The schedule to calculate deferred income taxes accomplishes

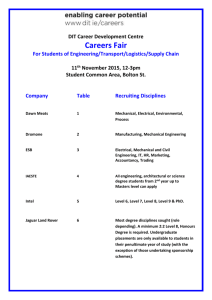

advertisement

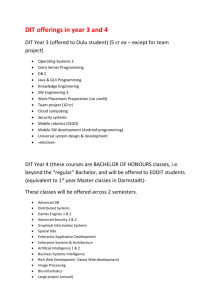

Page 1 CHAPTER 5: SUPPLEMENT FOR DEFERRED INCOME TAXES Introduction This chapter discusses the recognition of income taxes for financial accounting purposes and for income tax purposes. There are differing objectives between the rules of GAAP and the income tax laws, leading to differing recognition of some revenue and expense items. The result is that GAAP will lead to a different calculation of net income than the tax laws. We will differentiate the two in this chapter by calling net income on the GAAP basis “financial income,” and net income under tax rules “taxable income.” We will be preparing the following basic journal entry to recognize the components of income tax: Income tax expense xx Deferred Income Tax xx / xx Income Tax Payable xx Deferred income tax (DIT) represents the timing difference of the payment of taxes due to tax laws that recognize revenues and expenses in different periods than GAAP. If it is a credit balance, it is classified as a liability. Historically, the greatest contributor to this liability was depreciation. We saw in Chapter 6 how the depreciation for one asset could lead to significantly higher depreciation expense in early years using MACRS rather than straight line. If you multiply this times many assets, and many new asset purchases over many years, the difference continues to grow, rather than reverse out. For many years prior to the current standard (SFAS No. 109), companies were calculating income tax expense based on the net income in the financial statement, and calculating income tax payable based on the tax laws. This meant that Deferred Income Taxes (DIT), the difference, was a “plug”: Income tax expense xx net income x percentage Deferred Income Tax xx / xx plug Income Tax Payable xx taxable income x percentage However, after many years of growing differences (because of things like depreciation), this liability account became larger than any other liability on the balance sheet, and sometimes dominated equity as well. Part of the problem with the method of recognition was that accountants were creating this huge liability on the balance sheet, but couldn’t explain specifically what was in the account, because it was just a plug. (There is a bigger problem that we will address later in this chapter: Is it really a liability?) When SFAS No. 109 was developed, it called for a detailed schedule to calculate deferred income taxes, to show what items were causing the difference. The same schedule shows the calculation of taxable income and income tax payable. Now the journal entry is prepared as follows: Income tax expense xx plug Deferred Income Tax xx / xx schedule Income Tax Payable xx schedule We will be preparing several schedules to calculate DIT, but first you need to understand what items need to go into the schedule. Temporary Differences and Deferred Income Taxes Some transactions affect accounting income and taxable income differently. Some differences may be permanent. For example, income from municipal bonds is not taxable (not today, not later). This Page 2 permanent difference is removed from the schedule of calculations before DIT is calculated. DIT should relate only to those items which are temporary, and which will reverse out in future periods. These temporary (or timing) differences result from the different rules of recognition for GAAP and for tax. The differences “originate” in one period and reverse out over one or more future periods. These differences fall into 2 categories: 1. Differences leading to financial income in excess of taxable income at time of origination (future taxable - taxable in the future): a. Revenues or gains that are taxable after they are recognized in financial income (such as income from an equity investment in excess of dividends received). b. Expenses or losses that are deductible for income tax purposes before they are recognized in financial accounting (such as MACRS depreciation for tax with straight-line for financial accounting). 