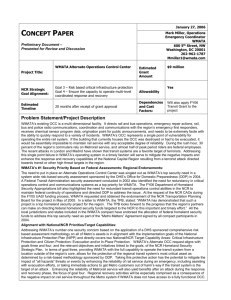

Washington Metropolitan Area Transit Authority Performance

advertisement