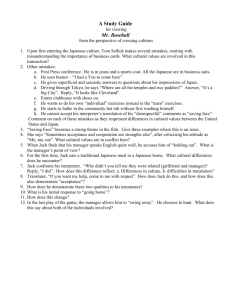

A Young CPA Stands His Ground

A Young CPA Stands His Ground

Revenue Recognition for a High-Tech Startup

Source: Ethics and Fraud in Business: Cases and Commentary

Abstract

Advanced Tech, Inc., is a start-up. The venture capital owners have agreed to another round of funding and brought in a new management team. The president, vice president of sales and vice president of operations are all good friends. To reduce expenses, the operations V.P. is also the acting V.P. of finance, even though he has no accounting background. After an unsatisfactory audit, the controller is fired and Manuel Gonzales, a young CPA, becomes the interim controller. Manuel has worked there less than a year and feels out of his league. Miraculously, on the last day of a critical month, the V.P. of sales announces receipt of an order that provides the business needed to meet the expectations of the venture capital owners. Manuel has to decide how far to push his opinions regarding proper cut offs for shipments-with little support among the management team for his conservative views.

Background

After two years as an auditor for a large national accounting firm, Manuel Gonzales wants to jump into industry. Advanced Tech, Inc., a small start-up company, just won a second round of venture capital money and is looking for an assistant controller. Even a non-technical person like Manuel can see the demand for their product and, if the product is a hit in the market place, Advanced Tech could become a major corporation.

"I could be in on the ground floor," he thought to himself. Advanced Tech had all the ingredients for a big win.

The venture capital company brought in very experienced management from Fortune 500 companies and promised sufficient money to sustain operations for at least a year. If the new product sold well,

Advanced Tech could expect a third round of funding. Also, the plant was near his new home. This was important as Manuel and his wife were expecting their second child and Manuel did not want a long commute. Even the worst-case scenario was not so bad. If the company went bankrupt, Manuel could return to public accounting or get a job with another high tech start-up in the area. This was an opportunity he could not pass up.

Growing Excitement

Time passed and Manuel became a solid contributor. Though the controller had all the direct contact with management, as assistant controller, Manuel helped prepare the monthly financials and slides. He understood them and could explain them, too. Advanced Tech grew to 150 employees. Each month, everyone felt the excitement grow as orders and revenue increased. About one year passed and the venture capital owners granted a third round of financing based on a promising new revision of the product. The pressure was intense to increase orders, but Manuel knew that the venture capital owners concentrated most of all on shipments or revenue to indicate the health of the start-up. Shipments meant that Advanced Tech could actually manufacture a product, delight customers, create a brand, establish a market for the products, make money and, ultimately, go public. This would make the venture capital owners and the employees successful.

Because of his CPA experience, Manuel knew about long hours and deadlines. What was new was the sense of power he felt when the monthly results were altered by several percentage points due to his estimates for bad debt and obsolete inventory. Manuel felt like a real businessman. He also realized his responsibility to be truthful and fair when reporting the monthly results. This was troublesome at times, especially when he changed his method of estimating. Judgment was the only guiding light. Manuel took comfort in knowing that the controller reviewed all estimates and had ultimate responsibility for the financial statements.

Then it happened. In an effort to keep expenses low, the accounting department always had insufficient people. The accounts payable and accounts receivable were not clean and reconciled. The year-end audit results reflected these weaknesses. When the controller reported the situation to the new management team, the controller was fired and Manuel was named the interim controller until a permanent replacement could be found. Unfortunately, the month-end close was coming up and it was a critical month. The venture capital partners expected growth in revenue this month. The management staff was highly experienced so they did not encourage unethical behavior, but Manuel felt very uncomfortable being the sole judge of whether the financial statements were fairly stated. Moreover, as the lame duck interim controller, Manuel felt out of his league-and believed that everyone knew it.

The Problem

As the month-end approached and a visit from the venture capital owners loomed, Manuel anxiously watched shipment levels. The manufacturing facility was located a mile away, and after long days at the office Manuel did not normally go to the plant at month-end to review for proper shipment cutoffs.

