Draft Feasibility study for Swartkops Lodge - Nov 2007

advertisement

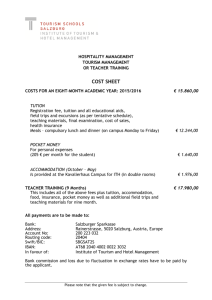

Accommodation and Tourism Facility in Motherwell - A Feasibility Study November 2007 Contents 1. Background 2 2. Description of the Project 2 3. This Feasibility Study 2 4. The Tourism Grading Council of South Africa Provides the following Definitions of Categories of Accommodation Establishments 3 5. The Tourism Industry in South Africa, The Eastern Cape and Nelson Mandela Bay 4 6. Key Markets for a Proposed Motherwell Tourism Accommodation Facility 6 Support from the Motherwell Community The Coega Industrial Development Zone The General Growth in the Tourism Industry in the Nelson Mandela Bay Area World Trends to Eco-Tourism and Cultural Tourism 6 6 7 7 7. Proposed Sites for the Proposed Motherwell Tourism Accommodation Facility Motherwell Central The Swartkops River Estuary 8 8 8 8. What type of Tourism Accommodation Facility Could Work on this site? Cost Handicaps Which Type of Tourism Accommodation Establishment 9 9 9 9. Prelimary Financial Feasibilities 11 Services to be Offered Expenses 11 11 10. Design of the Proposed Motherwell Eco-Lodge and Chalets 15 11. Costing of the Construction of the Proposed Motherwell Eco-Lodge and Chalets 15 12. Final Financial Feasibilities 16 Department of Trade and Industry – Incentive Grants Income and Expenditure Tables Conclusions on Financial Feasibility 1 16 16 18 ACCOMMODATION AND TOURISM FACILITY IN MOTHERWELL FEASIBILITY STUDY 1. BACKGROUND The Nelson Mandela Bay Municipality in conjunction with the Development Bank of Southern Africa put to tender in June 2007 a Tender Specification for a Feasibility Study and, if feasible, for a business plan for an accommodation and tourism facility in Motherwell. The tender was awarded to Development Partners, working in conjunction with Dojon Financial Services cc and Mr Peter Myles, the Director of the Tourism Research Unit at the Nelson Mandela Metropolitan University. Draft sketches are to be done by The Matrix cc Urban Designers and Architects. 2. DESCRIPTION OF THE PROJECT It was proposed that the envisaged facility would include: An ethnic-look restaurant A tavern and/or bar Entertainment area Accommodation facilities Several curio shops Vegetable gardens It is envisaged that the facility would create possibly 50 direct employment opportunities, and possibly 28 other employment opportunities. The appointed service provider would have to: Conduct a comprehensive feasibility study for the proposed accommodation and tourism facility; On confirmation of its feasibility, prepare a comprehensive business plan to ensure that the proposed facility will be operated in a sustainable manner. The combined feasibility study and business plan must include: A comprehensive market analysis A review of technical aspects of the project An environmental analysis of the impact of the proposed facility Economic and financial analysis of the proposed facility, including 20 year projections to determine viability, and Social and institutional analysis for the proposed facility. 3. THIS FEASIBILITY STUDY This feasibility study is designed to inspect particularly the financial feasibility of a variety of possible facilities, and to determine under what conditions such facilities could be possible. The Business Plan will propose strategies to minimise risk and to overcome difficulties, and will inspect a wider range of the variables outlined in 2.4 above, as opposed to the financial feasibilities which will dominate this feasibility study. The feasibility study will eliminate types of facility which appear to have no chance of financial success – the business plan will attempt to show how the preferred and most feasible options could be made to work. 2 4. The TOURISM GRADING COUNCIL OF SOUTH AFRICA provides the following definitions of categories of accommodation establishments: Backpacker & Hostelling A Backpacker and/or Hostelling establishment is an accommodation facility that provides communal facilities, including dormitories, yet may offer a range of alternative sleeping arrangements. Only establishments that cater for transient guests (travelling public) will qualify for grading. Bed and Breakfast Bed and Breakfast accommodation is provided in a family (private) home and the owner / manager lives in the house or on the property. Breakfast must be served. Bathroom facilities may or may not be en-suite and/or private. In general, the guest shares the public areas with the host family. Guest House A guest house can be an existing home, a renovated home or a building that has been specifically designed to provide overnight accommodation. A guest house will have public areas for the exclusive use of its guests. A guest house is a commercial enterprise and as such the owner or manager may live on the property. Country House A country house is a large guest house, usually situated in natural, peaceful surroundings such as near a nature reserve, a forest, a lake etc. It offers all the services of a hotel, including dinner. Hotel A hotel provides accommodation to the travelling public, has a reception area, and offers