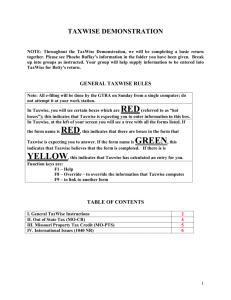

downloaded - Tax

advertisement