Wedding, private event and Bar Mitzvah

advertisement

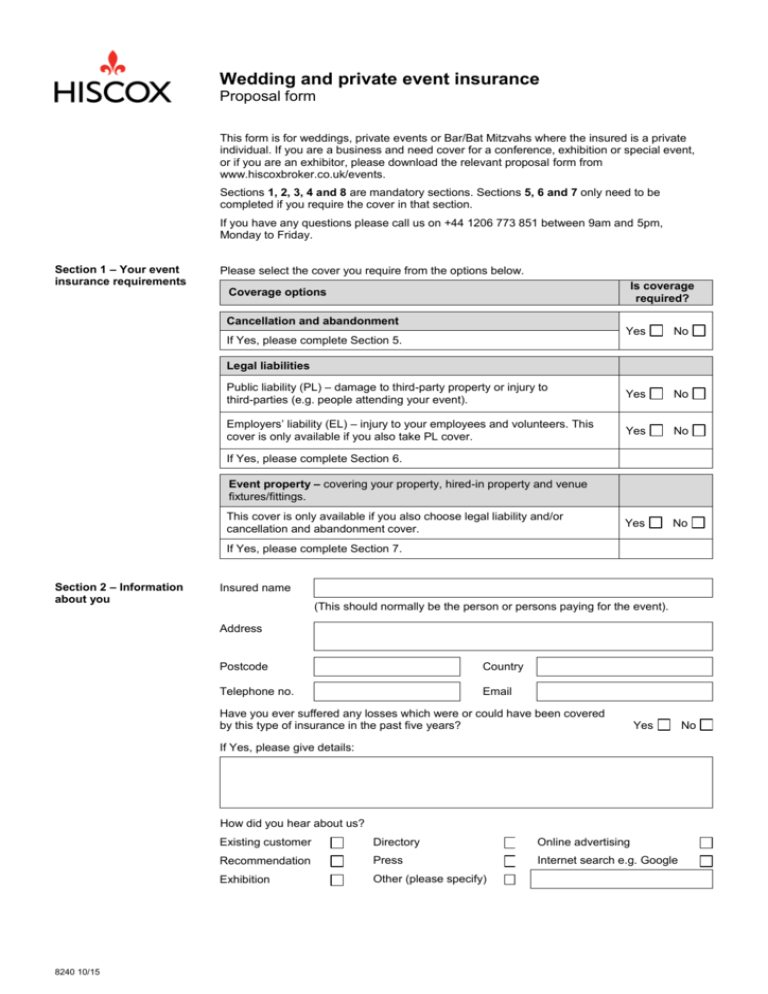

Wedding and private event insurance Proposal form This form is for weddings, private events or Bar/Bat Mitzvahs where the insured is a private individual. If you are a business and need cover for a conference, exhibition or special event, or if you are an exhibitor, please download the relevant proposal form from www.hiscoxbroker.co.uk/events. Sections 1, 2, 3, 4 and 8 are mandatory sections. Sections 5, 6 and 7 only need to be completed if you require the cover in that section. If you have any questions please call us on +44 1206 773 851 between 9am and 5pm, Monday to Friday. Section 1 – Your event insurance requirements Please select the cover you require from the options below. Is coverage required? Coverage options Cancellation and abandonment Yes No Public liability (PL) – damage to third-party property or injury to third-parties (e.g. people attending your event). Yes No Employers’ liability (EL) – injury to your employees and volunteers. This cover is only available if you also take PL cover. Yes No Yes No If Yes, please complete Section 5. Legal liabilities If Yes, please complete Section 6. Event property – covering your property, hired-in property and venue fixtures/fittings. This cover is only available if you also choose legal liability and/or cancellation and abandonment cover. If Yes, please complete Section 7. Section 2 – Information about you Insured name (This should normally be the person or persons paying for the event). Address Postcode Country Telephone no. Email Have you ever suffered any losses which were or could have been covered by this type of insurance in the past five years? Yes If Yes, please give details: How did you hear about us? 8240 10/15 Existing customer Directory Online advertising Recommendation Press Internet search e.g. Google Exhibition Other (please specify) No Wedding and private event insurance Proposal form Section 3 – Information about the event Event name What type of event is this? Wedding or civil partnership Bar Mitzvah or Bat Mitzvah Other event (please describe the type of event) Is a professional event organiser running this event on your behalf? Yes No Name of the company organising your event Period of the event From / / To / / Venue tenancy dates (including build-up and breakdown) From / / To / / How many guests do you expect to attend the event? Section 4 – Information about the venue Venue name Venue address Postcode Country Do written contracts of hire exist between either you or your event organiser and the venue(s)? Yes No Is any part of this event to be held in the open, or in a tent, marquee or temporary structure? Yes No Yes No Are you using any other venues/locations for parts of this event (e.g. church or register office for the wedding ceremony)? If Yes, please give details: Section 5 – Cancellation and abandonment cover Please complete this section if you require cancellation and abandonment cover. Currency (this is normally the currency in which the event budget is held) Expenses (this is the total of everything you spend organising the event) If the event is a wedding and you wish to include cover for honeymoon expenses, what is the cost of the honeymoon? Cover for the non-appearance of key people Cover is provided as part of your cancellation cover for circumstances where the nonappearance of key people results in the necessary and unavoidable postponement, abandonment, cancellation, curtailment or relocation of the insured event. Cover depends on the type of event and is subject to certain conditions and exclusions (see the policy wording for more details). 8240 10/15 Wedding and private event insurance Proposal form If the event is a wedding, cover is provided for: If the event is a private party, cover is provided for: 1. The host and hostess, their parents, stepparents, children and siblings (if invited). 2. the official who is booked to preside over the wedding; the bride and groom, their parents, stepparents, children and siblings, the best man, the ushers and bridesmaids. If the event is a Bar/ Bat Mitzvah, cover is provided for: 1. the Rabbi or the Cantor who are booked to preside over the event; 2. the bar mitzvah boy or bat mitzvah girl, their parents/ stepparents, brothers and sisters (if invited). Question 1 Are any of these key people travelling to the event from overseas? Yes No Yes No Yes No Yes No Yes No Yes No Yes No Yes No Yes No Yes No Yes No Yes No Question 2 Are any of these key people due to arrive in the country where the event is taking place less than 24hours before the start of the event? Question 3 Do any of these key people have any known medical conditions? Question 4 Will any of these key people be over 70 years of age on the day of the event? If you have answered Yes to any of the questions above, please give details below. Do you require cover for any additional people, other than those listed above (e.g. other members of family or performers/artists at the event)? Yes No Yes No If Yes, please give details below Are more than 25% of guests traveling to the event from overseas? 