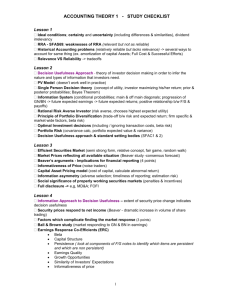

Review Checklist

advertisement

REVIEW CHECKLIST Module 1: Accounting under ideal conditions Ideal conditions; certainty and uncertainty (including differences & similarities), dividend irrelevancy, arbitrage, accretion of discount, abnormal earnings RRA - SFAS69; weaknesses of RRA (relevant but not as reliable) Historical Accounting Revisited mixed measurement model, (relatively reliable but lacks relevance), revenue recognition, recognition lag Relevance VS Reliability -> tradeoffs (Without ideal conditions, complete relevance & reliability are not jointly attainable therefore necessary to trade off these two desirable characteristics, NI does not exist as a well-defined economic construct Module 2: Decision usefulness approach to financial reporting Decision Usefulness Approach - theory of investor decision making in order to infer the nature and types of information that investors need. PV Model (doesn’t work well in practice) Single Person Decision theory (concept of utility, investor maximizing his/her return; prior & posterior probabilities; Bayes Theorem) Information System (conditional probabilities; main & off main diagonals; progression of GN/BN -> future expected earnings -> future expected returns; positive relationship b/w F/S & payoffs) Rational Risk Averse Investor (risk averse, chooses highest expected utility) Principle of Portfolio Diversification (trade-off b/w risk and expected return; firm specific & market wide factors, beta risk) Optimal Investment decisions (including / ignoring transaction costs) Beta Risk (covariance calc, portfolio expected value & variance) Decision Usefulness approach & standard setting bodies (primary user groups, characteristics of information required) Mod 3 Efficient Securities Market Efficient Securities Market (semi strong form, relative concept, fair game, random walk) Market Prices reflecting all available information (Beaver study -consensus forecast, rational expectations) Beaver’s arguments - Implications for financial reporting (4 points) Informativeness of Price (noise traders, partially informative) Capital Asset Pricing model (cost of capital, separation of expected and unexpected returns, calculate abnormal return) Information asymmetry (adverse selection; timeliness of reporting; estimation risk) Social significance of properly working securities markets (penalties & incentives) Full disclosure -> MD&A 1 REVIEW CHECKLIST Module 4 Information Perspective on decision Usefulness Information Approach to Decision Usefulness – extent of security price change indicates decision usefulness Predicting Investor Behavior (4 points; Beaver - increase in volume of share trading) Factors which complicate finding the market response (3 points) Ball & Brown study (market responding to GN & BN in earnings, possible reasons for anticipation effect, recognition lag) Earnings Response Co-Efficients (ERC – magnitude of unexpected return) Beta Capital Structure Earnings Quality Persistence (price irrelevant, transitory, permanent; look at components of F/S notes to identify which items are persistent and which are non-persistent) Growth Opportunities Similarity of Investors’ Expectations Informativeness of price Implications of ERC research – importance of disclosure Measuring Investors’ Earnings Expectations - Time series approach, Analysts’ forecasts Greatest Market Price Response =Best accounting policy? (public good VS private good, investor use of information) Information content of RRA - reasons for weak results for explanatory power of RRA Module 5: Measurement Approach to Decision Usefulness Measurement approach - more fair values incorporated into F/S proper Are Security Markets Efficient? (limited attention, overconfidence; representativeness, selfattribution bias; share price momentum) Prospect Theory (Kahneman and Tversky) Is Beta dead? (beta not stationary) Excess Stock Market Volatility Stock Market Bubbles Efficient Security Market Anomalies post announcement drift (Bernard & Thomas) market response to accruals (Sloan) implications of securities market inefficiencies for financial reporting other reasons supporting a measurement approach (market not as efficient) Value relevance of financial statement info (Lev’s study on earnings quality) Ohlson’s Clean Surplus Theory Auditor’s Legal Liability (supports use of valuations) Current Value Accounting (value in use, fair value) Measurement Oriented Standards – lower of cost or market, revaluation IAS 16, ceiling tests for PPE, IAS 36, IAS 2, IFRS 6; OPEB’s; IAS 19, SFAS 87 Financial Instruments – IAS39 (must know 4 categories); excess net income volatility, mismatch Hedging - purpose of hedging and why a company would not hedge; fair value and cash flow hedges, differences between SFAS 133 and IAS 