at least a ‘breakfast room’ or communal eating area. In general a hotel makes food and beverage services available to guests; these may be outsourced or provided by the hotel. Lodge A Lodge is an accommodation facility located in natural surroundings. The rates charged are usually inclusive of all meals and the experience offered at the lodge, with game drives, battlefield tours, etc. Self catering A self-catering establishment is a house, cottage, bungalow, flat, studio, apartment, villa, houseboat, tent or any accommodation where facilities and equipment are provided for guests to cater for themselves. The facilities should be adequate to cater for the maximum advertised number of residents the facility can accommodate. Caravan and Camping A Caravan and Camping Park is a facility that provides ablution and toilet facilities and space for guests to provide for their own accommodation, such as a tent, motor home and/or caravan. 3 5. THE TOURISM INDUSTRY IN SOUTH AFRICA, THE EASTERN CAPE AND NELSON MANDELA BAY This is a vast and highly nuanced topic, and a research paper by Peter Myles, Director, Tourism Research Unit of the Nelson Mandela Metropolitan University on this topic is included as Annexure A. We will draw from this research as needed, and a summary of some salient points is as follows: Travel and tourism is the largest and fastest growing industry in the world. 800 million global tourists travel the world annually, with only 2 mil (0.25%) overseas (defined as, the world but excluding Africa) visitors visiting South Africa. South Africa is currently ranked 37th in the world as a tourism destination, but is growing faster than other major world players. Major events (Rugby World Cup 1995; World Summit Sustainable Development 2002; Cricket World Cup 2003) have each caused considerable growth in numbers of overseas visitors to South Africa. African tourists outnumber overseas visitors to South Africa by 2.5 to one (2005; 5.4 million African visitors) but spend considerably less. The Eastern Cape only hosts 8% of foreign visitors to South Africa, which translates to 6% of total South African bednights utilized. Foreign tourists use, mostly, hotels; followed by self-catering units and then guest houses. The Eastern Cape is the 7th most popular province for foreign tourists. 80% of visitors to the Eastern Cape visit Nelson Mandela Bay. Domestic tourism is enormously bigger (in numbers) than foreign tourism, with an estimated nearly 50 million domestic tourist trips having been made in 2003. Statistics here are, however, unreliable. Domestic tourists are predominantly social visitors (in the Eastern Cape 80% are visiting friends and family) and shopping is their biggest activity. NM Bay played host to 405,600 foreign tourists and 2,015,710 domestic tourists in 2006, who, in total, spent R4.6 billion (about half each foreign and domestic). By 2010 these numbers will rise to 488,000 foreign tourists spending R5.3 billion, and 2.3 million domestic tourists spending R3.8 billion. The fastest growing types of tourist accommodation over the last 10 years have been bed and breakfasts (B and B’s) and resorts and self-catering. All types of tourist accommodation have, however, shown growth. Growth in accommodation for tourists in NM Bay is as follows Hotels Self-Catering B & B’s Backpackers Resorts 1996 13 12 100 4 7 2006 29 52 141 8 8 % Growth 123% 433% 41% 100% 14% Page 24 of Annexure A inspects the current supply of hotel facilities in the Nelson Mandela Metropolitan area in 2004. Two five star hotels have subsequently been added to this listing: o o The King’s Tide Boutique Hotel (in Summerstrand), with 10 rooms charging between R300 and R650 per person per night; and The Windermere Hotel (in Humewood), with 8 rooms charging between R700 and R1250 per person per night. 4 Of note with regard to the above: With the exception of the Pine Lodge, which we would contest should be in the Primary Market category, those establishments in the Secondary Market are older, smaller, cheaper and less likely to satisfy a discerning traveller. They are not models to replicate, we believe, and would probably not be rebuilt today as and where they are. Should we then include the Pine Lodge, the King’s Tide and the Windermere into the primary market category, this category becomes 17 hotels with just over 1520 rooms between them, averaging a 2004 room rate of just under R400 (possibly R500 now) and enjoying nearly 70% occupancies. Extraordinarily, with the single exception of the Edward Hotel, all 16 other hotels in the Primary Market Category are on the Summerstrand / Humewood beachfront. This is possibly not surprising as this beachfront has considerable attractions: o o o o o It is the home of the Metro’s three biggest tourist attractions (the beaches, the Boardwalk Casino Complex, and Bayworld) It is close to the Airport, with the only car-rental facilities in the metro. It is beautiful, scenic, and offers walks and open-air entertainment opportunities, in a safe environment It is adjacent to the Humewood Golf Club; the University; Telkom Park Rugby Grounds and the Humerail sports facilities; and includes a Casino