurate to the best of my (our) knowledge. ___________________________________________ Certifying Parent or Guardian Printed Name _____________________________________________ Parent or Guardian Signature Date ___________________________________________ Certifying Parent or Guardian Printed Name _____________________________________________ Parent or Guardian Signature Date Please remember to: Answer each question, entering zero if applicable. Attach a copy of your most recent tax return, including all attachments and schedules. Return to: Providence Christian Academy 48 Woodland Hills Road Asheville, NC 28804 828-658-8964/Phone 828-658-8965/Fax