Manuel had not worried about cutoffs very much except for the annual wall-to-wall physical inventories.

About 4:00 pm on the last day of the month, Manuel received word that marketing had just received a large order. Marketing felt this order and the shipment it represented would provide the revenue

Advanced Tech's owners required for the month. Manuel didn't see how manufacturing could convert an order to a shipment so quickly and he felt that the accounting rules were being stretched. Would he need to monitor the manufacturing plant this weekend for proper cutoff of shipments?

"I have plans this weekend with the family." he thought to himself.

Manuel went to his office, closed the door and asked himself several questions. When does a shipment physically occur? When it rolls off the production line? When the product is placed in a box and the box taped shut? When the address label is put on the box? When the box is placed on the loading dock?

When the box is placed in the freight truck? When the truck leaves the premises? If the freight company's last pickup is at noon; should you count boxes that are labeled and placed on the shipping dock that afternoon and ready for pickup by the freight company the following workday? What if the freight truck only came twice a week and month-end was two days after the last freight pickup? His CPA training did not touch on these questions.

The Options

Manuel tried to call two audit managers at the CPA firm where he once worked. Neither one was available. Manuel had to act immediately, but he was on his own and didn't have a lot of experience. He had done inventories back in his audit days, but that did not prepare him for this dilemma. Manuel knew that the V.P. of marketing was a very experienced, hard-charging salesman who avoided accountants and focused totally on winning deals. He took pride in solving problems, meeting sales objectives and openly viewed accounting rules as anti-sales. Manuel knew that the V.P. of marketing would not listen.

"Maybe the order came from his friend who will cancel the order in a month or two," Manuel thought to himself cynically. "This would allow Advanced Tech's sales team to make their numbers for the month and, in their eyes, save the company. That would work for this month but would put us in a bigger hole next month."

Manuel dismissed this thought as it was not year-end and he would give them the sales team the benefit of the doubt. Besides, he monitored order cancellations and returns each month. If the order was bogus, he would see the cancellations when they came in. He realized that a natural tension existed between sales and accounting and that he was the company police. Like it or not, he had the final say.

"And what would that final say be?" he wondered.

Executive Input

The V.P. of operations, Duane Phipps, was the acting V.P. of finance, so Manuel quietly walked to his office and knocked.

Duane was at this desk. "Come in Manuel. How are you doing?"

"Hello, Mr. Phipps. I am doing fine, thanks. Mr. Phipps, we have a problem. Regarding this new order that just came in, I'm not sure manufacturing can get the products boxed and labeled and on the truck before midnight tonight so I can count them as shipments."

"Now Manuel, let me tell you that many companies count shipments if the product has an order attached and it is in the finished goods area essentially ready to ship," countered Duane.

"Oh, really. I thought the product had to be physically on the truck in legal possession of the carrier and on its way to the customer," said Manuel.

"Oh no. That is not how it is done in my experience," Duane said.

"Well, I am in a tight spot here, Mr. Phipps, but I will not let us count a product as a shipment just because it is in the finished goods area," said Manuel, with more confidence in his voice than he really felt.

Manuel and Duane discussed industry practices for a few more minutes. The V.P. of operations was unconvinced but relented and said he would notify management.

That night after dinner, Manuel finally reached his contacts at his old CPA firm. One contact said that the shipments had to be on a third-party truck and the other said that the product didn't need to be in a box but could be counted if it was in the finished goods/shipping area and had an order attached to it at midnight. In other words, there was no clear answer and it was up to Manuel's judgment. That evening,

Manuel and his wife and two sons drove to the manufacturing plant to see what was going on. Outside the plant, Manuel noticed the following people's cars: V.P. of operations, V.P. of marketing, V.P. of research and development and the chief executive officer. Manuel entered the manufacturing plant and saw all of the management staff plus their spouses placing products in boxes and affixing address labels. Sheepishly, Manuel approached the V.P. of operations and asked, "How is it going?"

"Fine. We appreciate your ethics even though we may not agree. As a management staff we felt you were young and we did not want to override your authority. You are just trying to do your job, too, so the shipper is on his way now to pick up these boxes" the V.P. said.