2. Differences leading to taxable income in excess of financial income at time of origination (future deductible – deductible in the future but taxable now). a. Revenues or gains which are taxable before they are recognized in financial income (such as cash received in advance for future service). b. Expenses and losses which are deductible for income tax purposes after they are recognized in financial income (this includes most estimates, such as warranty expense, bad debt expense, loss contingencies). We will focus in this chapter on the specific items mentioned above, and use them in different illustrations: accelerated depreciation (MACRS versus straight line), accelerated revenue (cash received in advance versus unearned revenue), estimated losses/expenses (like warranties and loss contingencies) and deferred revenue (equity method versus cash received for dividends). Scheduling Deferred Income Taxes The schedule to calculate deferred income taxes accomplishes several things (See page 15 of this handout for an illustration). The schedule will yield the amount of income tax payable in the current year, and the amount of the deferred tax asset or liability that will be recognized in a future year. The scheduling of a DIT component is different in the year of origination than it is in subsequent years. The year of origination is the first year that the difference enters into the schedule. In subsequent years, the difference will proceed to reverse out, sometimes over many years (like depreciation). In the First Year of a Difference In the first year a DIT component is scheduled, it is entered into the first and second numerical columns, and will have opposite signs, and a net -0- effect. Look at the first column. The first numerical column starts with the current year's financial income and converts it to taxable income by adjusting the differences between the GAAP method and the tax method for various income statement techniques. The resulting taxable income is then used to calculate income tax payable for the journal entry. The second numerical column holds the amounts that represent the total reversals of the effects scheduled. We will be looking at several common DIT items, both in this chapter and in your company analysis. Several of these items are explained (and illustrated) in the next section. Page 3 Depreciation: In Chapter 6, we found that MACRS depreciation gave more depreciation expense in the early years, and less in the later years. More expense means less income. Therefore, to convert financial income (FI) to taxable income (TI) for the current year, we need to subtract the excess expense to convert FI to TI. Whatever we subtract now, we will be adding back later, so we schedule the addition into the DIT column. Estimated expenses: In Chapters 6 and 8 we have looked at several estimated expenses; these include bad debt expense, warranty expense and contingent losses. In all of these cases, we recorded estimated expense before it had been realized. The IRS takes the position that we should record these expenses only when realized: bad debt expense when the accounts receivable is written off; warranty expense when the warranty service is delivered; contingent loss when the loss is finally settled. For these situations we must back the estimated expense out of FI in the current year to convert to TI; to back out the expense we must add to FI. We will get to deduct the expense in the future, when incurred, so the reversal is carried as a deduction in the DIT column until it reverses out. Pension expense: Note that pension expense (for the defined benefit pension plan) is an estimated expense, and fits into this category. However, the general rule in tax is that the expense can be deducted as paid. When we compare funding to expense, we find the difference between financial income and taxable income. Sometimes pension expense is more than cash paid, and we need to adjust the excess expense out of FI to get to TI. Sometimes pension expense is less than cash paid, and we get to include the extra amount paid for tax purposes. Therefore, this adjustment can go either way (it can cause a deferred tax asset or a deferred tax liability). Watch for this item in your company project. If it is a deferred tax asset, pension expense was higher than the cash paid that period. The reverse is true for a deferred tax liability. Customer advances: when companies receive advance payments from customers for goods or services yet to be delivered, the amount is taxable when received, even though FI does not yet reflect the income. To convert from FI to TI, we must add the amount to FI. Illustration of Schedule - First Year In the year of origination, the effects would be scheduled with the following signs: Current year Future years I.T. Payable Deferred I.T. Pretax financial income xx Future deductible examples: Revenue: Customer advances + Expense: Estimated expenses + Future taxable examples: Revenue: Excess equity income + Expense: Excess MACRS depr. + Taxable income xx Page 4 Illustration of Schedule - Subsequent Years In subsequent years, the effects that were indicated for "future years" would enter into the "current year" column. The