Here

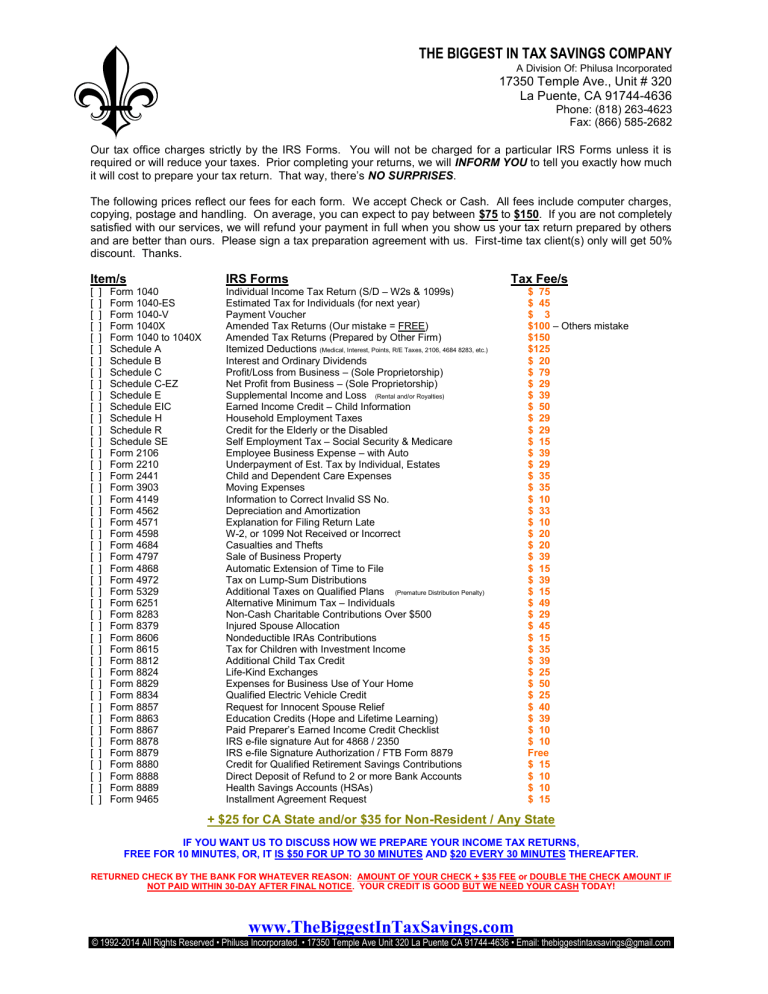

THE BIGGEST IN TAX SAVINGS COMPANY

A Division Of: Philusa Incorporated

17350 Temple Ave., Unit # 320

La Puente, CA 91744-4636

Phone: (818) 263-4623

Fax: (866) 585-2682

Our tax office charges strictly by the IRS Forms. You will not be charged for a particular IRS Forms unless it is required or will reduce your taxes. Prior completing your returns, we will INFORM YOU to tell you exactly how much it will cost to prepare your tax return. That way, there’s NO SURPRISES .

The following prices reflect our fees for each form. We accept Check or Cash. All fees include computer charges, copying, postage and handling. On average, you can expect to pay between $75 to $150 . If you are not completely satisfied with our services, we will refund your payment in full when you show us your tax return prepared by others and are better than ours. Please sign a tax preparation agreement with us. First-time tax client(s) only will get 50% discount. Thanks.

