Word copy

advertisement

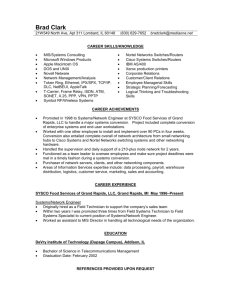

Date of evaluation: 3/8/03 – 3/9/03 Current stock price: $23.59 (3/11/03) Introduction Sysco Corporation (SYY) 1390 Enclave Parkway Houston, TX 77077-2099 (281) 584-1390 Company website: www.sysco.com Sysco (an acronym of Systems and Services Company) is the largest North American distributor of food and food related products to the foodservice industry (aka “food-prepared-away-fromhome” industry). It was founded in 1969 and went public in 1970. It has grown annual sales from $115 M to over $23 B through both internal operations and acquisitions in that time period. To date, it has acquired over 70 companies involved in the foodservice industry. It is broken into five main segments, of which only two are reportable. These are the Broadline (representing approximately 85% of revenue) and SYGMA (representing approximately 10% of revenue) segments. The other three are specialty produce, meat, and lodging industry segments. These latter three provide fresh produce, custom-cut fresh steaks and other meats, and personal care guest amenities, housekeeping supplies, room accessories and textiles to the lodging industry, respectively. They have offices in 43 states, the District of Columbia, and nine Canadian provinces. Their trucks are everywhere. Why I am interested I first ran across SYY from a Cheesecake Factory (CAKE) news report, indicating that CAKE had arranged to distribute some of its cheesecakes and specialty desserts through the Broadline segment of SYY. Random reading since then has indicated that SYY is the largest company in its industry, that other companies are falling upon hard times, that SYY is considered to be “highly conservative” in its accounting practices, that customers are pleased with this company’s services and products, and that it has consistently increased revenue for over 30 years (though data I was able to collect only goes back to 1990). Revenue has increased each of the last 12 years (from 1990; its fiscal year ends in June), with earnings increasing every year except 1998 in the same time frame. (In 1998, earnings declined 1.66% from 1997.) It also made the A+ list of a recent Standard & Poor report on companies that have been excellent performers over the past 17 years (http://tinyurl.com/6sro). This implies that SYY has a moat that is expanding and that it is not a commodity. It has a consistent history of acquiring its competitors, growing to be the dragon of its class. I consider it has a moat because getting into this business on a large scale is not very easy. While the expense of obtaining trucks and warehouses may not be huge, breaking into the customer and supplier base, developing good relations with suppliers and customers, and organizing an efficient, inexpensive delivery system can be, and probably is, quite a large problem. Customers tend to be very loyal to good service (as I know from the business I work in) and getting them to switch to the new kid on the block is not easy. Especially in a general delivery situation. There are ways of doing this, but they do not come cheaply. Specialty delivery could be different in that you could have a product very few others have. But that also probably means demand would not be very high. And eventually, Sysco would buy you out, anyway, ha ha. Finally, SYY’s core business, distributor to the food service industry, seems to be one of the stable, all-the-time businesses. While individual restaurants may come and go as customers’ tastes change (a risk for CAKE), there will always be a need to supply restaurants with the food they need. Hotels, while taking a hit recently in the downturn of travel, still need to provide guests with amenities (such as the little soaps and bottles of shampoo found in the rooms) and textiles. Hospitals and universities need to house and feed their clients and staff. Caterers need to supply their customers. At this time, SYY has over 415,000 customers. That is not going to go away any time soon. Even if going-out-to-eat is not done as often during an economic slow down or recession (as was the case over the last three years), Sysco has proved that they can continue to grow during these times. Sysco, a brief history Nine companies originally formed Sysco. Stockholders in those nine companies exchanged their stock for SYY common