2001-2002 student untaxed income form

advertisement

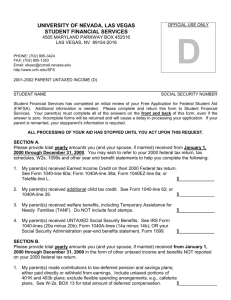

UNIVERSITY OF NEVADA, LAS VEGAS STUDENT FINANCIAL SERVICES OFFICIAL USE ONLY I 4505 MARYLAND PARKWAY BOX 452016 LAS VEGAS, NV 89154-2016 PHONE: (702) 895-3424 FAX: (702) 895-1353 Email: sfsssc@ccmail.nevada.edu http://www.unlv.edu/SFS 2001-2002 STUDENT UNTAXED INCOME FORM (I) STUDENT NAME SOCIAL SECURITY NUMBER Student Financial Services has completed an initial review of your Free Application for Federal Student Aid (FAFSA). Additional information is needed. Please complete and return this form to Student Financial Services. You must complete all of the answers on the front and back of this form, even if the answer is zero. Incomplete forms will be returned and will cause a delay in processing your application. ALL PROCESSING OF YOUR AID HAS STOPPED UNTIL YOU ACT UPON THIS REQUEST. SECTION A. Please provide total yearly amounts you (and your spouse, if married) received from January 1, 2000 through December 31, 2000. You may wish to refer to your 2000 federal tax return, tax schedules, W2s, 1099s and other year end benefit statements to help you complete the following: 1. I/we received Earned Income Credit on my/our 2000 Federal tax return. See Form 1040-line 60a; Form 1040A-line 38a; Form 1040EZ-line 8a; or Telefile-line L. $______________ 2. I/we received additional child tax credit. See Form 1040-line 62; or 1040A-line 39. $______________ 3. I/we received welfare benefits, including Temporary Assistance for Needy Families (TANF). Do NOT include food stamps. $______________ 4. I/we received UNTAXED Social Security Benefits. See IRS Form 1040lines (20a minus 20b); Form 1040A-lines (14a minus 14b); OR your Social Security Administration year-end benefits statement, Form 1099. $______________ SECTION B. Please provide total yearly amounts you (and your spouse, if married) received from January 1, 2000 through December 31, 2000 in the form of other untaxed income and benefits NOT reported on your 2000 federal tax return. 1. I/we made contributions to tax-deferred pension and savings plans; either paid directly or withheld from earnings. Include untaxed portions of 401K and 403b plans; exclude flexible spending arrangements (e.g., cafeteria plans). See W-2s, BOX 13 for total amount of deferred compensation. $_______________ SECTION B. (Continued) 2. I/we reported IRA deductions and payments to self-employed SEP, SIMPLE, and Keogh and other qualified plans. See IRS Form 1040lines (23 plus 29); or Form 1040A-line 16. $_______________ 3. I/we received child support payments for children living in my/our home. Do NOT include foster care or adoption assistance payments under Title IV-A or IV-E of the Social Security Act. $_______________ 4. I/we received tax-exempt interest income. See IRS Form 1040 or 1040Aline 8b. $_______________ 5. I/we received foreign income, which was excluded from federal income taxes. See IRS Form 2555-line 43 or Form 2555EZ-line 18. $_______________ 6. I/we received untaxed portions of pensions. Do NOT include rollovers. See IRS Form 1040-lines(15a minus 15b) + (16a minus 16b) or 1040Alines (11a minus 11b) + (12a minus 12b). $_______________ 7. I/we received a Federal tax credit on special fuels. See IRS Form 4136line 9 (non-farmers only). $_______________ 8. I/we received housing, food and other living allowances as members of the military, clergy, and others (including cash payments and cash value of benefits). Include basic allowance for housing. Exclude rent subsidies for low-income housing. $_______________ 9. I/we received veteran’s non-education benefits such as Death Pension, Dependency and Indemnity Compensation (DIC), etc. Do NOT include education benefits, e.g. GI Bill, Dependents Education Assistance Program, VA Vocational Rehabilitation Program, VEAP benefits, etc. $_______________ 10. I/we received other types of untaxed income and benefits not reported elsewhere in Section A or B, such as worker’s compensation, untaxed portions of railroad retirement benefits, Black Lung Benefits, Refugee Assistance, etc. Do NOT include student aid, WIA educational benefits (formerly JTPA), or benefits from flexible spending arrangements. $_______________ 11. I/we received cash or money paid on my/our behalf, not reported elsewhere on this form. Do NOT include non-monetary gifts/support received from friends/relatives. $_______________ I certify the information given on both sides of this form is true and complete. ________________________________________________________________________________ STUDENT SIGNATURE DATE 2002 Student Untaxed Income.02/05/01