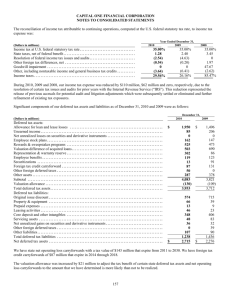

Test of Deferred Income Tax Provision (Liability Method)

advertisement

CLIENT: AUDIT PROGRAM ___________________________________________________________ PERIOD: ___________________________________________________________ SUBJECT: DEFERRED TAXATON Est. Hrs. Phase/ Level W/P Ref. Procedures AUDIT OBJECTIVES To determine whether: A. B. C. Deferred tax liability/asset represents obligation/asset of the company as at the balance sheet date and have been properly recorded. Deferred tax is properly described, classified and adequate disclosures have been made in accordance with the requirements of the Companies Ordinance, 1984 and IAS-12. Deferred tax amounts have been adequately calculated, recorded and disclosed/classified in the financial statements. SUBSTANTIVE PROCEDURES 1. Deferred Taxation 1.1 1.2 1.3 1.4 1.5 1.6 1.7 1.8 1.9 Obtain a deferred tax working schedule from the client alongwith related disclosures for current and prior periods. Match and cross-refer with the relevant sections of the working paper file. Obtain schedule of temporary differences at balance sheet date alongwith the supporting details. Obtain schedule of tax base of each component of balance sheet alongwith working. Determine and ensure the consistency and adequacy of method used. Review and test the cumulative temporary differences as of the balance sheet date. Review the scheduled reversals of cumulative temporary differences and determine whether all identified temporary differences have been scheduled in a reasonable manner that is consistent with information obtained in other audit areas. Obtain management's representations regarding scheduled reversals, if appropriate. Test the computation of deferred tax liabilities/assets by applying appropriate provisions of enacted tax law to scheduled reversals particularly the tax rates applicable at the time of expected reversals. Review the client's tax-planning strategies that affect the recorded amounts of deferred taxes under the liability method and determine that all valid strategies that could materially affect deferred taxes have been identified and accounted for. Page: 1/4 O/AP/2 By Comments/Explanations CLIENT: AUDIT PROGRAM ___________________________________________________________ PERIOD: ___________________________________________________________ SUBJECT: DEFERRED TAXATON Est. Hrs. Phase/ Level W/P Ref. Procedures 1.10 1.11 1.12 1.13 1.14 If appropriate, obtain management's representations as to their ability and intent to implement the strategy if necessary. Determine the strategy's compliance with the tax law. If the client’s aggregate temporary differences (rather than preparing a detailed schedule of reversals), determine whether the aggregate approach produces materially different results. [However, if no major changes are expected to occur in the tax rules/law and the tax rates are not expected to be changed in future, aggregate working would be sufficient]. Determine whether deferred tax assets and liabilities are properly classified as to current or non-current based upon work performed in testing the deferred tax provision/credit. Review and test the cumulative temporary differences as of the balance sheet date. 2. Presumptive Tax 2.1 2.2 2.3 2.4 If the total income is covered under presumptive tax regime (under Section 153 and 154) no deferred tax should be accounted for. Where a portion of income is covered under 153 and 154, ensure that reasonable estimate for sales is made relating to “non-supplies” for future year based on past trend. Check that deferred tax liability relating to nonsupplies has been made accordingly after considering reasonability of the estimate made. Ensure that proper disclosure is made in accounts where it is impracticable to develop a reasonable estimate of “non-supplies” in future. 3. Tax Losses and Credits 3.1 3.2 Ensure that loss for current year/prior year (pending assessment) taken for deferred tax computation should be based on the estimated amount of loss, which is likely to be assessed by the tax authorities. Disclosure to be made distinctly of the fact. In case of revaluation of fixed asset ensure that the requirement of Accounting TR-10 have been followed for calculation of deferred tax. Page: 2/4 O/AP/2 By Comments/Explanations CLIENT: AUDIT PROGRAM ___________________________________________________________ PERIOD: ___________________________________________________________ SUBJECT: DEFERRED TAXATON Est. Hrs. Phase/ Level W/P Ref. Procedures 3.3 3.4 3.5 3.6 3.7 3.8 Has the client prepare an analysis of loss carry forwards (book and tax) available at yearend. Verify the clerical accuracy of the analysis and ensure that loss carry forwards utilized to offset current year taxable income have not expired. Summarize financial statement disclosures related to loss carry forwards. Tax losses should be segregated between losses on account of depreciation and trading losses and give priority of set off against the profit accordingly. Has the client prepares an analysis of significant tax credit carry forwards for book and tax purposes and compare amounts utilized to offset Federal income taxes with amounts available. Verify the clerical accuracy of the analysis. Examine detailed support for tax credit carry forward calculations. (Scope: __________.) Update the carry forward schedule of tax credits (both book and tax), as appropriate. 4. Deferred Tax Asset 4.1 4.2 Ensure that deferred tax asset recognizing tax saving is not required to be set up if a reasonable estimate of turnover/profits for foreseeable future cannot be made (refer paragraph 1.4 of ICAP selected opinion No.1). Deferred tax asset should not be accounted for unless it can be ensured with reasonable surety that future “tax profits” will be available for realization of such assets and the management will be able to plan its tax strategies in a manner to obtain benefit of such assets. [Note: Such future income should be enough to cover the future deferred tax assets (deductible temporary differences) first and any remaining future income should be applied to assess the realisability of deferred tax assets. Other tests as deemed necessary Page: 3/4 O/AP/2 By Comments/Explanations CLIENT: AUDIT PROGRAM ___________________________________________________________ PERIOD: ___________________________________________________________ SUBJECT: DEFERRED TAXATON Est. Hrs. Phase/ Level W/P Ref. Procedures O/AP/2 By Comments/Explanations Management Letter Prepare management letter points including: Internal control weaknesses; Business improvement opportunities; Legal non-compliance; Accounting system deficiencies; and Errors and irregularities not material at the financial statements level. Disclosure Ensure appropriate disclosure have been made in accordance with the reporting framework and fill relevant portion of Financial Statement Disclosure Checklist (FSDCL). Supervision, review and conclusion 1. 2. 3. 4. Perform Senior review and supervision. Resolve Senior review points. Resolve Partner and Manager review points. Conclude response to the audit objectives. Audit conclusion Based on the substantive test procedures, I/we performed as outlined above, it is my/our opinion that the audit objectives set forth at the beginning of this audit program have been achieved, except as follows: ___________________________________________________________________________________________________________ ___________________________________________________________________________________________________________ ___________________________________________________________________________________________________________ Date:____________ ______________ Signature ___________ Job Incharge Page: 4/4 ________ Manager _______ Partner