Manuel explained, "The two audit managers I discussed this with disagree slightly on exactly when an order converts to a month-end shipment, but I feel that during the year, this is a workable policy. At yearend, however, we will be very clean and the goods must be on the truck. Agreed?"

"Agreed." said the V.P. of operations.

On the way home, Manuel looked at his wife and sons and sighed with relief. It would be a good weekend after all.

Names used are fictitious and do not represent any real person or company. The AICPA neither approves nor endorses this case. The case was developed with support from the AICPA

Foundation.

Copyright © 2003 by the American Institute of Certified Public Accountants, Inc., New York, New

York.

Above the Law: An Executive's Double Standard

Fraudulent Use of Corporate Funds

Source: Ethics and Fraud in Business: Cases and Commentary.

Abstract

All of the vice presidents of Brazos Manufacturing, Inc. (BMI) had been urged to cut their budgets. The executive vice president (EVP) couldn't wait to charge out another bottle of wine or treat his family to another fancy dinner on the company's tab...and the ethics officer didn't seem to mind. What's the best course of action for the controller who uncovers the EVP's actions?

Background

"Will you change my W-2 form to show that I've used my car for personal use?" Troy, the EVP of BMI, asked Jack, the company controller. Although Jack handled many personal requests for the EVP, this request didn't sound quite right. It had been a busy day at BMI, an international automotive parts supply company, and Jack's thoughts were burdened with his responsibilities. As controller of a $550 million company, Jack had to juggle many tasks using his knowledge of ethics and his natural inquisitiveness.

He took his job seriously and knew that his signature on company documents meant that he was not only aware of the company procedure but approved of it.

One thought troubled Jack. Troy Sozuko didn't turn in any business miles. All of the miles he drove in his company-provided vehicle were considered personal for accounting's sake, Jack mused. The W-2 form reflected 100% of his personal use, so there was nothing to change. Jack considered the EVP's tenure and authority at BMI Sozuko had been with BMI for the past 30 years and was the highestranking officer in North America. Perhaps Jack could take a look at his expense reports and ascertain an acceptable legal number of business miles based on gas receipts turned in. Upon initial review of

2001 expense reports, Jack discovered a startling truth: flagrant discrepancies. Not only had Troy expensed original gas receipts, but there were duplicate, triplicate and, in some instances, quadruple copies of gas receipts occurring on the same day, at the same gas station, at the same pump number with purchases taking place just moments apart from one another.

How could this be? Jack thought. For goodness sake, Troy only had one car! Even if Troy was gassing up his and his wife's car, BMI's policy strictly prohibited expensing gas for any vehicle other than a company car. This caused Jack to look further. When he did, what he found was shocking. Jack had to entrust this information to the ethics officer of BMI.

A Dilemma

"Don't worry, it can't be that much," smirked the ethics officer, Matt Thompson. Jack had only begun to report his findings, beginning with Troy's reimbursement for fraudulent gas expenses, and Matt's response had shocked him. Jack realized that Matt considered the gas expense discrepancies to be small in the grand scheme of business at BMI. However, it bothered Jack to think that standards were strictly enforced just a couple of months ago when an employee had been terminated for misuse of company funds. Were the executives at BMI above the law? More troublesome, now that Jack was privy to the apparent favoritism shown to executive officers, how could he, as controller, condone or approve of such practices? He didn't approve at all, and in fact, he was infuriated.

"But Matt, there's more," Jack sputtered. The questionable gas receipts had led Jack to search expense reports for the past three years, where he had found personal dinners charged to BMI, personal items claimed as business gifts and false reporting of travel and entertainment receipts for dinners and lunches that never took place. (Further examination also uncovered up to three weeks' vacation a year that was never reported to human resources and payroll, thereby allowing Troy time off with pay, as well as requests to be paid for his accrued but "unused" vacation at the end of each year.). Matt Thompson stared blankly at Jack as the facts were presented.

