SYLLABUS: FINANCIAL MANAGEMENT FINK 507, Sect 125

advertisement

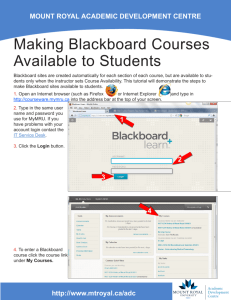

SYLLABUS: FINANCIAL MANAGEMENT FINK 507, Sect 125 Summer, 2013 Mode of Instruction: This class meets fully online during the accelerated 8-week summer semester that begins Tuesday, June 4, and ends Friday, July 26. The course uses the TAMUCT Blackboard Learning system described below and later in this Syllabus - Section 7.0 titled: “Technology Requirements.” You will use the Blackboard username and password communicated to you separately to log on to this system. As of Spring 2012, Texas A&M-Central Texas uses its own Blackboard system and the usernames and passwords that you used to log on to Tarleton State University’s Blackboard are no longer valid. Students should check the new Blackboard site continuously throughout the semester for Communication, Assessments, Solutions, Calculator Tutorials, and other helpful information. See (http://tamuct.blackboard.com). Instructor: Dr. Mary H. Kelly Assistant Professor of Finance Office: 323F in Founder’s Hall on the new campus Phone: 254-501-5846 Instructor’s Office Hours: Monday, Wednesday: 4:00 – 4:45 pm and 7:15 – 7:45 Tuesday, Thursday: 9:00-11:00 Virtual Office Hours Do not hesitate to request an appointment for any other day or time. Communication between Instructor and Student: Apart from office hours, the best way to reach me is with FIN 507 in the subject through Bb email or the university email (mhkelly@ct.tamus.edu). I generally respond within a day or two, or sooner if I am online. There is a Discussion Board on Blackboard that will allow you to ask questions of others in the class and receive their answers. Utilization of this discussion board is a key feature for class interface and will allow you to share your specific experience and knowledge with others. Administrator for Course, Department, and School of Business Administration (SOBA): Ms. Charlotte Wesley at cwesley@ct.tamus.edu or 254-519-5437. Appointments and other information can be obtained with her assistance via email or phone. UNILERT – An Emergency Warning System for Texas A&M University – Central Texas This notification service gives Texas A&M University-Central Texas the ability to communicate health and safety emergency information quickly via email and text message. By enrolling in UNILERT, university officials can quickly pass on safety-related information, regardless of your location. Please enroll today at http://TAMUCT.org/UNILERT. 1 Important Dates this Semester: Friday, April 19, was the last day to apply for graduation in Summer 2013. Monday, June 3, is the deadline to drop or add this course. Drop/Add procedures are in Sect 9.0. Monday, June 10, is the last day to drop this course without any record. Monday, June 24, is the last day to drop this course with a Q or W Saturday, August 11, is Commencement. Monday, August 26, is the first day of Fall Semester, 2013. 1.0 Course Description: 1.0a Catalog Description Course focuses on financial decision making in the modern corporation. Basic issues include capital budgeting, capital structure, corporate sources of funding, dividend policy, financial risk management, standard theories of risk and return, and valuation of assets. Prerequisite: Graduate standing and FIN 500 (if required of student), or approval of the MBA Admissions Committee. 1.0b Expanded Description The purpose of this course is to improve the financial decision making skills of students by exposing them to a graduate treatment of advanced concepts and techniques used by financial managers in the modern corporation. A central theme of this course is value based management. The course begins with an elevated review of the analysis of financial statements. Emphasis is given to the construction and interpretation of the statement of cash flows and the possibly differing pictures of corporate financial health as given by accrual versus cash flow methods. Financial ratio analysis follows. Conventional liquidity, activity, debt, debt coverage, profitability, DuPont, and market based ratios are computed and used in both time series and industry average analyses. The impact of off-balance sheet items on ratio interpretation is discussed. Some examples of financial planning and techniques of financial forecasting follow. These methods require use of computerized spreadsheet models in "what if" scenarios. The impact of interest rates and shifts in the yield curve as they relate to the firm's financing mix (debt versus equity) is presented. Fundamental concepts related to risk and return follow. Risk in a portfolio context is developed along with the CAPM and the calculation of beta. Time value of money methods extend the basic ideas of compounded growth rates and discounting. Bond and stock valuation methods are developed. Bond ratings, their determination, and how they impact the firm's cost of capital are