Old Material

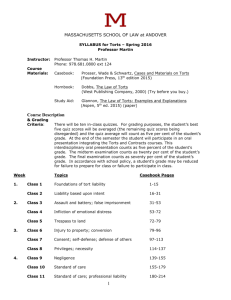

advertisement

Hensler, Trends in Tort Litigation, The Story Behind the Statistics – SK Detail Outline for Exam 7 – No Longer on Exam Hensler, Trends in Tort Litigation, The Story Behind the Statistics – SK Introduction The policy debate over tort reform The statistical debate … … on the litigation explosion … on the growth in amount awarded The worlds of tort litigation Treating three worlds as one invites distortion Key questions to be answered Litigation: How Much is There? The controversy Data sources … … and data problems Total amount of tort litigation nationwide is growing slowly But growth differs for different case types High-stakes personal injury suits are growing faster Where the explosion may occur So how much tort litigation is there? Jury Awards: Stable or Out of Control? More statistical confusion Which yardstick to use Median awards – probably the best measure of a “typical” award. Mean awards – extreme high/low values can distort this as a measure of “typical” award. Expected awards = avg award * probability of winning. ICJ jury verdict studies Key issues studied - kinds of cases tried and trends in outcomes - how juries compensated various types of injuries and how it changed over time - how jury verdicts are related to the characteristics of litigants Data is specific to San Francisco and Cook County. Overall, median awards haven’t changed much … - from 1960 to 1975, median stayed about the same in both jurisdictions. … but some recent changes are evident – in the 80’s, Cook County’s median dropped slightly (possibly due to a change from contributory negligence to a comparative negligence standard), but San Francisco rose dramatically (possibly due to the establishment of mandatory arbitration for smaller-value case drove smaller-value cases out of the courts). But if you break it up by line, auto medians are stable, while product and med mal medians rose sharply. Average awards have risen sharply – for all lines in both jurisdictions. The chances of winning have increased – in both jurisdictions. In 60’s about ¼ won. In 70’s, about 1/3 won. In 80’s, about ½ won. In San Francisco, there was actually a small decrease in probability for product liability cases, but in 1980s they were still winning more than ½ . Together w/ higher awards, this leads to higher expected awards. Hensler, Trends in Tort Litigation, The Story Behind the Statistics – SK Are juries “out of control”? Jury awards might be changing because the cases are changing. Awards might be changing because juries are better able to calculate proper compensation/deterrents. Jury trial system might be correcting these awards in posttrial processes. If any of these are true, then juries are not “out of control”. Explaining jury behavior … … trying different kinds of cases – now juries are seeing more cases involving more serious injuries and larger expenses. … awarding more dollars for serious injuries – above increases due to larger cases, juries are still awarding more money for serious injuries. … responding differently to cases from different “worlds” of litigation – juries are more likely to award money in product, med mal, or work injury, than they are for an auto accident for an injury of the same degree of severity (premium effect). Juries also tend to award more money if the defendant is an institution (deep-pocket effect). It’s unknown whether juries respond differently to irrational sympathies or prejudices against defendants. What happens after trial? The bottom line Litigation Costs: How Much, to Whom? Transactions costs – complaints and rebuttals Where the dollars go Effect of case complexity Growth rate for transactions costs In sum … The Story Behind the Statistics The emerging worlds of tort litigation 3 differences evident in the numbers: 1) Routine personal injury torts (auto) are growing slowly in frequency and costs, and outcomes haven’t changed much over last 25 yrs. 2) Higher-stakes torts (malpractice, product liability) are growing faster in frequency and costs and outcomes have increased dramatically over the past 25 yrs. 3) Mass latent injury torts, when identified, tend to explode in number, carry high transaction costs, and have highly uncertain outcomes. Table 5.1 summarizes the 3 evolving worlds of Tort Litigation: Auto and Other Ordinary Lawsuits: high volume; stable law; routinized; increasing ADR; modest stakes; little difference potential; slow growth in frequency, outcomes, costs. Product Liability, Med Mal, Business Torts: lower volume; evolving law; increasingly