"Well," Matt said, shrugging. Jack realized that this was a touchy situation that needed to be handled carefully. He wondered whether a veteran like Troy Sozuko would be held accountable or even reprimanded for his actions. What made Jack boil, however, was the lack of concern and downright flippant manner in which this information was being received by the ethics officer of a company of BMI's stature. Jack couldn't believe Matt could react this way. It started to make sense, though, when he remembered that Matt Thompson reported to Troy Sozuko.

"Whatever you do," remarked Matt, "just don't report this to the president."

Jack had to think quickly. Do I dare tell him? Jack thought to himself. Only a month ago, Troy had asked

Jack to create a new company organizational chart that eliminated Matt's position. When Jack told Matt, he was shocked. Suddenly ethics were very important to him.

"Jack," he said, "go through Troy's expense reports for the past three years. I want to see it all! We're going to have to do something about this." Jack felt sick at this newly found enthusiasm for justice.

The Dirt

"Let's see. Monday, January 13, lunch at Osaki's, a credit card receipt. January 20, lunch at Osaki's, a blue cash receipt. February 10, which happened to be a Saturday, lunch at Osaki's, a pink cash receipt,"

Jack recalled out loud. Many years of auditing experience had taught him to notice little red flags such as these. Jack went to lunch at Osaki's and simply asked the manager what type of cash receipts they used.

"We only use brown receipts and have only used brown receipts for the last five years," the manager told Jack. Jack presented the blue and pink receipts and the manager emphatically told Jack that these were not his restaurant receipts. It appeared that Troy handwrote false receipts to receive reimbursement. Jack continued to dig deeper, thinking it very fortunate that he had a copy of the EVP's personal calendar. Troy had given Jack a copy a few months earlier so that Jack could schedule meetings. Having this tool made it easy for him to compare the personal calendar with the calendar Troy gave his own secretary. In fact, it showed Jack that Troy was indeed keeping two separate calendars.

How was it possible, for example, that Troy could be entertaining clients at Los Angeles' finest Italian restaurant —as his business calendar claimed—as well as attending his daughter's birthday party hosted at the same restaurant

—as his personal calendar said? Did he run back and forth between tables like the character in "Mrs. Doubtfire"?

Jack also uncovered dinner receipts expensed to the company that betrayed interesting information, such as four bottles of wine (to entertain clients) totaling $395 were purchased to go. There was no other receipt showing that dinner was purchased that evening. Did Troy entertain these guests at his home? Jack wondered. It was possible; however, more than twenty other receipts had proved client entertainment usually took place at the restaurant.

Then there were the business expenses on Saturdays and Sundays. Jack knew the EVP never did business on the weekends because he always spent time with his children. Questions about whether

Troy's actions were deliberate or accidental and coincidental were answered after three months of digging into stacks of expense reports. Jack felt that he had enough evidence to prove fraud.

Taking Action

But it wasn't that simple. In a perfect world, unethical behavior would be dealt with, ethics officers would enforce standards and employees who didn't follow those standards face the consequences. However, due to Troy's tenure with the company there was a possibility that this whole incident might be swept under the rug.

"After all," Matt said, "Troy has done an excellent job during his thirty year career at BMI."

Jack was furious. He still had a W-2 deadline to meet and was determined not to change the W-2 amount. If he did, he would be acting outside of his professional standards and allowing one person, although it was the EVP, a benefit not legally available to all other employees. He would have to deal with Troy and he wouldn't be easy to deter.

But Jack had an idea. Knowing that fraud had to be reported to the appropriate level of management if discovered by the independent auditors, Jack called the partner at the company's auditing firm and disclosed his findings. Now the truth had to come out and Jack had covered his bases. The CPA firm partner advised Jack to strongly encourage that this information be reported to the company president.

Jack met with the ethics officer again and played his trump card. "Matt, if we do not disclose this to the company president, I'll be forced to seek legal advice for my own protection, and I will openly reject any proposal to submit to the EVP's authority based on the fact that he is a thief."

Matt reconsidered. Jack refused to fight this battle alone and Matt was beginning to understand the significance of what Jack had discovered. What would Jack think of him if he let this incident slide?

Moreover, how would he look if the president was to find out and he had done nothing?

