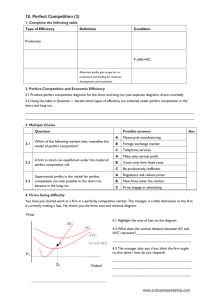

CHAPTER 14: PERFECTLY COMPETITIVE MARKETS

CHAPTER 12: PERFECTLY COMPETITIVE MARKETS

Intro:

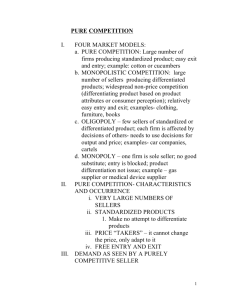

Think about gas market vs. cable TV market in Istanbul. If one gas station raises the price from 2.75 YTL to 3.25 YTL, how lower its sales would be? If Turk

Telekom raises price of standard cable TV from 3.5 YTL per month to 5 YTL per month, how lower its sales would be? Is it easier to buy from another gas station or to switch to another cable company? Which market is more competitive? Is this related to the number of gas stations number of cable TV providers? It turns out that the market for gas is more competitive than market for cable TV.

The Four Characteristics of the Perfectly Competitive Markets:

1. There are many sellers and many buyers in the market,

2. The goods sold by different sellers are the same, they are “perfect substitutes”,

3. Entry into the market and exit from the market is costless,

4. Buyers and sellers have sufficient knowledge about prices offered by others,

As a result of these assumptions, every individual seller and buyer takes market price as given . For any seller, there is no incentive to charge above the market price (she will lose all customers to competitors), or to charge below the market price (she can sell whatever amount she wants at the market price, so why charge lower price?).

Think about a gas station. 10 liters or 1 ton they sell, they get the same price per ton. Real world examples of perfectly competitive markets are hard to find. For

1

2 example, even if there are many gas sellers in Istanbul, the price of gas is not exactly same everywhere. Why? B/c (i) quality of gas may not be the same across different sellers, (ii) price information is not perfect, buyers do not know all current prices in all stations, (iii) Location matters; gas sold in Mecidiyekoy is not the same good as gas sold in Hadimkoy.

12.1 The Revenue of a Competitive Firm:

Show Table 1 : Metin’s Dairy Farm Milk Sales. Total Revenue is price times quantity. Notice that the price does not change with quantity produced (and sold) by this firm. So demand faced by this firm is horizontal. Draw demand faced by this firm as a horizontal line at the market price of 6 liras. Demand faced by a p. competitive firm is a horizontal line. This is because the firm is small compared to the aggregate market for milk. It takes the market price of 6 liras as given.

Define Average Revenue: AR = TR/Q

“How much revenue does the firm receive from an average gallon of milk sold

?”

Marginal Revenue: MR = change in TR / change in Q

“How much additional revenue does the firm receive from the last gallon of milk sold ?”

In Table 1, we can see that both AR and MR are equal to 6 liras.

AR equals to price since AR = (P*Q)/Q.

What about MR?

MR will be equal to price only in p. competitive markets. Every time Metin sells 1 more gallon, his total revenue increases by 6 liras, which is the market price. Would this be the case if Metin faced a downward sloping demand curve?

No, b/c as more gallons Metin would sell, price of all the previous gallons would

3 go down. For example, assume when Metin increases production from 3 to 4 gallons, price goes down from 6 to 5 liras/gallon. DRAW a demand curve TO

ILLUSTRATE the difference. Then, TR1=18 liras and TR2=20 liras, MR=2 liras/gallon which is less than both 5 liras and 6 liras. In markets that are not p. competitive, MR < price . For perfectly competitive markets, MR = price .

12.2 Profit Maximization:

The objective of any firm is to maximize its profit . To know profit, we need to know both about revenues and costs since Profit = Total Revenue - Total Cost.

Show Table 2.

Which quantity does the firm choose to produce? 4 or 5 gallons maximize profit.

Is it coincidence that between 4 and 5 gallons MR = MC = 6 liras = price? No, it is a result of marginal decision making. At 2 gallons, the marginal benefit to the firm

(marginal revenue) of the third gallon is 6 liras, while it costs 4 liras to produce the third gallon. So producing the third gallon actually has a marginal benefit to the firm greater than its marginal cost. This means profit increases by 2 liras when the firm produces the third gallon.

Then the firm decides to produce three instead of two. What about the fourth gallon? MR = 6 liras , MC = 5 liras hence it IS profitable to produce fourth gallon.

