THE ELASTICITY OF DEMAND (AND JUST ABOUT ANYTHING)

advertisement

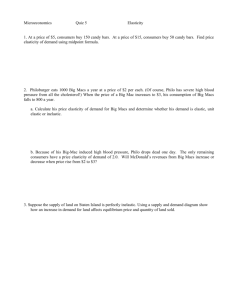

THE ELASTICITY OF DEMAND (AND JUST ABOUT ANYTHING) THE CONCEPT: THE ELASTICITY OF STEEL VS. RUBBER HOW MUCH DOES ONE THING CHANGE IN RESPONSE TO A CHANGE IN SOMETHING ELSE? THE CONCEPT OF ELASTICITY IS USED IN ENGINEERING & MANY BUSINESS FIELDS & ECONOMISTS USE SEVERAL DIFFERENT TYPES OF ELASTICITY MEASURES 1. (OWN) PRICE ELASTICITY OF DEMAND Ed = ELASTICITY COEFFICIENT % CHANGE IN QUANTITY DEMANDED = --------------------------------------------------------% CHANGE IN PRICE A NOTE ABOUT THE SIGN (NEGATIVE VS. POSITIVE): FOR OWN PRICE ELASTICITY, THE SIGN IS ALWAYS NEGATIVE, SO WE IGNORE IT. (CAN’T DO THAT WITH OTHER KINDS OF ELASTICITY) TERMINOLOGY INELASTIC Ed < 1 THIS MEANS QUANTITY DOES NOT CHANGE MUCH RELATIVE TO PRICE UNIT ELASTIC Ed = 1 THIS MEANS QUANTITY DEMANDED CHANGES PROPORTIONALLY TO PRICE ELASTIC Ed > 1 THIS MEANS QUANTITY DEMANDED CHANGES MORE THAN PRICE A CAUTION ABOUT SAYING DEMAND IS “ELASTIC” OR “INELASTIC” (ELASTICITY IS NOT THE SAME AS SLOPE) ELASTICITY IS ALWAYS RELATIVE TO WHERE YOU ARE ON A DEMAND CURVE OR BETWEEN TWO OR MORE DEMAND CURVES. P %Δ Q 3–4 %Δ P 10 – 8 - 1/3 - 0.33 Ed = ------ = ---------- = ----- = ------ =- - 1.65 2/10 0.20 $10 $8 %Δ Q 9 – 10 %Δ P 2-1 - 1/9 - 0.11 1/2 0.50 Ed = ------ = ---------- = ----- = ------ =- - 0.22 $2 $1 D 3 4 9 10 Q WHY DO WE CARE? KNOWING PRICE ELASTICITY ALLOWS US TO BE ABLE TO PREDICT CHANGES IN THE QUANTITY DEMANDED IN RESPONSE TO PRICE CHANGES CHANGES IN REVENUES ELASTICITY: SOME ADDITIONAL COMMENTS AVAILABILITY OF SUBSTITUTES (MORE CONSUMER CHOICE) INCREASES ELASTICITY DEFINING MARKETS AND PRODUCT LINES, E.G., THE DEMAND FOR PEPSI IS MUCH MORE ELASTIC THAN THE DEMAND FOR “COLA” THE DEMAND FOR BUDWEISER IS MUCH MORE ELASTIC THAN THE DEMAND FOR “BEER” ELASTICITY AND TIME: THE LONGER THE PERIOD THAT CONSUMERS HAVE TO ADJUST, THE MORE ELASTIC DEMAND. EXAMPLES: GASOLINE, ELECTRICITY THE BIGGER THE PRICE INCREASE, THE MORE ELASTIC THE DEMAND. MOVING TO A MORE ELASTIC PART OF THE DEMAND CURVE MAKES CONSUMERS MORE WILLING TO BEAR SEARCH AND TRANSACTIONS COSTS TO FIND SUBSTITUTES, ETC. CALCULATING ELASTICITY MEASURING ELASTICITY IS SENSITIVE TO HOW YOU DO IT & INFORMATION AVAILABLE IF ALL YOU KNOW IS THAT Q CHANGED X% & P CHANGED Y%, THEN ALL YOU CAN