Two-part interconnection charges

advertisement

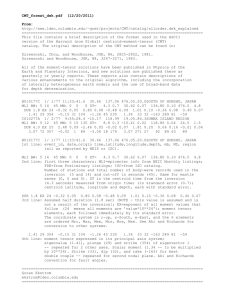

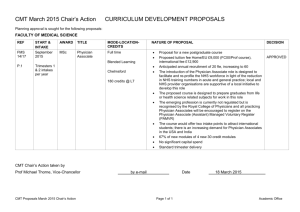

DRAFT Two-part interconnection tariffs Paper Submitted to the ITS European Conference Porto, September 2005 Jonathan Sandbach1 Head of Regulatory Economics, Vodafone Group Tel: +44 (0) 7795 300 653 Fax: +44 (0) 1635 238042 E-mail: jonathan.sandbach@vodafone.com Abstract This paper explores two-part tariffs for interconnection, assessing their implications for regulation. Two-part interconnection tariffs sometimes refer to a per minute and per call structure within network usage charges. However, this paper looks at a more fundamental two-part interconnection tariff structure in which networks pay a traditional usage charge (e.g. per minute or per call) for call termination, plus a fixed (non-usage) contribution towards the fixed costs of other networks, assessed on the number of subscribers (or market share) of the network. This paper uses a theoretical model of the interaction between two mobile networks and an incumbent fixed network to investigate the implications of the two-part interconnection tariff. We assume the networks compete within a Bertrand pricing framework, with Hotelling differentiation. Under a policy of cost based regulation of termination charges, a two-part interconnection tariff will result in lower usage based payments (per call or per minute) between networks. This should give lower retail prices per call, which will stimulate traffic between networks. Retail fixed fees will increase, but there will be an overall gain in consumer welfare, and overall economic efficiency. This paper does not consider practical challenges of introducing a two-part interconnection tariff. Introduction Two-part interconnection tariffs exist in a number of ways: Many interconnection charges are comprised of a call flag-fall charge, plus a per minute charge; Many interconnection arrangements require initial or on-going payments for the dedicated interconnection capacity (both traffic and signalling) between networks, plus usage related charges (per minute); 1 The views expressed in this paper are those of the author, and should not necessarily be attributed to Vodafone. 1 DRAFT In Australia, Optus has recently offered a two-part interconnection tariff for termination on its mobile network in which interconnecting networks can opt to pay a “fixed” sum (actually dependent on the number of end users), plus a lower usage charge.2 This paper is stimulated by the last of these cases. The paper uses a theoretical model of the interaction between an incumbent fixed network and two mobile networks to investigate the impact of two-part interconnection tariffs consisting of usage payments, plus fixed (non-usage) payments between networks covering a proportion of the fixed costs incurred by each network.3 We assume the networks compete within a Bertrand pricing framework, with Hotelling differentiation. The basic theory behind this model is laid out in the paper by Laffont, Rey and Tirole (1998) for the case of two competing networks, differentiated by a single metric. We will adopt essentially the same model, but extend the model to include a third network, distinguished by a second metric. This allows us to analyse the situation of two competing mobile networks (differentiated by one metric), and a fixed network equally differentiated from both mobile networks by a second metric (mobility). Thus the fixed network offers subscribers a different (lower) level of utility to either of the two mobile networks (because of the lack of mobility). For simplicity we further assume the mobile networks offer symmetrically equal utility to consumers, thus ensuring that, in equilibrium, they will attract the same number of subscribers. Model Let pm pf Fm Ff cmt cft cm cf am af fm ff 2 be the price of a call originated on a mobile network; be