Estates & Trusts - Zamperini - 2003 Spr

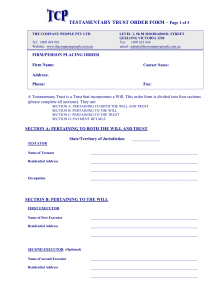

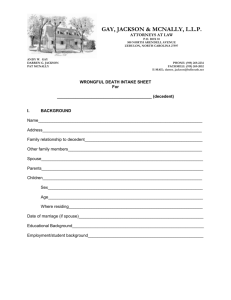

advertisement