End of Chapter Exercises: Solutions

advertisement

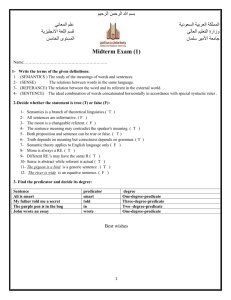

End of Chapter Exercises: Solutions Chapter 11 1. From the data in the table on the distribution of income (by quintile) between two states, A and B, you are required to compare the degree of income inequality between the two states using Lorenz curves and Gini Coefficients. Percentage of Total Disposable Income State A State B 50% 35% 20% 30% 15% 25% 10% 6% 5% 4% 100% 100% Quintile 1st 2nd 3rd 4th 5th Total Answer: 100% 80% 60% B 40% A 20% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% Area under Lorenz curve: A = 0.3; B= 0.328 Gini Coefficient: A = (0.5-0.3)/0.5 = 0.4; B= (0.5-0.328)/0.5 = 0.344 Therefore state B is less unequal than state A 100% 2. The data in the table below shows the breakdown of the referent group (RG) benefits for two projects (A and B), information about each sub-group’s income level and marginal propensity to save (mps). In addition you have ascertained that the mean income level is $30,000 per annum, that an appropriate value for ‘n’ (the elasticity of marginal utility with respect to an increase in income) is 2, and that the premium on savings relative to consumption is 10%. Income p.a. mps Net Benefits - A Net Benefits - B RG1 $20,000 0.05 $10 $20 RG2 $40,000 0.20 $20 $30 RG3 $90,000 0.60 $90 $40 With this information you are required to calculate and compare the projects’ net benefits in terms of: (i) unweighted aggregate referent group net benefits; (ii) aggregate net benefits weighted for atemporal distributional objectives (assuming consumption and savings have the same value at the margin); and, (iii) aggregate net benefits weighted for both atemporal and intertemporal distributional objectives. Answer: (i) (ii) (iii) A=$120; B=$90 weights: RG1 = 2.25; RG2 = 0.56; RG3 = 0.11. Weighted Net Benefits: A = $44; B=$66 A=$99; B=$92 3. You have been provided with the following information about three public sector projects with a breakdown of the referent group net benefits (unweighted) among the three referent group (RG) categories: Project A Project B Project C RG 1 $30 $40 $40 RG 2 $30 $20 $30 RG 3 $60 $40 $10 With the knowledge that all three projects are considered to have equivalent weighted net benefits, and that the three distribution weights are to have an (unweighted) average of 1, you are required to find the implicit values of the three distribution weights for RG1, RG2 and RG3 respectively. (Hint: follow Weisbrod’s method and note that the solution value for the weighted net benefit of each project is $100). Answer: RG1=1.67; RG2=1.00; RG1=0.33