the price of a call originated on the fixed network; be the fixed monthly payment for subscription to a mobile network; be the fixed monthly payment for subscription to the fixed network; be the marginal cost of a call terminated on a mobile network; be the marginal cost of a call terminated on a fixed network; be the marginal cost of a call on a mobile network (origination, transport and termination); be the marginal cost of a call on the fixed network (origination, transport and termination); be the interconnection charge for terminating calls on a mobile network; be the interconnection charge for terminating calls on the fixed network; be the marginal cost of a mobile network subscription (excluding calls); be the marginal cost of a fixed network subscription (excluding calls); See http://www.accc.gov.au/content/item.phtml?itemId=573237&nodeId=file425216ae5d14f&fn=O ptus%20submission%20in%20support%20of%20MTAS%20access%20undertaking.pdf And http://www.accc.gov.au/content/item.phtml?itemId=573257&nodeId=file425216ddd9755&fn= Optus%20MTAS%20access%20undertaking%E2%80%94December%202004.pdf 3 An extension of the analysis to a second fixed network, or third mobile network would be laborious, and unlikely to provide any further useful insights. 2 DRAFT gm be the fixed cost of a mobile network (e.g. geographical coverage); g f be the fixed cost of the fixed network; q ( p ) be the volume of calls per subscriber on a network, as a function of the price ( p ), assumed to be the same for both fixed and mobile networks; be the subscriber share of the fixed network; sf sm be the subscriber share of a mobile network; be the subscriber share of the fixed network; sf m f be the profit earned by a mobile network; be the profit earned by the fixed network. In addition, we will sometimes use a second subscript on some variables relevant to the two mobile networks to identify separate values for each individual network. The way we model this is as follows. Subscribers initially decide whether they will subscribe to the fixed or a mobile network. We assume that all consumers gain sufficient benefit from making calls (at prices within a relevant range) to ensure that they will join either a fixed or a mobile network – but not both.4 This assumption implies that the total number of subscribers (to all networks) is independent of prices. Subscribers are assumed to be distributed uniformly along a segment [0,1] in respect to their preferences for mobility. At one extreme ( x 0 ) subscribers place no value on mobility, whilst at the other extreme ( x 1) they place a value of t f on belonging to a mobile network. Therefore, we can represent the consumer surplus that an individual subscriber would receive from the fixed network as: w f tfx where wf is the difference between the variable consumer surplus from calls, v ( pf ) , and the fixed monthly payment: wf v( pf ) Ff Re-iterating, we assume that all consumers gain positive net surplus, and so subscribe to a network at any call price in a range relevant to our analysis. Meanwhile, the consumer surplus that an individual subscriber would enjoy from each of the mobile networks is wm1 tf (1 x) and wm 2 tf (1 x) , where wm1 and wm2 are the consumer surplus of subscribers to each of the mobile networks. The market share of the fixed network is found by determining the value of x at which subscribers are indifferent between the fixed and mobile networks. Thus: sf 1 wf sm1wm1 sm 2 wm 2 / sm1 sm 2 1 sm1wm1 sm 2 wm 2 f wf 2 2tf 2 sm1 sm 2 ( ) (1) 4 Clearly, in reality, many consumers will have both fixed and mobile subscriptions. In principle the analysis could be adapted to include this situation, but for the purposes of this paper we restrict our attention to cases where fixed and mobile subscriptions are alternatives. This will highlight issues that arise in this particular case. 3 DRAFT where f 1 / 2tf is an index of substitutability