i-m1 - Department of Management Services

advertisement

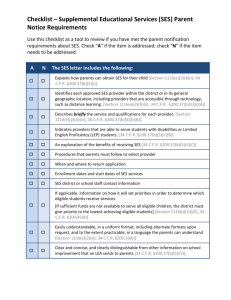

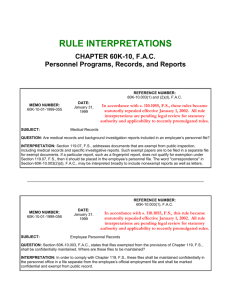

RULE INTERPRETATIONS CHAPTER 60M-1, F.A.C. Selected Exempt Service REFERENCE NUMBER: 60M-1.008(6) and 60N-1.007(5), F.A.C. MEMO NUMBER: 60M-01-01-1999-030 SUBJECT: DATE: January 31, 1999 In accordance with s. 110.1055, F.S., these rules became statutorily repealed effective January 1, 2002. All rule interpretations are pending legal review for statutory authority and applicability to recently promulgated rules. Payoff Upon Death of a SES/SMS Employee QUESTION: If a Selected Exempt Service employee dies, is the annual leave accrued on their last anniversary date prorated as if they simply terminated, and does the 480 cap apply? INTERPRETATION: In the case of death of an Selected Exempt Service or Senior Management Service employee, all accrued annual leave shall be paid. Leave accrued on the employee's last anniversary date is not prorated and the 480-cap does not apply. REFERENCE NUMBER: 60M-1.008(2) and 60N-1.007(2), F.A.C. MEMO NUMBER: 60M-01-01-1999-043 SUBJECT: DATE: January 31, 1999 In accordance with s. 110.1055, F.S., these rules became statutorily repealed effective January 1, 2002. All rule interpretations are pending legal review for statutory authority and applicability to recently promulgated rules. Holidays: SES and SMS Employees QUESTION: If a SES or SMS employee is required to work on a state holiday, what is the proper way to compensate for this? INTERPRETATION: In accordance with Section 110.117, F.S., certain days shall be paid holidays observed by all employees of state branches and agencies. Consequently, it is vital that agencies allow their SES and SMS employees to observe a day off for the holiday during the pay period in which the holiday occurs, even if the SES/SMS employee is required by management to work on the actual holiday. For example, say that in the month of May, the biweekly pay period containing a holiday (Memorial Day) is 5/15 through 5/28. The official state holiday is designated to be observed on 5/25. The SES/SMS employee who is required to work on 5/25 would be allowed to take another day off between 5/15 and 5/28 to use in place of the holiday they were required to work. Likewise, the SES/SMS employee whose regular day off falls on 5/25 would be allowed to take another day off between 5/15 and 5/28 to use as a holiday observance. In contrast, the monthly pay period is 5/1 through 5/31. Thus, the SES/SMS employee who is required to work or whose regular day off falls on 5/25, would be allowed to take another day off between 5/1 and 5/31. However, in the event the employee is unable to observe the holiday during the prescribed pay period, such holiday is forfeited. REFERENCE NUMBER: 60M-1.005(1)(a) and 60M-1.006(3), F.A.C. MEMO NUMBER: 60M-01-01-1999-070 SUBJECT: DATE: January 31, 1999 In accordance with s. 110.1055, F.S., these rules became statutorily repealed effective January 1, 2002. All rule interpretations are pending legal review for statutory authority and applicability to recently promulgated rules. Advertising Requirements QUESTION: Do vacant Selected Exempt Service (SES) positions have to be advertised for a minimum of fourteen calendar days? INTERPRETATION: The advertisement of a vacant SES position is discretionary. Section 110.605, F.S., was amended during the 1996 legislative session. Therefore, effective October 1, 1996, advertising SES vacancies is no longer required. However, an agency’s particular circumstances (e. g., affirmative action goals or current work force) should be considered before deciding whether to advertise. It should be noted that any selection decision must comply with federal and state EEO/AA laws. Chapter 60M-1 will be updated. REFERENCE NUMBER: 60M-1.008(8), F.A.C. MEMO NUMBER: 60M-01-02-1999-072 SUBJECT: DATE: February 23, 1999 In accordance with s. 110.1055, F.S., this rule became statutorily repealed effective January 1, 2002. All rule interpretations are pending legal review for statutory authority and applicability to recently promulgated rules. Annual and Sick Leave Payments: Leaving SES to OPS QUESTION: What is the proper handling of annual and sick leave credits of an employee who leaves the Selected Exempt Service (SES) to accept OPS employment? INTERPRETATION: An employee who is leaving the SES to accept OPS employment shall be paid for their unused annual and sick leave credits, if eligible for payment. Terminating from these pay plans to accept OPS employment meets the definition of termination from state government for leave purposes because