Corporate Tax Return

advertisement

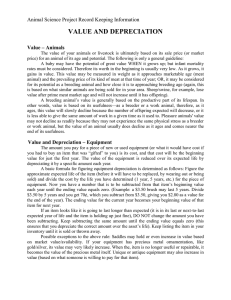

Tax II Corporate Tax Return Fall 2009 Due date: September 8 (Outreach September 15) Spring distance due date Feb 5 – please do not send earlier than Feb 4 Complete Form 1120 for Angler Corporation tax return problem #1 on page 2-51 of the text book. Install and use the TaxCut Business software on the CD packaged with the book. UPDATE the software when you load it. You do not need to do any further updates. Send the return by e-mail attachment to the Graduate Assistant who works with me, Katherine King - kzk0007@auburn.edu. Go into “file,” “print,” and select PDF. Then you will be able to save the file as a PDF file. Send the PDF file. The software will interview you, or you may select “whole form” and use the forms directly. It is a good idea to go through the interview process at the beginning for business name, etc. When it is time to enter numbers, I recommend “whole form” and then using “jump to linked field” as you go through the line items that have a link available. Additional information: 1. I used “sales” for business activity and “fishing tackle” for product and business code 451120 (for sales of hobby-type items). 2. Assume the owners are U.S. citizens. When you enter information about the time devoted to the business, put 100%, which indicates full-time. Make up addresses as needed. 3. Dividends are not in excess of accumulated earnings and profits. 4. For Cost of Goods Sold, see the Balance Sheets for beginning and ending inventory and plug an amount for purchases that will provide the correct CGS. IRC Section 263A does not apply, and there have been no changes in accounting method for inventory. 5. Override to enter depreciation = 40,000. This override should be the only one that you use. Overrides are normally a bad idea, but using this one keeps things much simpler for the tax return. 6. The software will work backwards to solve for Schedule M-1 Lines 1 and 2. Check these amounts against the amounts in the book. If the amounts are incorrect, something is wrong on the Schedule M-1 or on page 1. I recommend you do not enter ending RE on the Balance Sheet. Let the software calculate it and then check that it is correct. (You need to enter the dividends on Schedule M2; then ending RE should be correct.) 7. You need to do a final error check. Informational errors and the depreciation override are fine.