between the fixed and mobile networks. The two mobile networks then compete for the remaining market share and, to the extent that they offer different prices, will face market shares given by: sm1 1 sf ½ m(wm1 wm2) and sm2 1 sf ½ m(wm2 wm1) (2) where m is an index of substitutability between the two mobile networks. Substituting equations (2) into equation (1) gives explicit equations for the market share of the fixed network: sf 1 wm1 wm 2 2 f wf m wm1 wm 2 2 2 (3) It will be useful to write out the following partial derivatives: sf f wf 1 sm1 f m wm1 wm 2 wf 2 sm 2 1 f m wm 2 wm1 2 wf 1 sf f 2m wm1 wm 2 wm1 2 sm1 1 m1 sf f 2m wm1 wm 2 sm1 2 1 sf wm1 1 sm 2 m1 sf f 2m wm1 wm 2 sm 2 1sf wm1 2 (4a) (4b) (4c) (4d) (4e) (4f) Now turning to look specifically at the mobile networks, we are able to write the profit function (for, say, network 1). For convenience, we take the profit to be a function of price ( pm1 ) and consumer surplus ( wm1 ). The profit function is: m1 sm1 pm1 cm sm 2 am cmt sf af cmt q pm1 v pm1 wm1 fm sm1sm 2am cmt q pm 2 sm1sf am cmt q pf gm sf sm 2 sm1 gm sm1 gf (5) Where is the proportion of the network’s fixed cost that is covered from a fixed payment between networks (pro-rata according to subscriber shares). Differentiating with respect to price pm1 gives m1 sm1pm1 cm sm2 am cmt sf af cmt q' pm1 q pm1 v' pm1 (6) pm1 Noting v' pm1 q pm1 , this simplifies to: 4 DRAFT m1 sm1 pm1 cm sm 2 am cmt sf af cmt q' pm1 pm1 (7) And so the first order condition gives: pm1 cm sm2 am cmt sf af cmt (8) This simply states that networks will price outgoing calls at perceived cost, taking account of outpayment expenses to other networks. The price depends on the usage element of the interconnection tariff, but not the fixed element. Now differentiating with respect to wm1 , and substituting from equation (8) gives: m1 wm1 sm1 v pm1 wm1 fm sm 2am cmt q pm 2 sf am cmt q pf wm1 sm 2 am cmt q pm 2 sf am cmt qqf sm 2 am cmt sf af cmt q pm1 1 sm1 wm1 wm1 wm1 wm1 sf sm 2 sm1 sm1 gm gf wm1 wm1 wm1 wm1 Assuming symmetry between the two mobile networks, we expect in equilibrium: wm1 wm2 wm , sm1 sm2 sm , pm1 pm 2 pm and m1 m2 m (9) Thus, equations (4) become sf f wf sm1 f wf 2 sm 2 f wf 2 sf f wm1 2 sm1 f sm f m1 sf 2msm wm1 2 1sf 4 sm 2 f sm f m1 sf 2msm 1 s f wm1 2 4 (10a) (10b) (10c) (10d) (10e) (10f) And so the first order condition becomes m wm 5 DRAFT f 2msm v pm wm fm am cmt smq pm sfq pf 2 gm gf 4 f sm am cmt q pm af cmt q pf 1 0 2 Thus wm v pm fm 2 gm gf am cmt smq pm sfq pf f sm am cmt q pf af cmt q pm 1 2 (11) f 2msm 4 Finally, substituting both first order conditions of equations (8) and (11) back into the profit function of equation (5) gives f am cmt q pf af cmt q pm 1 sm 2 m 2 2msm f (1 ) gm (12) 4 The same analysis for the fixed network yields the following. f sf pf cft sm1 sm 2 am cft q pf v pf wf ff sf af cft sm1q pm1 sm 2 q pm 2 gf sm1 sm 2 gf gm (13) Differentiating with respect to price pf gives f sf pf cf sm1 sm2 am cft q' pf q pf v' pf pf (14) Noting v' pf q pf , this simplifies to: f sf pf cf sm1 sm 2 am cft q' pf pf (15) And so the first order condition gives: pf cf sm1 sm2 am cft (16) Now differentiating with respect to wf , and substituting from equation (16) gives: f wf 6 DRAFT sf v pf wf ff af cft sm1q pm1 sm 2q pm 2 wf sm 2 sm1 sm1 sm 2 sf af cf q pm1 q pm 2 am cf q pf 1 wf wf wf wf sm 2 sm1 gf gm wf wf Assuming symmetry between the two mobile networks, the first order condition becomes f wf f v pf wf ff 2smaf cf q pm gf 2gm sf f af cft q pm am cft q pf 1 0 Thus wf v pf ff 2smaf cf q pm gf 2 gm sf f af cft q pm am cft q pf 1 f Finally, substituting both first order conditions of equations (8) and (11) back into the profit function of equation (5) gives f sf 2 f af cft q pm am cft q pf 1 f (1 ) gf (17) Table 1 summaries the main results from the model. 