specialized; heavy pretrial procedure; little ADR; large $ potential per case; deterrence is factor; faster growth in frequency, outcomes, costs. Mass Latent Injury Cases: concentrated in time and place; problematic law; small, highly specialized bar; discovery critical; procedural innovation; enormous $ stakes for parties; deterrence is key issue; highly uncertain in number, outcome, and costs. Hensler, Trends in Tort Litigation, The Story Behind the Statistics – SK Routine personal injury torts Higher-stakes personal injury torts Mass latent injury torts – a special case of product liability torts. The latency of these injuries make discovery prolonged and costly. Large numbers of these claims can overload courts, leading to further delays. Future costs are highly uncertain. What the tort evolution implies for policy Keeton, “The Impact on Insurance of Trends in Tort Law,” Issues in Insurance – SK (1984) I. Introduction II. Changes in Sources of Compensation for Accidental Losses III. A Summary of Changes within the Basic Theories of Tort Liability Negligence and Strict Liability Negligence principle emerged in mid-19th century. Previously, strict liability seems to have dominated. Rylands v. Fletcher – English House of Lords – a landowner contracted with someone to construct a reservoir. This flooded a neighbor’s land. Under strict liability, the landowner was found liable. However, under negligence, he could have been found vicariously liable for the contractor’s negligence. The history continues – come back if more time…. Changes in the Practical Meaning of Negligence Reducing the Areas on Nonliability for Negligence Immunities – the idea that negligent person receives special protection. Govt immunities – municipalities were not liable for negligence in the course of their activities (operations of police force). Yet they were liable for negligence of employees in scope of proprietary activities (municipal skating rink). Charitable immunities – could be held liable for negligence in upper echelons of management. Family immunities Some developments follow to cut down these immunities: Charitable immunities – one argument was that if the charity had insurance they waived its immunity. This idea was not held in most courts, since a charity could only get full insurance or none. Second argument – the availability of insurance waives the insurance. This makes more sense – as insurance is now available, it would be wrong to expect a charitable hospital not to protect victims of their own negligence. Family immunities more resistant to liability insurance. This immunity is meant to protect family harmony and discipline. Liability claims could cause sources of friction in family. Or, two family members could collude to gain financial gain for both. Govt immunities – even less impacted by liability insurance. No-Duty Rules Statutes of Limitation Keeton, “The Impact on Insurance of Trends in Tort Law,” Issues in Insurance – SK (1984) Comparative Negligence “last clear chance” doctrine: allows a negligent plaintiff to recover full damages if the defendant had the “last clear chance” to avoid an accident. contributory negligence places entire loss on plaintiff. “pure” comparative negligence: recovery = %-age of “full” damages equal to %age of negligence attributed to the defendant. “limited” comparative negligence: If a plaintiff is more negligent than the defendant then plaintiff is barred from recovery. Variations include: “not-morenegligent” in which if plaintiff and defendant are equally negligent, plaintiff gets 50% recovery. “less-negligent” requires plaintiff to be 49% or less negligent to receive a recovery. Abrogation of Guest Statutes – default is that a driver of a car is subject to liability for injuries to a passenger caused by the driver’s negligence. Some states (by judicial decision) require proof of fault beyond ordinary negligence for a “guest” passenger (that is a passenger not for hire or present for the benefit of the host). In 1920s and 1930s, majority of the states enacted “guest statutes” declaring a host driver would not be liable to a “guest” passenger for injuries caused by ordinary negligence. Liability is however existent for “gross negligence”, “recklessness” or “willful and wanton misconduct”. Justifications for statutes: 1) to bar claims of an ungrateful guest against a generous host; 2) to protect against collusion between a host and guest. Consumer protection ideals grew in 1960s and 1970s, and states have begun repealing these statutes, starting with CA Supreme Court who ruled them as being unconstitutional as a violation of “equal protection” clauses. Changes in Rules of Law Affecting Negligence Claims Standards of Professional Duty The Basic Standard – a negligent standard. A practicing person must not only perform according to his duties, but must also have the qualifications to do so. If a person performs well, but does not qualify, he is still negligent. 