The Deal

Matt called a meeting with BMI's North American Ethics Committee. Although life would have been

easier if he could sweep this under the corporate rug, he was forced to act. Maybe he could avoid personal involvement by telling Jack that the committee had agreed to research the matter. However, the North American Ethics Officer told Matt this was a local decision and should be handled locally.

They weren't going to get involved.

It took two weeks before Matt decided to tell the local president. Matt feared that the president would overreact and merely reprimand Troy, causing tension-or worse —between Matt and his boss. Matt would have been happiest if Jack had simply changed the W-2 form, but he had underestimated Jack's commitment to ethics.

Matt wanted an independent opinion of Jack's findings before presenting the information to the company president. Matt and Jack decided to hire a forensic CPA to confirm the findings. The forensic CPA concurred with all of Jack's findings and judgments. Now Matt had no choice but to disclose the matter to the president. Upon learning of these fraudulent acts, the president requested the involvement of the

North American Ethics Committee and asked the company human resource attorney to be involved in this meeting, as well.

"Why couldn't the president just make this decision?" Jack wondered. The answer was that if Troy were to be terminated, the president didn't want to face a wrongful termination suit. If, after being presented with the facts, Troy completely denied the allegations, the president needed legal protection to establish that BMI had acted appropriately. Would Troy, a thirty-year veteran of the company, admit to stealing?

Troy did admit to everything that he was confronted with by the Ethics Committee. In fact, his admission came so quickly that Jack had to wonder if there was more fraudulent activity to be discovered. Troy had apologized, sincerely, and asked to keep his job.

Names used are fictitious and do not represent any real person or company. The AICPA neither approves nor endorses this case. The case was developed with support from the AICPA

Foundation.

Copyright © 2003 by the American Institute of Certified Public Accountants, Inc., New York, New

York.

Manager Persuades Employees to Unknowingly Allow Embezzlement

Making Detection of Embezzlement Difficult by Misappropriating Financial Records

Source: Ethics and Fraud in Business: Cases and Commentary.

Abstract

Businesses today rely heavily on computers to cut costs, increase transaction speed, create competitive advantages and store vital information. This embrace of computer technology often means moving to large systems and networks. Although these systems and networks come with built-in controls, such as segregation of duties, they can never replace honest management. In this case, a manager under financial pressure used his influence over his employees to bypass the system controls. He was able to embezzle money until one employee courageously stood up to his questionable procedures.

Background

Duarf, Inc. owned several media businesses, such as newspapers, radio stations and magazines. It operated in many of the largest markets in the United States and Canada. The company had grown primarily through acquisitions over the past ten years and still used several of the acquired business systems.

Last year, the company decided to centralize all of its accounts payable processing, such as purchase orders, vendor maintenance, invoice processing and check printing. To accomplish this centralization plan, the company purchased the latest technology. Following the purchase, training sessions were held to ensure all processors and management could use all of the system's functions.

This technology included a robust database software package. The software provided internal controls, including matching invoices to purchase orders and receiving reports, signature dollar limits, segregation of processing duties and a controlled vendor list. All of the internal controls associated with the software were adequately designed. They were tested and found to be functioning properly within the system.

Before the centralization, Duarf, Inc. had eight separate accounts payable departments throughout the subsidiaries that processed approximately 7,000 transactions per month. At month-end, each department had to submit a consolidation package to corporate accounting. After the centralization, the accounts payable department was processing approximately the same number of transactions but was staffed with fewer full-time employees. Also, the consolidation process had been reduced to one package each month instead of eight. Duarf, Inc. had realized the planned cost savings and management was delighted with the results.

The Problem

Sandy Blanquet was a senior manager supervising the accounts payable process at Duarf, Inc. Sandy started at Cloudy News, a mid-size newspaper, about ten years ago. When Duarf, Inc. acquired Cloudy

News two years ago, Sandy was the accounting controller. As a result of the acquisition, Sandy was offered the opportunity to take part in centralizing the accounts payable processing for all of Duarf, Inc.'s subsidiaries. After the centralization process was completed, Sandy took on the responsibility of overseeing the entire department, from opening mail to processing payables to cutting checks. He managed 20 employees through four supervisors. In addition to managing the department, he was a check signer.