What about the fifth gallon? MR = 6 liras , MC = 6 liras. Net change in profit is zero so the firm is indifferent between producing 4 or 5 gallons. What about the sixth gallon? The MR of the sixth gallon is 6 liras, and the MC of producing it is 7 liras. It is not profitable to produce and sell the sixth gallon.

4

All firms pick their profit maximizing output at a quantity where MR = MC.

This principle holds in all types of markets.

Draw graph of profit. Give the intuition that profit maximization implies finding the peak of the profit function. This is where slope of the profit function is zero.

Profit = TR - TC , Take the change (derivative) of both sides divided by the change in the output quantity:

(Change in profit / change in Q)

= (change in TR / change in Q) – (change in TC / change in Q)

LHS is the slope of the profit function,

RHS first term is the slope of TR, which we defined above as MR,

RHS second term is the slope of TC function which we defined as MC. Then,

(Change in profit / change in Q) = Slope of Profit Ft. = MR - MC

So, the quantity of output where slope of the profit function is zero can be found by equating RHS to zero:

0 = MR – MC => MR = MC is the principle of profit maximization.

Since for a p. competitive firm, MR = price , a competitive firm picks its optimal output at where price = MC .

For markets that are not competitive, price > MR = MC at the optimal output chosen by the firm.

Show Figure 1. Now we want to apply profit maximization to the cost curves of last chapter. For profit maximization, we need the output that satisfies MR = MC condition. This is simply the point where MC curve intersects the MR curve.

5

Illustrate why the firm does not pick Q

1 or Q

2

, instead picks Qmax . Notice that it does not matter where the firm starts searching for profit maximizing output.

Show Figure 2 . Now what happens if the market price rises from P

1

to P

2

? Then the firm chooses the quantity Q

2

at which MR

2

= P

2 intersects the MC curve. Now think what happens in all other possible prices. You can realize that given price, the supply curve of a p. competitive firm is its MC curve. In other words, height of the supply curve shows the marginal cost of production. Note that all the supply curves that we have drawn in this class have assumed p. competitive markets .

12.3 Exceptions to the rule of Supply = MC :

1. Firm’s Short-run decision to Shut Down:

If the price is too low, a competitive firm may choose to shut down production temporarily. We differentiate between a temporary, shortrun “shut-down” decision and a permanent, longrun “exit the market” decision.

Example:

Consider a tomato farmer that observes that the total revenue from 1 ton of tomatoes does not even cover the variable cost of transporting 1 ton to the marketplace. Then naturally she would rather not plant tomatoes next season.

Would she sell her land? No, maybe she would wait for a year to see if the price will be any higher. In the short term of one year, by leaving the land empty, she can save the variable cost of transportation, but she still incurs the fixed cost of maintaining the land. In the decision whether to leave the land empty this year or not, fixed cost is irrelevant, i.e. fixed cost is a “sunk cost”. Sunk costs cannot be

6 recovered. She shuts down if the net benefit of a shutdown is positive: If she shuts down, she gets the following net benefits:

Loses revenue from sales, -TR

Saves variable costs, +VC

Cannot save fixed costs, 0 (no change)

Net Benefit of Shut Down = -TR + VC,

Shutdown if -TR + VC > 0

VC > TR . divide both sides by Q,

Shutdown if AVC > price show figure 3: short-run supply of a competitive firm is equal to zero if

price < AVC, and supply is equal to MC otherwise.

2. Firm’s Long-run Decision to Exit the market:

However, if she thinks that tomato prices will be low for a long time, then she might consid er selling the land and “exit the tomato market”. This means that she will not participate in the tomato sector anymore. If she sells the land, she saves both variable costs of transportation and also fixed costs of maintaining the land.

She exits the market if her net benefits are positive:

Saves + FC + VC = +TC

Loses -TR

Net Benefit of Exit = + TC - TR , exit market if TC – TR > 0, TC > TR. Divide both sides by Q, if ATC > price .

Show figure 4: long-run supply of a competitive firm is zero if price<ATC, and equal to MC otherwise.

7

In other words, a firm exits a market if TR < TC, TR – TC < 0, Profit < 0 . This means if it’s making a loss.

SIMILARLY, a new firm that was not in the market before ENTERS THE

MARKET if Profit > 0 in that market.

New firms enter the market if profit > 0, if TR > TC, divide by Q, if price > ATC.