sign of the effect does not change when it rolls into the current year. Note that some amounts might fully reverse in one year (like some warranties), some amounts might partially reverse each year for a number of years (like depreciation), and some items might remain deferred for many years (like equity income). Each item should be scheduled according to the "new" information regarding that item. For example if an estimated warranty of $10,000 was recorded in pretax financial income in 2005, and is expected to be paid in 2006, the $10,000 would be scheduled in the year of origination (2005) as follows: 2005 DIT Pretax financial income xx Future deductible: Warranty expense + 10,000 - 10,000 Taxable income xx This backs the expense out of 2005 income and indicates that it will be deducted for tax purposes when paid. Note that the net effect in the row of the scheduled amount (in the first year schedule) is zero. If we go forward to 2006, and $9,000 of the warranty has been paid out, but the other $1,000 is not expected to be paid until 2007, the information would be scheduled as follows: Prior 2006 DIT Pretax financial income xx Future deductible: Warranty expense +10,000 - 9,000 - 1,000 Taxable income xx Note that the amounts in subsequent years do not total to zero. The only way to see that the total equals zero is to continue to carry the "originating" column as well. Additional Issues in Preparing the DIT Schedule The first column of the schedule will calculate Income Tax Payable by using the current tax rate and multiplying it times Taxable Income. The second column of the schedule will calculate the "desired ending balance" in Deferred Income Taxes (either a deferred tax asset (DTA) or deferred tax liability (DTL) depending on a negative or positive balance). We will use the enacted tax rate for the future years, and multiply that rate times the net amount for the future taxable or future deductible. One other caution in the schedule: I stated earlier that the second column of the schedule indicates the desired ending balance in DTA or DTL, so the account must be analyzed similar to the Allowance for Doubtful Accounts. If there is a beginning balance in the account, the adjusting journal entry to record DIT would include only that amount necessary to bring the DTA or DTL up or down to the desired balance. Page 5 Illustration 1: Depreciation and Deferred Income Taxes The following problem illustrates the effect of MACRS depreciation on deferred income taxes, when straight-line depreciation is used for financial reporting. Company D purchases equipment on January 2, 2005 for $10,000. For its financial reports, Company D uses the straight-line method to depreciate this asset, assuming an 8 year life and no salvage value. For income tax purposes, the MACRS schedule requires that Company D use a 5 year life (with a half year in the first and last year). Assume that Company D has pretax financial income each year of $20,000, and a tax rate of 30% each year. No other temporary or permanent differences exist. The following differences in depreciation expense will result in the years 2005-2012: 2005 2006 2007 2008 2009 2010 2011 2012 Straight Line 1,250 1,250 1,250 1,250 1,250 1,250 1,250 1,250 MACRS 2,000 3,200 1,920 1,152 1,152 576 -0-0- Diff . - 750 - 1,950 - 670 98 98 674 1,250 1,250 Summary for 2005 Schedule 2005 ITP DIT (750) ╗ ║ ║ ╠════════════► ║ ║ ╝ 750 The schedule for 2006 timing differences (assuming no other activity) would be: Straight Summary for 2006 Schedule Line MACRS Diff. 2006 ITP DIT 2005 1,250 2,000 - 750 2006 2007 2008 2009 2010 2011 2012 1,250 1,250 1,250 1,250 1,250 1,250 1,250 3,200 1,920 1,152 1,152 576 -0-0- - 1,950 - 670 98 98 674 1,250 1,250 (1,950) ╗ ║ ╠═════════════► ║ ║ ╝ 2,700 Page 6 The schedule for 2007 timing differences (assuming no other activity) would be: 2005 2006 Straight Line 1,250 1,250 MACRS 2,000 3,200 Diff. - 750 - 1,950 2007 2008 2009 2010 2011 2012 1,250 1,250 1,250 1,250 1,250 1,250 1,920 1,152 1,152 576 -0-0- - 670 98 98 674 1,250 1,250 Summary for 2007 Schedule 2007 ITP DIT (670) ╗ ║ ╠══════════► ║ ╝ 3,370 The schedule for 2008 timing differences (assuming no other activity) would be as follows: Straight Summary for 2008 Schedule Line MACRS Diff. 2008 ITP DIT 2005 1,250 2,000 - 750 2006 1,250 3,200 - 1,950 2007 1,250 1,920 - 670 2008 2009 2010 2011 2012 1,250 1,250 1,250 1,250 1,250 1,152 1,152 576 -0-0- 98 98 674 1,250 1,250 98 ╗ ╠══════════► ║ ╝ 3,272 Required: Prepare schedules (see attached pages) to calculate deferred income taxes for 2005 - 2008, and prepare journal entries for 2005 - 2008 to record income taxes. Page 7 ILLUSTRATION 1 - DEPRECIATION