39; supplemental disclosures Extensive supplementary disclosure (to better assess risk) Accounting for intangibles accounting for purchased goodwill self developed goodwill (Lev & Zarowin - R&D) clean surplus model revisited Reporting Risk – management approach/investor approach, beta risk Stock Market Reaction to other risks (MD&A; risk related disclosures, sensitivity analysis and value at risk) 2 REVIEW CHECKLIST Module 6 Economic Consequences Economic Consequences -changes in accounting policies & constituency reaction; reasons why; standard setters’ actions as a result Employee Stock Options (definitions, accounting approaches, Black/Scholes model, tactics used to increase the value of ESO’s) Positive Accounting Theories Bonus Plan Hypothesis Debt/Equity Hypothesis Political Cost Hypothesis Efficient and Opportunistic versions of PAT Module 7 – An Analysis of Conflict Non co-operative games of mgr-investor conflict (Nash equilibriums, Danielson –> straight forward maximization, constrained maximization) Co-operative Game Theory Models (binding agreements, moral hazard, reservation utility, disutility of effort) Manager’s Information Advantage Revelation Principle Owner-Mgr employment contracts (first best; second best fixed & moving support, agency costs) Bondholder-Mgr Lending contracts Holmström Agency Model (2 performance measures in compensation contract) Characteristics of good performance measures – sensitivity and precision Contracts (incomplete and rigid) Module 8 Conflict Between Contracting Parties Are Incentive contracts necessary? (managerial labour market, shirking, earnings management) Managerial Compensation Plans (bogey, cap) Manager Compensation – Share price VS Net Income (pros & cons) Role of Risk in Manager Compensation (methods to reduce risk) Empirical Compensation Research Politics of Executive Compensation (Jensen & Murphy) Power Theory of Executive Compensation – compensation contracts are more consistent with opportunistic version of PAT Patterns of Earnings Management Taking a bath Income Minimization Income maximization Income smoothing Earnings Management (Healy’s study) (1) Control various accruals (discretionary VS non discretionary -look at components of F/S notes to identify which items are discretionary and which are non discretionary) (2) Change accounting policies Beneficial & adverse effects of earnings management Other Motivations for Earnings Management - contractual; meet investors’ expectations, IPO’s, communicate information to shareholders Why does earnings management persist? – costly to find out inside info, use of discretionary accruals to provide inside info Good Earnings Management (efficient contracting mgr behavior, blocked communication) Bad Earnings Management (opportunistic mgr behavior) 3 REVIEW CHECKLIST Module 9: Standard Setting: Economic Issues Regulation of Economic Activity – central authority, standard setting, costs and benefits of standard setting, proprietary information How to characterize information production Finer information Additional information Credibility First best information production Externalities and Free Riding MARKET FAILURES – externalities, free riding, Adverse Selection (insider trading, withholding bad news) Moral Hazard Unanimity (lack of) CONTRACTUAL INCENTIVES (for regulation of info production) Manager incentive contract; Debt Covenants -> concept of internalization MARKET BASED (non contractual) INCENTIVES (for regulation of info production) Managerial Labour Market Efficient Securities Market (Capital Market) Takeover Market Other INFORMATION PRODUCTION INCENTIVES * Disclosure Principle * Signalling * Private Information Search Securities Market Response to full disclosure – market liquidity, market depth, bid-ask spread Empirical Test of Disclosure Models (high quality disclosures, impact of estimation risk) Decentralized regulation – management choice of reporting -> improved relevance, less costly Cost & benefits of regulation Module 10: Standard Setting: Political Issues Two Theories of Regulation - Public Interest Theory (first best approach); Interest Group Theory, interest groups, legislature Conflict and Compromise – IAS 39, which applies to investments in debt and equity securities, macro hedging Distribution of the Benefits of Information (Regulation FD) - fair disclosure Criteria for Standard Setting - decision usefulness; reduction of info asymmetry; economic consequences; political aspects (reasonable compromise) International Integration of Capital Markets – convergence of standards, enforcement of standards, benefits of high quality stds, accounting challenges for adverse selection and moral hazard Ethical Perspective on Standard Setting – internal & external motivation, Bayles consumer perspective -> client interests most important 4