Executive Summary

Table of Contents

Executive Summary………………………………………………………………………2

Company Description………………………………………………………….…………2

Situation Analysis………………………………………………………………………...3

SWOT Analysis…………………………………………………………………………….3

Environmental Scan………………………………………………………………………..4

Plan Objectives……………………………………………………………………………..5

Market Segmentation and Buyer Behavior………………………………………………6

Target Markets…………………………………………………………………………….6

Industry Analysis……………………………….………………………………………….7

Competitor Analysis……………………………………………………………………….7

Strategic Direction……………………..………………………………………………..8

Business Portfolio Analysis……………………………………………………………….8

Product-Market Analysis…………………………………………………………………9

Marketing Mix Strategies……………………………………………………………….9

Product……………………………………………………………………………………..9

Price……………………………………………………………………………………….11

Place……………………………………………………………………………………….14

Promotion…………………………………………………………………………………15

Positioning…………...……………………………………………………………………17

Features and Benefits Sheet……………………………………………………………...17

Implementation………………………………………………….………………………17

Resources Required………………………………………………………………………17

Action/Timing……………………………………………………………………………..19

Gantt Chart………………………………………………………………………………..19

Quantity Analyses………………………………………………………………...………20

Organization Chart……………………………………………………………………….20

Evaluation & Control…………………………………………………………………...20

Monitored data and frequency…………………………………………………………..20

Marketing Mix modifications……………………………………………………………21

Appendix………………………………………………………………………..……….22

A.

Primary Data: Marketing Research Questionnaire…………………………………22

B. Works Cited…………………………………………………………………………….23

1

Executive Summary

Trail Tracker is a never-before-seen product that will revolutionize winter sports. Created by one of the leading creators of Global Positioning System products, Garmin is the first company to synergize electronics and trail maps. The goal of Trail Tracker is to ease the confusion of trail maps for winter sport enthusiasts; with Trail Tracker, one can see their current location and trail options, the overall mountain trail map, trail closures, temperature and wind conditions, and an emergency button. This device aims to create convenience through its immediate accessibility on the slopes. Currently, if one became lost on a mountain they have to stop, take off their gloves, open a trail map, figure out their current location, try to remember which runs are open, and look for a route. All of these stresses are alleviated with the Trail Tracker: with one press of a button one can see their current location and assess multiple options. Not only does Trail Tracker provide GPS services, it also creates confidence for skiers and snowboarders with the emergency button. When pressed, the Trail Tracker sends a signal and location to the Emergency Center ensuring a prompt rescue. The durable design coupled with the large joystick and buttons make Trail Tracker easily worn on the forearm on top of a jacket so no gloves have to be taken off or pockets unzipped. The services that this device provides are invaluable—once a skier tries this product, they will never want to ski the mountain again without it.

Garmin aims for this product to become an essential device for all winter activities. As its reputation and popularity grows, Trail Tracker will become an indispensable commodity for all major ski resorts to sell and rent to their customers. It will instill confidence in its users and ease the stress of navigating large ski resorts. Trail maps are notorious for their complexity and their impracticality, and with the production of Trail Tracker no one will ever lose their way on the slopes again.

Company Description

What first began as a brainstorming session of engineers around a card table in 1989 has currently matured into Garmin, a provider of devices using a Global Positioning System “to create navigation and communication devices that can enrich our customers’ lives” according to their mission statement. Co-founders Gary Burrell and Dr. Min Kao founded their company on the principles of innovation, convenience, performance, value, and service providing products that span various areas of interest which include automotive, aviation, marine, fitness, outdoor recreation, and wireless applications. What began as a factory in Olathe, Kansas, has now expanded their operations globally to

England, Taiwan, and Oregon.

Garmin provides devices aiming to sidestep the stress of navigation or travel with their easy-touse menus, logical options, and intuitive features. Their automotive products help drivers reach their destinations by providing directions and maps, marine unites provide detailed charts, aviation technology displays pilots’ necessities at a glance, fitness devices make workouts more efficient, and

2

outdoor recreation options provide direction for hikers and campers. Its penetration into diverse markets makes this company currently successful, and also provides opportunities for future growth. In 2006,

Garmin created 70 new products and they are constantly inventing more to remain at the top of the GPS

(Global Positioning System) competitive market.

The diversity of devices produced along with the global expansion of the company provides a solid financial and manufacturing base for new products like Trail Tracker.

Situation Analysis

SWOT Analysis

Internal Factors Strengths

Management Experienced management, board, and staff

Weaknesses

Rapid company growth may strain management resources

Offerings

Marketing

GPS and WAAS-enhanced navigation, communication, and information devices

Devices may be too complicated for casual users

Market shares in Marine, Recreation and

Outdoors, Fitness, Automotive, and Aviation industries; Strong brand equity

There exists only one Garmin retail store worldwide

Personnel

Finance

Manufacturing

Employs 4,750 associates worldwide Employee salaries and wages significantly cut net sales margins

All time record sales of $1.77 billion in 2006 All time record total operating expenses of $327.8 million in 2006

Introduced more than 70 new products in 2006 Products become quickly outdated

R&D Spent $113.3 million in R&D in 2006;

(compare with $32.2 million spent in R&D in

2002)

Need for constant innovation to maintain and increase market shares

External Factors Opportunities Threats

Consumer/Social Constant increase in demand for new products; increasing trend for GPS navigation devices (particularly in automotive industry)

Products may be too complex for some consumers

Competitive Strong brand equity and growing popularity Competitors may make cheaper, simpler devices and capture greater market share

Technological

Economic

New technologies enable product combinations (ex. GPS and Bluetooth)

Competitors have equal access to available technology

Consumers value advances in navigation, communication and information technology

Increasing numbers of people are in debt and may not have enough disposable income for leisure products

Legal/Regulatory U.S. government discontinued Selective

Availability in 2004

International partners of Garmin may have legal restrictions the U.S. doesn’t have

3

Environmental Scan

Social Forces.