SHOW this on Figure 4. Free entry/ exit means that whenever there is positive profit in the tomato sector, there will be new firms entering, and whenever profits go negative, existing firms will exit the market. show figure 5, illustrate area representing profits and losses. We know that profit = TR –TC.

since TR = Q x P and TC = Q x ATC, we can write profit = Q x (P - ATC)

The amount of profits can be shown as the shaded area on Figure 5(a).

Even if a firm is maximizing profits, it might be making losses. Maximizing profits is the same as minimizing losses since + losses = -profits . SHOW Figure 5(b) as an example of a firm minimizing its losses. The amount of losses is given by the shaded area, and this amount is equal to again profit = Q x (P - ATC) which is a negative number b/c P < ATC .

Question: Why does such a firm not exit the market?

Answer: It does exit, but it exits in the long run. Before the long-run comes, it might stay in the market to wait for the conditions to get better.

We assume number of firms is fixed in the short-run. Number of firms changes in the long-run.

12.4 Firm versus Market Supply

8

Short-Run Market Supply with a Fixed Number of Firms:

Show figure 6. In short-run , before entry/exit happens, we want to know how market supply looks like. Market supply equals the sum of the quantities supplied by the individual firms in the market.

Assume there are 1,000 identical firms in the market. These firms have the same cost structure (cost curves). At a price of 1 lira, an individual firm wants to supply

100 units. This is because firm picks Q according to price = MC , assuming price is greater than AVC (otherwise, the firm supplies zero amount). Then, the market supply is equal to 1,000 times the supply of an individual firm, which is 100,000 units. This is because all firms are identical to each other. Remember this is the short-run supply curve.

Long-Run Market Supply :

Show Figure 7. In the long-run, existing firms will exit when profits are negative

(p < ATC) and new firms will enter when profits are positive (p > ATC).

Let’s start with the case when profits are negative, firms are making losses. Then existing firms exit, industry supply decreases. As a result of that, price goes up and profits increase and become zero. After that there are no more exits from the industry.

We call this long run equilibrium.

In the other case, assume currently the firms are making positive profits. Then new firms will enter this industry. As a result, industry supply curve shifts right.

Then, price goes down and profits become zero. After profit becomes zero, there are no more entries into the industry. We are at long run equilibrium. Properties of the Long Run Equilibrium are:

9

1- Competitive firms make zero profit in the long run,

2- The LONG RUN MARKET SUPPLY CURVE IS HORIZONTAL at a price equal to the minimum of the ATC curve. Because this is THE

ONLY PRICE THAT MAKES PROFITS EQUAL TO ZERO since Profit

= (Price-ATC)*Q,

3- Firms produce at their efficient scale. This is the qty at which average costs are minimum.

Does it make sense to make zero economic (not accounting) profits?

Remember that we are not talking about zero accounting profits. Consider following example: I have spent 200,000 YTL from my own money to buy a farm and started producing tomatoes. I can also work as a university professor for

30,000 YTL a year. At zero economic profits, my accounting profits from tomato business must be equal to 200,000 x 0.05 + 30,000 = 40,000 YTL a year, assuming an annual 5% interest on bank deposits. 40,000 YTL is the amount of money I could have made by just staying in the university. I will stay in tomatoes business in the long-run only if my accounting profits from planting tomatoes is at least 40,000 TL. Remember that economic profits include all opportunity costs, including benefits of an alternative job I could have. This is the difference between the “common” accounting profit and economic profit.

An Example of a demand change

Consider the following EXAMPLE about the market for milk: DRAW Figure 8 (a)

Suppose that initially the market is in long run equilibrium as in the Figure.

Suppose American Medical Association announced that drinking milk reduces

10 chances of heart attack among men by 10 %. What happens to milk market in the short-run and in the long-run?

First the market demand for milk shifts right. In the short-run, number of firms is fixed, so price of milk goes up, existing firms produce more milk according to their MC curves. Firms will make positive profits. DRAW short-run response as on FIGURE 8 (b)

In the long run, new firms observe the positive profits and enter the milk industry.

When these new firms start producing milk, short-run market supply curve shifts rightwards. This causes the milk price to decrease. The decrease of price continues until profit becomes equal to zero. The new long-run equilibrium will be at point C. SHOW long-run response on Figure 8 (c) . We come to a new point on the long-run supply curve. This is why the long-run supply curve is horizontal.

The total milk output have increased compared to initial position. However, amount of milk produced by each firm did NOT increase, it is constant. Every firm produces at the efficient scale. But the NUMBER OF FIRMS in the industry has increased. This has increased industry output.