Schedule - 2005 Pretax financial income Future Deductible: I.T. Payable 20,000 DIT Future Taxable: Taxable (deductible) amount Tax rate 30% 30% Income tax payable DIT - liab (asset) DIT | | === | Journal entry - 2005: Income tax expense Income tax payable 2005 2006 2007 2008 2009 2010 2011 2012 Straight Line 1,250 1,250 1,250 1,250 1,250 1,250 1,250 1,250 MACRS 2,000 3,200 1,920 1,152 1,152 576 -0-0- Diff . - 750 - 1,950 - 670 98 98 674 1,250 1,250 Summary for 2005 Schedule 2005 ITP DIT (750) ╗ ║ ║ ╠════════════► ║ ║ ╝ 750 Page 8 Schedule - 2006 Pretax financial income Future Deductible: I.T. Payable 20,000 DIT Future Taxable: Taxable (deductible) amount Tax rate 30% 30% Income tax payable DIT - liab (asset) DIT | | === | Journal entry - 2006: Income tax expense Income tax payable Straight Line MACRS 2005 1,250 2,000 - 750 2006 2007 2008 2009 2010 2011 2012 1,250 1,250 1,250 1,250 1,250 1,250 1,250 3,200 1,920 1,152 1,152 576 -0-0- - 1,950 - 670 98 98 674 1,250 1,250 Diff. Summary for 2006 Schedule 2006 ITP DIT (1,950) ╗ ║ ╠═════════════► ║ ║ ╝ 2,700 Page 9 Schedule - 2007 Pretax financial income Future Deductible: I.T. Payable 20,000 Future Taxable: Depreciation Taxable (deductible) amount Tax rate DIT -670 19,330 30% Income tax payable DIT - liab (asset) 3,370 3,370 30% 5,799 1,011 DIT | 810 | 201 === |1,011 Journal entry - 2007: Income tax expense DIT Income tax payable 6,000 201 5,799 2005 2006 Straight Line 1,250 1,250 MACRS 2,000 3,200 Diff. - 750 - 1,950 2007 2008 2009 2010 2011 2012 1,250 1,250 1,250 1,250 1,250 1,250 1,920 1,152 1,152 576 -0-0- - 670 98 98 674 1,250 1,250 Summary for 2007 Schedule 2007 ITP DIT (670) ╗ ║ ╠══════════► ║ ╝ 3,370 Page 10 Schedule - 2008 Pretax financial income (loss) Future Deductible: Future Taxable: Depreciation Taxable (deductible) amount Tax rate Income tax payable DIT - liab (asset) I.T. Payable 20,000 98 20,098 30% DIT 3,272 3,272 30% 6,029 982 DIT |1011 29 | === | 982 Journal entry - 2008: Income tax expense DIT Income tax payable 2005 2006 2007 Straight Line 1,250 1,250 1,250 2008 2009 2010 2011 2012 1,250 1,250 1,250 1,250 1,250 MACRS 2,000 3,200 1,920 1,152 1,152 576 -0-0- Diff. - 750 - 1,950 - 670 98 98 674 1,250 1,250 6,000 29 6,029 Summary for 2008 Schedule 2008 ITP DIT 98 ╗ ╠══════════► ║ ╝ 3,272 Page 11 Illustration 2: Deferred Income Taxes Comprehensive Example 2005 Only: Given the following 2005 (originating) differences between financial accounting income and taxable income (Company D's first year of operation): 1. Estimated warranty costs in 2005 (expected to be paid out in 2007) were $4,000. 2. Depreciation difference for computers purchased in 2005 at a total cost of $40,000 (3 year life for MACRS, 5 year life for straight-line; see Chapter 9 for 3 year MACRS percentages): SL MACRS Difference 2005 8,000 13,332 -5,332 2006 8,000 17,780 -9,780 2007 8,000 5,924 2,076 2008 8,000 2,964 5,036 2009 8,000 -08,000 3. Company D collected $3,000 from customers in advance of delivering subscriptions. The subscriptions are expected to be delivered in 2006. 4. Pretax financial income for 2005 was $200,000, and the enacted tax rate for current and future periods is 30%. Requirements for Part A: 1. Prepare a schedule to calculate income tax payable and deferred income taxes for 2005. 2. Prepare the journal entry for 2005 to record income taxes. ILLUSTRATION 2 - COMPREHENSIVE PROBLEM A.1. Schedule 2005 Pretax financial income 200,000 Future Deductible: DIT Future Taxable: Taxable (deductible) amount Tax rate 30% 30% Income tax payable DIT - liab (asset) DIT | | === | A.2. Journal entry: Income tax expense Inc. tax payable Page 12 Information for Company Project 1. You will be examining the footnote disclosure for deferred income taxes as well as the financial statement presentation. Exhibit 5.6 indicates the schedule of DTA and DTL for Pfizer. The second column illustrates the disclosure for the DTA and DTL (this is the disclosure you want to find for your company). This disclosure indicates the different items that are contributing to the DTA or DTL, and the amount of DTA or DTL that was recognized each year for that item. Some companies list the revenue or expense item that is causing the deferral. Other companies list the related asset (like PP&E) or liability (like pensions) to indicate the category. 