Demographically, generation X and Y customers are interested in new technology, either for themselves or their children. For example, owning laptops, cell phones, mp3 players, and HD TVs are very popular nowadays. Whereas before, GPS were primarily used by government and military, the GPS market is now becoming highly popular among everyday people.

Culturally, the GPS niche appeals to wealthy peoples because navigation devices are seen as luxury and leisure possessions. As a result, upper and middle class citizens are most likely to purchase

GPS devices because they have more disposable income than lower class citizens.

Economic Forces.

Macro economic conditions in the United States provide possible obstacles to the success of GPS products such as the Trail Tracker. Many aspects of the American economy are struggling currently. For example, real estate property value is increasing making it difficult for people to buy and sell private and commercial property. Also, gas and oil prices have also hit all time highs in the past few years. Another example is education. The price of college education is increasing dramatically over the past few years.

On the foreign affairs front, the Iraq war is creating an enormous national debt. These trends will ultimately negatively affect consumers.

Micro economic trends are also important to consider. The strains of increased prices in gas, education, real estate on American spenders will reduce their disposable and discretionary income.

Consequently, there will likely be decrease in the number of purchases of expensive leisure products like the Garmin Trail Tracker.

Technological Forces.

New technology related to GPS navigation systems continues to come out. For example, a new

50-channel GPS receiver that "boasts an acquisition performance of less than one second" when combined with its AssistNow A-GPS service is now available. These fifth-generation devices have been implemented into the industry standard LEA form factor, which will make adding them into various automotive, consumer and industrial applications easy. Batteries with longer hours, and thinner devices with larger screens are also being developed and redeveloped. TV, Bluetooth, and radio functions are also being added into many GPS devices.

Competitive Forces.

Entry into the GPS producing market is relatively easy as is evidenced in that there are over 130 different brands that offer GPS navigators. Although entry is easy, success is much more difficult. Top brands like TomTom and Garmin have large market shares and have expert R&D teams that help them continually innovate and create new products.

4

There are many available substitutes in this industry as well. If one brand prices their products too high, dozens of other brands are there to attract such customers. With so many substitutes, companies have to strive particularly hard to differentiate their products from those of other companies.

Political.

A recent change to a federal law discontinuing SA has helped the GPS industry. With GPS devices greater accuracy more people are interested in buying them. Increase in value and popularity have been the primary consequences.

Regulatory Forces.

Various legislative acts have been passed to protect both the company and the consumer in recent years. For example, the Madrid Protocol of 2003 facilitated the protection of U.S. trademarks rights throughout the world. Also, the Better Business Bureau was created to facilitate self regulation by using moral persuasion to get companies to comply with its and national policies. Other acts include the

Sherman Act protecting against horizontal price fixing and predatory pricing, the Consumer Goods

Pricing Act, which prohibits vertical price fixing, the Federal Trade Commission Act which prohibits deceptive pricing, and the Robinson-Patman Act, protecting against geographical pricing and price discrimination.

Natural Forces.

Natural disasters are always affecting consumer buying behavior. With recent floods, tsunamis, earthquakes, fires, and hurricanes many consumers have lost valuable possessions. Instead of spending money on leisure products people may be forced to spend their money on relocating, rebuilding and/or remodeling their homes. As a result their discretionary and disposable income may become more limited.

Plan Objectives

Garmin aspires to accomplish various financial and non-financial objectives with the production of Trail Tracker. Financially, this company hopes to obtain steady revenue growth by doubling sales for the first four years of production of this product, as evidenced in the Evaluation and Control segment of this marketing plan. By the fifth year of production, Garmin hopes to maintain a 75% market share.

Garmin also hopes that the success of this product will boost its stock to an even higher price. Nonfinancially, Garmin plans to remain the premium supplier of GPS goods, and the reigning distributor of ski-GPS systems with the Trail Tracker. While Garmin has been expanding their manufacturing sites globally, another goal is to construct more Garmin stores, as there is only one in Chicago. Specific to

Trail Tracker, Garmin aims to steadily expand distribution of this device to all major ski resorts in North

America for the first three years of production, then penetrate foreign ski destinations by the fifth year of

5

production. Garmin is confident of the success of this product and the accomplishment of these objectives.

Market Segmentation and Buyer Behavior

The Trial Tracker serves three distinct markets. The first market we aim to reach is the skiing and snowboarding member of Generation X. More specifically, we’re looking to target men and women ages 25-42 who are taking family vacations, traveling on business, or take regular trips to mountain resorts. This is our primary market. The Trail Tracker is, at first glance, an extremely advanced trail map. Trail maps are used primarily when the skiers are unfamiliar with a mountain, like on a family vacation to Whistler or a business trip to Denver. These are the people who will make sure they bring their Trail Tracker with them wherever they go, appearing knowledgeable and savvy for their family or associates. They are the adventure travelers, successful individuals and families who desire more than the cliché trips to Hawaii and the Bahamas. The members of Generation X are entrepreneurial and Techfriendly. They love new technology and are willing to try out the latest and greatest. These men and women make up the majority of the skiing market and will be the first market to penetrate.

The second market is the more mature Baby Boomers, who care more and more about safety and longevity as they move to retirement. The features of the Garmin Trail Tracker like the Emergency call and run conditions equip them with the confidence and security to continue chasing their passions.

The Baby Boomers are generally curious but can be skeptical of new technology. The safety features are going to be the key selling point, and the Trail Tracker will be a perfect gift idea for their children and grandchildren.

The third market is the skiers and snowboarders of Generation Y, the young adults from wealthier families that don’t think twice about grabbing their parents’ credit card and heading for the slopes. This is the market that will help turn Trail Tracker technology into the standard method of mountain navigation. Generation Y is the technological generation and has an incredibly fast learning curve. They are the most vulnerable to fads, but they also have the potential to drive the market. With their ability to learn quickly, they also grow accustomed to the technology quickly. By making the Trail

Tracker a commodity they come to rely upon on the slopes, we can secure lifelong customers.