discussed. Stock valuation utilizes the conventional dividend discount models as well as price ratio analysis. The c concept of "free cash flow" is studied and contrasted with the more traditional discounted dividend models of valuation. More current methods to access manager performance such as market value added and economic value added are discussed and numerically demonstrated. The rationale and the used of the cost of capital is derived using real world examples. Basic capital budgeting decision techniques are explained along with methods to adjust for cash flow risk. Cash flow estimation is necessary for capital budgeting is demonstrated. Types of leverage are described and used to demonstrate how business and financial risk differ and how these risks impact expected return on equity in the levered firm. The Modigliani/Miller theorems are explained and related to various observed industry capital structures. The firm's dividend policy and share repurchase decision as they impact shareholder wealth are described. Various theories of dividend policy such as the Modiglian/Miller dividend irrelevance argument, the residual dividend theory, the tax and clientele theories of dividends, and the signaling aspect of a firm's dividend policy are discussed. 2 The course concludes with a discussion of various working capital management policies. Corporate ethics and related topics are discussed throughout the course. Global examples of corporate financial decision making are included when appropriate. A semester term paper covering a current topic in the firm's financial decision making is assigned. Spreadsheet mechanics using Excel are emphasized throughout the course. 2.0 Course Objectives and Outcomes. 2.1 Student Learning Objectives (SLOs). SLOs are measurable and a student should be able to demonstrate the SLOs listed below upon completion of this course. The Course Calendar states which Student Learning Objective or SLO listed below is addressed in each Assessment/Exam. A. B. C. D. E. F. G. H. I. Read real-world financial statements and draw conclusions about a firm's financial health. Construct and interpret important financial metrics. Calculate the value of financial assets by applying time value of money concepts. Calculate the fundamental value of a firm's debt and equity securities using prescribed models. Compute a firm's cost of capital used in financial decision making. Describe the implications of a sub-optimal capital structure. Describe investment decisions using established capital budgeting techniques. Describe the impact on firm valuation from dividends and share repurchases. Discuss unethical corporate governance and behavior and be able to describe decision making that may impinge on ethical standards. J. Create spreadsheets with financial data used to facilitate decision making. 2.2 Student Learning Outcomes. Upon completion of this course, students should understand the following, which will be measured as Student Learning Objectives or SLOs described above in 2.1. • The building blocks of value-based corporate decision making aimed at maximizing the firm's stock price. • The distinction between accrual and cash basis accounting. • The importance of understanding the firm's financial statements. • The importance of financial forecasting in overall financial planning. • The basics of the firm's financial environment as it pertains to interest rates. • The basics of risk and return as they relate to stocks in isolation and in a portfolio. • The various stock valuation models including free cash flow models. • Time value of money methods and bond and stock valuation. • The importance of a firm's bond rating. • Construction and use of the firm's weighted average cost of capital. • The basics of the capital budgeting process including techniques of cash flow estimation. • Risk analysis in capital budgeting decisions. • How leverage and capital structure are related to risk and expected return. • The basics of the firm's dividend policy decision. • Various working capital management strategies. • The financial aspects of bankruptcy and reorganization. • The importance of ethical behavior and how ethics should impact decision making • The relationships between academic course material and real-world decision skills 3.0 Required Readings, Materials, and Textbooks: (1) Text: Students may be using different texts, due to the implementation of a new text for this course and the availability of different texts used in previous semesters, but the content is very similar in all of these texts, so any one of the 3 following will be adequate for this course. The order of the topics may differ between texts and the Course Calendar attempts to address this by listing the topics with sufficient detail to use other texts. The new text is “Fundamentals of Corporate Finance” by Ross, Westerfield & Jordan, 10th edition or later. The ISBN is for the 