2. In your project evaluation, you will see some items listed in the DIT disclosure that we have not discussed (you may omit these from your discussion for the company project). They are more complex than the subjects we have already examined. For your information (not for the exam or project), a short explanation is offered here: Equity Investments: when a company owns greater than 20% of another company, this is an equity investment. The investing company recognizes income as a percentage of the investees income; the company does not recognize dividend income (based on cash flows as the investor receives the dividend). The IRS taxes only dividends received; the difference each year leads to a deferred tax liability until the investment is sold. Loss carryforwards: when a company or its subsidiaries has a loss, the company may file for a tax refund for prior years it has paid in (2 years prior, to the amount of the tax benefit on the loss). The company may also carry any unused loss forward (up to 20 years), and apply it against future earnings. The "carryforward" results in a deferred tax asset until it is used up (or expires). Problem: the company must generate income to get benefit from the deferred tax asset. If there is a probability that the asset will not get used, the company needs to estimate a valuation allowance (see below). Valuation Allowance: Deferred tax assets require that a company have future income before the DTA can be applied against that income. When a company has DTA, especially those caused by things that can expire (like the loss carryforward), the company must evaluate the asset to see if some of the asset might not be used. The allowance account writes down the DTA to the amount that is expected to be used. 3. In your company project, you will be asked to find the amounts reported in the balance sheet relating to DIT. SFAS No. 109 requires companies to distinguish between "current deferred" income taxes and "noncurrent deferred" income taxes. The difference is that the "current deferred" items are expected to reverse in 1 year, where the "noncurrent deferred" will reverse beyond one year. In this chapter, we did not distinguish between the current deferred and the noncurrent deferred (i.e., we calculated and recorded only one item of deferred income taxes). However, when reviewing financial statements for your project, please note that your company will usually have an amount in current deferred taxes (either asset or liability) and in noncurrent deferred taxes (either asset or liability). Some companies even report current DTA, noncurrent DTA, current DTL, and noncurrent DTL. Also, you will be asked to see if the disclosure reconciles to the display in the balance sheet. This will not be the case for many companies. Some companies aggregate current DTA and DTL with other current assets and liabilities, and you will not be able to reconcile the amounts. Page 13 Conceptual Issues with Deferred Income Taxes For this part of the discussion, let us focus only on the effect of different depreciation methods on deferred income taxes. We can extrapolate to other types of assets and liabilities once the concept has been established. Question 1: Is the DTL from depreciation difference really a liability? First: refer to the definition of a liability (see Chapter 8 notes), particularly the part that says "probable future sacrifices of economic benefits . . ." For deferred income taxes, the implied benefit that we are going to sacrifice is cash. Now: refer to the spreadsheet for Illustration 1 (year 2005 – attached again for discussion). What happens to deferred tax liability if a company chooses to use MACRS for both financial and tax reporting? Did the company pay any cash to make the deferred tax liability disappear? If the company can make a "liability" disappear with an accounting choice, and not a cash payment, is it really a liability? This finding can be applied to many deferred tax items, but is particularly obvious with DIT relating to depreciation. Question 2: How do analysts perceive DIT? The research findings are mixed, but many analysts completely ignore DIT when evaluating a company's financial position. They often reclassify the DIT effect to equity. Other analysts have found that the current portion of DIT has value when predicting cash flows for a company. Financial statement users are cautioned to view DIT differently than other assets and liabilities. Page 14 ILLUSTRATION 1 - DEPRECIATION REVISED FOR MACRS FOR BOTH Schedule - 2005 Pretax financial income Future Deductible: I.T. Payable DIT Future Taxable: Taxable (deductible) amount Tax rate 30% 30% Income tax payable DIT - liab (asset) DIT | | === | Journal entry - 2005: Income tax expense Income tax payable 2005 2006 2007 2008 2009 2010 2011 2012 Straight Line 1,250 1,250 1,250 1,250 1,250 1,250 1,250 1,250 MACRS 2,000 3,200 1,920 1,152 1,152 576 -0-0- Diff . - 750 - 1,950 - 670 98 98 674 1,250 1,250 Summary for 2005 Schedule 2005 ITP DIT (750) ╗ ║ ║ ╠════════════► ║ ║ ╝ 750