stock in 1969. On March 7, 1970, SYY had their IPO. Since then, it has acquired over 60 other companies or portions of companies. A brief list of the more recent acquisitions are: Portions of Marriott Distribution Services; Denver, CO Asian Foods, Inc.; specialty distributor; St. Paul, MN and Kansas City, MO Abbott Foods, Inc.; broadline foodservice; Columbus, OH Franklin Supply Co.; housekeeping supplies; Louisberg, NC SERCA Foodservice Inc.; foodservice and equipment; Toronto, ON North Douglas Distributors, Ltd.; broadline foodservice; Vancouver Island, BC Albert M. Briggs Co.; specialty meat; Washington, DC Freedman Co.; specialty meat; Houston, TX Guest Supply, Inc.; specialty to lodging; Monmouth Junction, NJ HRI Supply, Inc.; broadline foodservice; Kelowna, BC Fulton Provision Co.; specialty meat; Portland, OR Newport Meat Co. Inc.; specialty meat, seafood, poultry; southern California Doughtie’s Foods Inc.; food distributor; Virginia Buckhead Beef Co. Inc.; custom meats, seafood, poultry; Georgia Watson Foodservices, Inc.; broadline foodservice distributor; Lubbock, TX Freshpoint, Inc.; produce; US and Canada In 1977, they became the leading distributor to the foodservice industry and currently have an estimated 12% of the market share (based on revenues). Sysco has increased or continued dividends for at least the last 19 qtrs (according to their website) and has split 2:1 twice in the last five years (Dec, 2000 and Mar, 1998). Dividends are currently at $0.11 (per quarter). This gives a dividend yield of 1.80%. Almost 1500 institutions hold just over 70% of the 653,992,000 shares outstanding. The current short level is less than 2%. Who they sell to and what they sell They have two types of customers, “traditional” and “chain restaurant”. The traditional type includes restaurants, hospitals, schools, and hotels, while the chain restaurant type includes national hamburger, pizza, steak and chicken chains. Quoting from the most recent 10-K: “Products distributed by the company include a full line of frozen foods, such as meats, fully prepared entrees, fruits, vegetables and desserts, and a full line of canned and dry goods, fresh meats, imported specialties and fresh produce. The company also supplies a wide variety of nonfood items, including paper products such as disposable napkins, plates and cups; tableware such as china and silverware; restaurant and kitchen equipment and supplies; medical and surgical supplies; and cleaning supplies. SYSCO's operating companies distribute both nationally-branded merchandise and products packaged under SYSCO's private brands.” They also provide ancillary services such as product usage tracking, menu planning, food safety training, contract service for installing kitchen equipment, installation and service of beverage dispensing machines and assistance in inventory control. No single foodservice customer accounted for more than 10% of sales. Only one chain restaurant had as much as 5% of sales, that being Wendy’s International, Inc. All long-term contracts with customers can be cancelled by either party at its option. Restaurants accounted for nearly 2/3 of sales for each of the last 3 FYs. Hospitals and nursing homes, schools and colleges, and hotels and motels accounted for another 25%, while “other” accounted for the remainder. They purchase from thousands of independent sources (none more than 5% of the total), through generally centrally arranged purchasing contracts. These sources include “large corporations selling brand name and private label merchandise and independent private label processors and packers.” Competition Its primary competitors are US Foodservices, a subsidiary of the Dutch supermarket retailer, Ahold (AHO), Performance Food Group (PFGC), SuperValu Inc (SVU), McLane Foodservices Inc., Fleming Cos. (FLM), and Nash Finch (NAFCE). The latter two are targets of SEC probes. AHO has reported accounting irregularities in its vendor incentive programs (see this story http://biz.yahoo.com/rc/030306/food_sysco_outlook_2.html ). SVU: Sales (ttm) $19.7 B; net inc (ttm) $228 M; net margin = 1.1% Has had non-recurring charges each of the last 3 FYs ($46.3 M, $171.3 M, negative $60.1 M) while SYY has had none. Revenue (last 3 FYs) of $20.9B, 23.2B, and 20.3B. Net inc (last 3 FYs) of $198.3M, 72.9M, and 241.7M. PFGC: Sales (ttm) $4.44 B; net