Sandy's system access only allowed him to view accounts payable data. He could not process any transactions, edit the vendor list or print checks. However, he did review all voucher packages requiring a second signature. All checks had a facsimile signature printed by the computer system's check printers. Checks over $5,000 required a second signature (in other words, Sandy's signature). Checks over $50,000 required a third signature (i.e., vice president or above).

Financial Pressure

Sandy had always enjoyed the high life. He drove a new sports car. He lived in an upscale home. He took great vacations. Some might have said he lived just barely within his means. Having just returned from an extended vacation to Hawaii with his credit cards closing in on their limits, Sandy found that the advertising market had taken a turn for the worse. A couple of months later Sandy was in trouble because most of his savings were invested in Duarf, Inc. stock. He was overdue on his car payment and his mortgage. "If I can just get some money, a loan or something, for a couple of months, I could get ahead," he thought, sitting at his desk on the fourth floor at Duarf, Inc.'s headquarters. He rubbed his eyes. "Think," he murmured, knocking the side of his head with his knuckles. Then it dawned on him.

"Ah. Maybe I can borrow some money from Duarf. A check. No one will miss it and I will repay it as soon as I can." He turned to his computer screen and started to form a plan.

Employee 1

Jack Cross started at Duarf, Inc. three years ago as a corporate accounts payable associate. His primary responsibility was to process invoices paid by the corporate headquarters. His work ethic and knowledge of the process were valuable assets to Sandy during the centralization process. After the centralization was completed, Jack was promoted to senior associate responsible for maintaining the approved vendor list.

"Hey Jack, this 'Designing Pluz' invoice was just overnighted to me with a rush on it from some vice president at our Los Angeles printing site. Is this an approved vendor?" asked Sandy, sounding a little irritated. Jack looked up, slightly startled to see Sandy enter his cubicle.

"No, I don't see them in here," Jack said, fumbling with the keyboard. "Do you want me to add them to the vendor list?"

"Yeah, could you do that right now? I am going to walk this over to Mabali for processing. Don't bother with the verification form, it will take too much time," Sandy added somewhat curtly, knowing that if Jack completed the verification form, he would call the telephone number on the invoice to verify the vendor's information. Jack quickly added the vendor to the list.

Employee 2

Mabali Smith recently returned from her honeymoon. She had spent three weeks in India, touring and visiting relatives. Mabali started with Duarf, Inc. at the time of the centralization and was an accounts payable associate with invoice processing responsibilities. Chris Topper, a senior associate, reviewed her vouchers for posting.

"Mabali, I have a rush invoice here from the L.A. printing site. Are you busy?" Sandy asked as he approached Mabali's desk. Mabali, who was talking to her husband on the telephone, quickly hung up.

"Oh, hi, Sandy. Uh, no, I'm not busy. Who's it from?" sputtered Mabali, obviously surprised by Sandy's presence.

"It's from some V.P. over there. He thinks he can just send me an invoice and expect it to be processed immediately. Here is his signature." Sandy pointed to the invoice. "Are you sure you are not too busy?"

"Oh no. I'm not too familiar with this signature. Should I look him up in the authorization limits file to make sure he can approve this invoice?" asked Mabali.

"Don't worry about it. If he's a V.P., he's authorized up to $50,000," counseled Sandy. Mabali entered the invoice into the system.

"I can put this in Chris's in-box and let him know it's a rush job."

Mabali suggested.

"Actually, I'm going to have Juan post it. I have to talk with him anyway." Sandy took the invoice and walked towards Juan's cubicle, knowing that Juan had authority to override the purchase order matching process.

Employee 3

Juan Namkaps started with Cloudy News five years ago, and had known Sandy for most of those years.

When Cloudy News was acquired by Duarf, Inc., Juan was offered a supervisor position in the accounts payable department. His primary responsibilities were to review all of the purchase order matching exceptions and to supervise five associates.

"Juan, what going on?" Sandy announced as he approached Juan's cubicle. Sandy sat down across from Juan.