1974 – Supreme Court of Washington found that a uniform custom in a profession is not controlling. A person suffered eye damage because she wasn’t diagnosed for glaucoma. The medical experts said it’s not routine to test glaucoma for people under 40, but court found they should have. Changes in Practical Meaning – there appears to be a trend of seeing less strong negligent claims being heard in court. Though the standard is not changing, the substance (level of tolerance) may change. State of Knowledge – how much did the profession in itself know at the time of treatment? This can change through time. Strict liability never applies in practice. Establishing the Standard of Care – the degree of care needs to be established Proof of Violation – the loss needs to be proved. res ipsa loquitur – the thing speaks for itself. If something is obvious, there is no need to further prove the violation. Keeton, “The Impact on Insurance of Trends in Tort Law,” Issues in Insurance – SK (1984) Liability of Insurers for Conduct of Their Own Agents Liability in Excess of Policy Limits The company’s duty to defend the insured stems from the relationship between them created by the insurance contract. Company can control defense and settlement that affects its interests and the insureds’ interests. These interests can sometimes come into conflict. If a claim can settle for an amount not exceeding the limit of liability, the insured’s best interest is to settle within the policy limit. The company’s best interest is to reject settlement and try the case in hopes of winning and pay no liability. Other Liabilities of Insurers – the knowledge of insurance coverage in a case may affect the attitudes and decisions of judges and juries. This could be a bias against insurers. But there are three principles that can explain this. 1) Disallowing unconscionable advantage – where there is a disparity in knowledge between parties. Usually, the P/H knows little about the contract in comparison w/ the insurer’s representative. This principle disallows an insurer to have such an advantage. 2) Honoring reasonable expectations of the applicants and intended beneficiaries, even though there was painstaking study of policy provisions. 3) Detrimental reliance – a redress may be allowed to the claimant if he justifiably relied on an agent’s representation. Additionally, recent decisions have indicated that an insurer has a duty to deal fairly w/ insured; that this duty is violated if insurer refuses to honor a claim; and the insured has a cause of action for collecting damages. Changing Measures of Damages Compensatory Damages Bodily Injury Cases stuff (come back later) More than before, compensation awards are based on identifying separate elements of damage rather than one lump sum – leading to higher total damages. Another practice is “per diem” method where an attorney demonstrates one day’s amount for suffering, and multiply by the # of days already suffered and will suffer in the future to get total reward – leading again to higher total damages. Another is the use of economists as expert witnesses to state an opinion as to increases in earnings through an entire work life expectancy (had injury not occurred) and to predict probable reduced earnings – but this method tends to offset the discount to PV, leading to too high an answer. In addition, life expectancy has increased – increasing awards, and medical costs are rising higher than price indexes. Property Damage Cases Punitive Damages Countermeasures and the Net Impact of Changes Damages Rules Insurance Contract Provisions Keeton, “The Impact on Insurance of Trends in Tort Law,” Issues in Insurance – SK (1984) Proposals for Legislation Affecting Liability The Scope, Impact, and Promise of Countermeasures Within Negligence Law IV. Statutory Substitutions of Compensation Systems for Tort Law Employee Compensation – A Total Substitute No-Fault Automobile Insurance: A Partial Substitute A Survey of No-Fault Laws A total substitute (much like WC) for auto has been considered in Canada, but never adopted in the US. What is today called “no-fault” is actually a partial substitute – first appearing in MA in 1971, then in 24 states by 1976, which