10th edition is 9780073382395. This text has an excellent website: www.mhhe.com/rwj. The text above also is available for a Reduced Price that includes Premium Online Content at no additional cost when purchased from the university’s Bookstore. It has been specially prepared by the publisher with fewer chapters than the hardcover listed above and the chapters may be in a slightly different order. The ISBN is 9780077717605 or 1121770134. This text has an excellent website: www.mhhe.com/rwj The previous text is “Corporate Finance: A Focused Approach,” 4th edition, by Michael Ehrhardt and Eugene Brigham. The ISBN is 13-9780324655681. The previous editions are similar and would be acceptable, too. The text has an excellent website: www.cengage.com/finance/ehrhardt. (2) The texts may have a Study Guide. A Study Guide generally provides an outline of each chapter, plus hundreds of questions and numerical problems in multiple-choice format with answers and solutions. A Study Guide can be useful both to help students get the “big picture” prior to reading the text and later as a self-test tool. Feedback from students who have used a Study Guide has been very positive. (3) Computer Access to Excel. In this course, Excel is recommended for performing financial calculations over a financial calculator, yet a financial calculator may be used, too. It’s important for students to know that the keystrokes differ both between excel and calculators, and among different models of calculators, which can lead to different answers and wrong financial decisions. (4) If a financial calculator is used, the most popular one used by students is the TI BAII+ that can be purchased for about $30. 4.0 Course Requirements: Attached to the end of this syllabus is the Course Calendar - a schedule of course topics and assignments required for completion of this course. Depending on class dynamics, we may move more quickly or slowly to enhance the learning environment. Changes made at the discretion of the instructor will be announced in class and posted on Blackboard. 5.0 Complete Course Calendar: The complete course calendar is attached to this syllabus and any changes made at the discretion of the instructor will be announced in class and posted on Blackboard. The Course Calendar shows the learning outcomes targeted by each particular assessment and/or assignment. The format of this course requires you to work on your own a great deal. To facilitate your learning, solutions to problems will be posted on Blackboard and can total many pages; hence, be fiscally prudent with any printing. Throughout the semester, current events will be discussed and guest speakers may visit the classroom. 4 6.0 Grading Criteria and Rubrics: The grade will come from 4 Excel Assignments, 1 Current Event Research Assignment, 1 quiz, 3 Exams. A maximum of 400 points will be awarded as follows: 44 Points from four Excel Assignments: Each of the 4 Excel Assignments will be worth a maximum of 11 points. 6 Points from a Quiz: Complete one timed quiz on recognizing corporate logos. 50 Points from a Research Assignment: A current topic in finance will be assigned by the instructor. 300 Points from three Exams: Each of the three exams will be worth a maximum of 100 points, consisting of multiple choice questions and/or short essays that cover both concepts and calculations. The format of each exam is likely to be a window of several days to complete online and may involve only one attempt, more than one attempt that produces an average of all attempts, or another format that may be a classroom setting; hence, it is important for students to check Bb postings and be aware of announcements during class to ensure accurate information on assessments. A missed assessment will count as a zero unless prior arrangements have been made with the professor, who reserves the right to allow a missed assessment to be made up by applying its weight to another assessment. Any written assignments will be graded for application of APA style, as well as proper spelling, grammar, writing skills, and content. Discussion Boards A Discussion Board will be available for student interactions on course topics and other Discussion Boards will be set up for the Group Project (accessible only to group members). Incomplete Policy: A grade of “Incomplete” can be given only under extenuating circumstances, such as serious illness or other necessary absences. Summer semester grades of “Incomplete” must be completed in accordance with university policy. If this does not happen, then the “Incomplete” will be changed to an “F.” If you are not earning at least a “C” in the course, and have not completed most of the course, then an “Incomplete” grade may not be appropriate. Grading Scale will be as described below. A = 90 -100% or 360 - 400 points B = 80 - 89% or 320 - 359 points C = 70 - 79% or 280 - 319 points D = 60 - 69% or 240 - 279 points F = below 60% or below 240 points 7.0 Technology Requirements: This course will use the new TAMU-CT Blackboard Learn learning management system for some class communications, certain content distribution, and most or all assessments. You will use the Blackboard username and password communicated to you separately to log on to this system. Logon to http://tamuct.blackboard.com to access the course. Username: Your Tarleton email address (the complete email address, e.g. john.doe@go.tarleton.edu) 5 Initial password: Your DuckTrax ID (UID). For technological or computer issues, students should contact the TAMU-CT Blackboard Support Services 24 hours a day, 7 days a week: Support Portal: http://www.ct.tamus.edu/bbsupport. Online chat (through the support portal at: http://www.ct.tamus.edu/bbsupport). Phone: (855)-661-7965. Blackboard supports the most common operating systems: PC: Windows 7, Windows XP, Windows Vista, Windows 2000, Mac: Mac OS 10.6 “Snow Leopard®”, Mac OS 10.5 “Leopard®”, Mac OS 10.4 “Tiger®” Check browser and computer compatibility by following the “Browser Check” link on the TAMU-CT Blackboard logon page. (http://tamuct.blackboard.com) This is a CRITICAL step as these settings are important when you take an exam or submit an assignment. Upon logging on to Blackboard Learn, you will see a link to Blackboard Student Orientation under My Courses tab. Click on that link and study the materials in this orientation course. The new Blackboard is a brand-new interface and you will have to come up to speed with it quickly. This orientation course will help you get there. There is also a link to Blackboard Help from inside the course on the left-hand menubar. Your ability to function within the Blackboard system will facilitate your success in this course, as some requirements are expected to be online. Technology issues are not an excuse for missing a course requirement – make sure your computer is configured correctly and address issues well in advance of deadlines. 8.0 Drop and Withdrawal Policy: If you discover that you need to drop this class, you must go to the Records Office and ask for the necessary paperwork. Professors cannot drop students; this is always the responsibility of the student. The record’s office will give a deadline for which the form must be returned, completed, and signed. Once you return the signed form to the records office and wait 24 hours, you must go into Duck Trax and confirm that you are no longer enrolled. If you are still enrolled, FOLLOW-UP with the records office immediately. You are to attend class until the procedure is complete to avoid penalty for absence. Should you miss the deadline or fail to follow the procedure, you will receive an F in the course. 9.0 Academic Integrity: Texas A&M University-Central Texas expects all students to maintain high standards of personal and scholarly conduct. Students guilty of academic dishonestly are subject to disciplinary action. Academic dishonesty includes, but is not limited to, cheating on an examination or other academic work, plagiarism, collusion, and the abuse of resource materials. The faculty member is responsible for initiating action for each case of academic dishonesty. 10.0 Disability Support Services: If you have or believe you have a disability, you may wish to self-identify. You can do so by providing documentation to the office of Student Affairs on the main campus at 254- 519-5721. Students are encouraged to seek information about accommodations to help assure success in this class. 11.0 Tutoring Services: TAMUCT offers its students tutoring, both on-campus and online. Subjects tutored include: Accounting, Finance, Statistics, Mathematics, and Writing (MLA and APA). For hours, or if you're interested in becoming 6 a tutor, contact Academic Support Programs at 254-519-5496 or by sending an email to: gnichols@ct.tamus.edu. Tutor.com is an online tutoring platform that enables TAMU-CT students to log-in and receive FREE online tutoring and writing support. This tool provides tutoring in Mathematics, Writing, Career Writing, Chemistry, Physics, Biology, Spanish, Calculus, and Statistics. Chat live with a tutor 24/7 or use the Tutor.com To Go App on your iPhone, iPod touch, or iPad. Visit www.tutor.com/togo to download the app for free. For access please visit www.ct.tamus.edu/AcademicSupport and click the link for Tutor.com. 12.0 Library Services: Library distance education services aims to make available quality assistance to A&M-Central Texas students seeking information sources remotely by providing digital reference, online information literacy tutorials, and digital research materials. Much of the A&M-CT collection is available instantly from home. This includes over half of the library's book collection, as well as approximately 25,000 electronic journals and 200 online databases. Library Distance Education Services are outlined and accessed at: http://www.ct.tamus.edu/departments/library/deservices.php. Information literacy focuses on research skills which prepare individuals to live and work in an informationcentered society. Librarians will work with students in the development of critical reasoning, ethical use of information, and the appropriate use of secondary research techniques. Help may include, but is not limited to: the exploration of information resources such as library collections, the identification of appropriate materials, and the execution of effective search strategies. Library Resources are outlined and accessed at: http://www.ct.tamus.edu/departments/library/index.php. 13. Additional Information: An important component of a learner-centered syllabus is a section directed to you, a student scholar, that explains the instructor’s teaching philosophy for this course. Here is a summary: My expectations are for you to develop reasonable proficiency with financial theories and applications to the decision-making process. Current events in finance will be discussed. Also, I hold a special interest in your professional development that stems, in part, from a career in corporate banking prior to specializing in higher education. Specifically, I obtained progressively responsible industry experience during a rapidly changing time in the financial services industry. Beginning with a formal Financial Analyst Training Program and advancing to Regional Finance Manager and Vice President of Corporate Banking for the largest U.S. financial institutions, I managed professionals in credit, collections and business development, while maintaining relationships with large companies across the U.S. for structured financings, swaps, fx, trust services, cash management, private banking, and other commercial services. Please don’t hesitate to discuss the course or professional development with me, as I never tire of teaching finance and discussing related matters with students! Remember: the best way to reach me is with FIN 507 in the subject to Blackboard email or University email. 14.0 Course Calendar is below. The dates on the calendar correspond to a section of this course taught face-to-face by Dr. Kelly and students in this online section may attend that section as desired - if space permits and this offers a benefit to the classroom. This section meets MW from 4:45 – 7:15 pm in Room 310 Founder’s Hall for 8 weeks, with the first class Weds, June 5. If attending the class, TRY TO BRING A LAPTOP and try to find a seat not normally occupied. 7 MODULE 1 Weeks 1,2 Dates(face-to-face section) Topics (not listed by chapter), Assignments, Exams and Due Dates June 5 Review Syllabus Optional Video Outside of Class on Careers in Finance at link below. See Careers Interview with three different types of financial managers http://highered.mcgrawhill.com/sites/0073382469/student_view0/video_clips.html Overview of Financial Management and the Financial Environment Review text for: Financial Language vs. Financial Calculations; Info/statistics on Financial Market Dynamics, Forms of Organization, etc. June 10 Financial Statements, Calculation of “Free Cash Flow” and Taxes See Bb posting of video on Financial Stmt Review See Bb postings for Calculator Tutorial (will need to do arithmetic now, but will do more complex calculations after exam 1) See Bb postings for Sample Excel In-Class Assignment Suggestion: do with a split screen showing problem and solution. Grad Student may come to classes to assist with review of prerequisite material on concepts and calculations using calculator and/or excel Review text for: Concepts and Procedures used to prepare Financial Stmts Public Policy Impact on Corporate Finance Decisions (Examples: EBITDA, Dividends Paid on Income Stmt) Free Cash Flow Calculations vs. Net Income Calculations EBITDA & other real-world calculations of “Free Cash Flow” (vs. text vs. yahoo.finance and why FCF is calculated vs. GAAP) See Bb posting on Free Cash Flow Practice Problems Optional Law & Order-CI episode: Tuxedo Hill from amazon.com Topics include the language of finance, especially FCF, EBITDA, and publicly traded companies; the episode can be purchased at amazon.com for about $3 and runs about 45 minutes w/o commercials. June 12 Ratio Analysis with Financial Statements Review text for: 5 Categories of Ratios and the most common ratios (about 15) 6th Category added in Bb posting of practice problems –Productivity Ratios (example: Sales/Total Employees; Sales/Full-time Positions) 7th Category added as description for Common Size Financial Stmts (see text and know for exams; know Balance Sheet Identity) 8 Understand DuPont Equation for ROE (history and usefulness for seeing 3 categories at once thru algebra) Review Ratio Benchmarks and Window Dressing See Bb posting for Ratio Practice Problems Optional Video on Ratios beyond text at link below (20 minutes) (the video can be located