7 DRAFT Table 1: Summary of Model Results Mobile networks pm Retail call charge Retail fixed charge Profit Fm m One-part interconnection tariff Two-part interconnection tariff cm sm am cmt sf af cmt cm sm am cmt sf af cmt fm am cmt smq pm sfq pf fm 2 gm gf am cmt smq pm sfq pf f sm am cmt q pf af cmt q pm 1 2 f sm am cmt q pf af cmt q pm 1 2 f am cmt q pf af cmt q pm 1 2 2msm smwm Welfare s mw m m f am cmt q pf af cmt q pm 1 sm 2 Consumer surplus f 2msm 4 f sm 2 m gm 2 2msm 4 v p fm am cmt smq pm sfq pf f sm sm 2 am cmt q pf af cmt q pm 1 f 2msm 4 sm v pm fm am cmt smq pm sfq pf gm f 2msm 4 f (1 ) gm 4 v p fm 2 gm gf am cmt smq pm sfq pf sm f am cmt q pf af cmt q pm 1 sm 2 f 2msm 4 smv pm fm am cmt smq pm sfq pf gm sfgm smgf m 8 DRAFT Table 1 (continued): Summary of Model Results One-part interconnection tariff Two-part interconnection tariff Fixed network pf Retail call charge cf 2sm am cft cf 2sm am cft Retail fixed charge ff 2smaf cf q pm Profit Ff f sf f af cft q pm am cft q pf 1 sfwf Welfare sfwf f All networks Welfare f 2 f Consumer surplus sf f af cft q pm am cft q pf 1 sf f af cft q pm am cft q pf 1 f sf f af cft q pm am cft q pf 1 2 gf v pf ff 2 smaf cft q pm sf sf f af cft q pm am cft q pf 1 f sf v pf ff 2smaf cft q pm gf s mw m 2 m sf w f f ff gf 2 gm 2smaf cf q pm 2 smv pm fm am cmt smq pm sfq pf sf v pf ff 2 smaf cft q pm 2 gm gf f (1 ) gf v pf ff 2smaf cft q pm gf 2 gm sf sf f af cft q pm am cft q pf 1 f sf v pf ff 2smaf cft q pm gf 2 smgf sfgm 2smv pm fm am cmt smq pm sfq pf sf v pf ff 2smaf cft q pm 2 gm gf 9 DRAFT Implications of the Model A number of implications can be drawn from the results in Table 1: In all cases (where there is a two-part retail tariff), each network’s retail call price will equate to the cost incurred by that network, taking account of proportion of calls that bear a usage termination charge on another network. Thus, call prices will differ between fixed and mobile networks (to the extent that network costs, usage based termination charges, and the proportion of calls terminating on other fixed and mobile networks will differ). In general mobile networks will have higher own network costs, but lower outpayments to other networks. Retail fixed prices will be based on the fixed cost per subscriber, offset by the profit made on terminating calls to that subscriber, plus a profit. The retail fixed price is also increased by the contribution each network needs to make to the fixed costs of other networks for increases in its subscriber share (and the loss of contribution it receives itself). The profit is related to the degree of differentiation between networks. The profit of the fixed network is determined by its degree of differentiation from the mobile networks ( f ). The profit of the mobile networks is determined by its degree of differentiation from the fixed network and the differentiation between mobile networks( f and m ), irrespective of whether or not there is a two-part interconnection tariff. The profits of both networks are determined by the quantity afq pm amq pf : the “balance of payments” between the fixed and a mobile network. Fixed network profits are positively related to this quantity, whilst mobile network profits are negatively related to this same quantity. The extent to which this quantity does affect profits of either fixed or mobile networks is dependent on the degree of differentiation between fixed and mobile networks. Profits are not directly affected by call costs, since these are fully passed on in retail tariffs, although there will be an indirect impact via quantities. If we set f 0 (i.e. the fixed is fully differentiated from mobile networks), the model predicts that the fixed network can make infinite profit due to the lack of competitive constraint and the insensitivity of overall subscription levels to prices. Furthermore, the fixed network does not affect the profitability of the mobile network and so we get the Laffont, Rey and Tirole (1998) result