The one thing all these market segments have in common in the fact that they either ski or snowboard. As such, they all are visiting major mountain resorts, which we also must market to greatly.

Places like Whistler in Canada or Vale in Colorado are very high-end resorts that attract a large number of these people, most with plenty of expendable income. By marketing to the large, high-end resorts, we can help increase their prestige and secure channels through which to market the Trail Tracker.

6

Industry Analysis of GPS Navigation

With the explosion of the information age has come a quest for knowledge. More than ever before, consumers have a passionate desire for navigation devices, including Global Positioning

Systems. Busy lifestyles have necessarily facilitated the rapid creation and expansion of such devices.

Increased global travel and domestic mobility also lend people to frequently find themselves in unfamiliar locations.

The Global Positioning System (GPS) was designed as a dual-use system with the primary purpose of enhancing the effectiveness of U.S. and allied military forces. GPS is rapidly becoming an integral component of the emerging Global Information Infrastructure, with applications ranging from mapping and surveying to international air traffic management and global change research. The growing demand from military, civil, commercial, and scientific users has generated a U.S. commercial GPS equipment and service industry that leads the world. Augmentations to enhance basic GPS services could further expand these civil and commercial markets. On May 1, 2000 President George Bush announced the end of Selective Availability when he said,

“Today, I am pleased to announce that the United States will stop the intentional degradation of the Global

Positioning System (GPS) signals available to the public beginning at midnight tonight. We call this degradation feature Selective Availability (SA). This will mean that civilian users of GPS will be able to pinpoint locations up to ten times more accurately than they do now.”

This discontinuation contributed to the manufacturing surge in GPS devices throughout the U.S. Today, there are over 130 brands offering GPS devices. Prominent brands include: Garmin, Tomtom, Magellan,

Lowrance, and Navman. Products range from aviation to fitness to marine to military GPS devices.

Specifically, Garmin brand has emerged as a top market share holder in the GPS navigation device industry.

Competitor Analysis

The GPS market amasses roughly $19 million in annual sales. Recently, GPS systems are being designed to accommodate consumers with all budgets. Depending on the brand and specific device, products can range from about $100 to over $6000. GPS products generally fall into seven categories: personal handheld (laptop, mobile phone, etc.) automotive, fitness, outdoor recreation, marine, aviation, and military. Of these seven, the automotive GPS systems are seeing the most rapid growth in sales.

Major GPS brands include Garmin, Magellan, TomTom, Lowrance, and Navman.

The Garmin Trail Tracker will be the first product of its kind; therefore this specific product does not have any current competitors. Competitor TomTom primarily manufactures automotive and

PDA/mobile navigation GPS and accessories. Magellan, in addition to driving navigation systems, offers hiking, camping and biking GPS navigation. However, they don’t specifically offer a GPS for skiers with downloadable resort trail maps. Lowrance similarly offers automotive, marine, aviation, and

7

outdoor GPS navigation. Again, though, they don’t offer anything to skiing enthusiasts. Navman offers marine and automotive GPS navigation systems. However, they are based in New Zealand and their primary target countries are Australia, New Zealand, UK, Norway, Spain, France, and Italy.

Strategic Direction

Business Portfolio Analysis

Garmin as a company has experience extremely large and rapid growth in the last two years. In

2006, the company had a 170% increase in sales for their automotive product lines, a 20% increase in their outdoor/fitness lines, and 5% & 2% increases in their marine and aviation product lines, respectively. Garmin is the industry leader in GPS navigational products, with over 50% market share in automotive fueling the growth. The automotive GPS lines include the Streetpilot series, the Zumo, and the industry-leading Nuvi series. The high growth rate and high market share of the automotive product lines make them the business’s star performers.

The outdoor/fitness products are also experiencing significant growth. The 20% sales increase in

2006 show the successful market penetration of the company. Garmin products represent nearly half the handheld GPS system sold each year, giving them substantial market share. Products like the Etrex and

Foretrex series target hikers and campers while the Forerunner series combines GPS tracking with fitness technology and heart monitoring for the running and cycling market. The outdoor/fitness products act as stars for the company as well, but don’t have nearly the market growth as the automotive products.

The marine and aviation product lines offered by Garmin offer some of the best available technology to captains. Their low growth (5% and 2%) is in response to a slowing in the boating and small plane industry as a result of higher gas prices. Given the slowing, their small growth was at the expense of competitors rather than the benefit of a growing market. As a result, their market share

8

continues to increase. The GPSMAP series and countless systems available for boats act as cash cows for the company, offering little growth but legitimate market share.

Product-Market Analysis

The Garmin name is universally recognized as the highest quality portable GPS devices on the market. They have a dominant market share and continue to lead the way in the industry with innovation and product development. As the company focuses on vertical integration, they see the production of their products from start to finish, and provide excellent follow-up and customer support services. Their excellent maintenance of the brand name has given them a significant advantage over their competitors.

With whatever new products they create or whatever markets they enter, they carry the Garmin name.

For further market penetration with existing products, Garmin can seek out contracts with auto manufacturers to get Garmin GPS navigation systems in more cars as stock options rather than aftermarket modifications. They can also increase their Forerunner sales by sponsoring marathons and ultramarathons, getting their newer products into the minds of their target market.

New product development for current markets can help Garmin to maintain its competitive edge over competitors. They may offer modifications like traffic updates in their automotive GPS systems, which would create a great point of difference for the company.

For market development, Garmin can seek new markets for their existing products to further increase their sales. Examples include marketing their handheld hiking devices like the Foretrex to mountain bikers, or pushing their Forerunner GPS/heart monitoring devices to the road cyclist community. Both of these markets show a need for such devices and could greatly contribute to the sales growth of Garmin outdoor/fitness products.

While Garmin is already diverse in the range of products they offer, there is still enormous opportunity to expand the use of their GPS technology and devices. The Trail Tracker would be a new product in a new market for Garmin, expanding their clientele to include an untapped and affluent population. There are many directions that Garmin may take its products, their biggest challenge is narrowing them down to the most profitable and avoiding growing too quickly. Garmin’s name means quality and reliability, and by spreading their management too thin they would risk that reputation.