and a movie complex. It is well-served with restaurants (more than 50) and shops (Humerail, Pick’nPay Summerstrand, etc.) and all necessary tourist facilities. Simply put, with the exception of the Metro’s game parks, about all of its tourist attractions are concentrated on this beachfront axis, making it the obvious place for further investment, and also making it very difficult for other investment areas to compete. There is a greater geographical spread of other types of tourist accommodation: The main areas (for rooms) are: Area Summerstrand Humewood Central Walmer Uitenhage Mill Park / Linkside Rooms 1256 902 421 258 138 131 Others of note here are: Amsterdamhoek / Bluewater Bay Coega Motherwell 90 50 and 4 It is estimated that an additional 233 rooms are required in NMB tourist accommodation establishments by 2010, and a further 487 by 2015. 5 6. KEY MARKETS FOR A PROPOSED MOTHERWELL TOURISM ACCOMMODATION FACILITY From the summary points outlined in section 5, it is obvious that the development of an ambitious tourist accommodation establishment away from the Summerstrand / Humewood beachfront must be approached with great caution. In the case of this Feasibility Study, the following four positives should be recorded: 6.1 Support from the Motherwell Community Motherwell is a large community, with a significant middle class component. Motherwell’s population is estimated at 180,000, and a significant number of these are middle class. A study of the employed and unemployed in Motherwell suggests that there are about 47,000 Motherwell residents in employment, and it is estimated that, in 2006, there were over 3,600 housing bonds in Motherwell, averaging more than R45,000,00 per bond. This is evidence of a significant middle-class presence (See Motherwell Employment Survey, and Motherwell Baseline Survey, both by Development Partners conducted in 2006 [remember references]). This suggests that there will be a need for a tourist accommodation facility to cater for school and church groups visiting Motherwell; as well as for visitors to the area for weddings, funerals and the many other social events that are the stuff of everyday life. Price is, however, a great concern – this is not an area for premium prices – and backpackers and self-catering arrangements are fundamental to the success of such an institution. Further, to date there are no restaurants, or tourism accommodation establishments in Motherwell – while this suggests a limited market for the services offered, the success of existing take-away businesses suggests that there will be support for a restaurant / coffee shop; and that it would provide a much-needed social facility of making Motherwell an easier place for middle-class people to live in. It is difficult to predict the extent to which the Motherwell community will support such an establishment, but a limited degree of support is reasonably predictable. 6.2 The Coega Industrial Development Zone Annexure B contains three documents. A two-page document, “The Coega Project, Milestones”; A table of announced investors in the Coega IDZ; their dates and the numbers of jobs these corporations will create; and An eight-page summary of announcements of investors in the Coega IDZ. While many of the investment projects in the Coega IDZ are in process and not yet “bricks and mortar”, what is incontestable is: The port of Ngqura is nearing completion, and the required handling equipment is about to be installed. The Coega IDZ is now well-advanced, with world class civil construction services in place including roads, sewers, etc. Factory investors could now be accommodated and the first ones are arriving; Nearly R8 billion has been spent by government in the above regard; The Coega Development Corporation is about to move into its 9700m² new headquarters building in the IDZ – this will happen in December 2007. All of this points to an explosion of industrial and commercial activity adjacent to Motherwell, which can only increase the number and income of the Motherwell middle-class; and create demand for tourist accommodation, restaurant facilities; recreation facilities and workshop / conference facilities. While some of this will be taken up in the Summerstrand / Humewood strip, there nevertheless remains a tremendous opportunity for the development of accommodation, and restaurant, conference and recreational facilities in the areas adjacent to the Coega IDZ. 6 Would have been a good idea to put in a map to show proximity of M’well vs Coega and City 6.3 The General Growth in the Tourism Industry in the Nelson Mandela Bay Area In section 5 and Annexure A we saw that a considerable growth is projected for the tourism industry in NM Bay – tourism numbers are expected to rise by 80,000 foreign and 300,000 domestic tourists, 2006 to 2010; and this increased number of tourists is expected to spend R4.5 billion more per annum. It is reasonable to expect that some of this will become available for different and more adventurous tourism establishments. It has also been projected that, after taking into consideration existing plans to build new tourist accommodation, an additional 233 accommodation rooms are required by 2010, and a further 487 by 2015. Surely, some of this could happen beyond Summerstrand / Humewood. 