inc (ttm) $66.5 M; net margin = 1.5% Revenue (last 3 FYs) of $3.24B, 2.60B, and 2.06B. Net inc (last 3 FYs) of $40.4M, 26.9M, and 19.2M. McLane is a segment of WalMart. According to WalMart’s 2002 10-K, “We do not treat the operations of our subsidiary, McLane Company, Inc. ("McLane"), as a separate operating segment as a result of the size of its operations relative to the other segments of our business, but show its results of operations under the heading "Other" in our segment financial data. McLane provides products and distribution services to retail industry and institutional food services customers. You will find information concerning the financial results of our operating segments and the total assets of each of those segments in Note 9 of the Notes to Consolidated Financial Statements … McLane offers a wide variety of grocery and non-grocery products, which it sells to a variety of retailers including the Company’s Wal-Mart Stores and SAM’S CLUB segments. McLane is not a significant segment and therefore, results are not presented separately.” “McLane s net sales for the three fiscal years ended January 31, 2002, 2001 and 2000 were $13.8 billion, $10.5 billion and $8.8 billion, respectively.” Other than this, I could find no information about McLane in the WalMart 10-K. Sysco has many smaller competitors, companies that produce and distribute their own products, such as Dryers, Hersheys, General Mills, Danone Group, HJ Heinz, Monterey Pasta, McCormick & Company, and United Natural Foods. While some of these are quite large (e.g. General Mills), these do much more than distribute food and/or distribute to grocery markets rather than restaurants. From the most recent 10-K: “The business of SYSCO is competitive with numerous companies engaged in foodservice distribution. While competition is encountered primarily from local and regional distributors, a few companies compete with SYSCO on a national basis. The company believes that, although price and customer contact are important considerations, the principal competitive factor in the foodservice industry is the ability to deliver a wide range of quality products and related services on a timely and dependable basis. Although SYSCO's share of the foodservice industry market in the United States and Canada was approximately 11.7% as of June 29, 2002, SYSCO believes, based upon industry trade data, that its sales to the U.S. "food-prepared-away-from-home" industry were the largest of any foodservice distributor during fiscal 2002. While adequate industry statistics are not available, the company believes that in most instances its local operations are among the leading distributors of food and related nonfood products to foodservice customers in their respective trading areas.” Management All executive offices have been employed by Sysco for at least the last five years (except for the Sr. VP Admin, 1999). Most have held their positions since 2000 or before. The current CEO, Richard Schneiders, was appointed as such in January 2003. He had been the COO since 2000 and a director since 1999. Cotros, the former CEO, had held his position since 2000 and had been a director since 1998. Both men are/were long time employees of the company. From the 10-K: “Cash generated from operations is first allocated to working capital requirements; investments in facilities, fleet and other equipment required to meet customers' needs; cash dividends; and acquisitions fitting within the company's overall growth strategy. Any remaining cash generated from operations may, at the discretion of management, be applied toward a portion of the cost of the share repurchase program, while the remainder of the cost may be financed with additional long-term debt. SYSCO's share repurchase program is used primarily to offset shares issued under various employee benefit and compensation plans, for acquisitions and to reduce shares outstanding, all of which may have the net effect of increasing earnings per share.” This seems to me to be a very pro-shareholder statement. Basically, use earnings to improve the business, pay the owners, and grow the business. Sounds good and Sysco has demonstrated that they can do this in both up economies and down economies. Dividend payouts have ranged from 29.5% to 39.5% of net earnings over the last 5 years, with an average of 33.8%. Share