can be classed in two classes: 1) add-on statutes: where negligence is maintained (no tort exemptions), but nofault is considered for provisions such as S&S and offset to coordinate benefits to avoid double recovery: AR, DE, MD, OR, SC, SD, TX, VA. 2) partial-tort-exemption eliminate claims for some injuries (of less consequence). Less serious injuries receive only no-fault benefits. More serious injuries receive both no-fault and negligent benefits (with provisions for double recovery): CO, CT, FL, GA, HI, KS, KY, MA, MI, MN, NV, NJ, NY, ND, PA, UT. Degrees of Partial Tort Exemption States can differ even in how they define “less” serious from “more” serious. Consider 5 categories: minor, substantial, moderate, serious, and severe. Some states bar pain and suffering claims for minor: CT, NJ. Some bar for minor and substantial (12 states). Some bar for minor, substantial, and moderate: HI, MI. The Uniform Motor Vehicle Accident Reparations Act would have barred all the way up to serious injuries, but was never adopted. Forms of Partial Tort Exemption medical threshold – tort action is permitted if expenses are in excess of a stated dollar amt. This can be unfair or create incentives to incur medical expenses just to get over the threshold. descriptive standard – a descriptive threshold. It doesn’t have the problems of a financial threshold, but it can be up to interpretation in the courts. deduction form damages findings – a technique never used by any state. There is a deductible amount ($5000) of which you must overcome to collect for pain & suffering, but it is deducted from the award. This could lead to a push for higher awards to compensate. Key Issues in the Controversy Criticisms of existing auto negligent/insurance system follow: 1. System is an incomplete system of reparation. It leaves victims to bear too much loss that could be paid through insurance. 2. System in inequitable. It pays some claimants more than others. 3. System is too slow in delivering payments. 4. System is wastefully expensive (admin costs) due to requiring case-by-case determinations, and lump-sum findings of damages under indeterminate guidelines. 5. System encourages routine exaggeration of claims and fraud. Keeton, “The Impact on Insurance of Trends in Tort Law,” Issues in Insurance – SK (1984) 6. Negligence is impractical to prove in a large %-age of accidents. 7. Liability insurance is an unsatisfactory product – unattractive to consumers. And if regulation causes rates to be too low, insurance becomes less available. 8. The system is self-contradictory in theory and self-defeating in practice. Developments ensure that wrongdoers are protected by insurance from having to pay, and victims are compensated from some source regardless of fault. Responses to criticisms follow: 1. System is not designed to compensate for all loss – it’s designed to distinguish between more deserving and less deserving victims and to compensate the more deserving victims. 2. Negligence law is based on individual moral accountability. 3. Basing liability on negligence is a deterrent to careless conduct. 4. Difficulties of applying negligence laws to auto are exaggerated. 5. Critics of negligence system should offer a better alternative. Removing fault would mean taking benefits from more deserving victims to pay benefits to less deserving victims. 6. The shortcoming of System are less serious than those of any alternative. 7. If speedy payments are desired, a social welfare system should be chosen. 8. Compensation plans are a threat to the present private insurance system. 9. Court delay is a separate problem and can be bettered through providing adequate courts and improved procedures. 10. Marketing and regulatory problems are separate from questions concerning compensation. Any other system would do nothing to solve these problems. 11. A no-fault compensation plan would penalize low-risk drivers and provide a bonus to those most responsible for causing injuries. 12. Predictions/assertions of greater efficiency/savings from an alternative are greatly exaggerated. Performance of No-Fault Laws Proposals for Other Areas V. Basic Premises of Compensation Systems Six Influential Premises – some of these are in conflict with each other. 1. Decisions of entitlement (to compensation) and obligation (to pay) should be based on fault. 2. Decisions of entitlement and obligation should be based on a standard that differs from fault in usual sense (strict liability or compulsory loss insurance). 3. 