6.4 World Trends to Eco-Tourism and Cultural Tourism Annexure D is a paper commissioned for this report, and again written by Mr Peter Myles, Director of the Tourism Research Unit at the Nelson Mandela Metropolitan University. Some significant points in the paper include the following: A significant percentage of travellers today look for “new experiences such as controlled danger, unusual environments and cultures, personal or physical improvements and emotional development”. The “one size fits all” type of vacation no longer works. Travellers now look for unique and authentic experiences and will no longer wish to visit the same places. “In future, travel will be viewed not just as a vacation, but as a way of culturally differentiating yourself”. “Sustainable tourism” and “responsible tourism” are new and growing markets – eco-lodges, which minimise energy and water consumption and protect flora and fauna, are to be supported. A new type of tourist is emerging: more educated, experienced, independent, conservation-minded, respectful of cultures, and insistent on value for money. “Responsible” will become to travel what “organic” is to food – a mainstream consumer favourite that is more enjoyable for you, and better for local people and the plant” The World Tourism Organisation estimates that 37% of international tourists are cultural tourists – interested in cultural and heritage attractions, museums, art and performances. Authentic tourism experiences are amongst the fastest-growing, highest demand products in the tourism industry today – reaching into the community; hands-on and interactive activities; special access, behind-the-scenes and exclusivity; learning and discovery, and shared experiences. “Creative tourism” is another growing market – actively engaging tourists in activities. In Nelson, New Zealand, a network of businesses now offer tourists creative experiences: bone carving; Maori language classes; weaving; felting and woodwork and cooking and gastronomy. This is an excellent opportunity to involve “tutors” from the local community. 7 7. PROPOSED SITES FOR THE PROPOSED MOTHERWELL TOURISM ACCOMMODATION FACILITY There are two possible areas for the development of the proposed Motherwell Tourism Accommodation Facility – somewhere inside Motherwell proper, or on a site overlooking the Swartkops River, on Motherwell’s western boundary. Motherwell Central The centre of Motherwell is a area with an increasing number of public facilities – the Shoprite Shopping Centre; Hospital and Raymond Mhlaba Sports Centre are in close proximity to each other, and are now adjacent to an innovative housing estate (under construction) and a housing advice centre. Land is available here, and the positioning for public transport is good. We considered this area in-depth, but, in the end, felt that the attractions were not strong enough to compete, in any meaningful way, with the qualities of the Summerstrand / Humewood beachfront, as outlined in section 5. As such a tourism accommodation establishment here could easily develop an economic “inferiority complex”, which would see it undercharge by general market standards and as such battle to remain solvent. If the executives of Coega are meaningfully part of the future customer profile of the proposed establishment, we feel that this site would not provide the required attraction to compete with Summerstrand / Humewood. The Swartkops River Estuary The Swartkops River estuary is the biggest estuary in any major South African city. It has a massive and diversified wildlife, and, while development does encroach on the pristine conditions in a number of places, it remains a significant area for wildlife, fishing and watersports. And it is adjacent to Motherwell, with the residential areas of Motherwell being separated from the estuary by the Motherwell Nature Reserve. There are two areas of this Nature Reserve where roads exist and clearing has happened. They are outlined in the map in Annexure C. While obviously not ideal, it is suggested in this feasibility study that these two areas be investigated as the potential site for the proposed Motherwell Tourism Accommodation facility. It will be difficult enough for a Motherwell business to compete with the Summerstrand / Humewood strip – but the Swartkops River, and views of it and access to it, could provide a competitive advantage for a Motherwell tourism accommodation facility, and provide something different, exciting and beautiful. Of the two sites outlined in Annexure C, the site adjacent to the Swartkops stormwater canal has major civil construction pending – the concrete filter tanks at the bottom of this canal are to be enlarged, and the new tanks will be over 100m wide, running across the riverside of the site. As such it is not recommended by this study. The second site has magnificent views of the river estuary, and, should a boardwalk be built sensitively, it could have access to the riverfront and thereby become a centre for watersports. There are many challenges to the