repurchases are done primarily to offset employee compensation. The following repurchases have occurred since FY2000: FY2000 11,320,800 shares $16.456 average FY2001 16,000,000 shares $26.762 average FY2002 18,000,000 shares $26.309 average In Q2FY2002 (Sep – Dec, 2001), supply chains began to be reorganized to improve efficiency and to increase effectiveness of the central procurement and merchandising functions of the company. Presented risks These are mainly what the company covered in its last 10-K statement (in the Management’s Discussion), with a few of my comments added and a couple of categories added. Low margin business The foodservice industry is characterized by high inventory turnover with low profit margins. Prices of its products are based on the cost of the product plus a calculated markup. If costs increase, margins go down. Regional pricing pressures also apply. However, net margin is currently at 2.9% and has grown in 9 of the last 12 years. (For comparison, PFGC has a current net margin of 1.5%, AHO is at 0.28%, and SVU is at 1.1%.) Allowance for doubtful A/R decreased from $43 M in FY2001 to $30 M in FY2002. Leverage and debt service Historically, a significant portion of Sysco’s growth comes from acquisitions. Continued growth depends on continued expansion. If it cannot meet its debt obligations, then this growth could be seriously impaired. Management has an on-going target of 35-40% LT debt to capitalization. This may fluctuate slightly above or below, depending on current needs and cash flow. At the end of the FY2002, it was 35.6%, while at the end of FY2001, it was 31.4%. End of FY2002 LT debt was $1.176 B (a debt to equity ratio of 0.55). Product liability claims Injury or illness to others from its products is a risk. The company believes it has sufficient insurance to cover potential claims, though this could change. Possible changes include insurance cost increase and a large increase in product liability claims. Suppliers All the products sold by Sysco are made by other companies. Thus, guaranteed steady supply is not possible. Delays could be induced by strikes by suppliers’ employees, weather, crop failure, etc. Labor relations 14 labor agreements with unions covering approximately 22% of the unionized workforce expire in FY2003. Failure to successfully renegotiate agreements could cause work interruptions. This is considered somewhat unlikely due to the company’s successful history with unions in the past. Integration of acquisitions Integration must be smooth and timely. Delays could come from acquisitions in areas outside of Sysco’s core experience or corporate structures. Such delays could distract management from Sysco’s own management and could cause substantial costs. Interest rate changes The majority of the $1 B in long-term debt is at fixed rates. Approximately $200 M is at a floating rate. Market changes could adversely affect either of these and impair the company’s management of debt. Stock options In FY2002, granted 30,514,910 at weighted avg price of $27.81. This is 3.9% of outstanding. Using Black-Scholes, they estimate a fair value for grants in 2002 of $8.81. Pension fund Pension funding liability was $65M in FY2002 and $5M in FY2001. These were accounted for by a comprehensive loss in the balance sheets by increasing liability and decreasing shareholder equity. Change in CEO Charles Cotros retired effective Jan 1, 2003, and was replaced by Richard Schneiders. Change in head management is always a risky proposition, but if planned well, should go smoothly. First two quarters of this calendar year should be watched carefully. Selected financial numbers: All $ in millions, except per share data. All data for fiscal years (ends at end of June). “%G” is % growth, year-over-year, and is given for changes from 1997 to 1998, as well. CAGR is compounded annualized growth rate. Revenue: FY 2002 2001 Rev 23350 21784 %G 7.2 12.8 CAGR-10 yr = 10.1% 2000 19303 10.8 1999 17423 13.7 1998 15328 6.0 Net income: FY 2002 2001 Net Inc 680 597 %G 13.9 33.9 CAGR-10 yr = 14.8% 2000 446 23.2 1999 362 21.9 1998 297 -1.7 Margin% 2.31 2.08 1.94 2.91 2.74 Free cash flow (operating cash flow – capex): FY 2002 2001 FCF 658 614 %G 9.0 38.6 CAGR-10 yr = 20.8% 2000 443 48.7 1999 298 201.1 1998 99 -65.5 Return on Assets (net income / total assets): FY ROA% %G 2002 11.4 4.0 2001 10.9 