Nevertheless, Garmin has plenty of opportunities to pursue, and the Trail Tracker would be an excellent choice to take the company into a new market.

Marketing Mix Strategies

Product

The Garmin Trail Tracker is a unique product completely new to the skiing market. There is essentially no competition with very few products offering digital trail maps for most all ski resorts across America with similar features. This being said, the product is in the introduction stage of the

9

product life cycle, which describes the stages a new product goes through in the marketplace, and intense promotion needs to be enacted in order to get the target market to gain knowledge that such a product exists. In relation to Garmin’s company, the Trail Tracker is hitting a target market that already is extremely familiar with the company and their products, with some potential buyers already using similar products to navigate the road for driving or hiking. Therefore, this is a current market with a new product being introduced, and while looking at the market-product strategies, this would classify as product development.

Since this product is in the introduction stage of the product life cycle, the most important objective for the company is to create consumer awareness and stimulate the initial purchase by the consumers. Without competition, the need for Trail Tracker comes from primary demand, which is the desire for the product class rather than for a specific brand. Therefore, Garmin need to be able to not only display what makes this product special, but also why the consumer needs it. Since the type of user buying the product views the Trail Tracker as a consumer good—primarily a durable good—where they shop for it; the initial sales volume of the product won’t be terribly sufficient in the first couple of years.

It is a high-learning product, meaning that significant education of the customer is required and thus makes the introductory period longer. Sales will be slow at first, and therefore the company needs to expect that it won’t make money on the product until after a couple of years.

The product itself has some key features that the consumer needs to know when purchasing the

Trail Tracker. It is a portable, wrist attached unit, 3” high by 5.5” wide, which provides an interactive and modern trail map for the ski mountain where the user currently is. Additionally, the product has a battery life just long enough for a whole day of skiing, ranging between 8 and 12 hours depending on how often it is used. The product’s internal lithium battery is rechargeable via an outlet cord and charges rather quickly. The Trail Tracker also features a waterproof/rugged functional design, with rubber protection on the corners to protect it, a clear screen that is fog and scratch resistant, and durability to prevent the unit from breaking or malfunctioning when falling on the slopes. The product also features an internal 8 gigabyte memory, which is extremely useful when uploading and saving trail maps from visits to various ski resorts. The trail maps at the different ski mountains are downloaded from kiosks that are positioned strategically on the mountain, near ticket purchase and high traffic ski areas. Free of charge, the consumer easily connects their product to a USB port from the kiosk, which automatically uploads the mountain’s trail map, updating trail conditions, closures, lift closures, potential weather, and additional information the mountain wants the skier to know for the day. This is extremely useful, as not only is the consumer getting a digital trail map, they are getting an updated trail map each and every day providing more than what they could get from the typical paper trail map. Additionally, the consumer can delete trail maps or save them with easy usage from the main menu screen on the product.

10

Besides being able to locate and show where the consumer is at all times on the mountain via

GPS, the Trail Tracker also features an emergency button that updates ski patrol, transmitting a radio frequency to them. This is very useful in keeping the mountain safe and allowing ski patrol to act quickly in emergency situations. Other features on the product include the ability to toggle between different views of the mountain with easily clicking on a button, having the option to go from an overhead view, third person, elevation, and “ski map” view. This allows the user to have the GPS view they want when skiing down the mountain or when planning out routes for the day. The product also features a display of the temperature and altitude on the screen at all times, essential information a skier and snowboarder would enjoy having the knowledge of when asked in a questionnaire. Additionally, with a large screen, joystick navigation and a zoom scroll wheel, they can easily move around the mountain finding trails and exploring the mountain while waiting in lift lines and while on the ski lift.

Lastly, the Trail Tracker also keeps track of the user’s route history and statistics for the day, allowing the consumer to see where they skied during the day, how far they skied, and also how many runs they skied. The product is more than just a GPS system with all these provided features.

In branding the product, key phrases and design already distinguish it from those of the competitors and future competitors. With the slogan “Navigate the mountain with precision …”, identification of the product as being an extremely handy device in pin-pointing location has been established. Additionally, the unique design and extreme thoughtfulness to function has separated it from potential competition. Brand personality can also be added to the product, with the product being linked to the words of ‘rugged, sophisticated and versatile’ as key human characteristics associated with the brand name. Lastly, brand equity plays a huge role in the product’s potential success. Brand equity, or the added value a given brand name, gives to a product beyond the functional benefits provided, is important with the company of Garmin. Garmin is associated as being the leading producer of innovative and functional global positioning systems for all forms of life, not just navigation for driving.

Lastly, packaging and labeling the product is important. With the probability of only providing one or two forms of packaging the Garmin Trail Tracker, the product must be on display within the packaging through clear plastic so that the consumer knows exactly what the product looks like and its size. Communication and functional benefits need to be expressed on the packaging, listing its features and when and how to use the product. Adding to the package, a case for the Garmin Trail Tracker needs to be shown to protect the product when traveling. A strong packaging of the Garmin Trail and listing what’s included in the product is important in selling the product and separating it from competition.

Price

Pricing the product is the next key step in the marketing mix strategy. The first objective in setting the price is to look at the pricing objectives. For the Trail Tracker, Garmin is specifically looking

11

at profit and sales for the product. In looking at profit for the product, Garmin is managing for long-run profits on the product after the product comes out of the introductory stage of the product life cycle. For the Trail Tracker, Garmin is looking for a target return objective when looking at the ROA, or return on assets. After a couple of years, it would be great to see a ROA of at least 500% of the cost and production of the product. Secondly, Garmin aims to increase sales with the pricing of the product;

Garmin doesn’t want to enter too high or too low as to where the product doesn’t sell or oversells without making enough money. With the proper pricing, it will lead to increase in market share and profit.