"Hey, Sandy. What's up?" Juan said.

"Some V.P. at the L.A. printing site overnighted me an invoice and demanded that I run it through

ASAP," Sandy explained while tossing the invoice across Juan's desk. Juan picked it up. "Can you post

it?" Juan attempted to post the invoice, but it did not match any purchase orders in the system.

"No P.O., Sandy." Juan looked up and saw Sandy's face starting to get red.

"What? You have got to be kidding me! He overnights me an invoice and there's no P.O. in the system,"

Sandy blurted, looking past Juan at the computer screen. "Well, just override it and I'll have a chat with our L.A. friend." Juan overrode the matching exception and posted the invoice for payment. Sandy grabbed the invoice and stomped back to his office.

Employee 4

Darlene Beau was primarily responsible for printing the afternoon check run. She was hired only three months ago but had experience with the system Duarf, Inc. used to process payments. Knowing the check for this Designing Pluz invoice would require his signature, Sandy telephoned Darlene. Sandy explained to her that there would be a special check in the afternoon run and, since it would require his signature, he would save her time by reviewing the voucher package himself. She willingly accepted and even thanked him for his thoughtfulness.

Getting the Check Out the Door

The check was printed, signed and mailed following the normal operating procedures. However, it was mailed to a post office box owned by Sandy and he deposited the $32,450 into his new business account

—"Designing Pluz."

Repeating the Job

Although the money did help alleviate Sandy's financial pressures, he found himself wanting to try it again. He realized that with the fake Designing Pluz account already on the approved vendor list, he could easily push another invoice through the process. Less than two weeks after the first phony invoice was paid, he attempted it again.

Sandy created another Designing Pluz invoice for $12,945. He was careful to keep the amount low enough that both checks combined would not stand out on the L.A. printing site's monthly budget for actual analysis. He decided to use different accounts payable associates to process the payment but to tell the same story.

Employee 5

Rachel Nicki had been with Duarf, Inc. for two years. She was an associate whose primary responsibility was processing supply invoices, such as paper, ink and press materials. Most people did not know that she was married to one of Duarf, Inc.'s senior internal auditors because she did not take his last name.

Her husband had been working on implementing a fraud hotline for the company and spoke to her often about it.

"Rachel, I have a rush invoice here from the L.A. printing site. Are you busy?"

"No, not too busy. Hold on, just a second," Rachel said. Sandy had interrupted her in the middle of processing an invoice. She finished up with what she was doing and asked, "Why the rush?"

"Some V.P. over there wants it processed ASAP. Here is his signature." Sandy pointed to the invoice as he handed it to her. Rachel studied the invoice and the signature. She began to open the authorization limits file on her computer, but Sandy stopped her. "Rachel, I really don't have time for that now. He's a

V.P."

"I'm sorry Sandy. I have to check him out to see if he's authorized to approve invoices," Rachel explained, looking curiously at Sandy. She found the file and began to scan it for the name. She looked back at the signature and asked, "Is this Sandman or Zachvan?"

"Look, I appreciate your insisting on processing this by the book, but I really need this processed now.

Take my word for it, he's authorized." Sandy said.

Somewhat shocked by what Sandy had said, Rachel began, "When I process something, my initials are input into the data record and I don't put my name on anything unless it's by the book." However, Sandy snatched the invoice and walked away before she could finish.

Two hours later, Rachel was still puzzled by Sandy's behavior. She had a funny feeling about that invoice and decided to call the company's fraud hotline. The operator was pleasant and let her know she

could remain anonymous. The operator inquired about the situation, then thanked her for the information. He explained that he would recommend an internal review of the Designing Pluz vendor.

Discovery

Two months later, Rachel received a department-wide e-mail saying that Sandy was leaving the company. The e-mail added that Sandy would be prosecuted for allegedly embezzling over $40,000.

Names used are fictitious and do not represent any real person or company. The AICPA neither approves nor endorses this case. The case was developed with support from the AICPA

Foundation.

Copyright © 2003 by the American Institute of Certified Public Accountants, Inc., New York, New

York.