17.8 2000 9.3 4.8 1999 8.8 12.5 1998 7.9 -10.6 Return on Equity (net income / shareholder equity): FY ROE% %G 2002 31.9 14.7 2001 27.8 9.8 2000 25.3 -0.2 1999 25.4 15.9 1998 21.9 1.5 LT debt / total assets: FY %G 2002 0.20 11.7 2001 0.18 -17.4 2000 0.21 -12.7 1999 0.24 6.2 1998 0.23 15.1 Current ratio (current assets / current liabilities): FY %G 2002 1.42 -0.4 2001 1.43 -6.8 2000 1.53 -9.1 1999 1.69 2.5 1998 1.65 -6.6 Average yearly P/E ratios (ValueLine): 2002 27.1 2001 28.2 2000 26.4 1999 24.8 1998 23.0 1997 19.6 1996 20.5 1995 19.0 1994 23.1 1993 23.6 Average is 23.5 Current P/E(ttm) is 21.8 Valuation Using StockWorth’s 3-stage growth valuation based on earnings, here are three different scenarios (using a 12% discount rate for each, just slightly higher than historical market returns). X / Y / Z are annual growth rates for 0-5 yr / 5-10 yr / 10+ yr. P/E ratios are calculated with ttm earnings of $1.08. A: Start with close to Zack’s analyst consensus 5-yr growth (15%) (also close to CAGR-10 yr of earnings) 14 / 9 / 3 . . . $24 (P/E 22.2) . . . 20% safety margin = $19.20 B: Start with lowest of Zack’s analyst 5-yr growth 12 / 8 / 3 . . . $21 (P/E 19.4) . . . 20% safety margin = $16.80 C: Start with CAGR-10 yr of sales 10 / 7 / 3 . . . $19 (P/E 17.6) . . . 20% safety margin = $15.20 Current price: $23.59 (P/E 21.8) Conclusions There is concern over the cleanliness of Sysco’s accounting practices, especially with regards to vendor incentive programs (see the news article at http://biz.yahoo.com/rc/030306/food_sysco_outlook_2.html ). However, several analysts admit that Sysco’s accounting practices are clean. Sysco says that when they changed auditors in 2002, the new auditor did not find anything amiss. Also, Sysco says they are in compliance with the Emerging Issues Task Force 02-16 “Accounting by Customers for Cash Considerations Received From a Vendor”. There is a concern over the free cash flow in upcoming quarters when the tax benefit of the SERCA merger stops (which it apparently did at the end of 2002 – see the news article at http://boards.fool.com/Message.asp?mid=18706642 ). Without having seen the current quarter’s data, I am not particularly worried by this. Free cash flow has been growing steadily since at least FY1990 to FY2002. There is concern over net margins (2.9%). This is very slim (as seems to be true for most retailing companies) and any not-so-minor stumble will eliminate this. However, Sysco has managed to grow net margins (or stay steady) over the last 11 years and currently it is sitting at twice the level of its competitors (SVU 1.1%, PFGC 1.5%). Finally there is concern that to keep growing at the rate they have done, they have to keep acquiring. For 30 years Sysco has been acquiring companies. So far, they have done so very successfully. This seems to me to be the riskiest part of the business. However, they do not acquire for the glory, they acquire to gain market share, new customers, and new sources of supply. All of these reasons to me are value-enhancing reasons. If Sysco continues in this vein, they should continue to be able to grow by acquisition (as well as by “real growth”). The Intrinsic Value for this company seems to be in the low 20s, maybe as high as 24. Over the last ten years, the market seems to have been willing to grant it a P/E in the low 20s, where it currently resides. The company appears to be either fairly valued or slightly over valued at the moment. I would like to buy at $20 or $21, which it has a chance of reaching if the market as a whole continues on its downward slump. This does not have much safety margin priced in (10-15% or less, depending on which IV you choose), but that might be worth it for what appears to be a solid company. Can it come down that low (which it has not done in over two years, back through most of the bear market and 9-11)? I do not know. If war comes, would people go out to eat less often (restaurants account for about 60% of sales) ? If fuel prices continue to go up, would income go down or could Sysco adjust prices upward to take that into account? Will fears about accounting practices continue to tarnish Sysco? What about JP Morgan’s concern about tax deferment and cash flow? Will odd weather harm their suppliers? All short term and medium term concerns that might or might not bump the stock lower. Stay tuned.