8240 10/15 Wedding and private event insurance Proposal form Other cancellation coverage options Is cover required? Option 1 – Adverse weather cover for outdoor events Adverse weather is automatically provided as part of your cancellation cover for the indoor elements of your event. Do you require adverse weather cover for any part of your event which will be held in the open or in a temporary structure? Yes N/A No If Yes, please answer the questions below. If the amount insured against cancellation is less than £25,000, can you confirm that, to the best of your knowledge, the following is true: 1. no event has been cancelled at the venue in the past five years due to water logging or flood; 2. the venue is not particularly exposed to high winds (e.g. on the coast or on a hill); 3. the venue is more than 250 metres from the nearest river or stream. Yes No N/A If the amount insured against cancellation is greater than £25,000, we will send a supplementary questionnaire for you to complete. Please note that we may not be able to offer this cover if the event is imminent. Option 2 – Additional terrorism cover Cover is automatically provided for cancellation and abandonment losses caused by a terrorist attack for the event expenses, or £300,000, whichever is the lower. If event is costing more than £300,000, would you like a quote to increase the terrorism cover up to the full expenses? Section 6 – Legal liabilities cover Yes No Please complete this section if you require legal liabilities cover. Public liability (PL) cover This covers claims for damage to third-party property or injury to third-parties. What currency do you want the public liability limit to be in? What limit of public liability (PL) cover do you require? 1 million 2 million 5 million 10 million Will fireworks be used during this event? Yes No If Yes, are you employing a professional fireworks contractor? Yes No Does this event involve any potentially hazardous or unusual activities that could cause injury to anyone or damage to property (e.g. bouncy castles or other inflatables, fairground rides)? Yes No If Yes, please give full details including safety measures taken: 8240 10/15 Other Wedding and private event insurance Proposal form Employers’ liability (EL) cover This cover is a statutory requirement in the UK. It covers claims for damages following an injury to someone working for you at the insured event. This includes permanent and temporary staff, and volunteers (see the Key Facts document and policy wording for more details). Please note that: 1. we only offer EL cover along with PL cover, not on a standalone basis; 2. the standard limit we give is £10,000,000, or currency equivalent; 3. werequire cannotemployers’ cover employees contractors hired for the event, e.g. catering and Do you liability of (EL) insuranceyou for have this event? bar staff. How many employees, including will be at this event? Do you require employers’ liabilityvolunteers, (EL) insurance foremployed this event? Yes No How many employees, including volunteers, will be employed at this event? What kind of work will they be doing? Section 7 – Property cover Please complete this section if you require cover for property you own or property you have hired. Part 1 – General event property Amount of cover required If the event is a wedding we can cover; wedding attire, gifts, rings, cakes, flowers and stationery. If the event is a private party we can cover; gifts, cake, flowers and stationery. If the event is a Bar/Bat Mitzvah we can cover: Bar mitzvah gifts, cake, flowers and stationery. When are you covered? In the seven days leading up to the event, whilst these items are in your care. Up to 24-hours after the event whilst these items are at your home or in transit between your home and the event venue. Part 2 – Damage to venue cover We can offer a £10,000 (or currency equivalent) limit of cover for damage to buildings, fixtures and fittings at the venue which you are legally liable for. Do you require this cover? 