IRS News

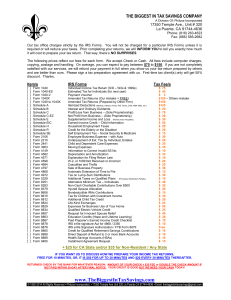

advertisement

INTERNAL REVENUE SERVICE NEWS FOR TAX PROFESSIONALS FEBRUARY 2009 ● There are many provisions of benefit to those in the Midwest disaster areas, including those attending college in these areas. Publication 4492-B and Fact Sheet 2008-27 (available soon) will have the latest information. ● Notice 2009-11 announces that Brokers May Furnish Certain Composite Annual Tax Reporting Statements by February 17, 2009, Without Penalty. The notice provides for a new February due date on an annual composite tax reporting statement, such as interest and dividends reported on Form 1099-INT and Form 1099-DIV. ● IR-2009-4 The IRS is offering a daily series of Tax Tips for the 2009 federal tax filing. ● Need information on the Recovery Rebate Credit? Go to the information center. ●If you have Spanish speaking constituency, see information on our IRS web site El IRS en Español (The IRS in Spanish). ● Upcoming Tax Talk Today programs include Surviving the IRS Audit on March 10th and Specialty Taxes: Estate and Gift and Employment Taxes on May 12th. ● The following seven forms will be disabled for e-filing until late February 2009 Form 3468, Investment Credit Form 5884-A, Credits for Affected Midwestern Disaster Area Employers Form 6478, Alcohol and Cellulosic Biofuel Fuels Credit Form 8820, Orphan Drug Credit Form 8900, Qualified Railroad Track Maintenance Credit Form 8909, Energy Efficient Appliance Credit Form 8912, Credit for Clean Renewable Energy and Gulf Tax Credit Bonds Form 8835, Renewable Electricity Production Credit Additionally, Form 8854, Initial and Annual Expatriation Information Worksheet, will be disabled for the entire 2009 Filing Season with Error Subscribe to Quick Alerts to hear when these forms are enabled for electronic filing. RECENT TECHNICAL GUIDANCE ● Mailing addresses for where to file your clients’ tax forms for 2009 are available. Lockbox payment addresses are changing for some individual and business taxpayers. The IRS has a number of toll-free numbers and hotlines to help you and your clients. ● The Current Edition of the Employee Plans News is available in the Retirement Plans Community section of the IRS.gov Web site. If you have a technical or procedural question relating to retirement plans, please visit the EP Customer Account Services If you have a specific concern about your retirement plan, call EP CUSTOMER ACCOUNT SERVICES at 1-877-8295500. The call center is open Monday - Friday, 7:30am to 4:30pm, Central Time. ● IR 2008-141The IRS announced an expedited process that will make it easier for financially distressed homeowners to avoid having a federal tax lien block refinancing of mortgages or the sale of a home. ● IR-2008-142 Publication 17, “Your Federal Income Tax,” comprehensive tax guide for individuals is available on IRS.gov. It contains more than 900 interactive links. ● IR-2009-02: IRS Begins Tax Season 2009 with Steps to Help Financially Distressed Taxpayers; Promotes Credits, e-File Options ● IR-2009-3— In the annual report, National Taxpayer Advocate urged Congress to simplify the tax code and recommended measures to reduce the burden on taxpayers who are struggling to pay their tax bills. ● IR-2009-5, The IRS announced the opening of an expanded IRS e-file program for 2008 federal tax returns. ● FS-2009-01: Highlights of 2008 Tax Law Changes: Popular Tax Breaks Renewed, Recovery Rebate Credit Available, Relief for Homeowners ● FS-2009-02: Tax Credits Provide Funds for First-Time Homebuyers, Childcare, Education and More ● FS-2009-03: Recovery Rebate Credit Is for Individuals Who Missed Last Year’s Economic Stimulus Payment ● FS-2009-04: The Official Internal Revenue Service Web Site Is IRS.gov ● Notice 2009-01 provides that a section 529 program (qualified tuition program) does not violate the investment restriction under section 529(b)(4) if it permits a participant to change investment strategy selected for a section 529 account twice during calendar year 2009. A change in investment strategy upon a change in the designated beneficiary of the account continues to be permitted as under Notice 2001-55. ● Notice 2009-05 provides guidance regarding implementation of the tax return preparer penalty under section 6694(a). TD 9436 contains final regulations implementing amendments to the tax return preparer penalties under sections 6694 and 6695. Revenue