3rd party liability insurance should be used not only for protecting the assets of insureds, but also to protect plaintiffs against financial irresponsibility of defendants. 4. Private enterprise should be used for funding and management of insurance. 5. Broad protection for a minimal level of welfare should be secured for everyone. 6. The security system should be publicly funded and managed through govt insurance or a tax system. Three Combinations Tort-Liability and Third-Party, Private-Enterprise Insurance (1), (3), (4) – predominant in auto lines (pre-no-fault) Strict Liability and Private-Enterprise Liability Insurance; No-Fault Compulsory Keeton, “The Impact on Insurance of Trends in Tort Law,” Issues in Insurance – SK (1984) Private-Enterprise Insurance (2), (4) Automobile no-fault is similar to products strict liability, but strict liability isn’t as limited as no-fault. No-fault has been discussed in extending to med mal. Two problems follow. 1. With auto, no-fault insurance can save money by eliminating small claims, resulting in costs similar to tort liability costs. With med mal, most injuries would be more expensive, causing prices to rise. 2. With med mal, the admin costs savings would be nowhere near the savings in auto no-fault. Causation would be difficult to prove. Social Welfare Protection, Publicly Funded (5), (6) Objectives of Compensation Systems – two key aims: 1. A good compensation system will be equitable from three perspectives: between those who receive benefits; those who bear burden of costs among different beneficiaries; and among different cost-bearers. 2. The system will contribute to protection, enhancement, and wise allocation of society’s human/economic resources. Foundation for Premises VI. Relationships Among Tort Trends and Concepts of Insurance and Insurability Inferences Regarding the Significance for Insurance of Tort and Economic Trends 1. These trends produce influences toward increases of claim costs at a rate in excess of changes in general price indices. 2. Countermeasures to slow the trend of rising costs only ameliorate the trend to a modest degree, but don’t promise to reverse the trend. 3. The fate of proposals for changes should consider their consistency with society’s social, economic, and moral objectives. 4. These trends present problems to the insurance industry and require reexamination of basic concepts of insurance and insurability. New Problems and Their Challenge to Private-Enterprise Insurance Insurance Consequences of Increased Costs: Expanded Markets and Reallocated Expenditures – If rates stay attuned to exposures, then the increased exposures produce both increased rates and increased profits. However, if rates rise too high, there could be resistance and reallocation of expenditures in the economy. Reduced Predictability of Pooled Exposures – As losses become less predictable, some exposures may become uninsurable. etc. This unpredictability is really evident in “long tail” lines such as professional liability and products liability. In med mal, one way get around this is to switch to “claims-made”. From the P/H’s perspective, they would see immediate savings in premiums, but in future years, they would make up the difference as more exposures fall into the “claims-made”. VII. An Epilogue About the Future Biggs, Statement of Jennifer L. Biggs, FCAS, MAAA, … July 10, 2003 – SK (selected pages) Biggs, Statement of Jennifer L. Biggs, FCAS, MAAA, … July 10, 2003 – SK (selected pages) Introduction History of Asbestos Usage Health Risks Associated With Asbestos Exposure Current Personal Injury Claim Situation Concerns of Major Parties Involved in Asbestos (Personal Injury) Litigation Seriously Injured Claimants Nonseriously Injured and Unimpaired Claimants Plaintiffs Attorneys Judges Major Asbestos Defendants Peripheral Defendants Insurers and Reinsurers Prior Efforts to Solve the Asbestos Problem Summary and Conclusions Exhibit 4 – FAQ Regarding Asbestos Litigation count Factors for Schedule O Lines Troxel & Bouchie, Property-Liability Insurance Accounting and Finance (Fourth Edition) – SK Methods of Maintaining Solvency Insurance Department Examinations Purpose of Examinations Examination Procedures NAIC Examinations Critique of the Examination System NAIC Regulatory Tests Purposes of the Tests Mechanics of the System Nature and Interpretation of the Tests Overall Tests Gross Premium to Surplus Net Premium to Surplus Change in Writings Surplus Aid to Surplus Profitability Tests Two-Year Overall Operating Ratio Investment Yield Change in Surplus Liquidity Tests Liabilities to Liquid Assets Agents’ Balances to Surplus Reserve Tests One-Year