file - Emily Griffith Technical College

advertisement

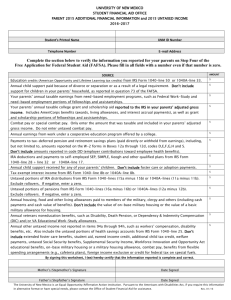

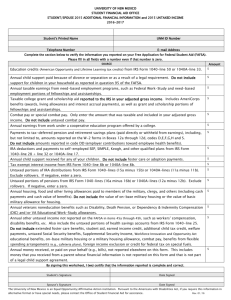

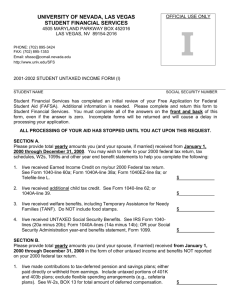

12VWD SID#___________________ EMILY GRIFFITH TECHNICAL COLLEGE 2011-2012 DEPENDENT STUDENT VERIFICATION WORKSHEET m m d Please print SID or SSN in black or blue ink d y y y y Please print DOB in black or blue ink Name_________________________________________________ E-Mail____________________________ If you have been selected for Verification by the US Department of Education, EGTC must collect this form and any tax or income statements from you and your family before you will be consider for Federal Student Aid funds. Make certain your (student) name and SID/SSN are on every page of documentation. Student/Parent(s) Information – Complete Below List below the people your parents will provide support to between July 1, 2011 and June 30, 2012. Include the following: Yourself (STUDENT) Your Parent(s) Your parents’ dependent children, who are generally those born after January 1, 1988 and unmarried. You may also include those dependent children for whom they are required to provide parental data when they apply for financial aid. Other people if they now live with your parent(s) and your parent(s) provide more than half of their support and will continue to provide more than half of their support from July 1, 2011 through June 30, 2012. FULL NAME AGE RELATIONSHIP TO STUDENT STUDENT (do not list yourself again) SELF COLLEGE ATTENDING between July 1, 2011 and June 30, 2012. Must be enrolled for 6 credits or more & working on an eligible degree or certificate. Emily Griffith Technical College Student/Parent 2010 Income- If you are married, you must complete BOTH columns below. Check only one box below for each column. Tax returns include the 2010 IRS Form 1040, 1040A, 1040EZ, a tax return from Puerto Rico or a foreign income tax return. If you did not keep a copy of your tax return, request a copy from your tax preparer or request an Internal Revenue Service form that lists tax account information at 1-800-829-1040. STUDENT PARENT(S) 1. I have filed or will file a 2010 federal tax form. 1. I have filed or will file a 2010 federal tax form. Submit a SIGNED copy of federal tax forms, and complete Submit a SIGNED copy of federal tax forms, and complete additional information on the back of this document. additional information on the back of this document. 2. I am not required to file a 2010 federal tax form. If you had earnings: List below all employers and amounts of income from work that you received in 2010. Complete additional information on the back of this document. Attach copies of your W2’s. If you had no earnings from work, please indicate ‘NONE’. __________________________________ $____________ 2. Employer Employer Amount __________________________________ Employer Amount __________________________________ Employer $____________ __________________________________ Employer $____________ Amount __________________________________ Employer Amount __________________________________ Employer $____________ I am not required to file a 2010 federal tax form. If you had earnings: List below all employers and amounts of income from work that you received in 2010. Complete additional information on the back of this document. Attach copies of your W2’s. If you had no earnings from work, please indicate ‘NONE’. __________________________________ $____________ __________________________________ Employer Complete Additional Information on the Back and Sign! Page 1 of 2 Amount $____________ Amount $____________ Amount $____________ Amount 12VWD Name:___________________________________________ Student SID/SSN_____________________ Calendar Year 2010 Additional Information Payments to tax-deferred pension and savings plans (paid directly or withheld from earnings), including, but not limited to, amounts reported on the W-2 forms in Boxes 12a through 12d, codes D,E,F,G,H and S. IRA deductions and payments to self-employed, SEP, SIMPLE, Keogh and other qualified plans from IRS Form 1040-line 28+ line 32 or 1040A-line 17. Child support received for any of your children. Don’t include foster care or adoption payments. Tax exempt interest income from IRS Form 1040-line 8b or 1040Aline 8b. Untaxed portions of IRA distributions from IRS Form 1040-lines (15a minus 15b) or 1040A-lines (11a minus 11b). Exclude rollovers. If negative, enter a zero here. Untaxed portions of pensions from IRS Form 1040-lines (16a minus 16b) or 1040A-lines (12a minus 12b). Exclude rollovers. If negative, enter a zero here. $ $ $ $ $ $ Housing, food and other living allowances paid to members of the military, clergy, and others (including cash payments and cash value of benefits). Don’t include the value of on-base military housing or the value of a basic military allowance for housing. $ Veteran’s non-education benefits, such as Disability, Death Pension, or Dependency & Indemnity Compensation (DIC) and /or VA Educational VA Educational Work-Study allowances. $ Other untaxed income not reported in items 44a through 44h, such as workers’ compensation, disability, etc. Also include the first-time homebuyer tax credit from IRS Form 1040 – line 67 and Making Work Pay credit from IRS Form 1040-line 63 or 1040A-line 40 or 1040 EZ line 8. Don’t include student aid, earned income credit, additional child tax credit, welfare payments, untaxed Social Security benefits, Supplemental Security Income, Workforce Investment Act educational benefits, on-base military housing or a military housing allowance, combat pay, benefits from flexible spending arrangements (e.g. cafeteria plans), foreign income exclusion or credit for federal tax on special fuels. $ Parent $ $ $ $ $ $ $ $ $ Money received, or paid on your behalf (e.g., bills), not reported elsewhere. $ XXXXXXXXXXXXXXXXXXXXXXXX $ Total Amount $ By signing this document, I certify that all the information reported on both sides is complete and correct. __________________________________________________________ ____________________________ Student Signature Date __________________________________________________________ ____________________________ Parent Signature Date WARNING: if you purposely give false or misleading information on this worksheet, you may be fined, be sentenced to jail, or both. Page 2 of 2