On the Benefits of Risk Pooling in Inventory Management

advertisement

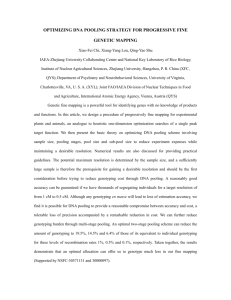

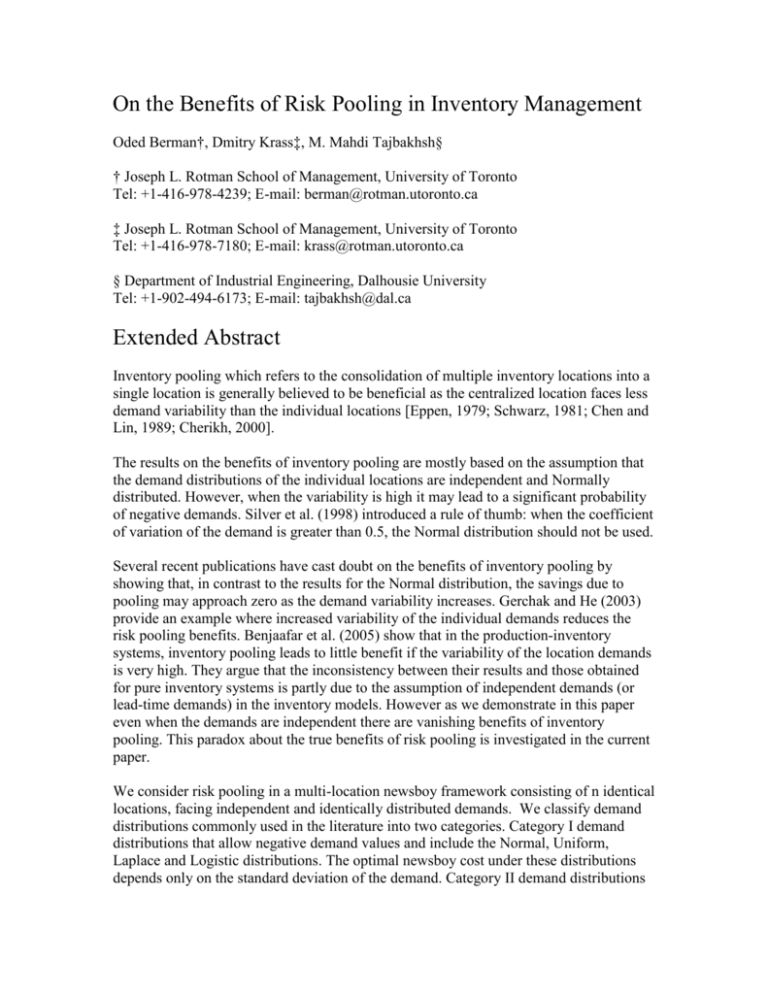

On the Benefits of Risk Pooling in Inventory Management Oded Berman†, Dmitry Krass‡, M. Mahdi Tajbakhsh§ † Joseph L. Rotman School of Management, University of Toronto Tel: +1-416-978-4239; E-mail: berman@rotman.utoronto.ca ‡ Joseph L. Rotman School of Management, University of Toronto Tel: +1-416-978-7180; E-mail: krass@rotman.utoronto.ca § Department of Industrial Engineering, Dalhousie University Tel: +1-902-494-6173; E-mail: tajbakhsh@dal.ca Extended Abstract Inventory pooling which refers to the consolidation of multiple inventory locations into a single location is generally believed to be beneficial as the centralized location faces less demand variability than the individual locations [Eppen, 1979; Schwarz, 1981; Chen and Lin, 1989; Cherikh, 2000]. The results on the benefits of inventory pooling are mostly based on the assumption that the demand distributions of the individual locations are independent and Normally distributed. However, when the variability is high it may lead to a significant probability of negative demands. Silver et al. (1998) introduced a rule of thumb: when the coefficient of variation of the demand is greater than 0.5, the Normal distribution should not be used. Several recent publications have cast doubt on the benefits of inventory pooling by showing that, in contrast to the results for the Normal distribution, the savings due to pooling may approach zero as the demand variability increases. Gerchak and He (2003) provide an example where increased variability of the individual demands reduces the risk pooling benefits. Benjaafar et al. (2005) show that in the production-inventory systems, inventory pooling leads to little benefit if the variability of the location demands is very high. They argue that the inconsistency between their results and those obtained for pure inventory systems is partly due to the assumption of independent demands (or lead-time demands) in the inventory models. However as we demonstrate in this paper even when the demands are independent there are vanishing benefits of inventory pooling. This paradox about the true benefits of risk pooling is investigated in the current paper. We consider risk pooling in a multi-location newsboy framework consisting of n identical locations, facing independent and identically distributed demands. We classify demand distributions commonly used in the literature into two categories. Category I demand distributions that allow negative demand values and include the Normal, Uniform, Laplace and Logistic distributions. The optimal newsboy cost under these distributions depends only on the standard deviation of the demand. Category II demand distributions are nonnegative and include the Lognormal, Gamma, and Weibull distributions. The optimal newsboy cost under these distributions depends on both the mean and the standard deviation of the demand. We note that Category I distributions can be used only when the demand variability is low. Two measures of inventory pooling savings are utilized for the analysis: the absolute saving (the reduction in the cost of operating the system due to inventory pooling) and the relative saving (relative to the non-pooled system). We analyze how the benefits of pooling change with the increase