at link below): Find title: “EVA: Dr Joel Stern of Stern Stuart defines MVA and EVA” at link below. http://highered.mcgrawhill.com/sites/0073382469/student_view0/video_ clips.html Exam 1 Due by end of day on Sunday, June 16 Addresses the following Student Learning Objectives (SLOs) described above in Section 2.1 of this Syllabus: A, B, I, J MODULE 2 Weeks 3,4,5 Dates(face-to-face section) June 17,19 Topics (not listed by chapter), Assignments, Exams and Due Dates Introduction to Time Value of Money Concepts and Calculations (“TVM”) See Bb postings called “Excel Tutorial” See Bb postings called “Calculator Tutorial” See Bb postings called “TVM handout.” Graduate Student/Tutor may come to classes to assist students with prerequisites of TVM Concepts, Calculations using calculator & excel Review text and Bb TVM Posting for: TVM Concepts, Calculations and Applications. (1) Lumps Sums (2) Annuities (3) Multiple or Uneven Cash Flows (4) Bonds (5) Stocks (numerous chapters on the topics of: risk and return metrics, such as sigma vs. beta; The Efficient Markets Hypothesis (EMH) Modern Portfolio Theory and Diversification; Stock Valuation with The Dividend Discount Model (DDM) vs. The Capital Asset Pricing Model (CAPM); (6) Capital Structure Decisions Calculations for WACC and the effects of capital structure on firm value (7) Capital Budgeting Decisions Analyzing the techniques of NPV, IRR and Payback Period 9 TVM for Lump Sums, Annuities, Uneven Cash Flows Optional Video Outside of Class at link below. Time Value of Money Part I - Lottery example of Present Value-Lump sum payment. http://highered.mcgrawhill.com/sites/0073382469/student_view0/video_clips.html Excel Assignment 1 See Bb postings on TVM for Lump Sums, Annuities, and Uneven Cash Flows for template and solution. Suggestion: do with a split screen to view both problem and solution. Due date is same as for Exam 2 June 24 June 26 See Bb posting for TVM Practice Problems-Lump Sums, Annuities, and Uneven Cash Flows TVM for Bond Valuation Optional Video Outside of Class at link below: Definition of the Bond Market and how it differs from the Stock Market http://highered.mcgrawhill.com/sites/0073382469/student_view0/video_clips.html Review text for: Bond Concepts and Calculations. See text for Credit Ratings - what Investment Grade Rating means; what High Yield or Junk Rating means; what Sinking Fund means; what Callable Bond means and YTC calculations; Priority of Claims in Bankruptcy for Bonds – secured vs. unsecured; What Bond Indenture means, etc. Excel Assignment 2 See Bb postings on TVM-Bonds for template and solution Suggestion: do with a split screen to view template and solution Due date is same as for Exam 2 July 1 See Bb posting for TVM Practice Problems-Bonds July 3 Exam 2. Due by End of Day on Sunday, July 6) Exam 2 addresses the following Student Learning Objectives (SLOs) described above in Section 2.1 of this Syllabus: C, D, E, F, and those noted previously. 10 MODULE 3 Weeks 6,7 Dates(face-to-face section) July 8 Topics (not listed by chapter), Assignments, Exams and Due Dates TVM for Stock Valuation Review text for: Stock risk measured by σ vs. β; Stock return measured by CAPM vs. DDM vs. Avg of both; Portfolio Management -weighting, diversification, risk profile; Empirical evidence of stock valuation models EMH and its three forms July 10 Excel Assignment 3 July 15 Excel Assignment 4 July 17 See Bb posting on TVM for Stocks using DDM for template & solution Due Date is same as for Exam 3 See Bb postings on TVM for Stocks using CAPM for template & solution Due Date is same as for Exam 3 See Bb posting for TVM Practice Problems- Stock Valuation TVM Applications for Capital Structure Analysis (as time permits) Review text for: Calculating WACC. Discuss empirical evidence suggesting the use of debt tends to increase the value of a firm - leading to the quest for an optimal capital structure that maximizes a firm’s value for the benefit of its owners/shareholders (recall, ch 1) In-class Lecture on: Dividends and Other Distributions to Owners Cash vs. Stock Dividends and Stock Buybacks The Signaling Theory TVM Concepts and Calculations for Capital Budgeting Analysis (as time permits) Review text for: Capital Budgeting Decisions by NPV, IRR, Payback, Other Methods NPV and IRR Rules for Acceptance of Project(s) Payback Rules - do not consider TVM at all Capital Rationing Reasons for NPV preference in capital budgeting decisions Exam 3 Due by End of Day on Sunday, July 22. This Assessment addresses the following Student Learning Objectives (SLOs) described above in Section 2.1 of this Syllabus: D, E, F, G, H and those noted previously. 11 MODULE 4 Week 8 Dates (face-to-face section) July 23, 25 Topics (not listed by chapter), Assignments, Exams and Due Dates Research Assignment on a Current Event Due by end of day on Monday, July 22. See Bb Posting for Readings and Research Requirements 12