that profit of the mobile networks is independent of the usage based interconnection charge. Implications for Interconnection Tariffs One-part Tariff Interconnection tariffs for call termination are usually regulated. The regulated rates are often (but not always) based on the cost of providing the interconnection service (e.g. long run incremental cost), plus an allocation of fixed and common costs. In the case of the simple one-part usage based interconnection tariff, this would lead to: 10 DRAFT am cmt af cft gm smq pm gf (18) sfq pf In this case, total welfare becomes: smq pm smq pm sfq pf W 1 part 2 sm v pm fm gm s f v p f f f 2 g f 2 gm gf smq pm sfq pf smq pm sfq pf smq pm W 1 part 2 smv p fm sf v p ff 2 1 gm 2 1 gf q p m q pf m f The intuition behind this result is simply that welfare is the total consumer surplus on calls, plus a factor that accounts for the additional producer surplus from interconnection termination rates being marked-up to recover a proportion of fixed costs (resulting in call retail prices being above underlying cost), less subscriber and network fixed costs. Two-part Tariff The situation is different with a two-part interconnection tariff. Here fixed costs are recovered by the fixed component of the interconnection tariff, which is passed on to consumers through the retail fixed price. Therefore am cmt af cft (19) And so welfare becomes W 2 part 2smv pm fm sf v pf ff 2gm gf Comparison of one-part and two-part interconnection tariff cases In comparing these two welfare results ( W 1 part and W 2 part ), it is important to distinguish the two different retail price levels ( pm , pf and Fm , Ff ) (and also, to a lesser degree of importance, the different market shares) between the one-part and two-part interconnection tariff cases. Compared to the one-part tariff case, the retail call price will be lower but the fixed monthly price will be higher. However, the latter does not feature in the total welfare, since it is simply a transfer from consumers to networks, and we assume the participation in the networks is independent of the fixed retail payment (although shares of individual networks are not). Therefore, we would expect that, compared to the one-part tariff case, v pm and v pf will be greater, reflecting both greater consumer surplus on the calls than would be made under the one-part tariff, and additional consumer surplus from greater volume ( q pm and q pf ). Off setting this will be the loss of producer surplus that networks make from terminating calls at a charge that allows some recovery of fixed costs. However, there will be an unambiguous net gain in welfare, principally from the stimulated calling volumes. 11 DRAFT Conclusion This paper has explored a model under which two mobile networks compete with a fixed incumbent under a two-part interconnection tariff. A two-part interconnection tariff will result in lower usage based payments (per call or per minute) between networks. This should give networks greater flexibility in pricing calls, and result in welfare enhancing increases of traffic between networks. It may thus capture some of the consumer benefit normally associated with regulatory intervention in reducing interconnection charges. We have not discussed the significant practical challenges in implementing a twopart interconnection tariff of the type analysed in this paper. The Optus tariff referenced in the introduction (which is similar in structure to the one discussed here) has a number of auditing requirements (e.g. to verify subscriber number), and excludes transit and international traffic. Nevertheless, two-part interconnection tariffs do appear to have positive welfare features that justify further consideration. References Laffont, J., Rey, P. and Tirole, J. “Network competition: I. Overview and nondiscriminatory pricing” RAND Journal of Economics, Vol. 29, No. 1, Spring 1998, pp. 1-37 12