When looking at price constraints, there are a few that limit the range of prices that can be set for the product. The newness of the product definitely is a constraint for the Trail Tracker, along with the cost of producing and marketing the product. Since the product is so new in a virtually untapped market for GPS systems, it is possible to raise the price of the product especially since there is few—if any— competition. Additionally, with the newness of the product, the cost it will take to market the product to gain consumer awareness will add heavily to the cost of producing the product. Since Garmin already produces many products using similar technology, the cost of production shouldn’t be terribly high.

However, constructing kiosks for uploading trail maps at all the ski mountains in the United States, and eventually at all major ski mountains in the world, will cost Garmin a great deal of money working with the ski mountains to establish. The cost of marketing the product also needs to be taken into account.

With heavy promotion, and borderline guerilla marketing tactics to get all of the target market to go out and buy the product, this will drastically increase the price of the product during its introduction. These are the biggest pricing constraints.

The next step is to estimate demand and revenue for the product. There are many demand factors for the potential consumer, including the consumer income and consumer tastes. Since most of the target market does have a high income, it shouldn’t be a problem when purchasing the product. However, the potential high price will prevent many skiers and snowboarders on a budget from buying. Also, consumer tastes will also affect the demand curve. While many people would love the added features of having a GPS trail map, some consumers prefer to stick to the free and easy to read paper trail maps provided by the resort. They might not be interested in learning the technology associated with the product and certain demographics of skiers and snowboarders might not find the product useful. This would include terrain park users and those that don’t like to explore the mountain or know it well already. Demand should be moderate, and as a result, revenue from the product should also be moderate.

It is hard to say that this product’s demand will be high considering that skiing in general is not the most widespread sport across the world, but potential for a higher demand and revenue is possible with proper pricing and great marketing and awareness of the product.

12

The third step in pricing is determining the cost, volume and profit relationships. Fixed cost for the product would be $3 Million, based on the rent for the building and salaries for a few executives working on the development of the product, and insurance on its production. This budget is an estimate and may vary slightly. Additionally, we must establish the variable cost of the product. From examining the labor and materials used in creating the product, the unit variable cost would roughly be $180. This is also a rough estimate of cost, but based on looking at other production costs from Garmin’s other systems, this is a fairly accurate reflection of how much each Trail Tracker would actually cost in production. Details of the break-even point and profit analysis are discussed later within the marketing plan.

The fourth step in pricing of the product is selecting an approximate price level. Since the product is in the introduction stage of the product life cycle, usually a product in this phase either uses price skimming, setting the initial price high, or penetration pricing, setting a low initial price on the product. These are various forms of demand-oriented approaches to pricing. However, since Garmin is a well established company and many consumers of the target market might already have a Garmin product, target pricing will be used. Target pricing estimates the price that the ultimate consumer would be willing to pay for the product. This price will be based on what consumers are roughly paying for

GPS systems for their car and other forms of life, and then increasing that price enough for all the added benefits that the Trail Tracker provides. For the Garmin Trail Tracker, price skimming is not desirable because Garmin doesn’t want to drive the consumer market away from the product because it’s too high—especially since there is no competition to possibly drive our price down. Additionally, if penetration pricing is used, it would grab a large portion of the skiing market to buy the product, but it might set the price too low to make up for the heavy promotional tactics expected to market the product.

All of these reasons are why Garmin feels that using target pricing is the best option.

The fifth step in pricing is setting the listed or quoted price of the product. When choosing pricing options, Garmin can either use a one-price policy or a flexible-price policy. One-price policy, which is also called fixed pricing, is setting one price for all buyers of a product. Garmin feels this is the best policy for the product, as most other Garmin products also use a one-price policy. With this in mind, the Trail Tracker unit price is will be set at $299.99. This is a reasonable price when looking at all the previous factors affecting the pricing of a product, and allows a significant amount of money between the unit variable cost ($200) and the price for promotional tactics and increased profit once out of the introductory stage. The other prices for Garmin factor into this price, as the company wants to stay in the middle of all their products when it comes to pricing to allow for many consumers to buy the product but also make sure that it covers all of the costs associated for the Trail Tracker.

13

The last step in setting the price is making special adjustments to the list or quoted price. There are three ways to adjust the list or quoted price: by discounts, allowances or geographical adjustments.

For the Garmin Trail Tracker, quantity discounts and seasonal discounts are two means looked at adjusting the price of the product. Quantity discounts pertain to the reduction in unit costs for multiple orders. Garmin wants families skiing to buy more than just one of these products, and feel that with a quantity discount it is possible to do just that. Possible ideas include buy two and save 10% on both products or buy three and get the fourth one free. Besides quantity discounts, the biggest discounts the

Garmin Trail Tracker can offer is seasonal discounts. Since the product is only going to be used during the ski season, which lasts in North America basically from November to April, seasonal discounts for the product in the summer will keep it selling. Offering a substantial discount, maybe reducing the price to $250, could prompt skiers and snowboarders to go out and buy the product during the non-skiing season. Now knowing the Garmin Trail Tracker’s price of $299.99, future steps in the marketing plan can be carried out.

Place

Being able to reach prospective buyers, either directly or indirectly, is a prerequisite for successful marketing. It is important for the Garmin Trail Tracker to use the right marketing channels to reach the consumers most likely to buy the product. For this fairly expensive product, there are a few different channels we would like to use in order to reach the consumers.

The first channel is the indirect channel, where there is an intermediary between Garmin and the consumer. This intermediary would be the retailer, a channel that will be used to reach the largest market of consumers, by going to large retail corporations. Garmin wants to be selective with distribution, and select a few large chain retailers that receive high traffic of the target market. These retailers would include Recreation Equipment Inc. (REI), Eastern Mountain Sports (EMS), Sports

Authority, North Face stores, Dick’s Sporting Goods, and Sports Chalet just to name a few large retailers. Besides this channel, Garmin would also use another indirect channel, which would include a wholesaler before the retailer stage of the marketing channel. This channel would be implemented in order to get the product in the “boutique” ski shops that are found near largely populated ski locations and where a majority of the target audience might go to purchase the product outside of the larger retailers. These wholesalers will help save Garmin time and money trying to sell the product to the smaller retailers near the Ski Mountains and other locations around the country. Example stores would be those found in ski villages and specialty ski stores distant from skiable areas but where the target market might live. Selling to these stores allows for consumers to purchase the product after seeing it being used or advertised on the mountains within their ski trip.