DO IS: Ed = (X%)/(Y%) FOR EXAMPLE, IF THE PRICE OF GASOLINE RISES 10% AND QUANTITY DEMANDED FALLS 1%: Ed = (1%)/(10%) = 0.1, I.E., INELASTIC IF WE KNOW PRICES AND QUANTITIES THEN WE CAN BE MORE PRECISE: Q2-Q1 P1 Ed = --------- X ---------Q1 P2-P1 ARC ELASTICITY THE PROBLEM OF MEASURING ELASTICITY IS RESOLVED BY USING AN AVERAGING METHOD Q2 - Q1 P2 – P1 Ed = -------------- ÷ -------------(Q1 + Q2)/2 (P2 + P1)/2 Q2 - Q1 P2 + P1 Ed = --------- x ---------Q1 + Q2 P2 – P1 AN EXAMPLE: SELLING 2X4s @ 49¢ ea. WE SOLD 12,000 PER WEEK WE DROPPED THE PRICE TO 39¢, SALES INCREASED TO 14,000 WHAT IS THE PRICE ELASTICITY OF DEMAND AND WHAT DOES IT IMPLY FOR PRICING POLICY? 14,000 - 12,000 .39 + .49 Ed = -------------------- x ------------12,000 + 14,000 .39 - .49 2,000 .88 Ed = --------- x ------- = (.0769) X (-8.8) = - 0.69 26,000 -.10 IN OTHER WORDS, DEMAND WAS INELASTIC, AND YOU SHOULD RAISE PRICES TO INCREASE REVENUES. PROBLEM: THE MARK-UP ON MOST LUMBER WAS 10 - 20%. THE MARK-UP ON HARDWARE, PAINTS, ETC. THAT WE ALSO SOLD RANGED FROM 50 - 250%. WE DON’T CARE IF WE LOSE MONEY ON 2X4s WE WANT TO GET THEM IN THE STORE AND SELL THEM OTHER STUFF (LOSS LEADER) CROSS-PRICE ELASTICITY HOW DOES THE CHANGE IN THE PRICE OF ONE GOOD, LIKE 2X4s, CHANGE THE QUANTITY DEMANDED (SHIFT THE DEMAND CURVE) FOR OTHER GOODS, LIKE HARDWARE? % CHANGE IN THE QUANTITY DEMANDED OF GOOD “A” EC = -------------------------------------------------------% CHANGE IN THE PRICE OF GOOD “B” NOW, THE SIGN OF THE COEFFICIENT IS IMPORTANT IF EC > 0 ---> SUBSTITUTE GOODS IF EC < 0 ---> COMPLEMENTARY GOODS IF EC = 0 ---> UNRELATED GOODS MONOPOLY? THE ALCOA CASE INCOME ELASTICITY MEASURES THE CHANGE IN QUANTITY DEMANDED (SHIFT IN THE DEMAND CURVE) RESULTING FROM A CHANGE IN CONSUMERS’ INCOMES % CHANGE IN THE QUANTITY DEMANDED EY = -------------------------------------------------------------% CHANGE IN CONSUMERS’ INCOMES AGAIN, THE SIGN MATTERS, IT TELLS WHETHER THE DEMAND CURVE IS SHIFTING OUT (+) OR IN (-) IF EY > 0 ---> “NORMAL GOOD” EXAMPLES: CLOTHING, CD’s, GASOLINE IF EY > 0 AND LARGE ---> “LUXURY GOOD” EXAMPLES: VARIETAL WINES (IN U.S.), FILET MIGNON, CHICKEN (IN THE 1930’s) IF EY < 0 ---> “INFERIOR GOOD” EXAMPLES: ROOT VEGATABLES, GRITS WHAT IS A NORMAL GOOD IN ONE PLACE AND TIME MAY NOT BE IN ANOTHER THE ELASTICITY OF JUST ABOUT ANYTHING ADVERTISING ORE BODIES