Reserve Development to Surplus Two-Year Reserve Development to Surplus Biggs, Statement of Jennifer L. Biggs, FCAS, MAAA, … July 10, 2003 – SK (selected pages) Estimated Current Reserve Deficiency to Surplus Greene, "Government Insurers," Issues in Insurance – SK (1987) I. Government Insurance Roles of Government as an Insurer Government as Exclusive Insurer Government in Partnership with Private Insurers Government in Competition with Private Insurers Social Insurance Versus Other Government Insurance Social Insurance Other Government Insurance Insurance Versus Social Welfare Insurance Versus Government Indemnity II. Types and Size of Federal Insurance Programs Extent of Federal Insurance Federal-Private Insurer Relationships Partnership Roles Competitor Roles Exclusive Roles Evaluation of Federal Programs Loan Insurance Property Insurance Crop Insurance Flood Insurance Riot Reinsurance and FAIR Plans Crime Insurance Life Insurance Pension Plan Insurance OASDHI Unemployment Insurance – objections include: 1) These laws differ in each state, causing inequities. 2) Some say benefits aren’t high enough. Others say they are too high – to provide a disincentive to return to work. 3) Experience rating system is questionable. It assumes the employer alone can control amt of unemployment, when it’s actually out of their control. Plus, employers in unstable industries are already paying the max tax, so taxes can’t be raised – creating an opportunity of temporary lay-offs on the govt. 4) “Suitable work” is defined such that workers could qualify for benefits even though some type of work is available – a problem among seasonal workers. 5) Some workers may be ineligible for unemployment because the employer was not required to purchase unemployment insurance. 6) Many people exhaust their benefits before being reemployed. Due to min and max benefits – highly paid workers receive a small %-age restoration, while low-paid workers receive a higher %-age. Also, no extra allowances for those who have dependents. Greene, "Government Insurers," Issues in Insurance – SK (1987) 7) In most states, the wage base is much lower than the actual wage earned. This accentuates cyclical and seasonal variation in the employer tax burden. III. Type and Size of State Insurance Programs Workers Compensation Evaluation of Workers Compensation Insurance Temporary Disability Income Insurance Evaluation of Temporary Disability Income Insurance Maryland State Automobile Insurance Fund Evaluation of MAIF State Property Insurance Financial Characteristics of the Plans Reasons for Establishing the Plans Evaluation of State Property Insurance Insurance Guaranty Fund – main purpose is to guarantee payment of claims to P/Hs and to prevent insolvencies. Evaluation of Insurance Guaranty Funds – too new to determine, but theoretically, it appears to be a sound development. State and Local Pension Plans IV. General Evaluative Statement V. Government Health Plans Versus Private Health Insurance VI. Analysis of the Rationale for Government Insurance Reasons for Government Insurance Residual Market Philosophy Compulsion Convenience Efficiency Collateral Social Purpose Criticisms of Government Insurance Residual market Philosophy Compulsion Convenience Efficiency Collateral Social Purpose General Observations About Rationale VII. Trends in Government Share of Insurance Markets Federal Share State and Local Share State and Local Pensions Workers Compensation Insurance General Observation About Trends VIII. Emerging Patterns in Government Insurance Programs IX. Implications for Private Insurers (do we need to know this?) X. Summary (do we need to know this?) Feldblum (Sch P), "Completing and Using Sch P" (Eighth Edition), CAS Study Note – W Feldblum (Sch P), "Completing and Using Sch P" (Eighth Edition), CAS Study Note – W (2003) (only IRIS section removed) Part 2 – Incurred Losses – net IRIS Loss Development Tests IRIS Retrospective Tests 9 and 10 Test 9: divide the latest 1-yr reserve development in Summary by the P/H’s surplus at end of prior year. Test 10: divide the latest 2-yr reserve development in Summary by the P/H’s surplus at end of 2nd prior year. Ratio of 20% or more is exceptional, which must be commented on in the Opinion. 