14

The last channel the company would look at would be the electronic marketing channel, which allows for the consumption of the product online. Since Garmin doesn’t sell the product directly from its website, this marketing channel would have to go through a wholesaler and retailer, such as Amazon,

Buy.com and other various forms of retailers. The online marketing channel is extremely useful in reaching the target market where it is possible that they cannot buy the product due to availability. An avid skier or boarder from Texas probably won’t find this product in stores there since there are no ski venues in the area, and therefore online shopping allows him to receive the product.

In the placement of this product nationally, and eventually internationally, selective distribution is key. Keeping between the two extremes of intensive and exclusive distribution means that Garmin selects a few retail outlets in a specific geographical area to carry its products. The product won’t be found in sports stores in Florida, Alabama, Texas or Kentucky for example, it just doesn’t make sense as it won’t sell since they are not ski locations. Choosing key regions of the United States, such as the

Pacific Northwest, North East, and states such as California, Nevada, Utah, Colorado and Montana, allows for proper distribution and sale of the product. Eventually, once the product goes international, distribution will be in Scandinavia, Central and Eastern Europe, the southern countries of South

America, and countries such as Japan, China and Russia.

Promotion

This is the fourth element in the marketing mix, consisting of elements such as advertising, personal selling, sales promotion, public relations, and direct marketing. Promotion is a huge part for the development of the Trail Tracker in order to inform prospective buyers about the benefits of the product, persuade them to try it, and remind them later about the benefits they enjoyed by using the product.

Advertising is going to be the largest form of promotion for the product, as it will allow the consumer to gain awareness of the product.

There are a few key mediums Garmin will employ in order to reach a wide audience. The first is television, which will demonstrate usage of the product and a handful of its functions. Television is great for this product as it’s important that the consumer not only sees what the product is, but all of its functions past just being a trail map. For the Trail Tracker commercials, seasonal advertising would be used, running either a flight or pulse schedule. Since this product is only going to be used in the winter and primarily only sold then, it is important to advertise hard at or before the opening of ski season from the months of October to December. Additionally, commercials will continue to air through the winter less frequently to keep a growing awareness of the product.

The second advertising medium would be via magazines. Ads would be in ski and snowboarding magazines, which are often purchased by our target market, avid skiers and snowboarders. The third advertising medium would be via the internet, with product advertisements also being on heavy ski and

15

snowboarding websites. Additionally, advertising would be placed on the Ski Mountains where the Trail

Tracker could be used, as high traffic to these sites exist for the traveling skiers and snowboarders. This would not only promote the product, but also let the consumer know that the Trail Tracker can be used at that mountain and kiosks exist for updating the conditions of the mountain for those ski days.

The final advertising medium would be through including the product in movies or television shows, if applicable. Product Integration, or the usage of the Trail Tracker by someone in the movie or show, would add a huge boost to sales and awareness. If there are any movies on the market where this product could be featured when a person is skiing or snowboarding, maybe even a James Bond or action movie would definitely benefit the product.

The next big portion of the promotional mix is sales promotion. Consumer promotions are sales tools used to support a company’s advertising and personal selling. There are a few different kinds of sales promotions the Trail Tracker could use, including coupons, samples, sweepstakes, contests, and product placement.

Coupons could be used, featured in magazines for the product, to stimulate demand of the product and encourage retailer support. Sample is another useful promotion. If Garmin could set up promotional tents at ski resorts across America during Christmas Break and high traffic ski weekends

(such as Martin Luther King Jr. weekend, President’s Day weekend, and even Thanksgiving), they could offer a handful of customers the opportunity to try the product at no cost for the day. This would encourage new product trial and allow the consumer to actually interact and see how great the product is while using it on the mountain.

The next form of sales promotion would be through sweepstakes and contests. With a sweepstake, it requires participants to submit some kind of entry requiring no effort on behalf of the consumer. A possible idea would be “an all inclusive ski vacation of a lifetime” for a family from

Garmin. The only way they could enter the sweepstakes would be from purchasing the product and getting a code to enter online for the grand prize. For a contest, it would be where consumers apply analytical or creative thinking to try to win a prize or gift. A contest could be based on the idea of “the best excuses for why you still use a paper trail map”, with the contestants sending in their ideas. The award could be a ‘ski makeover’, providing the consumer with news ski products and of course, a

Garmin Trail Tracker.

The last form of sales promotion would be product placement. If Garmin could get the Trail

Tracker on Oprah’s list of ‘Favorite Things’, it would be a huge success. Many viewers watch this episode of Oprah and this would gain great awareness of the product, introducing the new product and demonstrating its use.

16

The last and final means of promotion Garmin could use for the product would be using public relations. Having a positive PR person would advance the product, getting write ups of how great the product is in all forms of media reaching a large audience. Additionally, using ski resort marketing, getting the PR person to get trial tents on the slopes for consumers to interact with the product and test its features, would be beneficial. Engagement marketing is the trend in marketing today, and it is key that Garmin implements this tactic to increase sales and revenue.

Positioning

With the marketing mix strategies complete, the next step is positioning the product. Product positioning refers to the place the product occupies in the consumers’ minds on important attributes relative to competitive products. Since this is a market that virtually has no competition with other GPS

Trail Maps, Garmin needs to use head-to-head positioning involving competing directly with the free trail maps that consumers pick up at the mountains. With this in mind, there are a few key elements of this product that make it special. It is the best product you can get delivering the most accurate and upto-date information while you are on the trail. The paper trail maps can’t do either of this, as you have to search for where you are and also your knowledge of what’s open and closed isn’t shown on the trail map. Additionally, this product is positioned towards the middle and upper class skiers and snowboarders that are young adults to elders providing a fun, easy to use, and technologically advanced product that helps make skiing more fun and safe. Trail Tracker provides emergency button to alert ski patrol, ways to track where one has skied, the altitude, and the skier’s exact location—all things a paper trail map cannot do. It is a quality product that will last for numerous uses through many ski seasons.