the employee is no longer in a salaried established position. Therefore, a 31-day break before commencing the OPS employment would not be necessary, but the terminal payments must not be processed for at least 31 days following separation from SES. For updated instructions regarding the calculation of SES leave upon termination, refer to both the June 27, 1991 and July 10, 1992, memorandums regarding proration and payment of terminal annual and sick leave credits for SMS and SES employees. Calculation requirements will be clarified in the SES rules, which are currently under revision. REFERENCE NUMBER: 60M-1.006(3), F.A.C. MEMO NUMBER: 60M-01-03-1999-093 SUBJECT: DATE: March 29, 1999 In accordance with s. 110.1055, F.S., this rule became statutorily repealed effective January 1, 2002. All rule interpretations are pending legal review for statutory authority and applicability to recently promulgated rules. SES Acting Appointments QUESTION: Can a non-state employee be given an "acting appointment" in the Selected Exempt Service? Will the individual receive leave and other benefits outlined in Section 60M-1.006 (3), F.A.C.? INTERPRETATION: Yes, a non-state individual can be given an "acting appointment" in accordance with Section 60M-1.006 (3), F.A.C. However, notwithstanding the rule mentioned above and based on our research, individuals not currently employed within state government are entitled to insurance, benefits, leave and all other benefits outlined in Chapter 60M-1, F.A.C. Specifically, Section 121.051(1)(a), F.S., mandates participation in the State Retirement System and Section 110.123(4)(g), F.S., allows participation in the state insurance program. Therefore, based on the mandatory participation in the retirement system and participation in the state insurance program, it has been determined that individuals appointed from outside state government in "acting status" should be afforded leave and all benefits outlined in Chapter 60M-1, Selected Exempt Service, F.A.C. It is important to note that Career Service, Selected Exempt Service or Senior Management Service employees given an "acting appointment" remain in their current position and continue to earn leave and receive the benefits of their permanent position. MEMO NUMBER: 60M-01-03-1999-095 DATE: March 29, 1999 REFERENCE NUMBER: 60M-1.008(7), (11) and 60N-1.007(6), (10), F.A.C. In accordance with s. 110.1055, F.S., these rules became statutorily repealed effective January 1, 2002. All rule interpretations are pending legal review for statutory authority and applicability to recently promulgated rules. SUBJECT: SES/SMS Payment of Annual and Sick Leave/Transferring to a Different Pay Plan QUESTION: If an employee in either the Selected Exempt Service or Senior Management Service transfers to a pay plan which will not accept the entire annual or sick leave balance, may the employee be paid for the remaining leave which the receiving pay plan will not accept? INTERPRETATION: Yes. The above language, which has been in the rules since February 1, 1987, contemplated that a receiving agency would accept the transfer of hours subject only to the rules governing the receiving agency. No rule provision was made for the appropriate manner to handle unused annual and sick leave hours in cases where the receiving agency does not accept the transfer of annual and sick leave hours. Therefore, pursuant to the policy set by memorandum from the Department on June 27, 1991, employees who are transferring to another state entity which will not accept all unused annual and sick leave credits will be paid for the unaccepted portion, subject to the 480 cap for each, once proration has taken place. Chapter 60M-1 and Chapter 60N-1 F.A.C., will be revised accordingly. REFERENCE NUMBER: 60M-1.008(1), F.A.C. MEMO NUMBER: 60M-01-12-1999-125 SUBJECT: DATE: December 16, 1999 In accordance with s. 110.1055, F.S., this rule became statutorily repealed effective January 1, 2002. All rule interpretations are pending legal review for statutory authority and applicability to recently promulgated rules. "Included" Selected Exempt Service (SES) Employee: Earning of Special Compensatory Leave QUESTION: Can an "included" SES employee, such as a Personal Secretary earn special compensatory leave or choose to earn FLSA special compensatory leave in lieu of receiving paid overtime? INTERPRETATION: No. An SES employee cannot normally earn any type of overtime or compensatory leave. However, in order to comply with the Fair Labor Standards Act, an "included" SES employee must be paid at time and one-half for overtime worked. Updated: December 22, 1999