4 or more exceptional scores may trigger a financial examination. These test results are included in the Five-Year Historical Data exhibit. IRIS Prospective Test 11 – O/S loss ratio = O/S losses & LAE at a given statement date divided by the EP in that statement year. Test 11 updates O/S loss ratios from past 2 yrs using 1- 2-yr reserves developments, then compares these ratios to CY O/S loss ratio. There is a mismatch in premiums (current CY) vs. losses (all AYs). Volume growth/decline, changes in the mix of business between prop and liab, changes in types of policies issued distort the O/S loss ratio. Test 11 Overview – lessening ratios can show evidence of under-reserving. Restated O/S loss ratios: (1-yr reserve development + unpaid losses & LAE for prior yr) / prior yr’s EP; AND (2-yr reserve development + unpaid losses & LAE for 2nd prior yr) / 2nd prior yr’s EP. Indicated O/S losses & LAE = avg of restated O/S loss ratios * current year’s EP Indicated reserve deficiency = above – reported unpaid losses & LAE. A deficiency greater than 25% of P/H Surplus is an exceptional score. Illustration: IRIS Test 11 Growth, Mix by Line, and Policy Type Almagro/Ghezzi, "Fed Income Taxes-Provisions Affecting Property/Casualty Insurers" – W Appendix B. Loss and Loss Expense Reserve Discounting (1988) Payment Pattern Determination year = 1987 and are every 5 years. Secretary of Treasury establishes payment patterns at each determination year. If a company has sufficient experience to place it in top 90% of all companies writing a specific line, it can use its own experience. Also, the company must have WP for that line for at least the # of yrs unpaid losses are required to be reported (for that line). Else the company must use IRS patterns. There used to be Sch O, which included International and Reinsurance. For those lines, the aggregate of all Sch P lines should be considered. If a company elects to use experience, it must do so until the next determination year. If a company uses IRS factors, they are applied to the determination year and the following 4 AYs. If they use company factors, they must revise the pattern for each AY using the most recently files AS. Interest Rate Feldblum (Sch P), "Completing and Using Sch P" (Eighth Edition), CAS Study Note – W These are based on a rolling 60-month average of 100% of the midterm AFR effective at the beginning of each calendar month. Discount Factors for Schedule P Lines Discount Factors for Schedule O Lines IASA 2, Chapter 12: Taxation (Selected Pages) – L Efficacy of the Annual Statement (starting 12-5) Lots of detail here. In a nutshell, the AS is not always binding. The IRS can sometimes successfully challenge its use in determining taxes. Tax Rules Unique to Property and Liability Insurers Introduction IRC 832: (nonlife) insurance company taxable income = gross income minus allowable deductions. Gross income includes U/W and investment income & other income. Tax formula for nonlife is about the same as standard corporate tax formula except: Reserves – ins cos may deduct increase in reserves for ests of unpaid losses. UPR – Premium income deferred by 80% of the increase in UPR. Proration – 15% of otherwise tax exempt interest income and dividends received deduction are included in company’s income. Underwriting Income Premiums Earned – include in taxable income 20% of increase in UPR. This “revenue offset” is supposed to accomplish a better matching of acquisition expenses and premium income. More detail – come back if more time. Losses Incurred – expenses or operating costs are deductible. The “all-events test” stipulates that a deduction for a liability can’t be claimed until economic performance has occurred. This would mean that loss reserves are not deductible. However, there is an exception that insurers can deduct loss reserves on occurrences that have taken place. (no pure IBNR). More detail – come back if more time. Discounting Loss Reserves – insurers must discount their losses and LAE. discounted unpaid loss at end of year = PV of losses determined by: the gross amt; the pattern of claims payments; and interest rate. If the reserves are already discounted, they must be undiscounted and then rediscounted according to the tax discounting methodology. There is a federal interest rate for each year, to be applied by AY. Industry discount factors computed annually by Treasury based on: 1) the determined interest rate and 2) Loss and LAE payment patterns. Discrete vs Composite Factors on Long-Tail Lines International and Reinsurance Accident and Health Insurance Election to Use Own Experience – once you decide to use experience, you can’t revoke w/o permission from IRS. It’s based on “determination year” and 4 succeeding CYs. Absence of an NAIC Annual Statement Feldblum (Sch P), "Completing and Using Sch P" (Eighth Edition), CAS Study Note – W Other than Calendar Year Returns Fresh Start Impact of Discounting on IRS