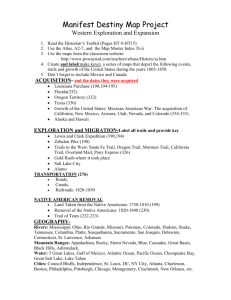

With all of this, it’s important to look at the FAB Chart, shown in Figure 1 below.

Figure 1. FAB Sheet for the Garmin Trail Tracker

Features Advantages

Waterproof/Rugged Design

Internal 8gb Memory

GPS Tracking

Updated Information

Emergency Button

Long Battery Life

Toggle View of Trail Map

Prevents damage and malfunction

Allows upload of numerous trail maps

You know where you are at all times

Trail Closures, conditions, weather, etc. updated daily

Let’s ski patrol know when you need them instantly

Allows you to ski the whole day with the product

Allows you to visualize your location in 4 modes

Benefits

Saves money

Saves money

Saves time

Saves time

Saves time and your life!

Saves time

Saves time & money

Implementation

Resources Required

According to its annual report, in 2006 Garmin posted its 16 th

consecutive year of revenue growth along with an all-time record of sales of $1.77 billion. According to Figure 2

, Garmin’s revenue and income are on an increasing trend with a $745.2 million revenue increase from 2005 to 2006. The

17

company’s growth has expanded by 73% which displays that Garmin’s environment has enough resources and capital for continuing their growth for products like Trail Tracker. The outdoor/fitness category grew 20% in 2006 proving that outdoor and fitness enthusiasts are looking for and buying the products that Garmin produces.

Garmin’s increasing capital can not only be applied to the success within their market—the recent global expansion provides an opportunity to expand their operation and wider market base. They currently employ 4751 full-time employees with the majority (2807 people) in Taiwan. Research and

Development also states that their 2007 projection is to expand and increase their investment even more, as evidenced in Figure 3 . Garmin increased their expenditures by $38.4 million to foster the creation of new products. This displays the superiority of Garmin’s Research and Development team in creating successful and new products (like the Trail Tracker.)

This task is implemented between the partnership of engineering and manufacturing teams; 970 people are employed within engineering and development to create new products. The development staff includes industrial engineers, software engineers, electrical engineers, mechanical engineers, and cartographic engineers. This multidisciplinary team designs products and provides a seamless transition into manufacturing. Garmin increased their manufacturing capacities to meet future demand and compete in a global marketplace. Their facilities include a European headquarters for distribution, marketing, and product support in England; two manufacturing facilities in Shijr and Jhongli, Tawian; global headquarters in Olathe, Kansas; and Salem, Oregon. Garmin currently acquired four companies as well: Dynastream, Digital Cyclone, EME (Garmin France), and Naumatic Marine Systems.

Figure 2. Revenue and net Income for Garmin Figure 3. Research and Development Expenditures

18

Garmin prides itself with its vertically integrated approach: every step in the control, marketing, manufacturing, and processing is run within the company. They attest their company’s success to three efficiencies of this vertical integration. First is the reduced time-to-market. Products are introduced to production at an early development stage, feedback is provided by manufacturing who immediately incorporates those changes into design before mass production begins; they reduce the time moving a product from design to mass production phase, therefore providing enough time to ensure high quality.

Another efficiency is design and process optimization: engineers rapidly design prototypes, providing a plethora of new concepts to the company to potentially distribute. Lastly, vertical integration increases logistical agility through operating their own manufacturing facilities. This minimizes problems—like shortages or long lead times—and can easily re-engineer the production process to bypass these shortages therefore reducing costs. Garmin purchases the components to their devices from sole source suppliers to decrease the potential of delays in vendor distribution. These efficiencies provide a high quality of product demonstrated by their ISO 9001-2000 status. All of these concepts will attribute to the seamless manufacturing of Trail Tracker devices.

Action/Timing

The Process of implementing Garmin’s Trail Tracker device begins at the research and development stage where the development and engineering staff work together to create a prototype.

Manufacturing provide feedback and incorporates it into the design. As a revolutionary and new product, Trail Tracker’s primary concern after creating the Trail Tracker is distributing knowledge of the product. Initially, Garmin will place advertisements in sports and ski enthusiast magazines, television commercials, while concurrently sending press packets to winter sports destinations in order to not only inform ski equipment stores, but to introduce the incoming retail of Trail Tracker to potential consumers in these areas. Garmin plans to distribute trial samples in major ski destinations such as Whistler, Vail, and Aspen for the first ski season and usage tutorial programs for the first two seasons of distribution.

As knowledge of Trail Tracker becomes more widespread, Garmin will continually expand their distribution to ski resorts and retail outlets, and further the distribution to electronics stores as well. The advertising, marketing, and distribution timing is visible in Figure 4 below.

19

Figure 4. Garmin’s Trail Tracker Gantt Chart

WBS Tasks

Task

Lead 7/1/2008 12/1/2008 7/1/2009 12/1/2009 5/31/2010

Task

1

1.1

R&D

Research

Director of

Operations

1.2

1.3

1.4

Task

2

2.1

2.2

2.3

Task

3

3.1

3.2

3.3

Design

Test Prototype

Mass Production

Product

Advertising Manager

Sports Mags/

Television

Ski Retail Stores

Ski Resorts

Retail

Resorts

Sporting Stores

Ski Rentals

Retail

Manager

3.4 Electronic Stores

Quantity Analyses

Through observations of the budgeting of previous Garmin outdoor recreation devices, Garmin projects its Trail Tracker budget to be $3 million. The retail price of Trail Tracker is to be $299.99 and the unit variable price is $180, therefore, Trail Tracker’s break even point is when roughly 25,000 devices are sold.