use of this site (they will be investigated in detail in the Business Plan) – nevertheless the views; the unspoilt natural vegetation; the river / frontage and the beauty of the site add up, we believe, to a compelling package and allow this site to present the most competitive alternative to the Summerstrand / Humewood beachfront that Motherwell has to offer. This site, with its natural beauty and extraordinary ecological opportunities, provides an opportunity to introduce to the Nelson Mandela Bay the first tourist accommodation establishment aimed at the new eco-tourism market. This is a huge and growing market, with very few accommodation establishments in the NM Bay Area designed to access it. 8 Annexure D has a paper by Peter Myles in this regard, which introduces this new, worldwide tourism growth market. 8. WHAT TYPE OF TOURISM ACCOMMODATION FACILITY COULD WORK ON THIS SITE? Cost Handicaps We believe that any development in Motherwell would have three major cost handicaps: Advertising costs. Any new business requires advertising and marketing to find its way into the market. We believe this facility will require considerable spending over a number of years to establish its reputation. Budget here – R120.000.00 per annum. Security costs. It is fundamental that guests should believe that their persons and vehicles are safe at the facility – any breach of this rule, and support would rapidly erode away. Security has capital costs (perimeter fencing, CCTV cameras, etc) and operating costs (gate control, security patrols). The capital costs will be covered in the next section – operating costs should be for security guards, 24/7. Budget – R240.000.00 per annum. Guest Transport. It is simple to guide a visitor from the Port Elizabeth Airport to the Holiday Inn Garden Court, or for that matter to any beachfront facility. Likewise from Coega. It is a much more complicated set of instructions to guide someone to a resort in the Motherwell Nature Reserve. As such a shuttle service, to pick up and drop off visitors to both the Airport and Coega, must be budgeted for. Budget – R96.000.00 per annum, plus drivers. We believe that any tourism accommodation establishment to be created in Motherwell will have to fund these three operating costs, if it is to prosper and succeed. Thus a budget cost of R456.000.00 per annum must be anticipated in the above regard. Which Type of Tourism Accommodation Establishment Would Work in Motherwell? In section 4 we listed the different categories of accommodation establishments. Here we will assess the feasibility of each type for the site in Motherwell, taking into account the cost handicaps mentioned above. 9 Hotel Hotels are expensive to build and expensive to run – and are thus expensive to stay in. Self-catering options are not common except in budget hotels, which have to be big to survive. In our opinion, a hotel would not succeed in Motherwell. Backpackers We believe a backpackers would find good support from visitors to the Motherwell community (visiting school, church and sport groups, etc), and would satisfy social and community needs. However it would not generate enough revenue on its own to meet the cost handicaps outlined above, and to employ significant staff to attempt to meet the employment creation targets set in the terms of reference of this study. For rates, see Willows Resort in Annexure E. We believe a backpackers establishment should be combined with another, stronger cash generating facility to approach the targets in this terms of reference. Bed and Breakfast Again, such an establishment would be of benefit, but the financial benefits would accrue to the owners and a small number of staff. 8.2.4 Caravan and Camping Again, at the going rate of R120 per caravan site per day (see Willows Resort in annexure D), such an establishment cannot succeed except if attached to another, stronger cash generating establishment. 8.2.5 Guest House, Country House, Lodge We believe that such an establishment is the best of the alternatives, to meet the targets set in the terms of reference of this project. 8.2.6 Self Catering This is a vital quality in reducing user-cost, and must be built into any potentially successful accommodation establishment in Motherwell. 8.2.7 Conclusion Our conclusion is to consider a hybrid-type of establishment: A lodge, set in the beautiful site of the Motherwell Nature Reserve overlooking the Swartkops River, in peaceful natural surroundings. The lodge will provide reception, catering and conference facilities. Accommodations to be provided in flexibly designed low-intensity chalets, which include some that are 8 sleepers (see Pine Lodge diagrams, Annexure E) to provide the backpacker option; and with kitchenettes for the self-catering option also. A boardwalk will provide access to the Swartkops River, where water sports and riverside facilities are to be made available. This hybrid option offers the best option of a user-friendly, inexpensive, yet high quality establishment that can accommodate the Coega market requirements, as well as a backpackers option, and provide a haven and a valued social amenity to the Motherwell