Testing of Loss Reserves Salvage and Subrogation Expenses Incurred – IRC 832: expenses incurred = all expenses shown on the AS, but deductible expenses must satisfy allowable categories. Testing Estimates of Unpaid Losses – the IRS is entitled to test the reserves for unpaid losses and LAE to determine if they are “fair and reasonable”. The “all-events” test must be satisfied – such that a liability is fixed and determinable. Also, the losses are timed such that they are deducted only in the year of “economic performance”. Investment Income = gross amt earned from interest, dividends, rent = amts received during yr + investment income “due and accrued at end of the taxable year”. Deduct amts “due and accrued at end of preceding taxable year.” Accrual of Discount and Amortization of Premium Dividends – dividends received from domestic corporations are eligible for the dividends received deduction (DRD). DRD = 70% if recipient owns less than 20% of distributing corporation. It’s 80% if recipient owns at least 20% but less than 80%. It’s 100% if the recipient owns at least 80%. 100% DRD is not limited, but the 70% and 80% deductions are limited to 70% and 80% of taxable income before DRD, capital loss carryback, and net operating loss deduction. (Limitation operative when taxable income is less than gross dividends received.) Proration-Exempt Investment Income – deduction for “losses incurred” must be reduced by 15% of tax-exempt income and DRD with respect to bonds/stocks purchased after Aug 7, 1986. More as time allows. Capital Gains and Losses Mark-to-Market Abnormal Losses United States Branches of Alien Insurers Alternative Minimum Tax: Preferences Affecting Insurers Overview Typically, compute AMT by making certain adjustments to regular taxable income to get “AMT income” or AMTI. Multiply AMTI by 20%, compare with other tax amt, and pay the higher of the 2. AMT = 20% of AMT over $40K. The $40K exemption is reduced 25 cents for each $1 that AMTI exceeds $150K. More as time allows. Small Corporation Exemption – applies to companies that had avg gross receipts of $5M or less for three tax yrs beginning with first tax yr after 12/31/96. After that the corporation loses this exemption if the prior three tax yrs receipts are in excess of $7.5M. Adjusted Current Earnings (ACE) = 75% of excess of current yr’s earnings and profits over pre-adj AMTI. Feldblum (Sch P), "Completing and Using Sch P" (Eighth Edition), CAS Study Note – W Components of ACE Adjustment and Pre-Adjustment AMTI Pre-adjustment AMTI = regular taxable income + AMT adjs and preferences (no ACE). More. Example of AMT Calculation Step 1: Pre-adjustment AMTI = Regular taxable income (before NOL carryover) + preferences +/- adjustments. 1000 + 100 + 200 = 1300. Step 2: ACE = Pre-adj AMTI + earnings & profits items – expenses related to earnings and profits items + DRD other than the 100% DRD and DRD from certain 20% or more corporations. 1300 + 550 – 100 + 150 = 1900. Step 3: ACE adjustment = (ACE minus pre-adj AMTI) * 75%. .75(1900 – 1300) = 450. Step 4: AMTI = Pre-adj AMTI +/- ACE adj – alternative tax net operating loss. 1300 + 450 – 0 = 1750. Income Tax Accounting (starting at 12-65) US GAAP Balance Sheet Approach Deferred Tax Assets NAIC Accounting – Codification Admissibility Standard Recording Deferred Tax Provision State Income Tax Provision Disclosure Requirements Tax Contingencies State and Local Taxation (starting at 12-70) State Taxes: Introduction General Taxes The Income Tax The Franchise Tax Unitary Reporting Specific Taxes Premium-Based Taxes Basis Rates Credits “In Lieu Of” Statutes Retaliatory and Reciprocal Taxes Retaliatory taxes connote a penal condition. These provisions are based on principle that if the aggregate taxes/obligations imposed by state of a foreign/alien insurer are greater than the taxes/obligations imposed by taxing state, then those same taxes/fees are payable to the taxing state. Reciprocal taxes denote a mutual return of favor. With these provisions, the taxing state recognizes lesser obligations imposable on their domestic companies in foreign states. Bottom line: If such taxes exist, the foreign insurer will pay the state the same taxes they would pay to their domicile state. Feldblum (Sch P), "Completing and Using Sch P" (Eighth Edition), CAS Study Note – W Miscellaneous Taxes Fire Prevention Taxes Underwriting Profits Tax on Marine Coverages Licensing and Filing Fees Assessments Guaranty Funds Second Injury Funds (stop here?) WC Funds Med Mal JUA Automobile Insurance Funds State Boards and Bureaus Other Insurance Assessments