Procedure 2009-11 ● Notice 2009-06 provides a temporary safe harbor and a transitional rule to implement a statutory change in the amount of denaturant that will be considered as "alcohol" for purposes of certain alcohol fuel credits. ● Notice 2009-07 designates a Transaction of Interest and outlines the disclosure requirements for situations where a domestic partnership is used to prevent the inclusion of subpart F income. ● Notice 2009-08 provides interim guidance on recently enacted § 457A, which generally provides that compensation deferred under a nonqualified deferred compensation plan of a nonqualified entity is includible in gross income when there is no substantial risk of forfeiture of the right to such compensation. ● Notice 2009-09 provides guidance to financial institutions on the reporting rules applicable to required minimum distributions for 2009 in light of the enactment of H.R. 737, The Worker, Retiree and Employer Recovery Act of 2008. ● Notice 2009-10 provides guidance for the treatment of certain obligations under IRC section 956(c). ● Notice 2009-12 explains how to allocate the first-time homebuyer credit under section 36 of the Code between unmarried co-purchasers of a principal residence. ● Revenue Procedure 2009-10 provides a safe harbor under which the Service will not challenge the treatment of a Payment or Excess Amount received by a money market fund from a fund advisor before January 1, 2010, provided that the money market fund treats the Payment or Excess Amount, as applicable, as short-term capital gain in the taxable year in which it is received. ● Revenue Procedure 2009-13 covers Form 944. TD 9440, REG 148568-04. ● Revenue Procedure 2009-14, provides guidance that makes the existing Pre-Filing Agreement (PFA) program permanent. ● Revenue Procedure 2009-15 provides temporary guidance regarding certain stock distributions by publicly traded real estate investment trusts (REITs). This revenue procedure amplifies and supersedes Rev. Proc. 2008–68 to extend the same treatment to publicly traded regulated investment companies (RICs). ● Revenue Ruling 2009-02 provides the covered compensation tables under section 401 of the Code for the year 2009 for use in determining contributions to defined benefit plans and permitted disparity. ● TD 9438 - contains regulations that provide guidance relating to foreign base company sales income in cases in which personal property sold by a controlled foreign corporation is manufactured, produced, or constructed pursuant to a contract manufacturing arrangement or by one or more branches of the controlled foreign corporation. These regulations, in general, will affect controlled foreign corporations and their United States shareholders. REG-150066-08 ● TD 9439 - contains final regulations relating to disclosures of corporate tax return information to the Bureau of Economic Analysis (Bureau). . ● TD 9441 contains temporary regulations that provide further guidance and clarification regarding methods under section 482 to determine taxable income in connection with a cost sharing arrangement in order to address issues that have arisen in administering the current regulations. REG-144615-02 ● TD 9442 - contains final regulations under section 1502 regarding the treatment of transactions involving obligations between members of a consolidated group. These final regulations will affect affiliated groups of corporations filing consolidated returns. ● TD 9443 contains final regulations relating to postponement of certain tax-related deadlines either due to service in a combat zone or due to a federally declared disaster. ● REG-113462-08 contains proposed regulations relating to conduit financing arrangements. The proposed regulations apply to multiple-party financing arrangements that are effected through disregarded entities, and are necessary in order to determine which of those arrangements should be recharacterized under section 7701(l) and Treas. Reg. §1.881-3. ● REG-150670-07 provides guidance regarding the distribution of stock of a controlled corporation acquired in a transaction described in section 355(a)(3)(B). ● REG-160872-04 contains proposed regulations under section 6707 of the Internal Revenue Code (Code), which provide the rules relating to the assessment of penalties against material advisors who fail to timely file a true and complete return required under section 6111(a).