community. Again, please refer to the growing eco-tourism market in the Paper in Annexure D. 10 9. PRELIMINARY FINANCIAL FEASIBILITIES: Services to be Offered Such a tourist accommodation establishment would offer three types of to-be-paid-for services: Accommodation, to be provided in Chalets. The smaller chalets would include a lounge with workstation (including ADSL connection and TV); a bedroom with double bed and cupboard; a bathroom with shower and a kitchenette with microwave, fridge, stove and catering equipment. Possibly a balcony with outdoor furniture could also be provided. The larger chalets could, like the Pine Lodge diagram in Annexure E, have two bedrooms, one with a double bed and one with two bunks, and two sleeper couches to sleep 8, thereby providing an upmarket backpackers facility at a low backpackers price; Catering, including restaurant, bar and tea service; and Conference Facilities, which would include: o o o A main conference hall capable of seating 200 schoolroom style and capable of being subdivided into two; A breakaway room to seat 40 schoolroom style, also capable of subdivision Two elegant boardrooms, each capable of seating 20. We will now consider the preliminary financial feasibilities of such a proposed establishment. Expenses The expenses of such an establishment can be divided into three categories: Expenses related to the accommodation and conferencing facilities, and some expenses of the entire establishment (security, cleaning, vehicles, etc.); Expenses related to the provision of catering, bar and tea services; Expenses related to repaying loans raised to build the establishment initially. For the purposes of this study, we will, however, assume: All catering, bar and tea expenses are subcontracted, and a rental, possibly based on turnover, is charged to the independent contractor. As such no provision is made for employing chefs, barmen, etc.; Expenses related to debt service will be treated separately, later. As such this section will only cover the first of the above three expense categories at this stage. Table 1 outlines the annual overheads excluding catering and debt service costs of three actual tourism accommodation establishments in the area (taken from Annual Financial Statements escalated up to 2007) and concludes, in the right-hand column, with a projection to the proposed Motherwell Eco-Lodge. 11 Annual Overholds Excluding Catering and Debt Service Costs (2007 Costs) Actual 3 Star 70 Room Chalets and Lodge Auditor Advertising 12,330 13,550 210,244 7,938 17,000 107,230 Credit card costs Cleaning 109,781 Projection 20 Chalet 4 Star 24 Room Hotel 126,213 Bad Debt Bank 3 Star 51 Room Hotel Motherw ell EcoLodge 12,000 55,030 120,000 22,875 19,949 60,000 117,463 72,157 (1) 6,000 181,908 80,000 Guest Comforts Pest Control Laundry 45,414 Commission Municipal Services: Electricity & Water Gas and Fuel 33,726 294,970 427,474 237,860 85,937 60,000 40,328 143,568 40,248 30,000 42,033 40,000 11,944 6,000 Rates 157,354 Computer Services 13,847 16,976 Internet 20,000 1,518 Depreciation 120,154 109,659 Insurance 103,920 103,810 48,155 16,355 84,076 5,943 286,817 470,434 Legal Fees - Debt Collection 60,000 50,000 930 Licences - SAMRO, SA Tour levy, etc Maintenance - Building, Furniture, Equipment Garden and Pool 6,000 100,000 100,272 Electrical Appliances Replacement Linen, etc 101,460 Motor Vehicle Expenses 37,750 12,710 96,000 Printing and Stationery 40,504 100,395 30,000 Replacement and Hiring Costs 52,168 2,690 Security 99,857 102,076 (1) Guest Transport Subscriptions 4,045 240,000 96,892 80,000 (1) 6,970 Sponsorships 1,216 Telephone and Postage 137,429 289,802 19,862 69,009 54,324 1,093,238 2,974,434 777,060 3,199,379 5,678,185 1,649,405 70 51 24 20 R 45,705 R 111,337 R68,725 R 84,800 Training Television 34,527 Travel and Enrolment Salaries, UIF, PAYE, Uniforms Other Expenses Total 11,518 Rooms Expenses per room per annum Notes: (1) As outlined in section 8.1 (2) Staffing component and monthly salaries (in brackets) 1 General Manager (R12,000) 1 Marketing Officer (R6000) 2 Front Office personnel (2 @ R3000) 1 Back Office (bookkeeper) (R5000) 1 Driver / Gardener (R3000) 6 Housekeepers (6 @ R2000) 1 Maintenance Officer (R6000) Total Monthly Wages Bill: R50,000 12 600,000 299,643 1,696,000 (2) Using this as our expenses projection, we can calculate the feasible number of rooms and required roomrate through the following graph: This graph shows that: A ten-roomed establishment, operating at 60% occupancy, cannot meet this expense budget at R500 per room per night – simply this does not work. A twenty-roomed establishment, operating at 60% occupancy, meets the entire proposed expenses budget (excluding catering and debt service costs) at R385 per room per night. A thirty-roomed establishment, operating at 60% occupancy, meets this budget at R285 per room night. This suggests that a minimum number of rooms / chalets is 20 – at this number a roomrate of R385 per night (against the Metro average of about R500) and at a 60% occupancy (against a Metro average of 70%) will see the accommodation revenue meet all operating expenses except for debt service. Catering is not considered, and rental on the catering franchise can only improve this situation. While a 30 room / chalet establishment is more profitable, we believe this is too ambitious initially. Nevertheless the site of the facility should be large enough to cater for this expansion in the future. 