Safe Work Australia Enterprise Agreement 2011-2014

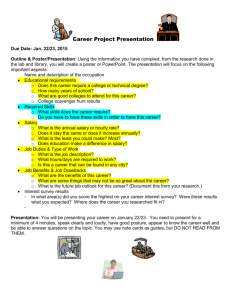

advertisement