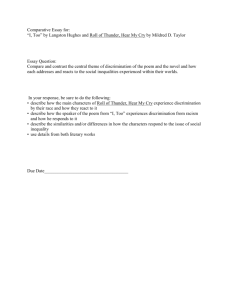

(multi-market) price discrimination

advertisement

PRICE DISCRIMINATION A monopolist may be able to engage in a policy of price discrimination. This occurs when a firm charges a different price to different groups of consumers for an identical good or service, for reasons not associated with the costs of production. It is important to stress that charging different prices for similar goods is not price discrimination. For example, price discrimination does not does not occur when a rail company charges a higher price for a first class seat. This is because the price premium over a second-class seat can be explained by differences in the cost of providing the service. Conditions required for price discrimination to work There are basically three main conditions required for price discrimination to take place. Monopoly power Firms must have some price setting power - so we don't see price discrimination in perfectly competitive markets. Elasticity of demand There must be a different price elasticity of demand for the product from each group of consumers. This allows the firm to extract consumer surplus by varying the price leading to additional revenue and profit. Separation of the market The firm must be able to split the market into different sub-groups of consumers and then prevent the good or service being resold between consumers. (For example a rail operator must make it impossible for someone paying a "cheap fare" to resell to someone expected to pay a higher fare. This is easier in the provision of services rather than goods. The costs of separating the market and selling to different sub-groups (or market segments) must not be prohibitive. Examples of price discrimination There are numerous good examples of discriminatory pricing policies. We must be careful to distinguish between discrimination (based on consumer's willingness to pay) and product differentiation - where price differences might also reflect a different quality or standard of service. Some examples worth considering include: Cinemas and theatres cutting prices to attract younger and older audiences Student discounts for rail travel, restaurant meals and holidays Car rental firms cutting prices at weekends Hotels offering cheap weekend breaks and winter discounts The aims of price discrimination It must be remembered that the main aim of price discrimination is to increase the total revenue and/or profits of the supplier! It helps them to off-load excess capacity and can also be used as a technique to take market share away from rival firms. Some consumers do benefit from this type of pricing - they are "priced into the market" when with one price they might not have been able to afford a product. For most consumers however the price they pay reflects pretty closely what they are willing to pay. In this respect, price discrimination seeks to extract consumer surplus and turn it into producer surplus (or monopoly profit). Perfect Price Discrimination Here the firm charges each individual the maximum price they are willing to pay. Ie there is no consumer surplus. This is basically impossible unless the firm knows exactly each consumers surplus! second degree price discrimination This type of price discrimination involves businesses selling off packages of excess capacity at lower prices than the previously published/advertised price. Examples of this can be found in the hotel and airline industries where spare rooms and seats are sold on a last minute standby basis. In these types of industry the fixed costs of production (the costs that do not vary with output) are high. For example, the high costs of building a hotel or leasing a plane are clearly fixed. At the same time the marginal or variable costs in these industries are small and predictable. Marginal costs are the costs of providing an extra unit of output. If there are unsold airline tickets or hotel rooms, it is often in the businesses best interest to offload spare capacity at lower (discounted) prices, always providing that the cheaper price that adds to revenue covers the marginal cost of each unit The low cost airlines are an example of this: Customers booking early with carriers such as AirAsia will normally find much lower prices if they are prepared to commit themselves to a flight by booking early. Closer to the date and time of the scheduled service, the price often rises, on the justification that consumer’s demand for a particular flight becomes more inelastic the nearer to the time of the service. third degree (multi-market) price discrimination Introduction This is the most frequently found form of price discrimination and involves charging different prices for the same product in different segments of the market. The market is usually separated in two ways: by time or by geography. For example, exporters may charge a higher price in overseas markets if demand is more inelastic than it is in home markets. How it works Suppose that a firm has separated a market by time into a peak market with inelastic demand, and an off-peak market with elastic demand. The firm aims to charge a profit maximising price to each group. Consumers with an inelastic demand for the product will pay a higher price than those with an elastic demand . Effects of Price Discrimination: Reduces consumer surplus although some consumers may be charged a lower price than before. Increases firms revenue The extra revenue may allow a previously loss making venture, to make a profit and therefore everyone benefits as now a service is provided that otherwise would not have been. Eg a doctor in rural Thailand cannot make a profit by charging everyone the same price. Most people cannot afford the costs. Therefore the community has no doctor. So they discriminate charging the rich far more and the poor far less. Everyone now has a doctor and all benefit.