in the variability of demand (at each location) and the number of locations. Our main results are: We show both analytically (where possible) and numerically (through MonteCarlo simulations), that the absolute benefit of inventory pooling increases with variability, and the relative benefit stays fairly constant, as long as the demand variability stays in the low range. However, this behavior changes drastically at higher variability levels. For all Category II distributions the benefits of pooling in terms of both measures of savings decrease rapidly once the coefficient of variation of demand (at each location) exceeds a certain threshold, and disappear entirely as the variability continues to grow. With respect to the number of locations being pooled, under a given level of variability the benefits of pooling do increase with the number of locations. However, under high-variability conditions, a certain minimum number of locations may need to be pooled before any appreciable benefits of pooling can be realized. These effects are due to the different operating regimes exhibited by the system under different levels of variability: as the variability is increased, the system switches from the normal operation to the effective shutdown (the system avoids taking the risk of too much inventories) and then to the complete shutdown (the system holds no inventory and accepts the full costs of unmet demand). The decrease in the benefits of inventory pooling is associated with the two latter regimes. Pooling allows the system to remain in the normal operation regime under higher levels of variability compared to the non-pooled system. Thus, inventory pooling is, indeed, beneficial under all variability conditions. We analyze the behavior of the inventory pooling benefits using the distribution free approximation in which only the first two moments of the demand distribution are known [e.g., see Gallego and Moon (1993)]. This is very valuable since, in most cases, the distribution of demand cannot be derived in closed form. We observed that the behavior of savings due to pooling using the distribution free approximation is similar to the behavior observed for other distributions in our numerical tests. References S. Benjaafar, W. L. Cooper, and J.-S. Kim. On the benefits of pooling in productioninventory systems. Management Science, 51:548–565, 2005. . M.-S. Chen and C.-T. Lin. Effects of centralization on expected costs in a multi-location newsboy problem. The Journal of the Operational Research Society, 40:597–602, 1989. M. Cherikh. On the effect of centralization on expected profits in a multi-location newsboy problem. The Journal of the Operational Research Society, 51:755–761, 2000. G. D. Eppen. Effects of centralization on expected costs in a multi-location newsboy problem. Management Science, 25:498–501, 1979. G. Gallego and I. Moon. The distribution free newsboy problem: Review and extensions. The Journal of the Operational Research Society, 44:825–834, 1993. Y. Gerchak and Q.-M. He. On the relation between the benefits of risk pooling and the variability of demand. IIE Transactions, 35:1027–1031, 2003. L. B. Schwarz. Physical distribution: The analysis of inventory and location. AIIE Transactions, 13:138–150, 1981. E. A. Silver, D. F. Pyke, and R. Peterson. Inventory Management and Production Planning and Scheduling. John Wiley & Sons, New York, third edition, 1998.