Item/s

[ ] Form 1040

[ ] Form 4684

[ ] Form 4797

[ ] Form 4868

[ ] Form 4972

[ ] Form 5329

[ ] Form 6251

[ ] Form 8283

[ ] Form 8379

[ ] Form 8606

[ ] Form 8615

[ ] Form 8812

[ ] Form 8824

[ ] Form 8829

[ ] Form 8834

[ ] Form 8857

[ ] Form 8863

[ ] Form 8867

[ ] Form 8878

[ ] Form 8879

[ ] Form 8880

[ ] Form 8888

[ ] Form 8889

[ ] Form 9465

[ ] Form 1040-ES

[ ] Form 1040-V

[ ] Form 1040X

[ ] Form 1040 to 1040X

[ ] Schedule A

[ ] Schedule B

[ ] Schedule C

[ ] Schedule C-EZ

[ ] Schedule E

[ ] Schedule EIC

[ ] Schedule H

[ ] Schedule R

[ ] Schedule SE

[ ] Form 2106

[ ] Form 2210

[ ] Form 2441

[ ] Form 3903

[ ] Form 4149

[ ] Form 4562

[ ] Form 4571

[ ] Form 4598

IRS Forms

Individual Income Tax Return (S/D – W2s & 1099s)

Tax Fee/s

$ 75

Estimated Tax for Individuals (for next year)

Payment Voucher

Amended Tax Returns (Our mistake = FREE)

Amended Tax Returns (Prepared by Other Firm)

$ 45

$ 3

$100

– Others mistake

$150

Itemized Deductions

(Medical, Interest, Points, R/E Taxes, 2106, 4684 8283, etc.)

$125

Interest and Ordinary Dividends

Profit/Loss from Business – (Sole Proprietorship)

Net Profit from Business

– (Sole Proprietorship)

Supplemental Income and Loss

(Rental and/or Royalties)

Earned Income Credit – Child Information

$ 20

$

$

$

79

29

39

$ 50

Household Employment Taxes

Credit for the Elderly or the Disabled

Self Employment Tax

– Social Security & Medicare

Employee Business Expense – with Auto

$ 29

$ 29

$ 15

$ 39

Underpayment of Est. Tax by Individual, Estates

Child and Dependent Care Expenses

Moving Expenses

Information to Correct Invalid SS No.

Depreciation and Amortization

Explanation for Filing Return Late

W-2, or 1099 Not Received or Incorrect

Casualties and Thefts

Sale of Business Property

Automatic Extension of Time to File

$ 20

$ 39

$ 15

Tax on Lump-Sum Distributions $ 39

Additional Taxes on Qualified Plans

(Premature Distribution Penalty)

$ 15

Alternative Minimum Tax – Individuals $ 49

Non-Cash Charitable Contributions Over $500

Injured Spouse Allocation

Nondeductible IRAs Contributions

Tax for Children with Investment Income

Additional Child Tax Credit

Life-Kind Exchanges

Expenses for Business Use of Your Home

$ 29

$ 35

$ 35

$ 10

$ 33

$ 10

$ 20

$ 29

$ 45

$ 15

$ 35

$ 39

$ 25

$ 50

$ 25

$ 40

Qualified Electric Vehicle Credit

Request for Innocent Spouse Relief

Education Credits (Hope and Lifetime Learning)

Paid Preparer’s Earned Income Credit Checklist

IRS e-file signature Aut for 4868 / 2350

IRS e-file Signature Authorization / FTB Form 8879

Credit for Qualified Retirement Savings Contributions

Direct Deposit of Refund to 2 or more Bank Accounts

Health Savings Accounts (HSAs)

Installment Agreement Request

$ 39

$ 10

$ 10

Free

$ 15

$ 10

$ 10

$ 15

+ $25 for CA State and/or $35 for Non-Resident / Any State

IF YOU WANT US TO DISCUSS HOW WE PREPARE YOUR INCOME TAX RETURNS,

FREE FOR 10 MINUTES, OR, IT IS $50 FOR UP TO 30 MINUTES AND $20 EVERY 30 MINUTES THEREAFTER.

RETURNED CHECK BY THE BANK FOR WHATEVER REASON: AMOUNT OF YOUR CHECK + $35 FEE or DOUBLE THE CHECK AMOUNT IF

NOT PAID WITHIN 30-DAY AFTER FINAL NOTICE. YOUR CREDIT IS GOOD BUT WE NEED YOUR CASH TODAY!

www.TheBiggestInTaxSavings.com

© 1992-2014 All Rights Reserved • Philusa Incorporated. • 17350 Temple Ave Unit 320 La Puente CA 91744-4636 • Email: thebiggestintaxsavings@gmail.com