8240 10/15 Yes No Wedding and private event insurance Proposal form Part 3 – High value property Description (e.g. no. and type of items) Value of owned equipment Value of hired equipment Is transit cover required? Marquees Yes No Audio visual/multimedia equipment Yes No Other Yes No Is all of the above property in good condition or state of repair? Yes No Will the property be left unattended at any point during the event? Yes No If Yes, please give details of all security arrangements: Section 8 Declaration and signatures Confidentiality and data protection By signing this proposal form you consent to Hiscox using the personal data you provide to us for the purpose of arranging and administering your insurance. This may also include sensitive personal data where necessary. We may share your personal data with third parties such as insurance providers, claims adjusters, fraud detection and prevention services and regulatory authorities. Where personal data relates to anyone other than yourself, you must obtain the consent of the person to whom the information relates, both to the disclosure of such information to us and its use by us as set out above. All personal data will be treated in confidence and in compliance with the Data Protection Act 1998. You have the right to apply for a copy of your information (for which we may charge a small fee) and to have any inaccuracies corrected. Law and jurisdiction You and we are free to choose the law applicable to this contract. Unless specifically agreed to the contrary this insurance shall be subject to English law and the policy wording will be in English. Information In deciding to accept this insurance and in setting the terms and premium, we have relied on the information you have given us. You must take care when answering any questions we ask by ensuring that all information provided is accurate and complete. You must tell us, as soon as possible, if there are any changes to the information you have given us. If you are in any doubt, please contact us or your insurance agent. When we are notified of a change we will tell you if this affects your policy. For example we may cancel your policy in accordance with the cancellation condition, amend the terms of your policy or require you to pay more for your insurance. If you do not inform us about a change it may affect any claim you make or could result in your insurance being invalid. Misrepresentation If we establish that you deliberately or recklessly provided us with false information we will treat the insurance as if it never existed and decline all claims. If we establish that you were careless in providing us with the information we have relied upon in accepting the insurance and setting its terms and premium we may: (i) treat the insurance as if it never existed, refuse all claims and return the premium. (We will only do this if we provided you with insurance cover which we would not otherwise have offered); (ii) amend the terms of the insurance (We may apply these amended terms as if they were already in place if a claim has been adversely impacted by your carelessness); (iii) charge more for the insurance or reduce the amount we pay on a claim in the proportion that the premium you have paid bears to the premium we would have charged you; or (iv) cancel the insurance in accordance with the cancellation condition of the insurance. 8240 10/15 Wedding and private event insurance Proposal form We or your insurance agent will write to you if we: (i) intend to treat this insurance as if it never existed; (ii) need to amend the terms of your policy; or (iii) require you to pay more for your insurance. Declaration I declare that (a) this proposal form has been completed after proper enquiry; (b) its contents are true, accurate and complete and (c) reasonable care has been taken to answer all questions honestly and to the best of my/our knowledge. I declare that: 1. I have not been convicted of any offence (other than motoring offences and spent convictions) in the last five years; 2. I have not been declared bankrupt in the last five years (including business partners); 3. I have not had another insurer decline, refuse to continue or apply special terms for anyone whose property or event is to be insured; 4. I am not aware of any current circumstances that could lead to a claim under this policy; 5. I understand that the signing of this proposal form does not bind me to purchase the insurance but agree that, should a contact of insurance be concluded, this proposal form and the statements made in it and the information provided in connection with it will be relied upon by us in deciding whether to accept this insurance. We require a signature in ink. Name Signature Date / / Please check that you have completed all relevant sections then return the signed and dated form to us: Email: eventinsurance@hiscox.com Fax: 0800 042 0335 Post: Hiscox, PO Box 501, Sittingbourne, ME10 9AF You should keep a copy of this form for your records. Policies are underwritten by Hiscox Underwriting Ltd on behalf of certain syndicates at Lloyd's (managed by Hiscox Syndicates Ltd) and Hiscox Insurance Company Ltd. Hiscox Underwriting Ltd is authorised and regulated by the Financial Conduct Authority. Hiscox Syndicates Ltd and Hiscox Insurance Company Ltd are authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. T 0800 840 2469 F 0800 042 0335 E eventinsurance@hiscox.com www.hiscox.co.uk For training and quality control purposes, telephone calls may be monitored or recorded. 8240 10/15