13 Should, as we suggest, the catering, bar and tea operations be subcontracted and as such only reflect in this feasibility study as a projected rental received from the subcontractor, the project has two further income sources that should be considered, and are included in the next graph. Notes (1) CONFERENCE, WEDDING AND FUNCTION RECEIPTS are estimated at 280 seats available per day, or 102200 per annum, at 15% usage = 15330 guest days per year, at R100 per guest = income of R1,533,000.00 per annum. (2) CATERING INCOME ESTIMATED at 10% of ESTIMATED CATERING TURNOVER of R876,000.00 = income of R87,600.00 per annum (3) ACCOMMODATION INCOME AS PER FIRST GRAPH, 20 chalets @ 60% occupancy at R300, R400 and R500 per room per night. 14 10. DESIGN OF THE PROPOSED MOTHERWELL ECO-LODGE AND CHALETS Annexure E includes drawings by The Matrix Architects cc, that are initial draft proposals with regard to the proposed Motherwell Tourism Accommodation facility. (While The Matrix staff have visited the site and inspected maps and relief drawings, and taken every care to ensure appropriate drawings, it must be noted that this is a feasibility study and as such the drawings are preliminary and designed mostly for costing purposes). Included also in this Annexure is a copy of “Infrastructure Guidelines - Nature Areas and Natural Open Spaces of Nelson Mandela Bay, Final Draft June 2007”, (of which The Matrix were co-authors), which guidelines have been used extensively in the preparation of these drawings. The drawings detail an Eco-Lodge, including the following facilities: Conference Facilities: o o o o A multi-purpose conference hall, seating approximately 200 theatre-style, and capable of many arrangements Two boardrooms, each capable of seating 15-20 around a board table A breakaway room, which is also multi-configurable; The necessary foyer spaces and toilets, and a kitchenette. All of this backs into a large courtyard and tea garden, with a boma and entertainment deck overlooking the Swartkops River. A hundred seater restaurant, with bar and recreation space / lounge attached, all arranged to overlook the River. Reception, office, laundry, kitchen, toilets and other necessary facilities. The proposed eco-lodge has a very “open-feel”, with a great, open central courtyard and a large deck overlooking the river. Also on site are 20 chalets, of two types: A two-bedroom unit, which can sleep 4 in luxury or can be used as a backpacker unit sleeping eight. A one-bedroom luxury unit, sleeping 1 or 2 in great comfort. The site also includes a boardwalk to the river, where a boathouse and recreation facility will be built; parking and a security gatehouse on the access road entrance. 11. COSTING OF THE CONSTRUCTION OF THE PROPOSED MOTHERWELL ECOLODGE AND CHALET Attached as Annexure F are Quantity Surveyor estimates of the construction costs of this proposed Eco-Lodge. The estimated final construction, and furnishing, cost is R40.570.000.00. 15 12. FINAL FINANCIAL FEASIBILITIES Department of Trade And Industry – Incentive Grants The Department of Trade and Industry has, for a number of years, run a reimbursive cash grant that can be claimed by tourism related industries. These grants are under review, and the new tables and types will be available early in 2008. The new grants will be, we are told, similar to the old Small Medium Enterprise Development Progressive grants (SMEDP) (see Annexure G hereto for the DTI’s notes on these grants). This SMEDP would have yielded a reimbursable cash grant (not taxable) of the following order to the Motherwell Eco-Lodge and Chalets. SMEDP GRANT on R40,570,000.00 Rate First R5,0mil 10% Next R10,0 mil 6% Next R15,0 mil 4% Next R10,570 3% TOTAL SMEDP GRANT, per year for 3 years R R500,000.00 R600,000.00 R600,000.00 R317,100.00 R2,017,000.00 Income and Expenditure Tables The following table provides estimated income and expenditure projections for the first five years of the existence of the Motherwell Eco-Lodge and Chalets. All are in real (uninflated) Rands, and it is assumed there will be no debt-service costs. Income Income from Conferencing Income from Accommodation Net Income from Catering Total Income Expenditure Expenditure EBITDA Depreciation PBIT Interest Paid PBT Corporate Tax Profit after Tax SMEDP Subsidy Profit after Tax and Subsidy Investment % return R41,243,000.00 Notes: (1) (2) (3) (4) (5) Year 1 511,000(1) 2 1,022,000(2) 3 1,533,000(3) 4 2,044,000(4) 5 2,044,000 1,460,000(5) 1,825,000(6) 2,190,000(7) 2,555,000(8) 2,555,000 58,400(9) 73,000(9) 87,600(9) 102,200(9) 102,200 2,029,400 2,920,000 3,810,600 4,701,200 4,701,200 1,636,000(10) 393,400 60,000 333,400 0(11) 333,400 0 333,400 1,636,000 1,284,000 60,000 1,224,000 0 1,224,000 110,022 1,113,978 1,636,000 2,204,000 60,000 2,144,000 0 2,144,000 403,920 1,740,080 1,636,000 3,065,200 60,000 3,005,200 0 3,005,200 767,520 