Figure 5. Break-even point for Trail Tracker

Break-even Point Formula FC

P – UVC

3,000,000 = 25,003 units

299.99-180

Fixed Cost

Unit Price

$ 3,000,000

$ 299.99

Unit Variable Cost $ 180

Organization Chart

Garmin’s present organizational structure appears in

Figure 5 . Since Garmin is a large, global corporation, this figure focuses primarily on the marketing positions within the company. As previously mentioned, they employ 4751 full-time employees in a plethora of positions ranging from engineering and product development to marketing. While the engineers developed Trail Tracker, the majority of the success of the product is attributed to the marketing team. Trail Tracker falls within the responsibility of the Outdoor Marketing Senior Director who implements this marketing plan.

20

Figure 5. Garmin’s Marketing Organization Chart

Board of Directors

President & CEO

Director Operations

Engineering & Development

Aviation

Vice President Marketing Director Finance & Admin

Automotive Marine Outdoor Fitness

Director Sales

Wireless

Product Manager:

Trail Tracker

Associate

Product

Manager

Marketing

Assistant

Evaluation & Control

Monitored Data and Frequency

As the Trail Tracker is a new product in a new market, significant advertising will have to take place in the beginning years in order to educate and inform the target market. Sales will be monitored by season, with midpoint check-ups at the end of January. Garmin aims to double sales every year for the first four years of introduction. At that point, a comprehensive assessment of the success of marketing efforts will be made in order to determine the best way to spur further growth and market penetration. Garmin hopes to maintain a 75% market share through then end of the 5 th

year of operation, establishing Garmin as the first and best alpine trail guide system and leaving little or no room for competition—Garmin seeks to create and fully dominate this new market. Profits will be slow in the introduction phase, but as it moves toward growth, Garmin expect profits to increase dramatically. Here is a chart summarizing profit goals:

Year 1 2 3 4 5

$ (in millions) .75 2.00 4.20 9.00 14.00

Marketing Mix modifications

The first year of production of the Trail Tracker will primarily be dedicated to increasing awareness of the product through sending samples to major ski resorts. With this testing period, Garmin will be able to receive substantial feedback on the Trail Tracker, and Garmin can assess any product weaknesses before its mass production and distribution. For example, if the joystick was not large enough, Garmin could modify the production to satisfy the consumer taste. Garmin representatives can observe which demographic responded strongest to the product and modify the marketing campaign to capitalize on profits as well as finding new opportunities to market the product.

21

Appendix A.

Market Research Questionnaire

1.

How often do you go skiing? once a year 2-4 times per season 5-10 times per season 10+ times per season

2.

How often do you use a trail map? rarely a couple times a day before every run multiple times each run

3.

How complicated is reading trail maps for you? (1-not complicated, 5-very complicated)

1 2 3 4 5

4.

How often do you get lost when skiing?

Rarely occasionally frequently constantly

5.

How many times on average do you take out a trail map during a day of skiing?

0-2 times 3-5 times 5-10 times 10+ times

6.

What is your level of concern for injury? (1-not worried, 5-very paranoid)

1 2 3 4 5

7.

What is your level of confidence in the efficiency of ski patrol emergency teams? (1-confident,

5-not confident at all)

1 2 3 4 5

8.

Do you try to stay below a certain altitude or above a certain temperature while skiing (for health or personal reasons)?

Yes No

9.

If you answered yes to question 8, how often do you feel you are aware of your current altitude and temperature while skiing?

Always aware sometimes aware rarely aware never aware

10.

What things are most important to you when choosing a ski destination?

Alkdfjaslfkjs;fljsa;lfkjas;lfkjsalf;kjsdfl;kjas;dflkjads;lfkjsdf;lkjadsf;lkjds;flkajf;lkajsflkjslkjsldfkj slkfjslkfjsalkfjlsfkja;lkfdsjasldkfjalfkdja;dlfskja;lfdskjalkfdsjalkdsfja;lkfdjalkfdsjalkfdsjaldskfjd

11.

Do you currently own a Global Positioning System (GPS) device?

Yes No

12.

If you answered yes to question 11, do you find these devices easy to navigate?

Yes No

13.

Would you find an electronic device to replace trail maps plus ensure altitude/temperature readings and prompt emergency aid useful while skiing?

Yes No

22

Works Cited

1. 2006 Annual Report. Garmin Ltd. Olathe, 2006. 01 Dec. 2007

<http://www8.garmin.com/aboutGarmin/invRelations/reports/2006_Annual_report.pdf>.

2. "Company." Garmin. 2007. Garmin Ltd. 01 Dec. 2007

<http://www.garmin.com/garmin/cms/site/us>.

3. GPS Maniac. Questex Media Group, Inc. 05 December 2007 <http://www.gpsmaniac.com/>.

4. GPS World. Questex Media Group, Inc. 05 December 2007

<http://www.gpsworld.com/>.

5. Kerin, Roger A., Steven W. Hartley, Eric N. Berkowitz, and William Rudelius. Marketing. 8th ed. New York City: McGraw-Hill/ Irwin, 2006.

6. LaGesse, David. “GPS for the Masses.” U.S. News. 14 August 2007. 05 December 2007

<http://www.usnews.com/usnews/biztech/articles/070814/14gps.main.htm>.

7. Magellan. Magellan Navigation, Inc. 05 December 2007 <http://www.magellangps.com/products/>.

8. Navigation Center. U.S. Department of Homeland Security United States Coast Guard. 05 December

2007 <http://www.navcen.uscg.gov/gps/>.

9. "Products." Garmin. 2007. Garmin Ltd. 03 Dec. 2007

<https://buy.garmin.com/shop/shop.do?cID=132>.

10. TomTom. TomTom International BV. 05 December 2007

<http://www.tomtom.com/products/index.php?Lid=4>.

23