2,237,680 1,636,000 3,065,200 60,000 3,005,200 0 3,005,200 991,716 2,237,680 2,017,000 2,350,400 2,017,000 3,130,978 2,017,000 3,757,080 2,237,680 2,237,680 5,7% 7,6% 9,1% 5,4% 5,4% And on Conferencing income assumed at 5% of occupancy. Conferencing income assumed at 10% of occupancy. Conferencing income assumed at 15% of occupancy. Conferencing income assumed at 20% of occupancy. Accommodation income assumed at 40% of occupancy on 20 rooms @ R500 per day. 16 (6) Accommodation income assumed at 50% of occupancy on 20 rooms @ R500 per day. (7) Accommodation income assumed at 60% of occupancy on 20 rooms @ R500 per day. (8) Accommodation income assumed at 70% of occupancy on 20 rooms @ R500 per day. (9) Catering income assumed at 10% of estimated turnover. (10) Expenses as at Feasibility Study section 9.2 minus depreciation (see later). (11) No debt service costs assumed – all investment is capital. The above table assumes that there will be no borrowing – that the capital and set up costs (see 5.1) of R41, 243,000.00 will be funded out of a capital investment. We have to investigate also the impact of borrowing on these calculations. The following is the impact of 100% borrowing. INCOME AND EXPENDITURE ASSUMING BOND OF R41,243,000.00 TOTAL INCOME EXPENDITURE Expenditure EBITDA Depreciation PBIT Interest PBT Corporate Tax Profit after Tax SMEDP Subsidy Profit after Tax and Subsidy Balance of Bond Payment Cash Flow Year 1 2,029,400 2 3 2,920,000 3,810,600 4 4,701,220 5 And on 4,701,200 1,636,000 1,636,000 1,636,000 1,636,000 1,636,000 393,400 1,284,000 2,204,000 3,065,200 3,065,200 60,000 60,000 60,000 60,000 60,000 334,400 1,224,000 2,144,000 3,005,200 3,005,200 5,774,000(1) 5,506,000 5,201,000 4,863,000 4,468,000 [5,440,000] [4,282,000] [3,057,000] [1,858,000] [1,463,000] 0 0 0 0 0 [5,440,000] [4,282,000] [3,057,000] [1,858,000] [1,463,000] 2,017,000 2,017,000 2,017,000 0 0 [3,423,000] [2,265,000] [1,050,000] [1,858,000] [1,463,000] 1,912,000 2,180,000 2,485,000 2,823,000 3,218,000 [5,335,000] [4,445,000] [3,525,000] [4,681,000] [4,681,000] Notes: (1) Assumed: 10 year bond of R41, 243,000 @ 14% - repayment R7, 686, 000.00 p.a. (2) Income and expenditure are assumed as in previous calculation. Clearly this option is not feasible – the red ink continues out forever, for the negative cash flow is unsustainable (after 10 years, when the bond is paid back, cumulative negative cash flow is greater than the capital borrowed on the bond). Where is the balance? When does this project succeed financially, with a level of borrowing, and make a reasonable return on investment? The following table inspects this breakeven area. 17 INCOME AND EXPENDITURE ASSUMING BOND OF R10,0 mil (1) TOTAL INCOME EXPENDITURE Expenditure EBITDA Depreciation PBIT Interest on Bond PBT Corporate Tax Profit after Tax SMEDP Subsidy Profit after Tax and Subsidy Balance of Bond Payment Cash Flow % Return on Investment of R10,0 million Year 1 2 3 4 5 2,029,400 2,920,000 3,810,000 4,701,000 4,701,000 1,636,000 393,400 60,000 334,400 1,400,000 [1,734,000] 0 [1,734,000] 1,000,000(3) [734,000] 1,636,000 1,284,000 60,000 1,224,000 1,335,000 [111,000] 0 [111,000] 1,000,000 889,000 1,636,000 2,204,000 60,000 2,144,000 1,260,000 884,000 0 884,000 1,000,000 1,884,000 1,636,000 3,065,000 60,000 3,005,000 1,176,000 1,829,000 0 1,829,000 0 1,829,000 1,636,000 3,065,000 60,000 3,005,000 1,080,000 1,925,000 303,000 1,624,000 0 1,622,000 464,000 529,000 604,000 688,000 842,000 [1,198,000] 0 360,000 3,6% 1,280,000 12,8% 1,141,000 11,4% 784,000 7,8% And on Notes: (1) It is assumed that the Eco-Lodge is built for R20 million, funded half (R10 million) as capital, and R10 million as a 14% 10 year bond. (2) Income and expenditure are as in previous calculations. (3) SMEDP subsidy calculated on R20 million construction costs. Conclusions on Financial Feasibility The previous calculations suggest that the Motherwell Eco-Lodge and Chalets project is feasible under the following conditions. The project can be built and fitted out for R20 million, which is considerably less than the “first-stab” design and costing done for this project. Total expenditure is held at R1.693.000.00 per annum (see section 9.2). Income increases in the following ratios (see 12.2). Year 1 Conferencing: 280 seats per day available: Occupancy projected Net income per day Conferencing income Nett Income from Catering Accommodation: 20 chalets Occupancy Rates Room Rate Accommodation Income Year 2 Year 3 Year 4 and on 5% R100.00 R511,000.00 R58,400 10% R100.00 R1,022,000.00 R73,000.00 15% 20% R100.00 R100.00 R1,533,000.00 R2,044,000.00 R87,600.00 R102,200.00 40% R500.00 R1460,000.00 50% R500.00 R1,825,000.00 60% 70% R500.00 R500.00 R2,190,000.00 R2,555,000.00 The Department of Trade and Industries continue to operate a SMEDP type subsidy for tourist accommodation establishments. The Eco-Lodge project is funded half by capital investment (R10 million) and half (R10 million) by a 10 year 14% commercial bond. Under these circumstances, the bond can be financed, and a return of possibly 4–13% on the balance of the capital enjoyed from year 2. This should be adequate to attract an investor. 18